(TheNewswire)

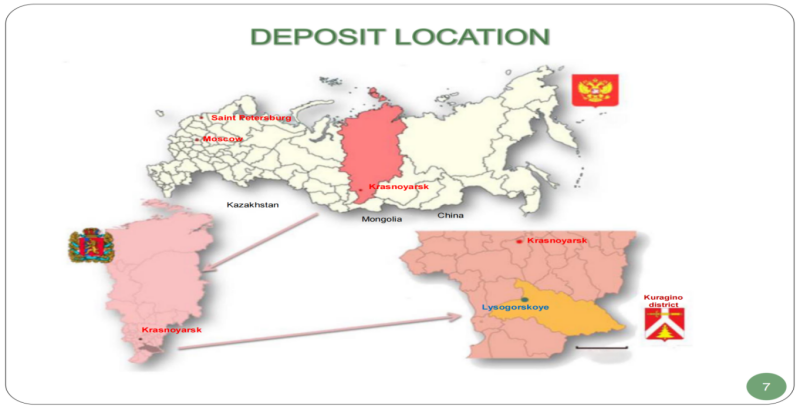

Vancouver, British Columbia TheNewswire - February 3, 2021 - Cache Exploration Inc. (the "Company", or "Cache"), (TSXV:CAY ) ( OTC:CEXPF ) is pleased to a nnounce the execution of a Letter of Intent (" L OI ") with the Artemovsky Rudnik Joint-Stock Company to acquire ownership of the previously mined Lysogorskoye Gold Deposit (" Lysogorskoye " or " the Project ") located in the southern Krasnoyarsk region, Russia. The Company is preparing t o conduct the necessary due diligence on the Project.

Artemovsky Rudnik JSC has 100% interest in the Lysogorskoye Gold Deposit. The shareholders of Artemovsky Rudnik JSC shall be issued shares of Cache Explorations and cash based on the value that both parties agree upon following the due diligence period. The Company has until April 30, 2021 to complete due diligence on the Project and sign a Definitive Agreement, The Definitive Agreement is subject to TSX Venture approval and any other approvals to complete this agreement. Either party may terminate this Letter of Intent with 10 business days following the completion of its due diligence.

Jack Bal, CEO of Cache Exploration Inc. States "We are extremely excited to commence due diligence on the Lysogorskoye Gold Deposit . Cache Exploration has been looking for production opportunities around the world to add shareholder value. We feel Lysogorskoye gives us the ability to become a producer in the near term"

All technical data on the Lysogorskoye Gold Deposit has been supplied by the vendor and has not been independently verified by a qualified person.

The Lysogorskoye Gold Deposit , located in the Kuragino district of Krasnoyarsk, comprises a formerly operated underground gold mine within a 5.34 km 2 license area located 2.5 km west of the Abakan-Taishet rail network, with access to the area power transmission grid, good roads and a local population of skilled people. The Vendor has held the license since August, 2017. The project may present an opportunity for rapid recommissioning for the production gold dore.

Discovered in 1960, formal evaluation of the Project resulted in an initial historical estimate of 10 tonnes (321,507 oz) of gold in 1968 (Soviet era "C2" classification). Past work has reportedly focused upon the exploration of a system of 26 NE-striking ‘veins' dipping 25 – 45o to the SE, and comprising of two types: quartz rich veins and structurally controlled zones of ‘cleavage crack' hosted gold deposition: these zones intersect locally to form broader ‘shoots', but commonly the ‘veins' range from 0.6 to 3.8m in width (averaging 0.85m). Past activity appears to have focused on gravity gold recovery. Some of the veins reportedly extend down-dip to 300m, and have been accessed underground via three adits (numbered 52 (deepest) – 54 (shallowest), of 60m vertical separation between them). Some 19,215 m of principal underground workings were driven between 1974 and 1995, developed around information from 27,541 m of surface drilling and 63,354 m of underground drilling. For the same period some 7,087 kg (227,852 oz) of gold production at 8.2 g/t (0.264 oz/t) was also recorded. Underground workings, which comprise of conventional drill and blast and some tunnel boring machine development, are reportedly dry and in good condition.

Since 2008 some additional exploration (by OJSC company "Minex Resources") included 1,715.3 m of drilling (12 holes) confirmed aspects of the historical work, and suggests potential for stockwork mineralization in addition to the vein hosted gold. Recoverable silver and possibly copper are also indicated. A technical report "Miramine - Mineral Resource Modeling and Estimation Report JORC-2011" by Miramine LLC was published on the Lysogorskoye gold deposit in (2011, historical). The estimation of resources is reported to consider 6,443 kg (207,147 oz) Indicated Resource and 46,331 kg (1,489,574 oz) Inferred at Lysogorskoye. A review and/or recalculation of the historic resource is required by an independent Qualified Person to confirm these as current resources as defined by NI 43-101. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources and the issuer is not treating the historical estimate as current mineral resources.

Since 2016 some additional technical work by the Vendor has confirmed a startup resource (category "C1") of 504 kg (16,204 oz at 9 g/t) and a development plan for a small gold plant has been prepared. The license includes an initial authorization for project development to include ore processing through an on-site Gold Recovery Plant, which contemplates cyanidation of flotation concentrate. The Vendor also reports recoverable silver and copper albeit at very low grades (Ag, approximately 2.46 g/t) and copper (approximately 0.2%).

Cache is pleased to announce that it intends to complete a non-brokered private placement of up to 10,000,000 units of the Company at a price of $0.28 per Common Share for aggregate proceeds of up to $2,800.000 (the "Private Placement") Each unit will consist of one common share and one half common share purchase warrant. Cache reserves the right to increase the size of the private placement to 15,000,000 units. Each warrant will entitle the holder to purchase one additional common share, up to a total of 5 million warrant shares, at a warrant exercise price of $0.35 cents exercisable for a period of 24 months from the date of closing; provided that, if, at any time prior to the expiry date of the warrants, the volume-weighted average trading price of the common shares on the Toronto Venture Exchange is greater than $0.50 for 10 consecutive trading days, the company may, within 10 business days of the occurrence of such event, deliver a notice to the holders of warrants accelerating the expiry date of the warrants to the date that is 30 days following the date of such notice. Any unexercised warrants will automatically expire at the end of the accelerated exercise period.

Closing of the private placement is subject to a number of conditions, including receipt of all necessary corporate and regulatory approvals, including the exchange. All securities issued in connection with the private placement will be subject to a statutory hold period in accordance with applicable securities legislation. The company intends to use the net proceeds of the private placement to finance exploration on the Kiyuk Lake property, for current liabilities and for general working capital purposes.

Finders' fees of 7 per cent in cash and 7 per cent in finders' warrants will be paid in connection with the completion of the offering, in accordance with TSX Venture Exchange policies.

The Company announces that it has granted to certain directors, officers and consultants of the company Options to purchase up to 2,000,000 million common shares in the capital of the company pursuant to the company's stock option plan. The options are exercisable on or before February 2, 2023, at an exercise price of $0.31 per share. The grant of Options is subject to regulatory approval.

About Cache Exploration

Cache is a gold focused Company that holds and operates the Kiyuk Lake Property which covers 590km 2 in SW Nunavut: the project features a number of gold bearing prospects including 2017 identification of 8m of 26.4 g/t gold at the Rusty Zone and extensive mineralization at East Gold Point with 64 m at 1.5 g/t gold and 10 m at 6.5 g/t gold. Extensive surficial float evidence indicates a series of high-interest gold systems (see https://cacheexploration.com/CAY-NR-10-26-17 to view plan maps of Rusty Zone and East Gold Point, section showing select KI17-004 and -005 drill results and Maps of rock and till sampling results.

Qualified Persons

Chris Pennimpede, P. Geo., is a Qualified Person as defined by National Instrument 43-101, has reviewed and verified the technical information provided in this release.

For more information about Cache Exploration, please visit: https://www.cacheexploration.com/

On behalf of the Board of Directors

Cache Exploration Inc.

" JackBal "

JackBal

Chief Executive Officer

FOR MORE INFORMATION, PLEASE CONTACT :

JackBal

Tel. 604-306-5285 jackbalyvr@gmail.com

Forward-Looking Information

This news release contains certain forward-looking statements within the meaning of Canadian securities laws, including statements regarding the Private Placement and Share Consolidation of Cache Exploration Inc. ("Cache"); the availability of capital and finance for Cache to execute its strategy going forward. Forward-looking statements are based on estimates and assumptions made by Cache in light of its experience and perception of current and expected future developments, as well as other factors that Cache believes are appropriate in the circumstances. Many factors could cause Cache's results, performance or achievements to differ materially from those expressed or implied by the forward looking statements, including: discrepancies between actual and estimated results from exploration and development and operating risks, dependence on early exploration stage concessions; uninsurable risks; competition; regulatory restrictions, including environmental regulatory restrictions and liability; currency fluctuations; defective title to mineral claims or property and dependence on key employees. Forward-looking statements are based on the expectations and opinions of the Company's management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS NEWS RELEASE REPRESENTS THE EXPECTATIONS OF THE COMPANY AS OF THE DATE OF THIS NEWS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE. WHILE THE COMPANY MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE SECURITIES LEGISLATION.

Copyright (c) 2021 TheNewswire - All rights reserved.