(TheNewswire)

Guyana Goldstrike Inc. (the " Company " or " Goldstrike ") (TSXV:GYA ) ( OTC:GYNAF) is pleased to announce that the Company has entered into a definitive option agreement (the " Agreement ") to acquire Alice Arm North (" Alice Arm " or the " Property "), a precious metals prospect located in the Golden Triangle, British Columbia from Granby Gold Ltd. (" Granby "), an arms-length private company

Alice Arm North is located approximately 50 km southeast of Stewart, British Columbia and 9 km south of the Dolly Varden Silver Mine owned by Dolly Varden Silver Corp. The Property comprises 16 mineral tenures, 100% owned by Granby, covering an area of approximately 842 hectares. Hecla Canada Ltd. currently owns all claims that immediately surround the Property.

Four mineral occurrences of polymetallic veins are currently known on the property: Eagle (Ag-Pb-Zn+/-Au), La Rose (Ag-Pb-Zn+/-Au), B and C (Zn-Pb), Cape Nome (Ag-Pb-Zn+/-Au). The Bunker Hill occurrence (Ag-Pb-Zn+/-Au) is adjacent to the claim group. Geophysics has identified a high resistivity axis in a northwest to southeast trend across the northeastern portion of the claim block, between the La Rose and Eagle mineral occurrences. This may reflect a zone of enhanced silicification. *

A magnetic low and coincident conductivity high are located approximately 600 m to 800 m north of the Bunker Hill mineral occurrence. The geophysical anomaly extends northerly to the area of the La Rose past producer.

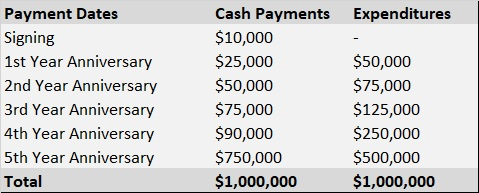

Under the terms of the Agreement, the Company will be granted the right to acquire up to a one-hundred percent interest in the Property in consideration for completing a series of cash payments totaling $1,000,000 over a five year term, of which $10,000 is due and payable to the Company initially, and incurring expenditures on the Project of at least $1,000,000 over a five year term. Granby will retain a 2.5% NSR on the Property with the Company having a right to make a one time buy-down of 1% of the NSR for $1,000,000. The Company is required to make the cash payments, and incur the expenditures, in accordance with the following schedule in order to maintain the Agreement in good standing and acquire the Property:

The Company anticipates that the Property will form part of a portfolio of exploration-stage gold projects and does not anticipate that the majority of its working capital or resources will be devoted to the Property in the next twelve months. No finders' fees or commissions are payable in connection with the Agreement.

* Campbell, December 2017, p 29

Qualified Person

Christopher Campbell, P. Geo is a Qualified Person in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects . Mr. Campbell has reviewed and approved the scientific and technical content of this news release.

For more information please visit www.guyanagoldstrike.com.

On behalf of the Board of Directors of

Guyana Goldstrike INC.

Peter Berdusco

President and Chief Executive Officer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain certain "Forward-Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target, "plan", "forecast", "may", "schedule" and other similar words or expressions identify forward-looking statements or information. These forward-looking statements or information may relate to the intended development of the Property, and other factors or information. Such statements represent the Company's current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affections such statements and information other than as required by applicable laws, rules and regulations.

Copyright (c) 2020 TheNewswire - All rights reserved.