Azarga Metals Corp. ("Azarga Metals" or the "Company") (TSXV:AZR) is pleased to announce that it has entered into a Term Sheet with Golden Predator Mining Corp. ("Golden Predator") to enable it to undertake due diligence and negotiate formal agreements to pursue an acquisition of the Marg copper-rich VMS project (the "Marg Project"), located in Central Yukon (the "Transaction

President, CEO and Director, Gordon Tainton, said: "We're very excited about the agreement to acquire the Marg Project. Marg is a high-grade copper-rich VMS project with significant gold and silver credits. The project has a NI43-101 resource and a PEA report that was completed in 2016. The positive outlook for base metals and the exploration upside associated with the Project make it a compelling value creating opportunity for Azarga Metals."

ABOUT THE MARG PROJECT

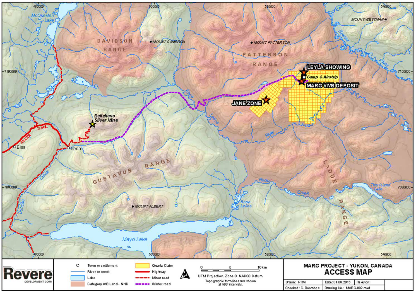

The Marg Project is an undeveloped volcanogenic massive sulphide ("VMS") deposit located in the Mayo Mining District in Central Yukon, approximately 40 kilometers east of Keno City (which itself is approximately 465 kilometers by road north of Whitehorse) (See Figures 1 and 2).

The Project consists of 402 Mineral Claims covering an area of approximately 8,403 hectares (~84 square kilometers).

The most recent NI43-101 Mineral Resource estimate for Marg (see Table 1) was completed by Mining Plus Canada Consulting Ltd. ("Mining Plus") in 2016 and incorporated into a Preliminary Economic Assessment ("PEA") for the Project (note: the PEA title is "Revere Development Corp, Marg Project Preliminary Economic Assessment, Technical Report, Yukon Canada" and dated 31 August 2016).

Table 1 - 31 August 2016 NI43-101 total Mineral Resource estimate for Marg Project at a 0.5% copper equivalent cut-off (combining high-grade and low-grade zones)1

| Category | Tonnage (mt) | Cu% | Pb% | Zn% | Ag g/t | Au g/t |

| Indicated | 3.7 | 1.5 | 2.0 | 3.8 | 48 | 0.76 |

| Inferred | 6.1 | 1.2 | 1.7 | 3.4 | 44 | 0.74 |

Note: 1. Where CuEq% was calculated = Cu% + 0.28 Pb% + 0.32 Zn% + 0.39 Au g/t + 0.0055 Ag g/t, which was assessed based on the following metal price and recovery assumptions: Cu price of 2.5 US$/lb and recovery of 80% (96.5% payable); Pb price of 0.8 US$/lb and recovery of 70% (95% payable); Zn price of 0.8 US$/lb and recovery of 90% (85% payable); Au price of 1100 US$/oz and recovery of 50% (90% payable); and Ag price of 16 US$/oz and recovery of 50% (90% payable).

The 2016 PEA was highly conceptual in nature. It envisaged the development of a 1.25mtpa 8-year life mining operation and floatation plant producing a copper concentrate, zinc concentrate and lead concentrate to be transported by road to the Skagway Port. Pre-development capital was estimated at C$291 million (+/- 40%). At a discount rate of 10% the PEA showed a pre-tax net present value ("NPV") of C$40.5 million and an internal rate of return ("IRR") of 16.0%. Albeit, those outcomes were calculated at very different commodity prices to those prevailing today, including: copper at US$2.75/lb (current spot ~US$4.23/lb); zinc at US$1.00/lb (current spot ~US$1.33/lb); and lead at US$0.90/lb (current spot ~US$1.04/lb).

The mineral resource estimate in the 2016 PEA was prepared in accordance with NI 43-101 standards and is considered by Azarga Metals management to have a high degree of reliability, however, the resource has not been verified by Azarga Metals and is considered historical in nature. A qualified person representing Azarga Metals has not done sufficient work to classify the historical estimate as a current mineral resource and Azarga Metals is not treating it as a current mineral resource. This resource was estimated for Revere Development Corp in a technical report titled "Revere Development Corp, Marg Project Preliminary Economic Assessment, Technical Report, Yukon Canada" and dated 31 August 2016.

Preliminary due diligence conducted by Azarga Metals highlights potential areas the Company would focus on initially to enhance the value of Marg under its ownership, including:

- Advancing metallurgical and mineralogical work - The 2016 PEA was done when very limited mineralogy or metallurgical test work, and this appears to have been a key issue for estimating recoveries, concentrate grades and processing costs. No material comminution test work had been performed and flotation test work was focused on production of a bulk concentrate as opposed to production of separate copper, zinc and lead concentrates as envisaged in the PEA and as would be more typical for similar VMS deposits. The issue of lack of relevant metallurgical and mineralogical test work presented itself in the PEA with lower than typical recoveries assumed for similar mineralization styles (including very low assumed recoveries into concentrate for gold or silver). The Company believes that more appropriate and extensive metallurgical and mineralogical test work could deliver improved economic outcomes.

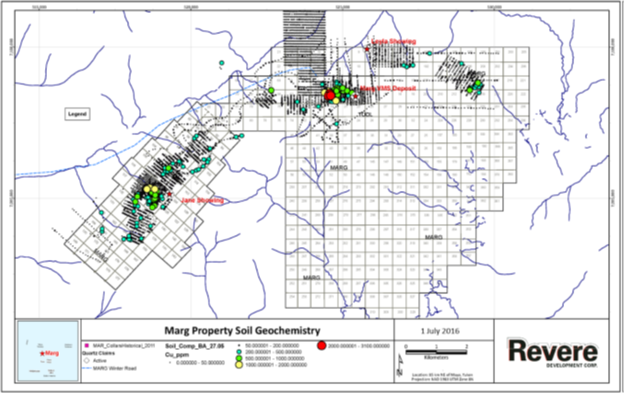

- Resource extension and exploration - Despite the high-grade nature of the Project and the likely substantially improved economics at current metal prices, Azarga Metals believes extending the forecast life of mine by 2-5+ years would have a material impact on the Project economics and appeal of Marg to project financing debt providers. The Company believes there is strong potential to materially add to mineralization at the Project. Firstly, at Marg itself, extensional drilling down plunge to the east along the main fold hinge of the deposit could extend known mineralization towards areas where previous drilling has shown evidence of the deposit continuing the direct vicinity down plunge. Exploration drilling can also target areas to the west of the main deposit area exploring for a theorized mineralized synform getting shallower at to the west. 2006 VTEM data (and surface geochemistry) suggests potential a structural repeat of the Marg deposit in an area referred to as the Jane Zone (6-7 kilometers southwest of Marg) (see Figure 3).

- Updated parameters - Based on the Company's preliminary internal review, utilizing updated parameters, including commodity prices may result in a material improvement to the projected NPV and IRR outcomes, relative to the 2016 PEA study.

Location, access and infrastructure

The Marg Project is located in Central Yukon about 40 km east of Keno City, which itself is 59 kilometers northeast of the village of Mayo and approximately 465 kilometers by road north of Whitehorse. Road access to Marg is by a 40 kilometer (winter only) road from Keno City. There is also a 390 meter airstrip on site.

An underutilized hydroelectric facility is located near Mayo and transmission lines extend to Elsa and Keno City. These power lines are connected into the regional grid of the Yukon.

Figure 1 - Location map of Marg Project (source: PEA)

Figure 2 - Access map of Marg Project (source: PEA)

Similar to the Faro Zinc Mine operated by Cyprus Anvil/Curragh Resources, the PEA envisages that concentrates from Marg would be trucked to the minerals port of Skagway, a road distance of 680 km.

Exploration history, geology and resources

The Marg deposit has been explored by a number of companies between 1965 and 2008. A number of diamond drilling programs were conducted from 1988 to 2008 for a total of 119 completed drill-holes and 34,224 cumulative linear meters of drilling. This drilling defined mineralization over a 1.4 kilometer trend distance, a down dip distance of 700 meters and across a stratigraphic thickness of approximately 100 meters.

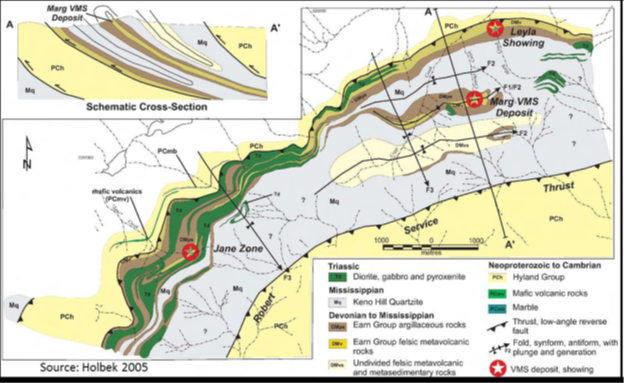

Marg, lying near the northern margin of the Selwyn Basin is underlain by a sequence of metavolcanic and metasedimentary rocks of Devonian and Mississippian age that lie between the Robert Service and Tombstone thrust faults (see Figure 3 below). The Project is a felsic-hosted VMS deposit associated with the Cordillera from Mexico to Alaska. These deposits are often referred to as Kuroko or Noranda Type massive sulphide deposits.

Figure 3 - Geological plan map of regional area around Marg (source: PEA)

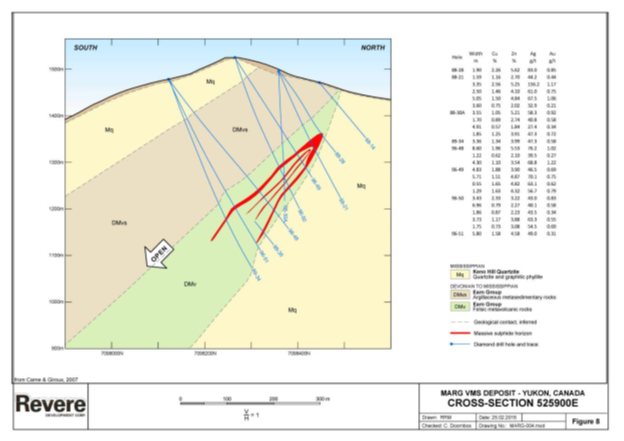

The Marg deposit consists of a series of continuous to discontinuous sheets of massive and semi-massive sulphide mineralization. The mineralized sheets or horizons are sub parallel, trend from 060° to 090° and dip from 30° to 50° south and generally plunge to the east at 40° (see Figure 4 below).

The massive sulphide layers are up to 23 meters in thickness within the fold hinge, which represents the core of the deposit. The sulphides average 1.6 meters true width for the Indicated high-grade zone and 5.2 meters true width for the encompassing low-grade zone.

The orebody is approximately 50 to 400 meters below the surface access elevation. Drilling has defined the mineralization for over 1400 meters along strike, and 700 meters down dip. Mineralization is open along strike, down dip and down plunge.

Figure 4 - Marg deposit selected cross-section looking east at 525,900 (source: PEA)

Mineralization occurs at, or near the contact between the footwall volcanoclastic rocks and the hangingwall argillaceous sediments. Mineralization is hosted within a wedge-shaped succession dominated by felsic metavolcanic rocks that appears to be tightly folded by two major deformation events that have both over-thickened the mineralization in the fold hinge and separated the mineralization in places along the fold limbs.

Sulphide minerals consist of pyrite, sphalerite, chalcopyrite, galena, tetrahedrite and arsenopyrite in a gangue of quartz, ferroan carbonate, muscovite and rare barite. Magnetite is notably absent.

The most recently available Mineral Resource estimate (presented in Table 2, Table 3 and Table 4 below) was included in the Mining Plus PEA.

Mineral Resource estimate is presented in two parts (for a high-grade zone and a low-grade zone), both at a 0.5% copper equivalent cut-off applied to the estimated blocks.

Table 2 - 31 August 2016 NI43-101 Mineral Resource estimate for Marg Project high-grade zone at a 0.5% copper equivalent cut-off1

| Category | Tonnage (mt) | Cu% | Pb% | Zn% | Ag g/t | Au g/t |

| Indicated | 3.7 | 1.5 | 2.0 | 3.8 | 48 | 0.76 |

| Inferred | 5.5 | 1.3 | 1.8 | 3.6 | 46 | 0.79 |

Note: 1. Where CuEq% was calculated = Cu% + 0.28 Pb% + 0.32 Zn% + 0.39 Au g/t + 0.0055 Ag g/t, which was assessed based on the following metal price and recovery assumptions: Cu price of 2.5 US$/lb and recovery of 80% (96.5% payable); Pb price of 0.8 US$/lb and recovery of 70% (95% payable); Zn price of 0.8 US$/lb and recovery of 90% (85% payable); Au price of 1100 US$/oz and recovery of 50% (90% payable); and Ag price of 16 US$/oz and recovery of 50% (90% payable).

Table 3 - 31 August 2016 NI43-101 Mineral Resource estimate for Marg Project low-grade zone at a 0.5% copper equivalent cut-off1

| Category | Tonnage (mt) | Cu% | Pb% | Zn% | Ag g/t | Au g/t |

| Inferred | 0.6 | 0.6 | 0.8 | 1.5 | 22 | 0.29 |

Note: 1. Where CuEq% was calculated = Cu% + 0.28 Pb% + 0.32 Zn% + 0.39 Au g/t + 0.0055 Ag g/t, which was assessed based on the following metal price and recovery assumptions: Cu price of 2.5 US$/lb and recovery of 80% (96.5% payable); Pb price of 0.8 US$/lb and recovery of 70% (95% payable); Zn price of 0.8 US$/lb and recovery of 90% (85% payable); Au price of 1100 US$/oz and recovery of 50% (90% payable); and Ag price of 16 US$/oz and recovery of 50% (90% payable).

Table 4 -31 August 2016 NI43-101 total Mineral Resource estimate for Marg Project at a 0.5% copper equivalent cut-off (combining high-grade and low-grade zones)1

| Category | Tonnage (mt) | Cu% | Pb% | Zn% | Ag g/t | Au g/t |

| Indicated | 3.7 | 1.5 | 2.0 | 3.8 | 48 | 0.76 |

| Inferred | 6.1 | 1.2 | 1.7 | 3.4 | 44 | 0.74 |

Note: 1. Where CuEq% was calculated = Cu% + 0.28 Pb% + 0.32 Zn% + 0.39 Au g/t + 0.0055 Ag g/t, which was assessed based on the following metal price and recovery assumptions: Cu price of 2.5 US$/lb and recovery of 80% (96.5% payable); Pb price of 0.8 US$/lb and recovery of 70% (95% payable); Zn price of 0.8 US$/lb and recovery of 90% (85% payable); Au price of 1100 US$/oz and recovery of 50% (90% payable); and Ag price of 16 US$/oz and recovery of 50% (90% payable).

Exploration potential

Marg remains open down plunge to the east along the main fold hinge of the deposit. Extensional drilling could extend known mineralization towards areas where previous drilling has shown evidence of the deposit continuing the direct vicinity down plunge.

The Marg deposit was discovered by a soil anomaly and has since been developed into a sizeable VMS deposit. To this effect, the potential of discovering a similar size deposit exists in the Jane Zone (6-7 kilometers to the southwest) (see Figure 5) where soil geochemistry identified an anomaly similar in scale (ie, across 12 kilometers of strike of favorable stratigraphy) and magnitude to Marg, lying within favorable host rocks.

Figure 5 - Marg area soil geochemistry (source: PEA)

The northeast extent of the geochemistry sampling from Figure 5 has identified another small anomaly that could potentially extend further along strike with additional soil sampling as it lies in the same favorable rocks as the Jane Zone.

PROPOSED TRANSACTION

Azarga Metals has executed a Term Sheet with Golden Predator with the following key proposed acquisition terms;

- A non-refundable Exclusivity Fee of C$50,000 payable within 5 days of signing for a 60-day exclusivity period to enable Azarga Metals to conduct its due diligence investigations

- On completion of the Transaction, fully paid ordinary shares in Azarga Metals, to the value of C$700,000 (based on the volume-weighted average trading price of Azarga Metals shares for the 20 trading days prior to any public announcement related to the Transaction). The Shares may be subject to an involuntary escrow period as determined by the relevant stock exchange and regulatory bodies. If the escrow period is longer than 6 months, a further cash payment of C$100,000 will be payable to Golden Predator on signing; and

- A further cash payment of C$200,000 at the one-year anniversary date for the completion of the Transaction; and

- A further cash payment of C$350,000 at the two-year anniversary date for the completion of the Transaction; and

- A milestone payment of C$300,000 (in cash or shares at Golden Predators discretion) upon final decision to mine by Azarga Metals at the Marg Project; and

- On and from completion of the Transaction, Golden Predator will be entitled to a 1% NSR royalty of all metals extracted from the Project. Azarga Metals will have the option to buy back 100% of the NSR for a cash consideration of C$1,500,000.

Proposed transaction conditions involve usual conditions (including the requirement for approval by the TSX Venture Exchange). The conditions also include receipt of appropriate consent under the existing Baker Steel Resources Trust convertible loan.

A Finders fee on final closing of the Transaction and in accordance with the Transaction milestones payable in cash or the Company's shares at the Company's discretion (the "Finder's Fee") will be: 10% of the first C$300,000 consideration received by the Company in connection with the Transaction; plus 7.5% on consideration of between C$300,000 and C$1,000,000 received by the Company in connection with the Transaction; and 5.0% on any consideration in excess of C$1,000,000 received by the Company in connection with the transaction, where consideration amounts are received from Introduced Parties and where such consideration excludes any payments received in the form of Exclusivity Fees.

Qualified Person Statement

Information in this report relating to Exploration Results is based on information reviewed by Mr. Kevin Piepgrass, who is a Member of the Association of Professional Engineers and Geoscientists of the province of BC (APEGBC), which is a recognized Professional Organisation (RPO). Mr. Piepgrass has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined by the 2012 Edition of the Australasian Code for reporting of Exploration Results, Mineral Resources and Ore Reserves, and as a Qualified Person for the purposes of NI43-101. Mr. Piepgrass consents to the inclusion of the data in the form and context in which it appears.

About Azarga Metals Corp.

Azarga Metals is a mineral exploration and development company that owns 100% of the Unkur Copper-Silver Project in the Zabaikalsky administrative region in eastern Russia. On completion of a first phase physical exploration program in 2016-2018, the Company estimated an Inferred Resource of 62 million tonnes at 0.53% copper and 38.6g/t silver for the project in the report entitled "Technical Report and Preliminary Economic Assessment for the Unkur Copper-Silver Project, Kodar-Udokan, Russian Federation" dated effective August 30, 2018 authored by Tetra Tech Mining & Minerals. The Resource remains open in both directions along strike and down-dip.

"Gordon Tainton"

Gordon Tainton,

President and Chief Executive Officer

For further information please contact Doris Meyer, at +1 604 536-2711 ext. 3, or Gordon Tainton, at + 1-604-248-8380 or visit www.azargametals.com or follow us on Twitter @AzargaMetals. The address of the head office of Azarga Metals is Unit 1 - 15782 Marine Drive, White Rock, BC V4B 1E6, British Columbia, Canada.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement:

This news release contains forward-looking statements that are based on the Corporation's current expectations and estimates. Forward-looking statements are frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "suggest", "indicate" and other similar words or statements that certain events or conditions "may" or "will" occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such factors include, among others: the actual results of current planned exploration activities; conclusions of economic evaluations; changes in project parameters as plans to continue to be refined; possible variations in mineralization grade or recovery rates; accidents, labor disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; and fluctuations in metal prices. There may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Forward-looking statements are not a guarantee of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

SOURCE: Azarga Metals Corp.

View source version on accesswire.com:

https://www.accesswire.com/655461/Azarga-Metals-Signs-Term-Sheet-to-Acquire-Marg-Copper-Rich-VMS-Project-in-Yukon