TSXV:OGN) (OTCQX:OGNRF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce that is has signed an agreement (the "Agreement") with Ivy Minerals Inc. ("Ivy"), a private mineral exploration company, to option Orogen's Ghost Ranch gold project in northeastern Nevada, U.S.A

Ivy can earn a 51% interest in the Ghost Ranch project by spending US$1.5 million over a four-year period, including a firm commitment of 4,000 feet of drilling. Orogen will retain a 49% interest in Ghost Ranch and reserve a 0.5% net smelter return ("NSR") royalty. Both Ivy and Orogen will then participate in a joint venture to develop Ghost Ranch. If either parties' equity interest in Ghost Ranch falls below 10%, their interest will convert to a 1% NSR royalty. Orogen would then retain a total 1.5% NSR royalty in the event the Company is diluted below 10%.

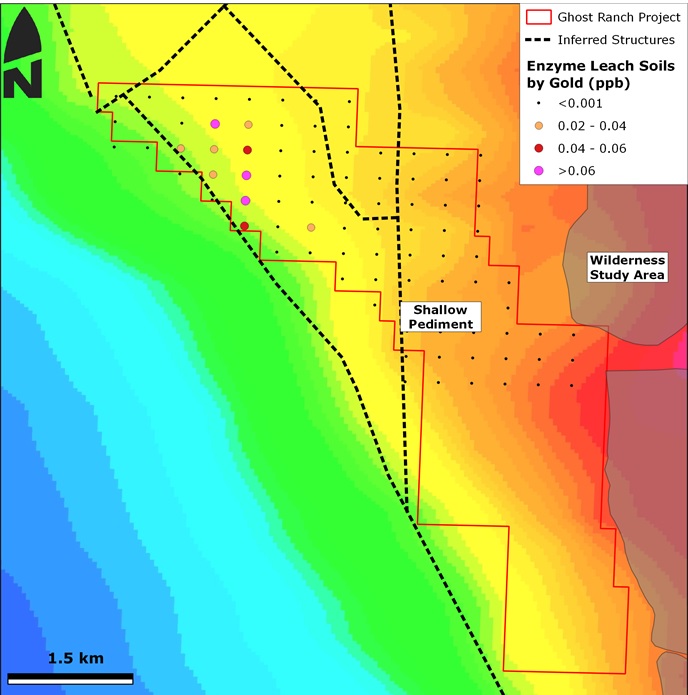

"Ghost Ranch is an undrilled Carlin-type target under shallow pediment along a regional gravity break, that could represent an extension of the Long Canyon trend," commented Paddy Nicol, Orogen's CEO. "The structure of this Agreement allows Orogen to participate with an equity interest in the event a discovery is made at Ghost Ranch, with the optionality of converting to an NSR royalty within a relatively short time frame."

About Ghost Ranch Property

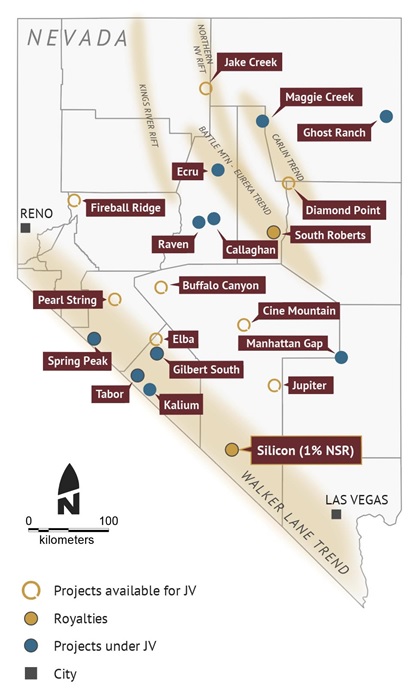

The Ghost Ranch project is located 25 kilometres west of West Wendover and 30 kilometres southeast of Nevada Gold Mines' Long Canyon open pit mine (1.97 million ounces M&I Resource at 3.21 grams per tonne gold)1 in northeast Nevada (Figure 1). The project consists of 258 claims located on BLM land encompassing a shallow shelf covered by less than one hundred metres of alluvium. Prospective Cambrian and Ordovician host rocks project into the subsurface and have seen no historic drilling. This stratigraphy outcrops to the east at Morgan Pass where Carlin-type mineralization occurs at surface but development has been limited due to the wilderness study area land status to the east of Ghost Ranch.

At Ghost Ranch, enzyme leach soils covering the northern half of the property display a strong correlation between inferred structures and anomalous gold and Carlin Suite elements (Figure 2).

The property represents a rare opportunity to discover Carlin-type systems in Nevada at less than one hundred metres depth. Ivy minerals have expanded the soil survey across the remainder of the project and will use these results to guide future drill plans.

Figure 1: Location of Ghost Ranch

Figure 2: Gold in soils at Ghost Ranch over complete Bouguer Gravity (red is high, blue is low)

About Ivy Minerals

Ivy Minerals Inc, established in 1978, is a private, closely held explorer of gold, silver and copper mineral projects with the potential to develop into high quality mines. It has active early-stage projects in Idaho, Nevada and Arizona.

Qualified Person Statement

All technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo., Exploration Manager for Orogen. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

About Orogen Royalties Inc.

Orogen Royalties Inc. is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño West gold deposit in Sonora, Mexico (2% NSR royalty) being developed by First Majestic Silver Corp. and the Silicon gold project (1% NSR royalty) in Nevada, USA, being advanced by AngloGold Ashanti N.A. The Company is well financed with several projects actively being developed by joint venture partners.

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Liliana Wong, Manager of Marketing and Investor Relations at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1201 - 510 West Hastings Street

Vancouver, BC

Canada V6B 1L8

info@orogenroyalties.com

Forward-Looking Information

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Forward-looking information relates to statements concerning the Company's future outlook and anticipated events or results, as well as the Company's management expectations with respect to the proposed business combination (the "Transaction"). This document also contains forward-looking statements regarding the anticipated completion of the Transaction and timing thereof. Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company, including expectations and assumptions concerning the receipt, in a timely manner, of regulatory and stock exchange approvals in respect of the Transaction.

Although the Company believe the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions. Furthermore, the extent to which COVID-19 may impact the Company's business will depend on future developments such as the geographic spread of the disease, the duration of the outbreak, travel restrictions, physical distancing, business closures or business disruptions, and the effectiveness of actions taken in Canada and other countries to contain and treat the disease. Although it is not possible to reliably estimate the length or severity of these developments and their financial impact as of the date of approval of these condensed interim consolidated financial statements, continuation of the prevailing conditions could have a significant adverse impact on the Company's financial position and results of operations for future periods.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Orogen Royalties Inc.

View source version on accesswire.com:

https://www.accesswire.com/664847/Orogen-Options-Ghost-Ranch-to-Ivy-Minerals