- Cliff Gold Project expanded 4.5-fold to 2,724 hectares to cover an additional 3 target areas

- Tosh Gold Project expanded 2.3-fold to 3,700 hectares to connect zones of gold mineralization along known structural trends

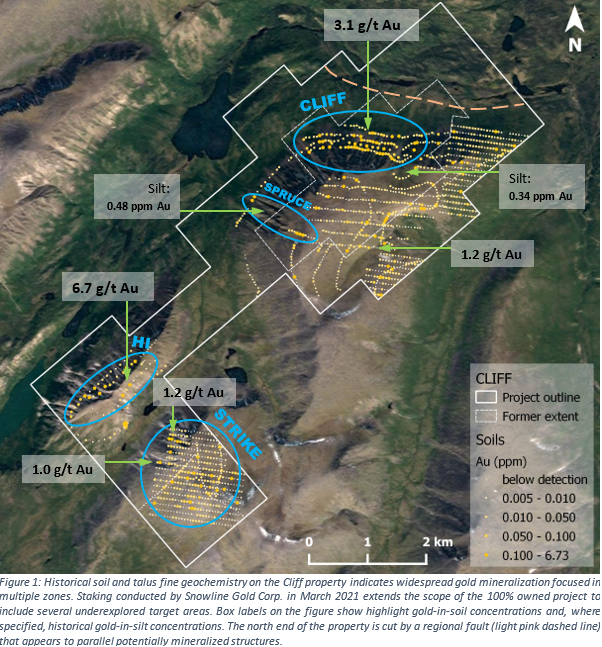

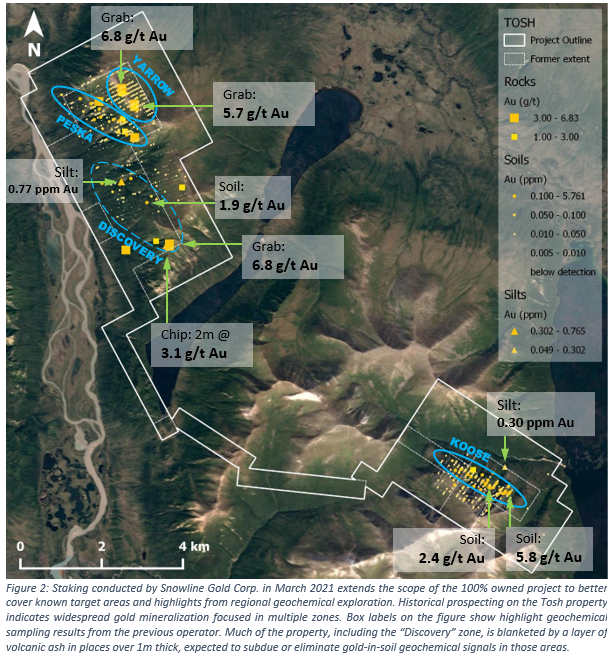

SNOWLINE GOLD CORP. (CSE:SGD) (the "Company" or "Snowline") is pleased to announce it has staked additional claims around the Cliff and Tosh Gold Projects, expanding them by 2,121 hectares and 2,069 hectares, respectively. The new claims consolidate the land positions at each project and cover additional prospective zones with historical elevated gold-in-soil sampling results

"We are excited to have consolidated Snowline's position around the Cliff and Tosh projects," said the Company's Chief Executive Office Nikolas Matysek, "Our expanded claims now fully cover all of the high-priority targets, as well as prospective adjacent ground, identified by earlier prospecting. Snowline has developed a diversified portfolio of gold projects throughout the Yukon, and we will examine all our options as we continue to advance our portfolio of projects this summer."

The Cliff Project

Snowline has staked 102 new claims around the Company's Cliff Gold Project located in southwestern Yukon's Ruby Range placer gold district (see March 16, 2021 release - Snowline Gold Corp. Introduces 100% Owned Cliff Gold Project for additional information). The total size of the Cliff Project has been expanded by 2,121 hectares to a new total of 2,724 hectares. The new claims provide better coverage around the main "Cliff" zone, including a major fault zone downslope from the target. The new staking also covers three additional target areas:

- The "Hi" zone is a 1.4 km long zone of elevated soils and talus fines over an exposure of the Ruby Range batholith. Eighteen of 44 historical soil samples in this area returned values above 40 ppb Au, to a maximum of 6.8 g/t Au.

- The "Strike" zone is a 1.5 x 1.5 km area with variably anomalous gold and arsenic in historical soils and talus fines to a maximum concentration of 1.26 g/t Au along the contact of the Kluane schist and the Ruby Range batholith.

- The "Spruce" zone has historic stream sediment samples up to 0.46 g/t Au that are downslope from soil samples up to 0.5 g/t Au.

Planned follow-up in 2021 will include detailed mapping and prospecting.

The Tosh Project

The Company has staked 99 new claims around the Tosh Gold Project in the southwestern Yukon, which is located in a geological and structural setting similar to Newmont's Coffee deposits (see March 23, 2021 release - Snowline Gold Corp. Introduces 100% Owned Tosh Gold Project for additional information). The total size of the Tosh Project has been expanded by 2,069 hectare to a new total of 3,700 hectares. The new staking connects high priority target areas into a single claim block. The larger claim position allows for the first detailed systematic look at the mineralizing system and better coverage along strike of kilometre-scale mineralized trends.

At Tosh, Snowline is gearing up for regional assessment and advancing existing targets in 2021. The regional assessment will be done through detailed stream sediment surveys. Geophysical surveying and geological mapping will guide target advancement.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Scott Berdahl, P. Geo., Chief Operating Officer of Snowline and a Qualified Person for the purpose of NI 43-101.

ABOUT SNOWLINE GOLD CORP.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with a 7-project portfolio covering over 70,000 ha. The Company is exploring its flagship 64,000 Ha Einarson and Rogue gold projects in the prospective yet underexplored Selwyn Basin, with drilling expected to commence in mid-2021. Snowline's projects all lie in the prolific Tintina gold province that hosts multiple million-ounce-plus gold mines and deposits, from Kinross' Fort Knox to Newmont's Coffee. Snowline's first-mover claim position presents a unique opportunity to explore and expand a new greenfield, district-scale gold system.

ON BEHALF OF THE BOARD

Nikolas Matysek, B.Sc. (Geol)

CEO & Director

CONTACT:

Snowline Gold Corp.

Nikolas Matysek, CEO

+1-778-228-3020

info@snowlinegold.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements about the Company reviewing its newly acquired project portfolio to maximize value, reviewing options for its non-core assets, including targeted exploration and joint venture arrangements, conducting follow-up prospecting and mapping this summer and plans for exploring and expanding a new greenfield, district-scale gold system. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/638036/Snowline-Gold-Significantly-Expands-Cliff-and-Tosh-Land-Positions