(TheNewswire)

Vancouver, Canada - TheNewswire - September 2 7 , 2021 - Nexus Gold Corp. (" Nexus " or the " Company ") (TSXV:NXS ) ( OTC:NXXGF ) ( FSE:N6E) is pleased to announce it has entered into a definitive share purchase agreement, dated effective September 23, 2021, with Cyclone North Resources Inc. (" Cyclone ") and each of the shareholders of Cyclone (collectively, the " Vendors "), pursuant to which the Company proposes to acquire all of the outstanding share capital of Cyclone from the Vendors.

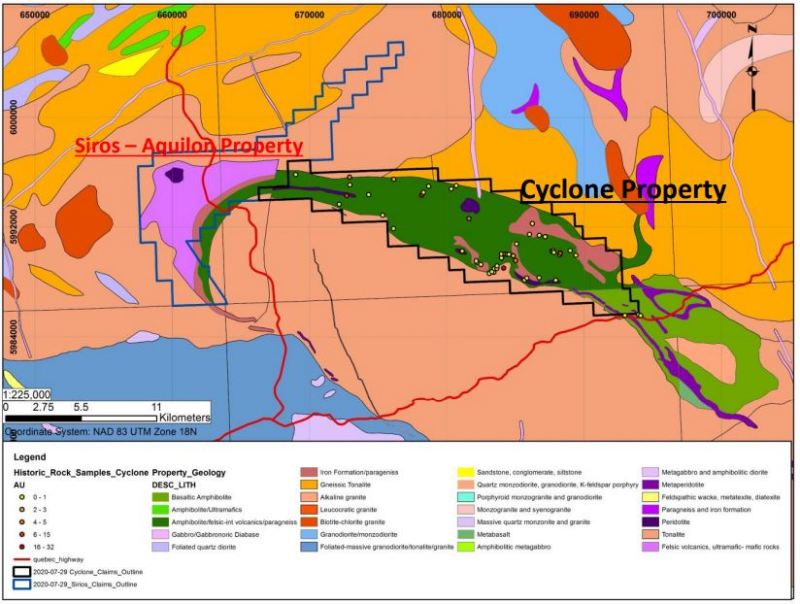

The Cyclone Project consists of a large, district-scale gold-nickel exploration project, located in the James Bay Region of northern Quebec. Within the James Bay Region are several past / producing gold mines including Newmont's Eleonore Gold Mine, which began production in 2014. Cyclone consists of 260 mineral claims, totalling 13,166 hectares, covering a 28-kilometer-long portion of the Aquilon Greenstone Belt. The Aquilon Belt is a relatively newly characterized (2011) series of volcano-sedimentary rocks that hosts potential for gold and nickel/copper mineralization.

Sirios Resources has conducted several exploration programs at their Aquilon Property, located immediately to the west of the Cyclone Property, in the same greenstone belt. Sirios' property has thirty (30) high-grade surface gold showings, including some with spectacular gold grades up to 800 grams per tonne and more (see Sirios Resources news releases September 22, 2020, and January 19, 2011). Numerous shallow drill holes were completed on the property over the years (205 holes totaling 12,247m), with the majority of the work concentrated on four of the showings.

Historical exploration at Cyclone consists of regional-scale mapping and prospecting, as well as an airborne magnetic-electromagnetic (EM) survey. The regional-scale mapping confirmed the mafic and ultramafic rocks, felsic volcanics and iron-formation. During the regional-scale mapping, some of the ultramafic rocks were found to contain minor sulphide (pyrhhotite, chalcopyrite and pyrite) with elevated nickel and chromium. The EM conductors remain largely un-tested.

Two types of gold mineralization have been identified within the western part of the belt. High grade vein-type gold mineralization found in auriferous quartz and carbonate veins hosted within felsic rock associated with felsite's and disseminated pyrite halos. Mineralization tends to be found along a strong lineament known as the Wolfe Corridor. And lower grade gold mineralization associated with bands of disseminated sulphides (Py-Po) with some anomalous copper and zinc values. Large volumes of ultramafic rock at the Cyclone Property suggest there is good potential for magmatic sulphide mineralization (Ni +/- PGE's).

"This acquisitions gives our Canadian portfolio a district scale foothold in an underexplored greenstone belt, in a well established mining area," said Alex Klenman, President and CEO. "Archean greenstones host the vast majority of gold mineralization in Canada, and the immediate area has produced some bonanza grade gold values. We feel the ability to develop almost an entire greenstone with multiple material upside will, in time, strengthen our asset base. We're looking forward to working with the vendors and getting work done in the coming months," continued Mr. Klenman.

Image 1: Cyclone property located on the Aquilon Greenstone Belt, North-Central Quebec, Canada

The Cyclone Project has not yet seen any drilling, or a systematic exploration program for gold or base-metals. At the north end of the Property, it is approximately 1.5 kilometres from an all-weather access road to the La Forge hydroelectric facility, and the all-weather Trans-Taiga Highway passes less than 1 kilometer from the south end of the Property.

The Company is at arms-length from each of Cyclone, and the Vendors. In consideration for all of the outstanding share capital of Cyclone, the Company has agreed to issue 12,000,000 common shares. In connection with completion of the transaction, the Company does not expect to assume any material liabilities, except for a cash payment of $50,000 related to ownership of the Cyclone Project and the requirement to fund exploration expenditures of at least $125,000 on or before March 31, 2022, to maintain the Project. The transaction will not result in the creation of a new insider, or a change of control, of the Company, within the meaning of applicable securities laws. Completion of the transaction remains subject to the approval of the TSX Venture Exchange and cannot be completed until such approval has been received. No finder's fees or commissions are payable in connection with the transaction.

Warren Robb P.Geo., Vice President, Exploration, is the designated Qualified Person as defined by National Instrument 43-101 has approved, the technical information contained in this release.

About the Company

Nexus Gold is a Canadian-based gold exploration and development company with an extensive portfolio of projects in Canada and West Africa. The Company's primary focus is on its 100%-owned, 98-sq km Dakouli 2 Gold Concession in Burkina Faso, West Africa, and the approximately 1400-ha McKenzie Gold Project, located in Red Lake, Ontario. The Company is concentrating on the development of its core assets while seeking joint-venture, earn-in, and strategic partnerships for other projects in its portfolio.

For more information, please visit nxs.gold

On behalf of the Board of Directors of

Nexus Gold CORP.

Alex Klenman

President & CEO

604-558-1920

info@nexusgoldcorp.com

www.nexusgoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.

Copyright (c) 2021 TheNewswire - All rights reserved.