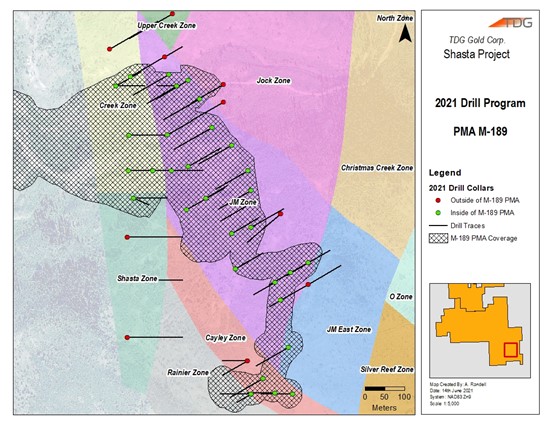

TDG Gold Corp (TSXV:TDG) (the "Company" or "TDG") is pleased to announce the commencement of its "Phase 1" diamond drilling program at the Shasta Project, which comprises 29 drill holes totalling 3,855 metres ("m

In TDG's news release of March 03, 2021, TDG published an exploration target range for Shasta of 0.90 - 1.47 million ounces of gold-equivalent ("AuEq") based on recompilation of historical drilling information contained in 18.717 million tonnes ("Mt") at 1.5 grams per tonne ("g/t") using a 0.3 g/t cut off grade ("cog") to 1.47 Moz AuEq contained in 50.7 Mt at 0.9 g/t using a 0.1 g/t cog. The exploration target presented is conceptual in nature and supported only by historical geological data, since the Shasta Project requires further drilling and surface sampling. It is not a NI 43-101 mineral resource estimate. There is no certainty that the future resource estimates for the project will achieve the exploration target resource reported in the March 03, 2021 news release.

The purpose of the proposed drilling is threefold: (1) to confirm the validity of historical drill assays; (2) to drill test known extensions to the existing mineralization around the historical mine workings; and, (3) to drill test for continuity of mineralization between historically identified zones.

Phase 2 drilling will depend on the results from the initial program, and a proposed third phase will target satellite zones around the Creek-Shasta and JM Zones. Phases 2 and 3 total 6,000 m of diamond drilling.

Figure 1 showing the Permitted Mine Area and proposed drill hole locations for Phase 1 (green) of the Shasta 2021 drill program.

EXPLORATION ACTIVITY UPDATE

The technical team led by VP Exploration Andy Randell mobilized to the project site on June 23, 2021. Initial exploration work involved collecting data and samples to augment the planned drilling at Shasta and to start collecting baseline data for other priority targets, including the past-producing Baker Mine and the Mets mining lease.

SHASTA

At Shasta, the JM and Creek Pits were mapped, and channel sampled around their periphery to create a set of modern observations to augment historical data. A total of 131 channel samples were collected from both pits and have been submitted to SGS Labs for assaying. Results are pending and expected around mid-August.

Ground magnetic geophysical surveys were also completed across the primary Shasta Phase 1 drill footprint, with additional grids extending to the east to target satellite zones. Initial interpretations confirm the existence of historically interpreted faults and at least one untested zone that shows magnetic highs in association with quartz stockwork veining in outcrop, which suggest exploration potential to discover previously untested mineralized zones.

Historical core from Shasta has been assessed for condition and suitability for a re-logging and sampling program, and which is currently underway.

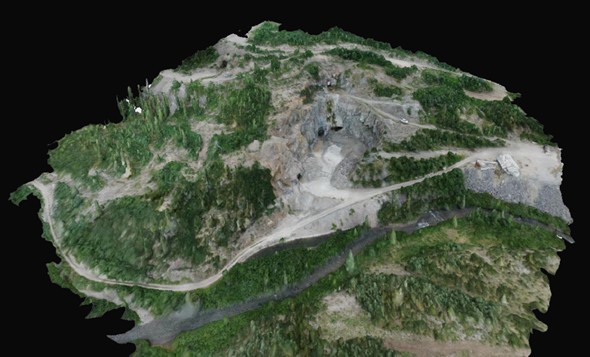

Drone surveys completed high-definition surveys of the pit areas to create 3-Dimensional models and volume controls for future assessment and modelling.

Figure 2 shows the 3-Dimensional drone survey results for the Creek Pit at Shasta.

BAKER

The focus of work at Baker has been in and around the historically mined B-Vein and its potential relationship with the North Quartz mineralized zone.

The Baker Mine operated intermittently between the 1981 to 1997 until it was then placed on reclamation status. There are 5 main veins in 6 defined zones. Two veins were mined (the A- and B-Veins) producing 41,281 oz gold ("Au") & 765,565 oz silver ("Ag") milled from 81,878 tonnes of ore.

The periphery of the B-Vein pit was channel sampled in early July 2021 across the vein and country rock to test the mineralization potential of several previously untested quartz stockwork zones. A total of 119 samples were collected and have been submitted to SGS Labs for assay. Results are pending.

Several ground magnetic survey grids were also completed around the B-Vein pit and on the west side of the historically mined A-Vein to provide an understanding of structural and geological controls at Baker.

Like Shasta, drone surveys were completed over several target areas to assist with future planning and exploration.

The exploration team has also completed a mapping and surface sampling in previously untested areas of altered or gossanous areas north of the main Baker pit. Samples have been submitted for assay and are pending.

METS

Initial exploration work started at the Mets mining leases, located 20 kilometres ("km") to the northwest of the Baker camp, and focussed on confirmation sampling of old showings and the completion of ground magnetic geophysical surveys over the main historical faults and structures.

Historical drill highlights include 9.52 g/t Au and 1.9 g/t Ag over 25.90 m and 3.57 g/t Au and 2.36 g/t Ag over 46.40 m, including 13.93 g/t Au and 2.00 g/t Ag over 11.80 m (see TDG news release of May 19, 2021).

CAMP

Upgrades to the Baker camp have been completed. New structures were mobilized to site resulting in a 35-bed camp with integrated power, water, and sewerage systems. Operational permits have been received. The old workshop at the mill site has been converted into a new geological and high-capacity logging facility.

ENVIRONMENTAL

Under the supervision of the Company's recently appointed VP Sustainability, Christy Smith, the environmental monitoring program on site has been established, with a focus on the installation of water monitoring stations across Baker and Shasta to comply with permit and operational requirements. This work has been completed in partnership with Chu Cho Environmental and Sasuchan LP. Wildlife and ecosystem baseline studies are due to commence in early August.

Qualified Person

The technical content of this news release has been reviewed and approved by Andy Randell, P.Geo., a qualified person as defined by National Instrument 43-101.

About TDG Gold Corp.

TDG is a major mineral claim holder in the historical Toodoggone Production Corridor of north-central British Columbia, Canada, with over 23,000 hectares of brownfield and greenfield exploration opportunities under direct ownership or earn-in agreement. TDG's flagship projects are the former producing, high-grade gold-silver Shasta, Baker and Mets mines which are all road accessible, produced intermittently between 1981-2012, and have over 65,000 metres of historical drilling. In 2021, TDG proposes to advance the projects through compilation of historical data, new geological mapping, geochemical and geophysical surveys, and drill testing of the known mineralization occurrences and their extensions. On June 29, 2021, TDG announced that it had entered into a non-binding letter of intent to acquire the Nueva Esperanza silver-gold advanced exploration and development project located in the Maricunga Belt of northern Chile. TDG currently has 64,423,459 common shares issued and outstanding.

ON BEHALF OFTHE BOARD

Fletcher Morgan

Chief Executive Officer

For further information:

TDG Gold Corp.,

Telephone: +1.604.536.2711

Email: info@tdggold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain certain "forward looking statements". Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Any forward-looking statement speaks only as of the date of this news release and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

SOURCE: TDG Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/656898/TDG-Gold-Corp-Commences-Drilling-at-the-Shasta-Project-Toodoggone-District-British-Columbia