TSXV: NOVR

OTCQB: NOVRF

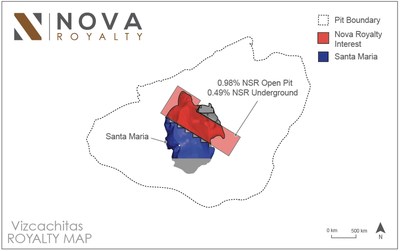

Nova Royalty Corp. (" Nova " or the " Company ") (TSXV: NOVR) (OTCQB: NOVRF) is pleased to announce that it has entered into a royalty purchase agreement (the " Purchase Agreements ") with RCF VI CAD LLC, an affiliate of Resource Capital Funds VI L.P. (" RCF VI " or the " Seller ") pursuant to which Nova will acquire an existing net smelter return (" NSR ") royalty (" Transaction ") of 0.98% on open pit operations and 0.49% on underground operations on the San José 13000 exploitation concession that forms part of the Vizcachitas Project in Chile (the " Project "), which is 100% owned by Los Andes Copper Ltd. (TSX-V:LA) (" LAC "). Transaction terms include US$6.5 million in cash payable on closing and up to US$9.5 million in common shares of Nova (" Nova Shares ") contingent upon the achievement of certain Project milestones.

Alex Tsukernik , Nova's President and CEO, commented, "Vizcachitas is one of the premier copper development projects in the Americas. We believe the project has all the necessary components to be a strategic development asset for a major producer and a critical part of the future supply chain. We are pleased to become a royalty holder alongside Resource Capital Funds, one of the mining sector's leading investors as it continues to support the project toward production. We look forward to welcoming them as a future shareholder".

The royalty ground covers approximately 50% of the projected open-pit mine plan. The closing of the Transaction (" Closing ") is expected to occur by March 2021 .

After the Closing of the Transaction, RCF VI will maintain exposure to the Project through its existing equity ownership stake in LAC and 2.0% NSR on open pit operations and 1.0% NSR on underground operations on the Santa Maria 1/60, Santa Teresa 1/60 and San Cayetano 1/20 concessions, which it has committed to purchase in June 2020 for a consideration of US$14 million . In the event RCF VI chooses to sell any remaining portions of its royalty position in the Project, Nova has an exclusive right for a period of thirty (30) days to engage in commercial discussions to acquire such royalty positions. This right will be in place for a period of five (5) years from Closing.

VIZCACHITAS

Vizcachitas is a copper-molybdenum porphyry deposit in central Chile , 100% owned by LAC. The project is located in an area with strong infrastructure and is within 100 kilometers of three major operating mines, Los Pelambres owned by Antofagasta (LON: ANTO), Andina, owned by Codelco and Los Bronces, owned by Anglo American (LON: AAL). The project is currently undergoing a permitting process for an expanded drilling program, the results of which will be used to complete a Pre-Feasibility Study, targeted for completion by the first half of 2022.

In June 2019 , LAC completed a Preliminary Economic Assessment (" PEA "), outlining a 45-year open-pit mine life at a throughput of 110,000 tonnes per day. The economic highlights of the PEA are shown below [1] :

- Copper price: US$ 3.00 /lb

- IRR: 20.7%

- After-Tax NPV @8%: US$ 1.8 billion

- After-Tax NPV @5%: US$ 3.2 billion

- Payback period: 3.4 years from initial operations; 5.4 years from initial construction

- High-grade starter pit: 0.53% CuEq average headgrade to mill over first 5 years of operations

- C1 Cash Cost (net of by-product credits): US$ 1.36 /lb for first 8 years of operation; US$ 1.58 /lb for Life-of-Mine

- Measured & Indicated Resource: 1,284 million tonnes at a copper grade of 0.40% and a copper equivalent grade of 0.45% (0.25% copper cut-off) with

- 11.2 billion lbs of copper

- 400 million lbs of molybdenum

- 43.4 million ounces of silver

- Inferred Resources: 789 million tonnes at a copper grade of 0.34% and a copper-equivalent grade of 0.39% with 5.9 billion lbs of copper, 221 million lbs of molybdenum and 22 million oz of silver

- Metallurgical test work has indicated high recoveries of clean copper concentrate

- No off-take encumbrances

- Preliminary Feasibility Study to be completed in fourth quarter of 2021

- Production expected by approximately 2025 to 2026

- Local and regional infrastructure in existence

- Active social program working with local communities

| Note 1: Please see technical report titled "Preliminary Economic Assessment for the Vizcachitas Copper/Molybdenum Project V Region, Chile" and dated June 13, 2019. The PEA is considered preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

TRANSACTION

The purchase price includes upfront consideration of US$6.5 million in cash and the issuance of Nova Shares with the values set forth below upon achievement of the following milestones on the Project: (i) US$1,750,000 upon issuance of a valid Resolución de Calificación Ambiental ("RCA"), an environmental permit that allows drilling activities regarding the Project, and an additional US$1.750,000 upon issuance of the other permits required by the RCA to commence the execution of drilling on the Project; (ii) US$1,500,000 upon the disclosure of a pre-feasibility study prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects with respect to the Project and which includes the Concession; and (iii) US$4,500,000 upon the first to occur of: (A) LAC or its successors or assigns makes a fully-financed construction decision on the Project (or any part thereof that includes the Concession); (B) LAC or its successors or assigns enters into an earn-in transaction with respect to the Project (or any part thereof that includes the Concession) or for LAC itself, with a third party, for a minimum interest of 51%; or (C) LAC or its successors or assigns sells the Project (or any part thereof that includes the Concession) or LAC to an arms' length third party.

The Nova Shares will be issued at a price per Nova Share that will be determined based on the 30-day volume weighted average trading price of the Nova Shares at the time of issuance. Nova has agreed to pay a finder's fee to an arm's length person totaling US$160,000 of the transaction value to be paid at Closing based on a volume weighted average trading price of the common shares of the Company prior to the date of Closing (subject to the acceptance of the TSX Venture Exchange, the " TSXV ").

BEEDIE CAPITAL FACILITY

Nova is also pleased to announce that it has entered into an amended and restated convertible loan agreement (" Loan Facility ") with Beedie Capital for acquisition of new royalties. The initial Loan Facility and the amendment will together provide for:

- Conversion of the existing C$3.5 million under the Loan Facility;

- Draw down of an additional C$5M under the initial Loan Facility with a new conversion price of C$5.67 based on a 20% premium to the 30-day volume weighted average price on the TSXV calculated as of February 9, 2021 in accordance with the terms of the Loan Facility;

- Increase of remaining facility from C$4.5 million by C$15.5 million for total available capital of C$20 million under the Loan Facility; and

- Increases Beedie Capital's total commitment to C$32.5 million (including prior equity investments) under the Loan Facility.

The initial Loan Facility included a C$13 million loan facility, of which C$3.5 million was previously drawn by Nova on October 7, 2020 . The Loan Facility is subject to customary closing conditions including the acceptance of the TSXV and is expected to close on or about February 12, 2021 .

Please see Nova's news release dated October 1, 2020 for additional information on the Loan Facility.

Qualified Person

Technical information contained in this news release originates in the public disclosure set out above and has been reviewed and approved by Christian Rios , AIPG Certified Professional Geologist, Advisor to Nova and a Qualified Person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects.

About Nova

Nova is a royalty company focused on providing investors with exposure to the key building blocks of clean energy – copper and nickel. The Company is headquartered in Vancouver, British Columbia and is listed on the TSXV under the trading symbol "NOVR".

About RCF

RCF is a group of commonly managed private equity funds, established in 1998 with a mining sector specific investment mandate spanning all hard mineral commodities and geographic regions. Since inception, RCF has supported 198 mining companies, with projects located in 51 countries and across 32 commodities. RCF aims to partner with companies to build strong, successful and sustainable businesses and in doing so, strives to earn superior returns for all shareholders. Further information about RCF can be found on its website ( www.resourcecapitalfunds.com ).

About Beedie Capital

Beedie Capital is the family office investment arm of Beedie Group, the largest private industrial owner, developer and property manager in Western Canada . Beedie Capital partners with ambitious operators of high-growth public and private companies across a variety of industry sectors in North America . Please visit beedie.ca/capital for more information.

ON BEHALF OF Nova Royalty CORP.,

(signed) "Alex Tsukernik"

President and Chief Executive Officer

Phone: (604) 696-4241

Email: info@novaroyalty.com

Website: www.novaroyalty.com

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

TECHNICAL AND THIRD-PARTY INFORMATION

Except where otherwise stated, the disclosure in this press release relating to the Vizchachitas project is based on information publicly disclosed by the owners or operators of this property and information/data available in the public domain as at the date hereof and none of this information has been independently verified by Nova. Specifically, as a royalty holder, Nova has limited, if any, access to the property subject to the NSR. Although Nova does not have any knowledge that such information may not be accurate, there can be no assurance that such third party information is complete or accurate. Some information publicly reported by the operator may relate to a larger property than the area covered by the NSR. Nova's royalty interests often cover less than 100% and sometimes only a portion of the publicly reported mineral reserves, mineral resources and production of a property.

Cautionary Note Regarding Forward-Looking Statements

This press release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation. The forward-looking statements herein are made as of the date of this press release only, and the Company does not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required by applicable law. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information in this press release includes, but is not limited to, closing of the acquisitions of the NSR; exploration and expansion potential, production, recoveries and other anticipated or possible future developments on the Vizcachitas project, current and potential future estimates of mineral reserves and resources; future commercial production from the Vizcachitas project; receipt of TSX Venture Exchange and all other required regulatory approval to the acquisitions of the NSR and the Loan Facility; and management's expectations regarding Nova's growth. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Nova to control or predict, that may cause Nova's actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including, but not limited to, the risk factors set out under the heading "Risk Factors" in the Company's final non-offering long form prospectus dated August 14, 2020 available for review on the Company's profile at www.sedar.com . Such forward-looking information represents management's best judgment based on information currently available. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

SOURCE Nova Royalty Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/February2021/10/c9314.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/February2021/10/c9314.html