- Geochemical anomaly suggests the presence of a deep-seated intrusion-related gold system, potentially analogous to Victoria Gold's Eagle or Kinross' Fort Knox deposits

- Ground magnetics reveal alteration signature across 3 x 2 kilometre area

- Prospecting grab samples to 7.98 g/t Au, shear zones to 4.1 g/t Au

SNOWLINE GOLD CORP. (CSE:SGD) (the "Company" or "Snowline") is pleased to provide additional detail on its 100% owned, 125 hectare Rainbow Gold Project, located within the Tintina Gold Belt. The Rainbow project covers a gold and pathfinder element soil anomaly associated with surface alteration caused by a recently discovered intrusion, thought to belong to the mid-Cretaceous Tombstone Plutonic Suite. Other Tombstone-related gold deposits within the Tintina Gold Belt include Fort Knox (~11 million ounces Au), and Eagle (~4.8 million ounces Au

"The Rainbow Gold Project is another key element in Snowline's Yukon-focused asset portfolio. The sampling and geophysics to date indicate we may be on top of a prospective intrusion like the types associated with other large deposits in the Tintina Gold Belt" said Nikolas Matysek, Chief Executive Officer of Snowline. "Historical work has established a clear deposit thesis that we will move to validate this season."

Snowline is reviewing the complete project portfolio it acquired from a private vendor and is focused on planning and prioritizing its exploration to maximize shareholder value. Specifically, it is examining multiple options for its non-core assets, including targeted exploration and joint venture arrangements.

Project Geology

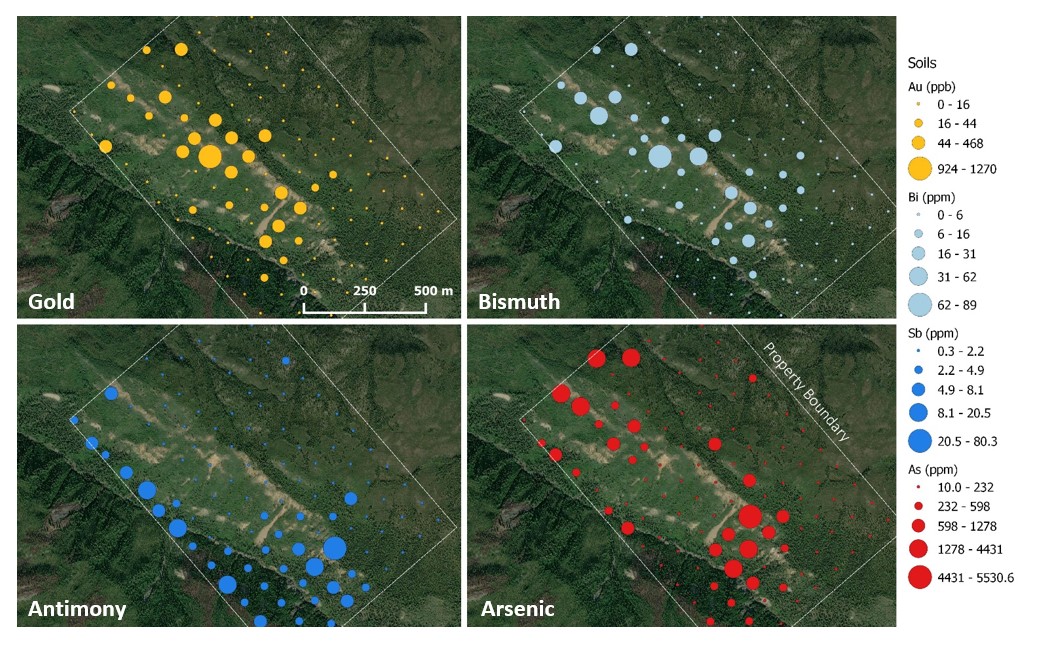

Grid soil geochemistry completed over the property revealed a 1 km by 300 m zone of high gold values (to 1.27 g/t) accompanied by anomalous bismuth, tellurium and tungsten flanked by zones of anomalous arsenic, antimony and silver (see Figure 1). This geochemical anomaly corresponds to the eroded edge of a 3x2 kilometre magnetic anomaly. Prospecting returned shear-hosted sulphide-bearing outcrop samples grading 4.1 g/t Au and locally-derived angular quartz float samples running 7.98 g/t Au. The magnetic anomaly reveals the potential size of the alteration system, and stream geochemistry anomalies that are 2.5 kilometres from the soil anomaly suggests that mineralizing fluids may have travelled at a similar scale.

A program of drone surveying, geochemical sampling and structural mapping is planned to establish suitable drill targets on the Rainbow property.

Figure 1: Intense, zoned, multi-element soil anomaly associated with eroded exposures of a hornfelsed zone around newly-discovered intrusive rocks at Rainbow. High spatial correlation between gold and bismuth, with anomalous antimony and arsenic peripheral to the gold zone is similar to zoning observed in known reduced intrusion related gold systems such as Kinross Gold's Ft. Knox deposit in Alaska.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Scott Berdahl, P. Geo., Chief Operating Officer of Snowline and a Qualified Person for the purpose of NI 43-101.

ABOUT SNOWLINE GOLD CORP.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with a 7-project portfolio covering over 70,000 ha. The Company is exploring its flagship 64,000 ha Einarson and Rogue gold projects in the prospective yet underexplored Selwyn Basin, with drilling expected to commence in mid-2021. Snowline's projects all lie in the prolific Tintina gold province that hosts multiple million-ounce-plus gold mines and deposits, from Kinross' Fort Knox to Newmont's Coffee. Snowline's first-mover claim position presents a unique opportunity to explore and expand a new greenfield, district-scale gold system.

ON BEHALF OF THE BOARD

Nikolas Matysek, B.Sc. (Geol)

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1-778-228-3020

info@snowlinegold.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements about the Company reviewing its newly acquired project portfolio to maximize value, reviewing options for its non-core assets, including targeted exploration and joint venture arrangements, conducting follow-up prospecting and mapping this summer and plans for exploring and expanding a new greenfield, district-scale gold system. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/639957/Snowline-Gold-Announces-100-Owned-Rainbow-Gold-Project-Central-Yukon