Scottie Resources Corp. (TSXV: SCOT) (" Scottie ") and AUX Resources Corporation (TSXV: AUX) (OTC: AUXRF) (" AUX ") are pleased to announce that, further to their proposed transaction announced on April 12, 2021 they have signed an amalgamation agreement dated May 4, 2021 (the " Agreement ") pursuant to which a wholly-owned subsidiary of Scottie will amalgamate with AUX and all of the issued and outstanding common shares of AUX following the amalgamation will immediately be exchanged for common shares of Scottie on a one-for-one basis (the " Transaction "). The Transaction will consolidate the contiguous gold-silver exploration assets of Scottie's Cambria Project and AUX's Silver Crown, Independence, American Creek, Lower Bear and Bear Pass Projects, all of which will benefit from operational and geological synergies.

Upon completion of the Transaction, it is expected that the shareholders of AUX will hold approximately 31% of Scottie's issued and outstanding shares. The board of Scottie will remain the same.

Anticipated Benefits of the Transaction

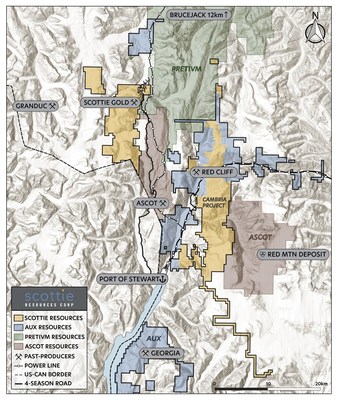

- District scale 522 km 2 100% owned in the heart of the Stewart Mining Camp adjacent to Pretium Resources and Ascot Resources Premier and Red Mountain deposits in the Golden Triangle (Figure 1).

- Consolidation of AUX's Silver Crown, Independence, American Creek, Lower Bear and Bear Pass Projects with Scottie's Cambria Project. The expanded Cambria Project will cover 27,465 contiguous hectares and includes five historical mines (Molly B, Bayview , Black Hills, Blue Grouse and Terminus).

- Three advanced Projects in the Stewart Mining Camp – Scottie Gold Mine, Georgia (including the Georgia River Mine) and Cambria (including five historical mines). All three Projects will be drilled in the 2021 field season including a 12,500 metre three rig diamond drill program at the Scottie Gold Mine.

- Scottie's significant infrastructure in Stewart will provide operational synergies to AUX's projects.

- Scottie will be well-capitalized with over $6 million in cash.

"The 2021 field season will be a transformative one for the combined company as we aggressively advance the total land package with a combined 16,000 metres of diamond drilling coupled with geophysics and property scale geochemical surveys," comments Brad Rourke , Chief Executive Officer of Scottie. "Due to the complementary land packages, consolidation of Scottie and AUX is a clear value add for shareholders in both companies."

Figure 1 – Scottie and AUX combined claims

Board of Directors' Recommendation

The Board of Directors of Scottie (with the exclusion of Mr. Rourke, who also serves as a director of AUX) have determined that the Transaction is in the best interests of Scottie and have approved the Transaction.

The Board of Directors of AUX (with the exclusion of Mr. Rourke, who also serves as a director of Scottie) have determined that the Transaction is in the best interests of AUX and have approved the Transaction. Further, AUX's Directors and certain shareholders have entered into voting and support agreements to which they have agreed to vote their AUX shares.

Transaction

Pursuant to the terms of the Agreement, the Transaction is expected to be completed by way of a three-corner amalgamation under the provisions of the Business Corporations Act ( British Columbia ) whereby 1302688 B .C. Ltd. (" Subco "), a wholly-owned subsidiary of Scottie, will amalgamate with AUX and all of the issued and outstanding common shares of AUX following the amalgamation will immediately be exchanged for common shares of Scottie on a one-for-one basis. Warrants and options of AUX will be exchanged into warrants and options, respectively, of Scottie. Closing of the Transaction is subject to a number of customary conditions being satisfied or waived by one or both of Scottie and AUX, including the receipt of AUX shareholder approval, together with any requisite minority approvals, and the receipt of all necessary regulatory approvals, including the approval of the TSX Venture Exchange.

Scottie and AUX are committed to consummating the Transaction in an expedited manner and it is anticipated that the annual general and special meeting of AUX shareholders to approve the proposed Transaction will be held in July 2021 and, if approved and all other conditions have been met, it is expected that the Transaction will close shortly thereafter. Further information regarding the Transaction will be contained in a management information circular to be mailed to shareholders of AUX in connection with the annual general and special meeting. All shareholders of AUX are urged to read the management information circular once available, as it will contain important additional information concerning the Transaction. Following completion of the Transaction, the company formed by the amalgamation of AUX and Subco will become a wholly owned subsidiary of Scottie. There can be no assurance that the Transaction will be completed as proposed or at all.

About Scottie Resources

Scottie owns a 100% interest in the high-grade, past-producing Scottie Gold Mine and Bow properties and has the option to purchase a 100% interest in Summit Lake claims which are contiguous with the Scottie Gold Mine property. Scottie also owns 100% interest in the Cambria Project properties and the Sulu property. Scottie Resources holds more than 25,000 hectares of mineral claims in the Golden Triangle.

Scottie's focus is on expanding the known mineralization around the past-producing mine while advancing near mine high-grade gold targets, with the purpose of delivering a potential resource. All of Scottie's properties are located in the area known as the Golden Triangle of British Columbia which is among the world's most prolific mineralized districts.

About AUX Resources

AUX holds more than 27,000 hectares of strategic claims in the Stewart Mining Camp in the Golden Triangle of British Columbia , which is among the world's most prolific mineralized districts, including the high-grade Georgia Project and the past-producing Georgia River Mine. The Georgia River Mine, which last operated in 1939 with a head grade of 23 g/t gold, contains 1.2 kilometres of underground access on three levels.

The technical disclosures in this release have been read and approved by Dr. Thomas Mumford , Ph.D., P.Geo., a qualified person as defined in National Instrument 43-101.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release includes forward-looking statements that are subject to risks and uncertainties. All statements within, other than statements of historical fact, are to be considered forward looking, including, but not limited to, statements regarding the entering into of a definitive agreement between Scottie and AUX, the timing of the AUX shareholder meeting and approval of AUX shareholders, closing of the proposed Transaction and the anticipated benefits of the Transaction. Although Scottie and AUX believe the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, continued availability of capital and financing, and general economic, market or business conditions and regulatory, shareholder and administrative approvals, processes and filing requirements. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. We do not assume any obligation to update any forward-looking statements.

SOURCE AUX Resources Corporation

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/May2021/06/c5748.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/May2021/06/c5748.html