Tarku Resources Ltd (TSXV:TKU)(FRA:7TK)(OTCQB:TRKUF) (the "Company" or "Tarku") is pleased to announce additional results from its 2021 drill program on the high-grade Silver Strike Project in the Tombstone District of Arizona (the "Project"). Significant results include 720 gt silver, 6.44 gt gold, 5.08% lead and 5.05% zinc or 1,515 gt silver equivalent (AgEq) over 1.5 m in hole SS21-007 targeting north-south structure located in the historic Lucky Cuss mine area

Julien Davy, President and CEO of Tarku, stated: "we are extremely pleased with the early results of our Silver Strike drill program. The silver equivalent numbers this close to the surface, far exceeded our expectations. Additionally, presence of gold, lead and zinc, at such high grades was unexpected and welcomed. To date we have received the lab results for 10 out of 23 drill holes, providing us already with a much clearer picture of the geological setting of our Silver Strike project. There are too many high-grade spikes of different metals at different locations over the project to assume coincidence, thus we strongly speculate presence of a large Carbonate Replacement system feeding all various spikes."

"This mineralisation is within the same stratigraphic package and shows significant similarities in terms of geological context to the nearby Hermosa project which in 2018 was purchased by South32 for $1.8 billion."

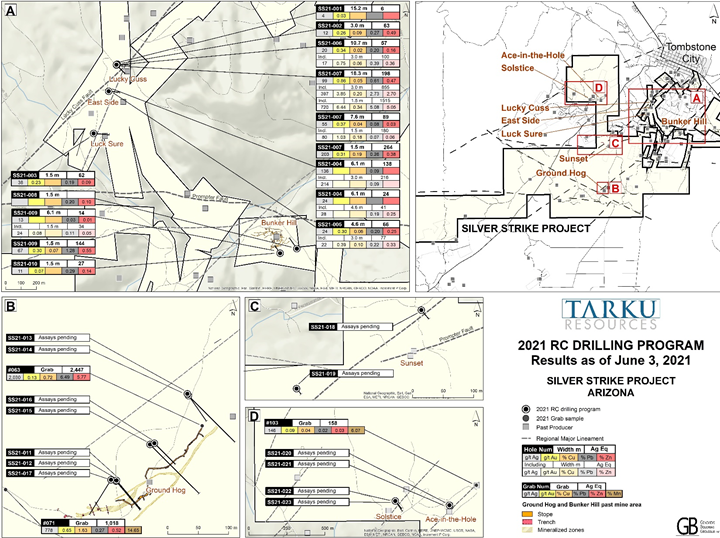

Tarku's first drill program on the Silver Strike project was completed on May 28, 2021. The program totaling 8,921 feet aimed to test the potential of high-grade silver in 5 different zones (see Table 1 & 2):

- the north-south structures (Lucky Cuss Fault) around the Lucky Cuss, Luck Sure and East Side historic mines areas,

- the east-west structure (Prompter Fault) around the Bunker Hill historic mine area,

- the regional north-east structure around the Ground Hog historic mine,

- the west extension of the east-west Prompter fault and

- the Solstice and Ace-in-the-Hole historic mines areas (see Figure 1).

The results received to date include the first 10 holes (SS21-001 to SS21-010) targeting the first two zones described above. Sampling methodology included taking of 5 ft long samples and all results are reported as an average grade over 5 ft.

Holes SS21-006 and SS21-007, revealed that the targeted Lucky Cuss structure encounters several high-grade mineralized zones that appear to be dipping at low angle (to sub-horizontal) within the north-south structure. If proven, this unexpected flat vein orientation within steeply dipping structures could help the Company to better target its future exploration programs. Hole SS21-007 intersected an interesting 3 meters grading 397 g/t Ag, 3.85 g/t Au, 0.20% Cu, 2.73% Pb and 2.70% Zn or 855 g/t AgEq at the depth of 6.1 meters showing the high-grade potential of the Lucky Cuss veining system. As shown in Table 1, the same hole also intersected 1.5 m grading 180 g/t AgEq at 15.2 meters depth and 1.5 m grading 264 g/t AgEq at 74.7 meters depth supporting the stacking interpretation of several high-grade veins within the same Lucky Cuss structure.

The variety of mineralization within the sediments at Lucky Cuss suggest that the Carbonate Replacement Deposit (CRD) model could be more extensively spread over the Silver Strike property than originally expected and that the limits have not yet been found. CRD are typically high-temperature carbonate-hosting Ag-Pb-Zn deposit formed by the replacement of sedimentary, usually carbonate rock, by metal-bearing solutions in the vicinity of igneous intrusions that play the role of heat source. With some local variations, ore body geometries could vary from chimneys to veins to blanketlike body along the bedding plane of the rock, it is then commonly called a manto. Those Polymetallic replacements/mantos are often stratiform wall-rock replacement orebodies distal to porphyry deposits (copper or molybdenum).

Figure 1: Location Map - News Release June 3rd, 2021 (See full size Figure 1)

Table 1 below lists the best assays results received to date and utilizes samples with over 5 g/t Ag and over 0.05 g/t Au. Due to the presence of some significant gold and base metals results, a silver equivalent index (AgEq) was calculated using the criteria described below, Table 1. Once all results have been received, Tarku will be in an excellent position to plan the future exploration programs that will encompass soil geochemistry, geophysics surveys, and a more significant and targeted drill programs.

Table 1: Drill Hole Best Assay Results updated as of this date - News Release June 3rd, 2021.

- Ag Equivalent (AgEq): Only samples with over 5g/t Ag and over 0.05g/t Au were used - Prices of $24/oz silver, $1,800/oz gold (ratio Au:Ag = 65:1), $4.00/lb copper (ratio Cu:Ag = 0.01:1), $0.90/lb lead (ratio Pb:Ag = 0.002:1) and $1.20/lb zinc (ratio Zn:Ag = 0.003:1) were used for equivalent calculations. 100% recoveries have been considered as no metallurgical study has been made yet.

- Intervals shown are drill intercept, true thickness cannot be calculated yet.

Table 2: Final Drill Hole Locations - News Release June 3rd, 2021

Hole # | Target | From (m) | To (m) | Width (2) (m) | Ag (g/t) | Au (g/t) | Cu (%) | Pb (%) | Zn (%) | Ag Eq (1) (g/t) | Mn (%) |

SS21-001 | Lucky Cuss | 3.0 | 18.3 | 15.2 | 4 | 0.03 | 6 | 0.27 | |||

SS21-002 | Lucky Cuss | 0.0 | 3.0 | 3.0 | 12 | 0.26 | 0.09 | 0.27 | 0.49 | 63 | 0.26 |

SS21-003 | Luck Sure | 47.2 | 48.8 | 1.5 | 38 | 0.23 | 0.19 | 0.09 | 62 | 1.02 | |

SS21-004 | East Side | 67.1 | 73.2 | 6.1 | 136 | 0.09 | 138 | 2.68 | |||

incl. | 70.1 | 73.2 | 3.0 | 214 | 0.09 | 216 | 3.87 | ||||

SS21-004 | East Side | 80.8 | 86.9 | 6.1 | 24 | 24 | 0.79 | ||||

incl. | 82.3 | 86.9 | 4.6 | 28 | 0.19 | 0.25 | 41 | 0,83 | |||

SS21-005 | East Side | 123.44 | 128.02 | 4.6 | 24 | 0.30 | 0.06 | 0.20 | 0.25 | 66 | 0.33 |

incl. | 123.4 | 126.5 | 3.0 | 22 | 0.39 | 0.10 | 0.22 | 0.33 | 77 | 0.44 |

Hole ID | Target | Azimuth | Dip | Length drilled (ft) | Length drilled (m) | Coord_X (utmZ12N) | Coord_Y (utmZ12N) |

SS21-001 | Lucky Cuss | 135 | 50 | 400 | 121.9 | 587,665 | 3,507,708 |

SS21-002 | Lucky Cuss | 95 | 50 | 439 | 133.8 | 587,670 | 3,507,713 |

SS21-003 | Luck Sure | 95 | 50 | 525 | 160.0 | 587,516 | 3,507,262 |

SS21-004 | East Side | 95 | 50 | 292 | 89.0 | 587,614 | 3,507,537 |

SS21-005 | East Side | 95 | 56 | 435 | 132.6 | 587,614 | 3,507,537 |

SS21-006 | Lucky Cuss | 95 | 55 | 220 | 67.1 | 587,670 | 3,507,711 |

SS21-007 | Lucky Cuss | 95 | 90 | 325 | 99.1 | 587,665 | 3,507,710 |

SS21-008 | Bunker Hill | 325 | 50 | 440 | 134.1 | 588,841 | 3,506,511 |

SS21-009 | Bunker Hill | 325 | 50 | 255 | 77.7 | 588,732 | 3,506,481 |

SS21-010 | Bunker Hill | 325 | 60 | 400 | 121.9 | 588,732 | 3,506,481 |

SS21-011 | Ground Hog | 140 | 50 | 315 | 96.0 | 586,005 | 3,504,576 |

SS21-012 | Ground Hog | 140 | 60 | 400 | 121.9 | 586,006 | 3,504,577 |

SS21-013 | Ground Hog | 135 | 50 | 550 | 167.6 | 586,124 | 3,504,716 |

SS21-014 | Ground Hog | 145 | 60 | 360 | 109.7 | 586,122 | 3,504,719 |

SS21-015 | Ground Hog | 135 | 50 | 580 | 176.8 | 586,061 | 3,504,636 |

SS21-016 | Ground Hog | 135 | 60 | 320 | 97.5 | 586,068 | 3,504,638 |

SS21-017 | Ground Hog | 212 | 60 | 440 | 134.1 | 585,997 | 3,504,578 |

SS21-018 | West Rattlesnake | 140 | 55 | 435 | 132.6 | 586,291 | 3,506,430 |

SS21-019 | West Rattlesnake | 140 | 55 | 270 | 82.3 | 585,472 | 3,505,915 |

SS21-020 | Ace in the Hole | 140 | 55 | 160 | 48.8 | 585,950 | 3,507,778 |

SS21-021 | Ace in the Hole | 140 | 80 | 340 | 103.6 | 585,949 | 3,507,778 |

SS21-022 | Solstice | 145 | 55 | 440 | 134.1 | 585,616 | 3,507,804 |

SS21-023 | Solstice | 140 | 70 | 580 | 176.8 | 585,616 | 3,507,804 |

TOTAL | 8,921 | 2,719.1 |

Qualified persons

Julien Davy, P.Geo., M.Sc, MBA, President and Chief Executive Officer of Tarku, the qualified person under National Instrument 43-101 Standards of Disclosure for Mineral Projects, prepared, supervised and approved the technical information in this news release.

About Tarku Resources Ltd. (TSX.V:TKU / FRA:7TK / OTCBQ:TRKUF)

Tarku is an exploration company focused on new discoveries in favourable mining jurisdictions such as Quebec and Arizona. In Quebec, Tarku owns 100% of the "Three A's" exploration projects, (Apollo, Admiral and Atlas Projects), in the Matagami Greenstone belt, which has been interpreted by management as the eastern extension of the Detour Belt, and which has seen recent exploration successes by Midland Exploration Inc., Wallbridge Mining Company Ltd., Probe Metals Inc. In Arizona, in the Tombstone district, Tarku owns the option to acquire 75% on 20km2 in the Silver Strike Project.

Tarku Contact Information:

Email: investors@tarkuresources.com

Website: www.tarkuresources.com

Please follow @TarkuResources on LinkedIn, Facebook, Twitter and Instagram.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release may contain forward-looking statements that are subject to known and unknown risks and uncertainties that could cause actual results and activities to vary materially from targeted results and planning. Such risks and uncertainties include those described in Tarku's periodic reports including the annual report or in the filings made by Tarku from time to time with securities regulatory authorities.

SOURCE: Tarku Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/650271/Tarku-Reports-High-Grade-Drilling-Results-of-up-to-1515-gt-Ag-Equivalent-over-15-m-at-Silver-Strike-in-Arizona