- Government authorizes the Al Andaluz Investigation Permit

- Area permitted for exploration in the Escacena Project more than doubles (115% increase)

- Exploration to begin immediately on several large high priority targets and extensions to the La Romana copper tin discovery

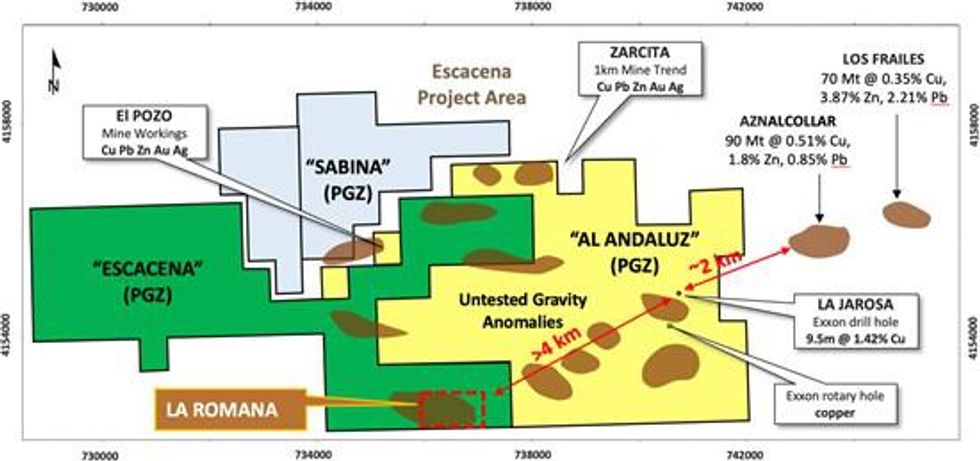

Pan Global Resources Inc. (TSXV: PGZ) (OTC Pink: PGNRF) ("Pan Global" or the "Company") is pleased to announce that the Regional Government of Andalusia (Junta de Andalucia) has authorised the "Al Andaluz" Investigation Permit at the Escacena Project. The permitting of "Al Andaluz" significantly expands the area for exploration in the Escacena Project. Al Andaluz is located immediately adjacent to the former Aznalcollar open pit mine and approximately 12km west of the Las Cruces copper mine, in the Iberian Pyrite Belt, southern Spain.

Tim Moody, Pan Global President and CEO, states: "The granting of the Al Andaluz Investigation Permit is a significant step forward for Pan Global. The property hosts several large gravity targets similar to the gravity anomaly associated with our La Romana discovery and has outstanding potential for the discovery of additional large copper deposits (See Figure 1 below). A drill hole with 9.5m at 1.42% Cu by Exxon in 1985 on the edge of one of these gravity anomalies at La Jarosa, confirms this potential. With Al Andaluz now granted and over $15mm in the treasury our plans to immediately commence an aggressive exploration program opens the opportunity to make additional copper discoveries in this highly prospective area."

INVESTIGATION PERMIT (PERMISO DE INVESTIGACION) GRANTED FROM THE REGIONAL GOVERNMENT OF ANDALUSIA - "AL ANDALUZ"

The Al Andaluz Investigation Permit (previously referred to as Al Andalus) is granted by the Regional Government of Andalusia (Junta de Andalucia) for an initial period of three years and can be renewed for additional periods.

Al Andaluz adds approximately 2,365 hectares to the area now permitted for exploration in the Escacena Project area. This represents a 115% increase to the area which now totals approx. 4,428 hectares. An additional 1,030.5 hectares remains under application (total 5,458.3 hectares).

Figure 1 - Escacena Project area, mineral rights (approx. 5,458 Ha) and targets

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/5190/104523_125122ffe4151b2a_001full.jpg

The newly issued investigation permit allows Pan Global to begin exploration immediately. Reprocessing of regional gravity data has identified several large gravity targets in Al Andaluz that will be followed up with geophysics prior to drilling. A gravity survey over the entire area will now commence and a detailed airborne electromagnetic and magnetic survey is planned for January 2022.

An Induced Polarity and detailed gravity survey will begin as soon as possible at the La Jarosa target, where a drill hole completed by Exxon in 1985 intersected 9.5m at 1.42% Cu on the edge of a large gravity anomaly. There has been no other follow up at La Jarosa since 1985. Other priority targets include two areas at El Pozo and Zarcita with surface indications of Cu Pb Zn Ag Au mineralization, extensive alteration and historical mine workings. The Company anticipates a significant follow-up drill program in 2022 on targets generated from the ongoing exploration work.

Drill testing gravity anomalies has directly led to other copper discoveries in the surrounding area, including Las Cruces (>40 million tonnes), Los Frailes (>70 million tonnes) and Pan Global's La Romana deposit (drilling in progress).

Qualified Person

Patrick Downey, a Director of Pan Global Resources and a qualified person as defined by National Instrument 43-101, has reviewed the scientific and technical information that forms the basis for this news release. Mr. Downey is not independent of the Company.

About Pan Global Resources

Pan Global Resources Inc. is actively engaged in base and precious metal exploration in southern Spain and is pursuing opportunities from exploration through to mine development. The Company is committed to operating safely and with respect to the communities and environment where we operate.

On behalf of the Board of Directors

www.panglobalresources.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

info@panglobalresources.com

Statements which are not purely historical are forward-looking statements, including any statements regarding beliefs, plans, expectations or intentions regarding the future. It is important to note that actual outcomes and the Company's actual results could differ materially from those in such forward-looking statements. The Company believes that the expectations reflected in the forward-looking information included in this news release are reasonable but no assurance can be given that these expectations will prove to be correct and such forward-looking information should not be unduly relied upon. Risks and uncertainties include, but are not limited to, economic, competitive, governmental, environmental and technological factors that may affect the Company's operations, markets, products and prices. Readers should refer to the risk disclosures outlined in the Company's Management Discussion and Analysis of its audited financial statements filed with the British Columbia Securities Commission.

The forward-looking information contained in this news release is based on information available to the Company as of the date of this news release. Except as required under applicable securities legislation, the Company does not intend, and does not assume any obligation, to update this forward-looking information.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/104523