Chip sampling with visible gold returns up to 134.46 g/t Au

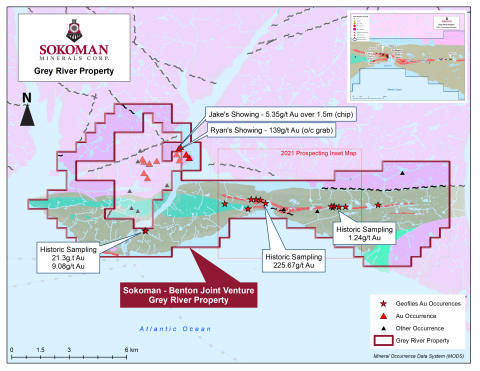

Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) ("Sokoman") and Benton Resources Inc. (TSXV: BEX) ("Benton"), members of a joint exploration alliance previously announced on May 27, 2021 (together, "the Alliance"), are pleased to announce they have received high-grade gold assays up to 134.46 g/t Au (visible gold noted in sample) at the Grey River Joint Venture located on the south coast of Newfoundland. The Alliance collected a series of grab and chip samples from outcrop and local float, and assays range from less than detection to 134.46 g/t Au (sampling details provided below). The sampling focused on an area roughly 500 m by 300 m immediately west of Gulch Cove where historical gold values of 225 g/t Au were reported by previous workers (see map).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210902005656/en/

(Graphic: Business Wire)

The high-grade visible gold-bearing sample (480309) is located a few metres from tidewater and consisted of a 0.50 cm chip believed to be at the same location as the 225 g/t Au historical sample reported by previous workers. The sample also contained anomalous bismuth (>1000 ppm Bi), and silver (>6 ppm Ag), for which overlimit assaying is pending. A second sample (480310), contiguous with the aforementioned sample, returned 3.09 g/t Au from a 30 cm chip. In addition, a number of anomalous grab samples ranging from less than detection to 1.22 g/t Au were returned from the sampling over a 500 m strike length of the quartz zone that has been mapped by the government over an 8 kilometre E-W strike length and up to 300 m in width. Further sampling along this trend to the west has been completed in recent days and submitted for assay.

The Alliance has also completed sampling of five archived drill holes that were drilled for silica by the Newfoundland government in 1968. The drilling took place approximately 2 kilometres east of where the high-grade results are located. Examination of the old cores revealed up to 2% disseminated pyrite locally, and for which no records of gold assaying could be found. A total of 23 samples were taken that ranged from 0.25 m to 2.80 m in length with an average length of 1.21 m. Samples were sent to Eastern Analytical Ltd. in Springdale, NL for Au and ICP analysis.

The Alliance is also very pleased to announce that drilling permits have been received, and it intends to proceed immediately with sourcing a drill and crew, as well as addressing the logistical issues that will be faced. Drilling will most likely take place in October when conditions on the South Coast are more amenable to flying as it will be a helicopter-supported program. Total metres and number of holes will be refined once the geophysics has been modelled with the assay data and geology.

A recently completed Heliborne High Resolution Magnetic and Matrix Digital VLF-EM Survey flown by Terraquest Ltd. totaling 1099-line kilometres is currently being processed and will be used to further refine drill targets on the property.

The Grey River Project is targeting high-grade vein-hosted gold mineralization similar in style to the world class Pogo Mine in Alaska with past production of more than four million ounces of gold and current reserves of 5.9 Mt @ 8.0 g/t gold (1.5 million ounces gold) and resources of 23 Mt @ 9.8 g/t gold (6.9 million ounces gold). Source: Northern Star Resources Website – August 2021 .

Mineralization hosted at the Pogo Mine in Alaska is not necessarily indicative of mineralization hosted on the Grey River property.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., President and CEO of Sokoman Minerals Corp., and Nathan Sims, P.Geo., Senior Exploration Manager for Benton Resources Inc., both the 'Qualified Person' under National Instrument 43-101.

Sample Analysis

The samples were collected and delivered in sealed bags to Eastern Analytical Ltd. in Springdale, NL, by company personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. All samples were submitted for 34 element ICP analysis and gold by fire assay analysis. Two samples, 480309 and 480310, were submitted for total pulp metallics and gravimetric finish, based on the presence of visible gold in sample 480309. Analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh. The total sample is weighed and screened 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. Duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman and Benton are operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The company's primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The company also recently entered into a strategic alliance with Benton Resources Inc. through three large-scale joint-venture properties including Grey River Gold, Golden Hope and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims – 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada's newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100%-interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly-prospective property portfolio in Gold, Silver, Nickel, Copper, and Platinum Group Elements and currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains Net Smelter Return (NSR) royalties for potential long-term cash flow. Benton has also recently entered into a 50/50 strategic alliance with Sokoman Minerals Corp. (TSXV: SIC) through three large-scale joint venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland that are now being explored.

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements."

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company's expectations or projections.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210902005656/en/

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Sokoman Minerals Corp.

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Benton Resources Inc.

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

Websites: www.bentonresources.ca , www.sokomanmineralscorp.com

Twitter: @BentonResources , @SokomanMinerals

Facebook: @BentonResourcesBEX , @SokomanMinerals

LinkedIn: @BentonResources , @SokomanMinerals