Idaho Champion Gold Mines Canada Inc. (CSE:ITKO)(OTCQB:GLDRF)(FSE:1QB1) ("IdahoChampion" or the 'Company') is pleased to announce details for the planned drilling component of the previously announced 2021 exploration program (the "Field Program") at the 100% controlled Champagne Gold Project ("Champagne") near the city of Arco, Butte County, Idaho (See press release dated May 12, 2021

Idaho Champion has signed a contract for an 8,000-metre core drilling program (the "Drill Program") with National Drilling (Elko, NV). The Drill Program is expected to begin at Champagne in early July 2021, pending final approvals from the U.S. Bureau of Land Management. The Company's geologists are currently on-site and carrying out mapping and sampling around known occurrences of mineralized vein breccia and other intense alterations in the northern part of the property. The core logging and processing facility is also being readied for the upcoming drilling.

Company technical advisor, Dr. Craig Bow, commented on the findings of the 2020 program, "From Champion's technical efforts during the 2020 exploration program, we believe that the breccia veins and vuggy silica bodies exploited at Mine Hill and outlying areas represent two distinct epithermal events; a high silver, polymetallic phase and a distinct, high sulfidation overprint. Observed mineralization is consistent with the presence of a deeper-seated porphyry copper (moly) system at depth. Further, the ground geophysical survey conducted in 2020 suggests that the Mine Hill mineralization is cut at relatively shallow depths by a low-angle detachment fault and displaced 800 meters to the ESE. Drilling in 2021 will test for the roots of this system.'

2021 Drill Program

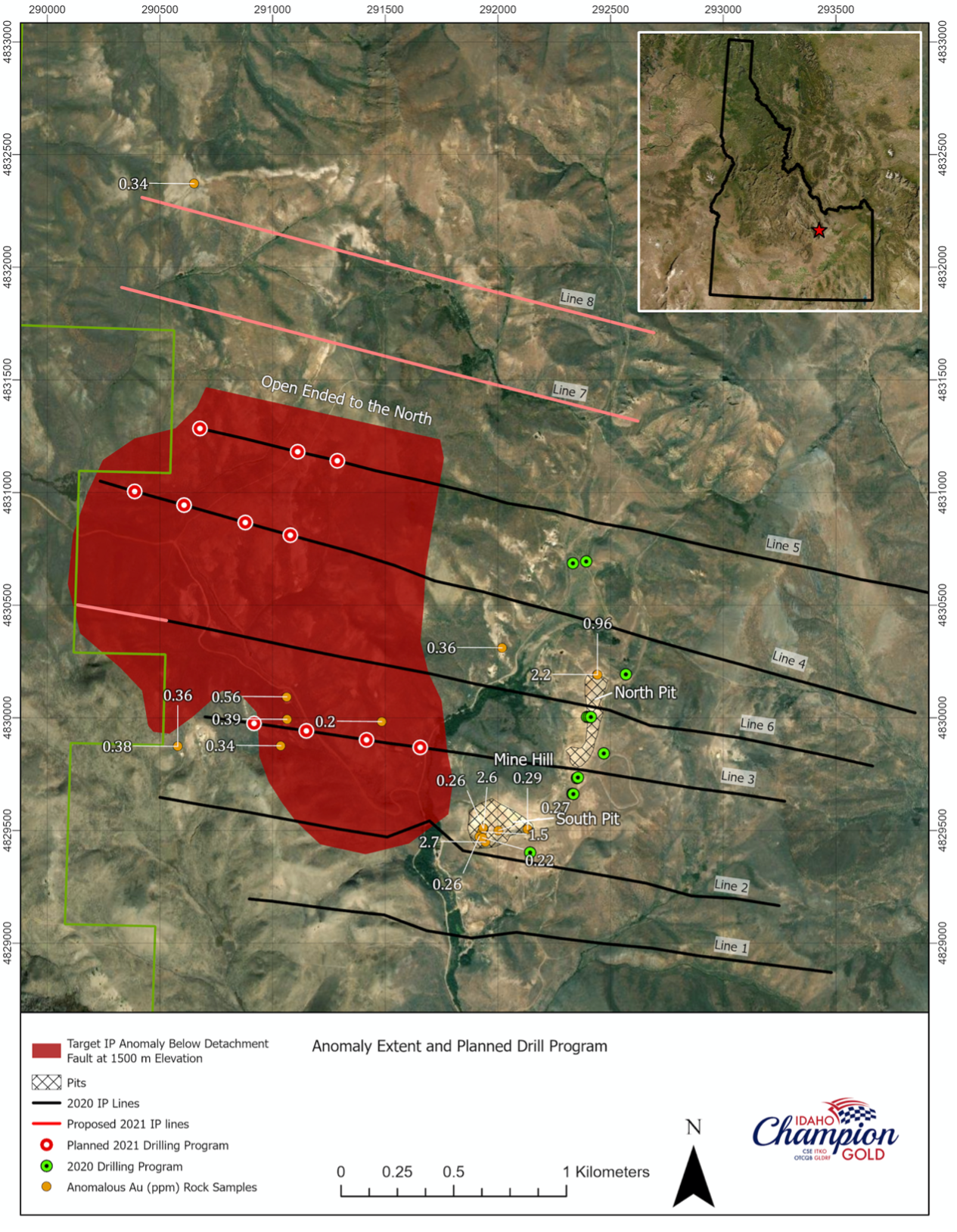

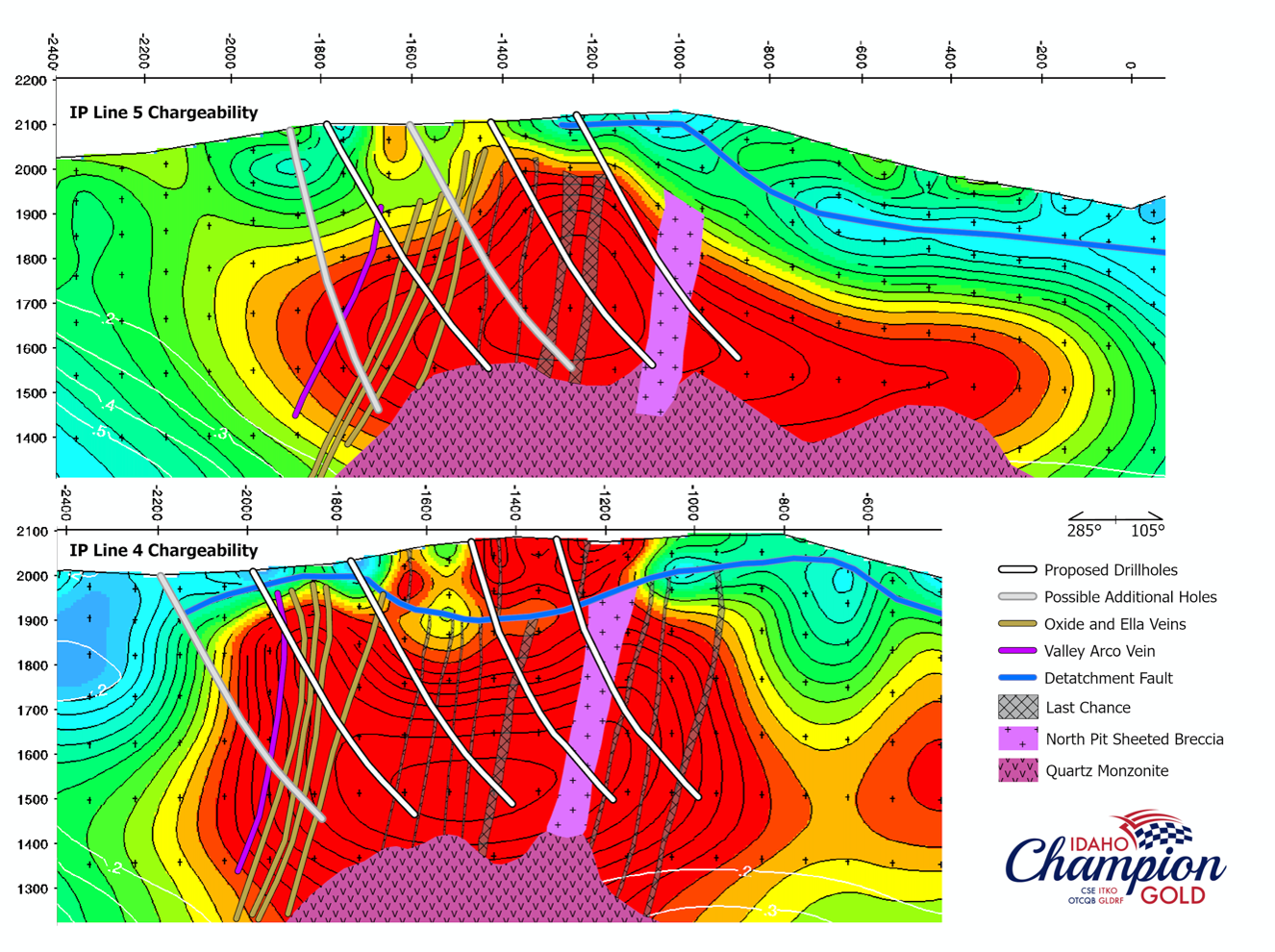

The Drill Program is designed to test the large Induced Polarization (IP) anomaly (Figure 1) identified during the 2020 exploration program northwest of the Mine Hill mineralization (See press release dated February 2, 2021). The drilling will proceed with a series of holes comprising "fences", first along IP line 4 and then line 5 (Figure 2). The program design includes possible additional holes along IP line 3.

"The drill targets along IP lines 4 and 5 are first priority because of the strength of the anomaly and the relatively shallow depth of cover rocks above the detachment fault, ranging between 30 to 60 meters. Given the relatively shallow depth to the target, there is the potential for outlining an open-pittable resource in this area," commented Chief Geologist, Robert Kell. "The mineralization at Mine Hill occurred in near-vertical to steeply dipping vein breccia and vuggy silica zones, so the angled holes in the 2021 program are designed to effectively test such high-angle features and optimize our geologic understanding."

Figure 1. 2021 Drill Program Location in relation to IP anomaly.

2021 IP Survey

As part of the Field Program, the Company will engage Durango Geophysical (Durango, CO) to complete IP line 6 and add two new lines, which will be completed late in the second quarter. Lines -7 and -8 will be designed to test for an extension of the IP anomaly another 800 meters to the north. The completion of line 6 is essential for fully defining the anomaly, which will be needed to plan further drilling to the south. Depending upon the results of the extended IP survey, the drill may be moved northward to test the continuation of the anomaly. Bringing in a second drill rig toward the end of August is already being considered to take on drilling out the anomaly in a southward direction, including the potential holes along IP line 3.

Figure 2. Cross Section of 2021 Drill Program location along IP Line 4 and 5.

The Company also announces the completion of the previously announced early exercise warrant incentive program (the "Program") (See press release dated: May 3, 2021). Under the Program, Idaho Champion received aggregate gross proceeds of $45,000 upon the exercise 300,000 Warrants and issued 300,000 incentive warrants. As per the Program, the Incentive Warrants are subject to a four-month and a day hold period from the date of the Incentive Warrant issuance pursuant to applicable Canadian securities laws. Each Incentive Warrant has a strike price of $0.25 for a period of five (5) years.

About the Champagne Project

The Champagne Mine* was operated by Bema Gold as a heap leach operation on an epithermal gold-silver system that occurs in volcanic rocks. Bema Gold drilled 72 shallow reverse circulation holes on the project, which complement drilling and trenching from other previous operators. The property has had no deep drilling or significant modern exploration since the mine closure in early 1992.

The Champagne Deposit contains epigenetic style gold and silver mineralization that occurs in strongly altered Tertiary volcanic tuffs and flows of acid to intermediate composition. Champagne has a near surface cap of gold-silver mineralization emplaced by deep-seated structures that acted as conduits for precious metal rich hydrothermal fluids. Higher grade zones in the Champagne Deposit appear to be related to such feeder zones.

* The Company cautions that the information about the past-producing mine may not be indicative of mineralization on Champion's property, and if mineralization does occur, that it will occur in sufficient quantity or grade that would result in an economic extraction scenario. The historic data were simply used to evaluate the prospective nature of the property. The Company has not yet conducted sufficient exploration to ascertain if a mineral resource is present on the property.

Qualified Person

The technical information in this press release has been reviewed and approved by Peter Karelse P.Geo., a consultant to the Company, who is a Qualified Person as defined by NI 43-101. Mr. Karelse has more than 30 years of experience in exploration and development.

About Idaho Champion Gold Mines Inc.

Idaho Champion is a discovery-focused gold exploration company that is committed to advancing its 100%-owned highly prospective mineral properties located in Idaho, United States. The Company's shares trade on the CSE under the trading symbol "ITKO", on the OTCQB under the trading symbol "GLDRF", and on the Frankfurt Stock Exchange under the symbol "1QB1". Idaho Champion is vested in Idaho with the Baner Project in Idaho County, the Champagne Project located in Butte County near Arco, and four cobalt properties in Lemhi County in the Idaho Cobalt Belt. Idaho Champion strives to be a responsible environmental steward, stakeholder and a contributing citizen to the local communities where it operates. Idaho Champion takes its social license seriously, employing local community members and service providers at its operations whenever possible.

ON BEHALF OF THE BOARD

"Jonathan Buick"

Jonathan Buick, President and CEO

For further information, please visit the Company's SEDAR profile at www.sedar.com or the Company's corporate website at www.idahochamp.com.

For further information please contact:

Nicholas Konkin, Marketing and Communications

Phone: (416) 567- 9087

Email: nkonkin@idahochamp.com

THIS PRESS RELEASE DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES IN ANY JURISDICTION, NOR SHALL THERE BE ANY OFFER, SALE, OR SOLICITATION OF SECURITIES IN ANY STATE IN THE UNITED STATES IN WHICH SUCH OFFER, SALE, OR SOLICITATION WOULD BE UNLAWFUL.

Cautionary Statements

Neither the Canadian Securities Exchange nor its regulation services provider has reviewed or accepted responsibility for the adequacy or accuracy of this press release This press release may include forward-looking information within the meaning of Canadian securities legislation, concerning the business of the Company. Forward-looking information is based on certain key expectations and assumptions made by the management of the Company, including suggested strike extension. Although the Company believes that the expectations and assumptions on which such forward-looking information is based on are reasonable, undue reliance should not be placed on the forward-looking information because the Company can give no assurance that they will prove to be correct. Forward-looking statements contained in this press release are made as of the date of this press release. The Company disclaims any intent or obligation to update publicly any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.

SOURCE: Idaho Champion Gold Mines Canada Inc.

View source version on accesswire.com:

https://www.accesswire.com/650834/Idaho-Champion-Gold-Announces-Drill-Program-at-Champagne-Gold-Project