Fabled Silver Gold Corp. ('Fabled' or the 'Company') (TSXV:FCO)(OTCQB:FBSGF)(FSE:7NQ) is pleased to announce updates of the results of diamond drilling from the newly upgraded 14,200 meter drill program on the 'Santa Maria' Property in Parral, Mexico

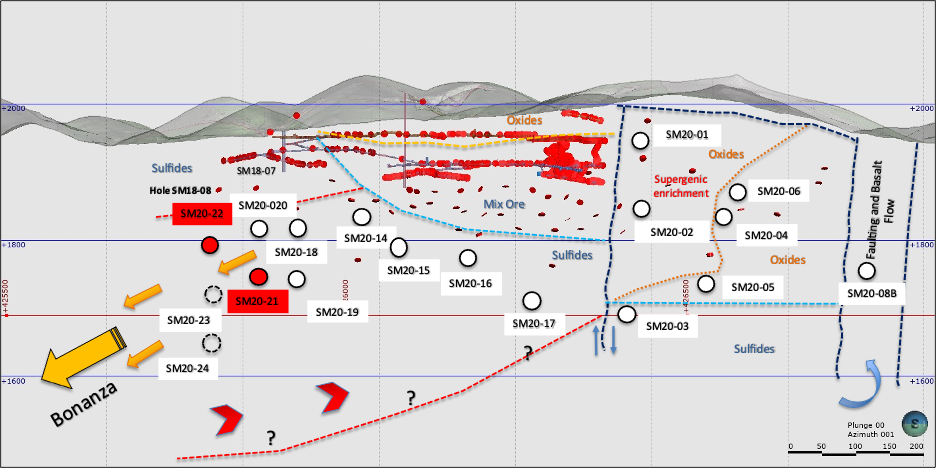

Peter J. Hawley, CEO and President, remarks, 'We are pleased to announce drill assay results for surface diamond drill holes SM20-21 and SM20-22, please see Figure 1 below.

Mr. Hawley continues: 'As a result of discovering this new gold domain system, and ongoing interpretation of structural controls, assays results to date, and visual examination of recently drilled holes we have immediately expanded the present drilling by 5,000 meters, to a total of 14,200 meters. This will ensure that we have significant meterage to properly evaluate this gold discovery.'

Figure 1 - Longitudinal View of Area of Current Drilling

SM20 - 21.

As previously reported, drill holes SM20-19 intercepted a large low-grade structure below a high-grade zone. The same applies in this case. Both holes SM20-19 and SM20-21 intercepted the structure at the same vertical depth of -225 meters which contains little gold at this elevation.

Readers should note, that these holes were drilled before receiving the assays from the gold discovery in hole SM20-20 previously reported.

Table 1- Drill hole SM20-21 Assay Results

Drill Hole | From m | To m | Width m | Au g/t | Ag g/t | AgEq* g/t | Pb % | Zn % | Cu % |

SM20-21 | 231.10 | 264.20 | 18.90 | 0.16 | 7.10 | 15.33 | 0.04 | 0.11 | 0.01 |

Includes | 242.30 | 244.40 | 2.10 | 0.92 | 15.75 | 63.07 | 0.20 | 0.48 | 0.01 |

- ** Ag Equivalent ('Ag Eq') grade is calculated using $20 per ounce Ag and $1,600 Au

Figure 2 - Cross Section for Drill Hole SM20-21

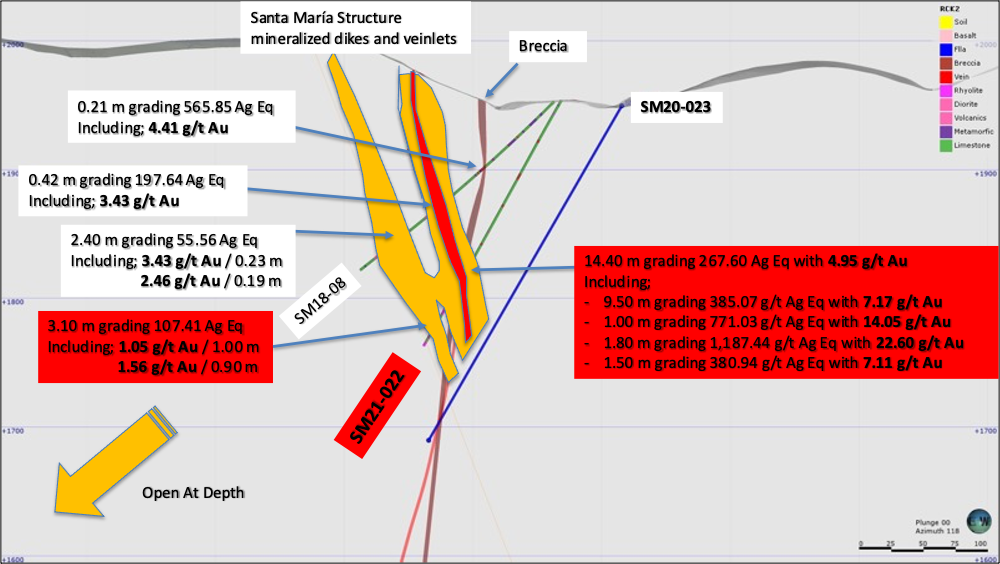

SM20-22

The next fence of holes SM20- 22, 23 and 24 are located 75 meters to the west of drill collars SM20-19-20 and have been designed to intercept the Santa Maria structure at a vertical depth of -175, -225, and -275 meters, respectively, using a newly interpreted mineral / structural thesis which includes new gold mineralization plunging 45 degrees to the west and remains open in all directions.

Peter J. Hawley states: 'As seen below in Tables 2 and 3 and Photos 1 to 4, we continue to define a new, never discovered high grade gold mineral domain system, with silver credits, over consistent widths in an area never explored, and which remains open to the west and at depth, plunging 45 degrees to the west and open in all directions for expansion.

Table 2- Drill hole SM20-22 Compilation Assay Results

Drill Hole | From m | To m | Width m | Au g/t | Ag g/t | Ag Eq* g/t | Pb % | Zn % | Cu % |

SM20-22 | 151.10 | 165.50 | 14.40 | 4.95 | 12.97 | 267.60 | 0.11 | 0.26 | 0.02 |

Includes | 156.00 | 165.50 | 9.50 | 7.17 | 16.25 | 385.07 | 0.14 | 0.29 | 0.03 |

179.30 | 182.40 | 3.10 | 0.94 | 59.06 | 107.41 | 0.53 | 0.37 | 0.04 | |

Includes | 179.30 | 180.30 | 1.00 | 1.05 | 65.60 | 119.61 | 0.77 | 0.00 | 0.04 |

Includes | 181.50 | 182.40 | 0.90 | 1.56 | 78.00 | 158.25 | 0.00 | 0.00 | 0.07 |

- ** Ag Equivalent ('Ag Eq') grade is calculated using $20 per ounce Ag and $1,600 Au

Table 3- Drill hole SM20-22 Selected Individual Assay Results

Drill Hole | From m | To m | Width m | Au g/t | Ag g/t | Ag Eq* g/t | Pb % | Zn % | Cu % |

SM20-22 | 156.00 | 157.00 | 1.00 | 14.05 | 48.30 | 771.03 | 0.63 | 0.00 | 0.08 |

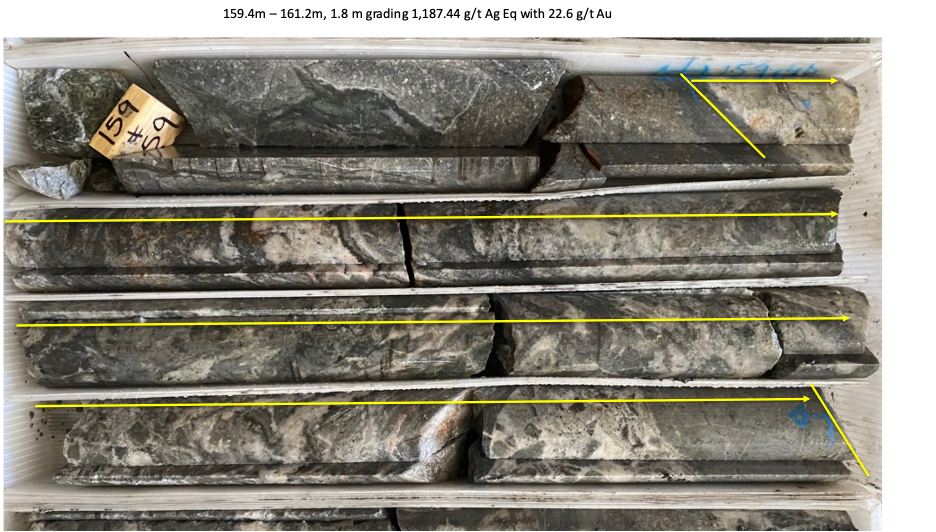

159.40 | 161.20 | 1.80 | 22.60 | 24.90 | 1,187.44 | 0.12 | 0.31 | 0.03 | |

161.20 | 163.00 | 1.80 | 1.10 | 10.40 | 66.98 | 0.04 | 0.18 | 0.04 | |

164.00 | 165.50 | 1.50 | 7.11 | 15.20 | 380.94 | 0.19 | 0.66 | 0.03 |

** Ag Equivalent ('Ag Eq') grade is calculated using $20 per ounce Ag and $1,600 Au

Photo 1 - SM20-22 Gold Intercept

Photo 2 - SM20-22 Gold Intercept

Photo 3 - SM20-22 Gold Intercept, Close Up

Photo 4 - SM20-22 Gold Intercept, Close Up

Figure 3 - Cross Section for Drill Hole SM20-22

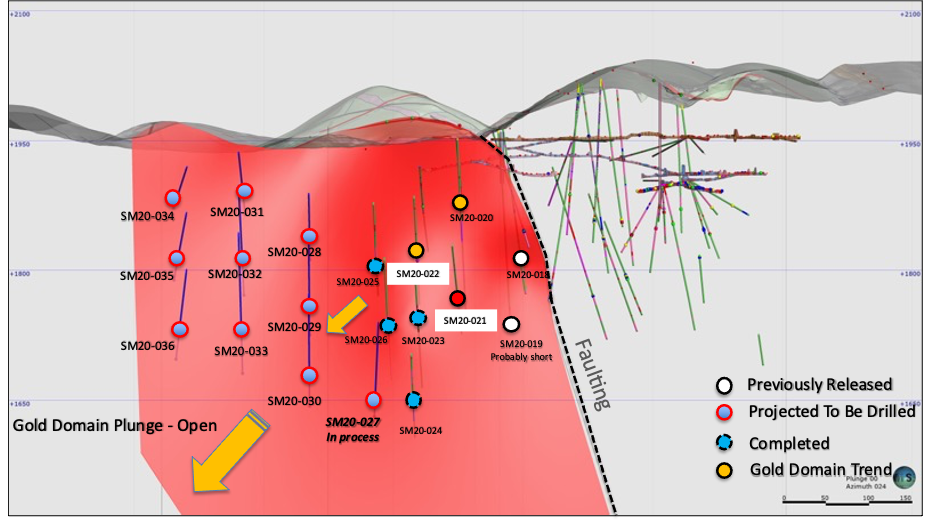

FUTURE DRILLING UPDATE

Drill holes SM20-23 - 26 have been completed and submitted for assay. Hole SM20-27 is in progress and sites for holes SM20-28 to 36 are planned, subject to assays results and structural interpretation.

Figure 5 - Longitudinal Section of New Interpretation

QA QC Procedure

Analytical results of sampling reported by Fabled Silver Gold represent core samples that have been sawn in half with half of the core sampled and submitted by Fabled Silver Gold staff directly to ALS Chemex, Chihuahua, Chihuahua, Mexico. Samples were crushed, split, and pulverized as per ALS Chemex method PREP-31, then analyzed for ME-ICP61 33 element package by four acid digestion with ICP-AES Finish. ME-GRA21 method for Au and Ag by fire assay and gravimetric finish, 30g nominal sample weight.

Over Limit Methods

For samples triggering precious metal over-limit thresholds of 10 g/t Au or 100 g/t Ag, the following is being used:

Au-GRA21 Au by fire assay and gravimetric finish with 30 g sample.

Ag-GRA21 Ag by fire assay and gravimetric finish.

Fabled Silver Gold monitors QA/QC using commercially sourced standards and locally sourced blank materials inserted within the sample sequence at regular intervals.

About Fabled Silver Gold Corp.

Fabled is focused on acquiring, exploring and operating properties that yield near-term metal production. The Company has an experienced management team with multiple years of involvement in mining and exploration in Mexico. The Company's mandate is to focus on acquiring precious metal properties in Mexico with blue-sky exploration potential.

The Company has entered into an agreement with Golden Minerals Company (NYSE American and TSX: AUMN) to acquire the Santa Maria Property, a high-grade silver-gold property situated in the center of the Mexican epithermal silver-gold belt. The belt has been recognized as a significant metallogenic province, which has reportedly produced more silver than any other equivalent area in the world.

Mr. Peter J. Hawley, President and C.E.O.

Fabled Silver Gold Corp.

Phone: (819) 316-0919

peter@fabledfco.com

For further information please contact:

info@fabledfco.com

The technical information contained in this news release has been approved by Peter J. Hawley, P.Geo. President and C.E.O. of Fabled, who is a Qualified Person as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Neither the TSX Venture Exchange nor its Regulations Service Provider (as that term is defined in the policies of the TSX Venture Exchange) does accept responsibility for the adequacy or accuracy of this news release.

Certain statements contained in this news release constitute 'forward-looking information' as such term is used in applicable Canadian securities laws. Forward-looking information is based on plans, expectations and estimates of management at the date the information is provided and is subject to certain factors and assumptions, including, that the Company's financial condition and development plans do not change as a result of unforeseen events and that the Company obtains any required regulatory approvals.

Forward-looking information is subject to a variety of risks and uncertainties and other factors that could cause plans, estimates and actual results to vary materially from those projected in such forward-looking information. Some of the risks and other factors that could cause results to differ materially from those expressed in the forward-looking statements include, but are not limited to: impacts from the coronavirus or other epidemics, general economic conditions in Canada, the United States and globally; industry conditions, including fluctuations in commodity prices; governmental regulation of the mining industry, including environmental regulation; geological, technical and drilling problems; unanticipated operating events; competition for and/or inability to retain drilling rigs and other services; the availability of capital

on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; volatility in market prices for commodities; liabilities inherent in mining operations; changes in tax laws and incentive programs relating to the mining industry; as well as the other risks and uncertainties applicable to the Company as set forth in the Company's continuous disclosure filings filed under the Company's profile at www.sedar.com

. The Company undertakes no obligation to update these forward-looking statements, other than as required by applicable law.

SOURCE: Fabled Silver Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/656972/Fabled-Continues-To-Intercept-New-High-Grade-Gold-System-With-Values-Intercepted-Up-To-2260-gt-Au-Expands-Surface-Drill-Program-to-14200-Meters