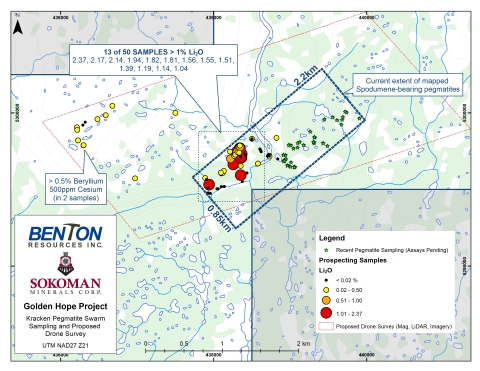

- Dyke system expanded: 2.2 km-long by 0.85 km-wide

- Fine-grained spodumene identified in several new areas

- Dyke system is wide open for expansion

Sokoman Minerals Corp. ("Sokoman") (TSXV: SIC) (OTCQB: SICNF) and Benton Resources Inc. ("Benton") (TSXV: BEX) (jointly "the Alliance") are pleased to announce that prospecting has expanded the area containing lithium-bearing pegmatite dykes, now known as "The Kraken Pegmatite Swarm", to an area measuring approximately 2.2 km-long by 0.85 km-wide. In the past two weeks, the Alliance has focused their prospecting to the east of the original discovery and now have identified multiple areas of spodumene-bearing pegmatites dykes ranging from 0.5 m to 10.0 m in thickness from possible stacked swarms striking approximately 50 degrees and dipping 45-65 degrees east with unknown strike length. A total of 55 samples were collected over the eastern-half of the swarm area and assay results are expected within the next few weeks. All samples were submitted to Actlabs in Ancaster, Ontario for analysis by Sodium Peroxide Fusion ICPOES + ICPMS.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211014005177/en/

Golden Hope Project: Kracken Pegmatite Swarm Sampling and Proposed Drone Survey

The Alliance also received further assays from a second phase of sampling collected from a till covered area, west of the original discovery, with samples of sub-crops and large local boulders returning anomalous results of rubidium, tantalum and lithium. One sample of a large, angular, purple pegmatite boulder located 600 m west of the original lithium zone graded 1.04% Li 2 O. The sampling has demonstrated that the dyke system contains economic grades of lithium, is widespread, and open along strike.

The Alliance is planning detailed geological mapping and a high-resolution drone survey that will include imagery, lidar and magnetic datasets to assist in the mapping and targeting the dyke system for drilling which will commence shortly. The companies have already completed a 5,709 line-km Heliborne High-Resolution Aeromagnetic & Matrix Digital VLF-EM Survey flown by Terraquest Ltd. with the final data currently being processed. The survey will provide the structural / lithological setting and help identify gold-bearing structure extensions, as well as any unrecognized structures including those potentially related to the lithium-bearing pegmatites.

Benton's President and CEO, Stephen Stares, states: "The Alliance has discovered and released high-grade results up to 2.37% Li 2 O which is the first of its kind in Newfoundland. As the Alliance continues to advance the lithium potential, it's quickly becoming evident that the Kraken dyke system is a large, highly-evolved, pegmatite field similar to the geological environment and setting of other large systems in the Appalachian belt, including the important deposits held by Piedmont Lithium Inc in the Carolinas, eastern US, as well as in the geologically equivalent Avalonia Project being advanced by Ganfeng Lithium in the Caledonides of Ireland."

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., President and CEO of Sokoman Minerals Corp., and Nathan Sims, P.Geo., Senior Exploration Manager for Benton Resources Inc., both the 'Qualified Person' under National Instrument 43-101.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman and Benton are operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The company's primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The company also recently entered into a strategic alliance with Benton Resources Inc. through three large-scale joint venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims – 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada's newest and rapidly-emerging gold districts. The company also retains an interest in an early-stage antimony / gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the company's property.

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly-prospective property portfolio in Gold, Silver, Nickel, Copper, and Platinum Group Elements and currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains Net Smelter Return (NSR) royalties for potential long-term cash flow. Benton has also recently entered into a 50/50 strategic alliance with Sokoman Minerals Corp. (TSXV: SIC) through three large-scale joint venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland that are now being explored.

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements."

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Alliance's expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Alliance's prospects, properties and business detailed elsewhere in the Alliance's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Alliance does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Alliance's expectations or projections.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211014005177/en/

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Benton Resources

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

Website: www.sokomanmineralscorp.com , www.bentonresources.ca ,

Twitter: @SokomanMinerals, @BentonResources

Facebook: @SokomanMinerals, @BentonResourcesBEX

LinkedIn: @SokomanMinerals , @BentonResources