Japan Gold Corp. (the "Company") (TSXV: JG) (OTCQB: JGLDF) is pleased to announce the results of the three scout drill holes completed at its Ohra-Takamine Project in southern Kyushu. Drilling encountered narrow high-grade gold vein intercepts below the Urushi Mine, and multiple gold-anomalous sheeted quartz vein zones below the Ohra Mine workings.

Ohra-Takamine Central Mine Corridor Scout Drill Program

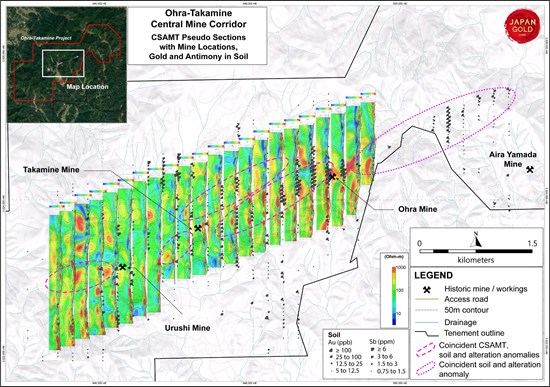

Three scout holes were drilled (total 1624.0 metres (m)) along the central 3.5 kilometres (km) corridor of alteration and epithermal-gold mineralization defined by the Ohra, Takamine and Urushi historic mines, (Figure 1). Production records prior to the government-imposed closure of these mines in 1943, include high-grade vein shoots with grades greater than 20 g/t gold at the Ohra Mine, and between 50 to 100 g/t1at the Urushi Mine, (Figure 2). Drilling targeted below these high-grade shoots, which lie coincident with surface soil geochemical anomalies (Figure 3) and CSAMT geophysical anomalies (Figure 4).

Drilling Results

- Drillhole OTDD20-001, targeting the down dip extension of the Urushi Mine workings, intersected 7 narrow, gold-anomalous quartz veins (Figure 5) including highlight intercepts of:

0.35 m @ 21.7 g/t Au & 13 g/t Ag from 233.95 m

4.15 m @ 1.6 g/t Au & 2.4 g/t Ag from 222.6 m

(inc. 0.55 m @ 3.5 g/t Au & 4.5 g/t Ag from 225.7 m)

(and. 0.25 m @ 6.5 g/t Au & 7.5 g/t Ag from 226.0 m)

1.2 m @ 1.5g/t Au & 31 g/t Ag from 114. 4m

(inc. 0.4 m @ 3.2 g/t Au & 84 g/t Ag from 115.2 m)

- Drill hole OTDD19-001, drilled from the north side of the Ohra Mine, intersected a 4.5 m wide (down-hole width) quartz vein from 227 m down hole. A 0.35 m wide portion of the vein returned 1.7 g/t Au and 5.0 g/t Ag.

- Drillhole OTDD20-002, targeting beneath the Ohra Mine workings (Figure 6) intersected numerous broad intervals of intense alteration and quartz veining from a downhole depth of 206 m to end of hole (584 m). These zones range from 4 to 40 m in downhole length.

Drill intersections include the following significant mineralized intervals:

Table 1: Anomalous drill hole intercepts.

| Hole ID | Azimuth (degrees) | Inclination (degrees) | Total Depth | From (m) | To (m) | Interval (m) | Au (ppm) | Ag (ppm) |

| OTDD19-001 | 195 | 45 | 455.00 | 231.15 | 231.50 | 0.35 | 1.7 | 5.0 |

| OTDD20-001 | 335 | 50 | 602.00 | 114.40 | 115.60 | 1.20 | 1.5 | 31.0 |

| Incl. | 115.20 | 115.60 | 0.40 | 3.2 | 84.0 | |||

| 166.95 | 167.20 | 0.25 | 1.1 | 1.8 | ||||

| 222.60 | 226.75 | 4.15 | 1.6 | 2.4 | ||||

| Incl. | 225.70 | 226.25 | 0.55 | 3.5 | 4.5 | |||

| Incl. | 226.00 | 226.25 | 0.25 | 6.5 | 7.6 | |||

| 233.95 | 234.30 | 0.35 | 21.7 | 13.3 | ||||

| 326.90 | 327.70 | 0.80 | 1.3 | 3.0 | ||||

| 329.10 | 329.35 | 0.25 | 1.5 | 4.0 | ||||

| 383.50 | 383.90 | 0.40 | 2.9 | 4.0 | ||||

| OTDD20-002 | 330 | 40 | 584.00 | No significant result | ||||

Urushi Mine

The mineralization intersected in the upper half of drill hole OTDD20-001, is separate and parallel to the veins mined in the Urushi workings, Figure 5. The up-dip extension of these veins is untested at the elevation of the Urushi Mine workings and may represent en echelon (parallel) repetitions of the high-grade veins mined at Urushi. The mineralized veins intersected below 326.9 m downhole appear to represent the down dip extension of vein structures mined historically in the Urushi workings.

Within the mine alteration corridor, 8 drill holes were completed as part of government funded geological survey work by the Metal Mining Agency of Japan (MMAJ) during the 1980's. Two drill holes located north of the Urushi Mine encountered narrow high-grade mineralization and indicate the potential for mineralized extensions along the north side of the mine workings, refer to Figure 5. The other MMAJ drill holes failed to reach the interpreted depth projection of the Ohra-Takamine vein system hence did not encounter significant mineralization.

Ohra Mine

Drill hole OTDD20-002 targeted the depth extent of three, wide, banded epithermal veins mined from surface over a ~140 m vertical extension at the Ohra Mine. Surface outcrops of the three Ohra veins are up to 4.6 m wide and vary in width between 0.3 and 8 m underground2, (Figure 2 & 6). Eight discrete zones of intense sheeted to stockwork veining were intersected, varying in downhole length between 4 and 40 m. These zones contain numerous banded and single-phase, fine-grained quartz and quartz-carbonate veins and veinlets up to 30 centimetres (cm) wide.

The five vein zones intersected between 228 and 360 m, immediately below the Ohra workings contain anomalously elevated gold values and are interpreted to represent the feeder structures to the Ohra veins mined in historical workings. Three vein network zones intersected deeper in the drill hole, between 420 to 523 m, could represent the feeder system to a separate, parallel vein system, (Figure 6). The lower three vein zones show limited exposure at surface, ~250 m above, but their surface expression is characterised by strong, pervasive clay alteration and elevated gold and pathfinder element geochemistry in soils. Sinter sub-crops, and coincident CSAMT, soil and alteration anomalism are traceable along the mine corridor for 1.5 km from the Ohra Mine towards the Takamine Mine representing the strike extension the Ohra Mine veins.

Conclusions and Next Steps

Information gained from these scout drill holes has been assessed along with coincident anomalies of CSAMT, soil geochemistry, alteration and geological mapping. These results have defined a series of un-tested targets that lie both along strike of, and parallel to the historic mines. The combined strike length of these more coherent geophysical-geochemical-alteration anomalies represents a series of priority drill target areas with a cumulative strike length of over 5 km, (Figures 1, 3 & 4). A separate, coincident soil geochemical - alteration anomaly extends the Ohra alteration system another 2.5 km along strike to the northeast. Geophysical surveys are planned to further define this large anomaly, (Figure 3).

The discovery of new vein zones with limited or weak surface outcrop in the vicinity of the Urushi Mine as well as between the Ohra and Takamine Mines, gives encouragement for the exploration potential both along the trend and below cover further along strike to the southwest, where coincident soil and CSAMT anomalies are partly concealed by younger post-mineral geology.

The Company has 11 additional drill pad locations permitted for drilling along the central mine corridor. With the definition of these new target zones, further drill pads will be permitted to properly test and advance the Ohra-Takamine Project.

References:

1 Gold Mines of Japan, 1989. The Mining & Materials Processing Institute of Japan.

2 Kim S., (1938) The Geology and Deposits in the Ohra Mine. The Mining Magazine, vol. 15, no. 3, p. 15-19.

Sampling Techniques and Assaying

The drilling results discussed in this news release are from drill core samples obtained by PQ, HQ and NQ-size triple-tube diamond core drilling using a Longyear 38, and PMC700 man-portable drill rigs owned and operated by the Company. The drilling program was fully supervised by Company senior geologists at the drilling site.

Drill core was collected in plastic core-trays at the drill site and transported by road in Company vehicles to its core shed storage facility in the nearby Urushi Village, located centrally within the project area. The drill core was carefully logged, photographed and sample intervals marked-up along predicted mineralized and selected unmineralized intervals by Japan Gold KK senior project geologists.

Sample lengths varied from 0.2 to 1.0 m; depending on the positions of geological contacts and variations in vein texture and composition. The core was split by diamond rock saw supervised by project geologists. Half-core sample was collected from the entire length of each designated sample interval and placed into individual-labelled, self-sealing calico bags for secure packaging and transport to the laboratory. The half-core samples weighed between 1 to 8 kg depending on the sample length and core size. A Chain-of-Custody was established between the Company and receiving laboratory to ensure the integrity of the samples during transportation from site to the lab. The samples were sent in batches to ALS Laboratories in Vancouver, Canada for sample preparation and assaying.

Samples were crushed, pulverised and assayed for gold 50 g charge Fire Assay/ AAS Finish (Au-AA24; 0.005 ppm lower detection limit) and a 48 multi-element by 4-acid digest with ICP-MS determination (ME-MS61L; Ag 0.002 ppm lower detection limit).

Certified Reference Materials (CRMs) were inserted by Japan Gold KK at every 20th sample to assess repeatability and assaying precision of the laboratory. In addition, the laboratory applied its own internal Quality Control procedure that includes sample duplicates, blanks & geochemical standards. They report these results with the certified Assay Report. Laboratory procedures and QAQC protocols adopted are considered appropriate. The CRMs and internal QC-QA results fall within acceptable levels of accuracy & precision and are considered to lack any bias.

Qualified Person

The technical information in this news release has been reviewed and approved by Japan Gold's Vice President of Exploration and Country Manager, Andrew Rowe, BAppSc, FAusIMM, FSEG, who is a Qualified Person as defined by National Instrument 43-101.

On behalf of the Board of Japan Gold Corp.

"John Proust"

Chairman & CEO

About Japan Gold Corp.

Japan Gold Corp. is a Canadian mineral exploration company focused solely on gold exploration across the three largest islands of Japan: Hokkaido, Honshu and Kyushu. The Company has a country-wide alliance with Barrick Gold Corporation to jointly explore, develop and mine certain gold mineral properties and mining projects. The Company holds a portfolio of 31 gold projects which cover areas with known gold occurrences, a history of mining and are prospective for high-grade epithermal gold mineralization. Japan Gold's leadership team represent decades of resource industry and business experience, and the Company has recruited geologists, drillers and technical advisors with experience exploring and operating in Japan. More information is available at www.japangold.com or by email at info@japangold.com.

John Proust

Chairman & CEO

Phone: +1 778 725-1491

Email: info@japangold.com

Cautionary Note

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements relating to the Private Placement. These statements are forward-looking in nature and, as a result, are subject to certain risks and uncertainties that include, but are not limited to, general economic, market and business conditions; receipt and timing of regulatory approvals; new legislation; potential delays or changes in plans; and the Company's ability to execute and implement future plans. These forward-looking statements include completion of the Private Placement and the use of proceeds from that financing. Actual results achieved may differ from the information provided herein and, consequently, readers are advised not to place undue reliance on forward-looking information. The forward-looking information contained herein speaks only as of the date of this news release. The Company disclaims any intention or obligation to update or revise forward-looking information or to explain any material difference between such and subsequent actual events, except as required by applicable law.

Figure 1: Ohra-Takamine Central Mine Corridor, simplified geology and historic mines, alteration, drilling and combined anomalous zones

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/5665/77406_b22f205924403ad9_001full.jpg

Figure 2: Ohra-Takamine central mine corridor long-section with historic workings and drill holes.

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/5665/77406_b22f205924403ad9_002full.jpg

Figure 3: Ohra-Takamine central mine corridor with gold and antimony soil anomalies and alteration interpretation

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/5665/77406_b22f205924403ad9_003full.jpg

Figure 4: Ohra-Takamine central mine corridor with CSAMT pseudo-sections, gold-antimony soil anomalies and combined anomalous zones

To view an enhanced version of Figure 4, please visit:

https://orders.newsfilecorp.com/files/5665/77406_b22f205924403ad9_004full.jpg

Figure 5: Urushi Mine cross-section with Japan Gold and MMAJ drill intersections

To view an enhanced version of Figure 5, please visit:

https://orders.newsfilecorp.com/files/5665/77406_b22f205924403ad9_005full.jpg

Figure 6: Ohra Mine cross-section with Japan Gold and MMAJ drilling

To view an enhanced version of Figure 6, please visit:

https://orders.newsfilecorp.com/files/5665/77406_b22f205924403ad9_006full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/77406