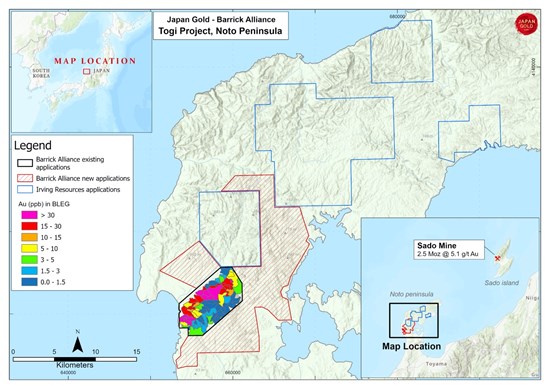

Japan Gold Corp. (TSXV: JG) (OTCQB: JGLDF) (the "Company") is pleased to announce acceptance by the Japanese Ministry of Economy, Trade and Industry ("METI") of 51 new prospecting rights applications covering approximately 145 sq km around its Barrick Alliance Togi Project, on the Noto Peninsula of Honshu Island (Figure 1).

Togi Project Highlights:

During November 2020, the Barrick Alliance collected 412 rock samples and 88 bulk leach extractable gold (BLEG) samples across the Togi Project. Systematic stream sediment sampling defined a continuous, 8 km long corridor of gold anomalous drainages within the Togi Project (Figure 1).

Rock samples collected during the BLEG sampling program from vein outcrops, float, and historic mine waste-dumps also provided very encouraging results:

- From the 412 rock samples collected, 235 samples assayed greater than 0.5 g/t gold, with 91 assaying greater than 5 g/t gold

- 64 of these samples assayed between 5 and 20 g/t Au

- And 27 of these samples assayed greater than 20 g/t Au, with a peak value of 79.7 g/t Au

For more information on results of the initial phase sampling at the Togi Project refer to the Company's news release dated April 22, 2021.

Following a review of these very encouraging results, the Alliance decided to apply for additional ground covering the same geological formations which host the gold mineralisation within the Togi Project.

These new additions to the Togi Project are part of the Barrick Alliances strategy to continue to expand the portfolio based on the identification of key prospectivity indicators throughout the gold provinces of Japan.

Togi Project

Togi Project, now comprising 184.7 sq km, is located on the northern flank of a regional graben structure, hosted in early Miocene andesite volcanics, and under-lain by a northeast trending gravity anomaly. A similar geological and structural setting is noted 160 km along strike to the northeast at Sado Island. Sado Island hosts Japan's second largest gold mine, the Sado Mine which produced of 2.5 million ounces of gold and 74 million ounces of silver1prior to its closure in 1974 (Figure 1).

Gold mineralization was discovered in the Togi area in 1896 and historic records from the Togi Goldfield report seven separate areas of workings along a 7 km trend which produced a combined 48,000 oz of gold and 180,000 oz of silver between 1910-212. The Mori vein from the Hirochi group at the northeast end of the corridor was reported to be up to 4 m wide with production grades averaging 14 g/t gold2.

Gold and silver mineralisation from the Urugami veins in the southwest of the corridor are hosted in stockwork vein and breccia zones. Mapped Sinter and the narrower stock-work style of quartz vein mineralization at Urugami indicate the top of a hot-spring epithermal system is preserved, supporting the potential for deeper boiling-zone vein targets at Togi.

References

1 Garwin, S.G. et al. 2005. Tectonic setting, Geology, and gold and copper mineralization in the Cenozoic magmatic arcs of Southeast Asia and the West Pacific. Economic Geology 100th Anniversary Vol. pp 891-930

2 Gold Mines of Japan, 1989. The Mining & Materials Processing Institute of Japan

Qualified Person

The technical information in this news release has been reviewed and approved by Japan Gold's Vice President of Exploration, Andrew Rowe, BAppSc, FAusIMM, FSEG, who is a Qualified Person as defined by National Instrument 43-101.

On behalf of the Board of Japan Gold Corp.

"John Proust"

Chairman & CEO

About Japan Gold Corp.

Japan Gold Corp. is a Canadian mineral exploration company focused solely on gold exploration across the three largest islands of Japan: Hokkaido, Honshu and Kyushu. The Company has a country-wide alliance with Barrick Gold Corporation to jointly explore, develop and mine certain gold mineral properties and mining projects. The Company holds a portfolio of 31 gold projects which cover areas with known gold occurrences, a history of mining and are prospective for high-grade epithermal gold mineralization. Japan Gold's leadership team represent decades of resource industry and business experience, and the Company has recruited geologists, drillers and technical advisors with experience exploring and operating in Japan. More information is available at www.japangold.com or by email at info@japangold.com.

For further information, please contact:

John Proust

Chairman & CEO

Phone: 778-725-1491

Email: info@japangold.com

Cautionary Note

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release contains forward-looking statements relating to expected or anticipated future events and anticipated results related to future partnerships and the Company's 2020 gold exploration program. These statements are forward-looking in nature and, as a result, are subject to certain risks and uncertainties that include, but are not limited to, general economic, market and business conditions; competition for qualified staff; the regulatory process and actions; technical issues; new legislation; potential delays or changes in plans; working in a new political jurisdiction; results of exploration; the timing and granting of prospecting rights; the Company's ability to execute and implement future plans, arrange or conclude a joint-venture or partnership; and the occurrence of unexpected events. Actual results achieved may differ from the information provided herein and, consequently, readers are advised not to place undue reliance on forward-looking information. The forward-looking information contained herein speaks only as of the date of this News Release. The Company disclaims any intention or obligation to update or revise forward‐looking information or to explain any material difference between such and subsequent actual events, except as required by applicable laws.

Figure 1: Barrick Alliance Togi Project, Noto Peninsula, West Honshu, 2020 BLEG results and the new area of accepted applications.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/5665/92034_fd6c5996947499f8_001full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/92034