TDG Gold Corp. (TSXV:TDG) (the "Company" or "TDG") is pleased to provide a second update on the ongoing resource definition drilling underway at its Shasta gold-silver project, located in the 'Toodoggone Production Corridor' of north-central British Columbia

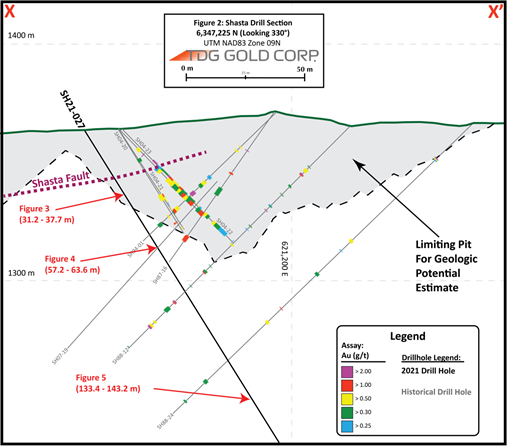

Following the exploration update provided on September 28, 2021, wherein TDG reported intercepts of up to 70 metres ("m") of quartz breccia and stockwork veining at its Shasta project, the ongoing drill program continues to intersect significant thicknesses of quartz breccia and stockwork-composite style veining, mineralogically comparable to historically mined material. These intercepts support the geological model prepared by Moose Mountain Technical Services ("Moose Mountain") that is being used to direct the drill campaign; however, the quartz veining/stockworking appears to continue deeper than predicted and well below the pit outline used to limit the geologic potential estimate announced May 5, 2021. Assay results are pending, with assay laboratories taking significantly longer than typical to process submitted samples due to significant backlogs. First drill core assays are expected by the end of 2021, and final assays in the first quarter of 2022. It is therefore too early to confirm if the deeper mineralization encountered will contribute to the pit-constrained mineral resource estimate being prepared by Moose Mountain and targeted for publication by TDG by the end of the first quarter of 2022.

2021 Drilling & Exploration Update

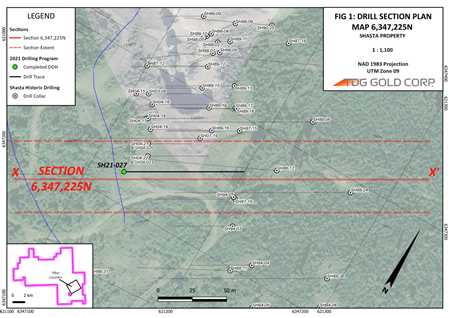

Diamond drill hole ("DDH") SH21-027 (Figures 1-2) was drilled to test mineralogical continuity and verify historical assay grades of adjacent historical drill holes in preparation for resource modelling. DDH SH21-027 intersected the Shasta fault at depth of 34.4 m and, once past the fault, encountered broad zones of silicified volcaniclastics with stockwork quartz veining, variable intensity potassic alteration with a sulphide assemblage comprised of pyrite and acanthite (a silver-rich mineral, Ag2S; see Figures 3-5).

For comparison, historical DDH SH04-023 intersected mineralization over a 20.3 m interval* (from 14.7 m) grading 1.98 grams per tonne ("g/t") gold ("Au") and 12.5 g/t silver ("Ag"). This included an interval near surface of 2.7 m (from 14.7 m) grading 9.75 g/t Au and 5.3 g/t Ag. In addition, historical DDH SH04-020 intersected mineralization over a 26.8 m interval* (from 18.0 m) grading 0.69 g/t Au and 28.8 g/t Ag.

* Note 1: drill holes and/or composite intervals with an asterisk denote that assay results are recorded from written reports and government filed assessment reports. Laboratory certificates in these examples have not yet been found in historical data search. Some records also show that samples were assayed at the Baker Mine Site Laboratory, where no individual assay certificates are recorded.

Figure 1. Drill section plan map of Central Deposit area ("JM" Zone locality).

Figure 2. Showing Shasta cross-section at 6,347,225N.

Figure 3. Core photo showing silicified potassic-altered volcaniclastics with quartz vein stockwork (intersected between 31.2 -37.7 m in hole SH21-027).

Figure 4. Core photo showing silicified potassic-altered volcaniclastics with quartz vein stockwork (intersected between 57.2 - 63.6 m in hole SH21-027).

Figure 5. Core photo showing silicified potassic-altered volcaniclastics with quartz vein stockwork / breccia (intersected between 133.4 - 143.2 m in hole SH21-021).

TDG has also received the first processed data from a 2021 LiDAR ("Light Detection and Ranging") and Orthophoto survey that was flown over TDG's Baker-Shasta mining leases and mineral claims. The LiDAR survey was conducted by McElhanney Ltd. and provides high-resolution topographic data (2.5 points per square metre) for engineering and resource modelling in addition to high-resolution orthophoto images (approximately 50cm pixel resolution) to enhance project planning and validate historical geological and geophysical work. Approximately 4 square-kilometres of survey data over the Shasta mine area (4 x 1 sq.km tiles) has been received and integrated into the Baker-Shasta geospatial database.

Next Steps

TDG expects its drill program at Shasta to be completed by early December 2021, with first assay results expected in late 2021. TDG's Baker Camp has been fully winterized to enable continuation of exploration at its Toodoggone projects later into 2021 and to recommence exploration activities earlier in 2022 than would be otherwise possible.

Cautionary Statements

The economic significance of interpreted mineralization must be treated with caution as assay results are still pending. In some intersections, the mineralization appears to extend below the pit used to constrain the estimate of geologic potential for the Shasta area (see news release dated May 5, 2021). While deeper mineralization is geologically significant, there is no guarantee that it would fall within a pit-constrained NI 43-101 mineral resource estimate (being prepared for TDG by Moose Mountain; targeted for publication at the end of Q1/22).

Qualified Person

The technical content of this news release has been reviewed and approved by Steven Kramar, MSc., P.Geo., a qualified person as defined by National Instrument 43-101.

This news release includes historical drilling information that has been reviewed by the Company's geological team. The Company's review of the historical records and information reasonably substantiate the validity of the information presented in this news release; however, the Company cannot directly verify the accuracy of the historical data, including the procedures used for sample collection and analysis. Therefore, the Company encourages investors to exercise appropriate caution when evaluating these results. Further data review is underway, in order to verify the validity of the data for the anticipated NI 43-101 compliant mineral resource estimate.

About TDG Gold Corp.

TDG is a major mineral claim holder in the historical Toodoggone Production Corridor of north-central British Columbia, Canada, with over 23,000 hectares of brownfield and greenfield exploration opportunities under direct ownership or earn-in agreement. TDG's flagship projects are the former producing, high-grade gold-silver Shasta, Baker and Mets mines, which are all road accessible, produced intermittently between 1981-2012, and have over 65,000 m of historical drilling. In 2021, TDG has advanced the projects through compilation of historical data, new geological mapping, geochemical and geophysical surveys, and, for Shasta, drill testing of the known mineralization occurrences and their extensions. The Company has entered into a binding agreement to acquire the Nueva Esperanza silver-gold advanced exploration and development project located in the Maricunga Belt of northern Chile, subject to closing conditions being satisfied. TDG currently has 70,867,903 common shares issued and outstanding.

ON BEHALF OF THE BOARD

Fletcher Morgan

Chief Executive Officer

For further information, contact TDG Gold Corp. at:

Telephone:+1.604.536.2711

Email: info@tdggold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain certain "forward looking statements". Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among other things: risks and uncertainties relating to exploration and development and the results thereof, including the results of the recently completed drill holes, the impact on future mineral resource estimates as well as the ability of TDG Gold to obtain additional financing, the need to comply with environmental and governmental regulations, fluctuations in the prices of commodities, operating hazards and risks, competition and other risks and uncertainties, including those described in TDG Gold's financial statements available under the TDG Gold's profile at www.sedar.com. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Any forward-looking statement speaks only as of the date of this news release and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

SOURCE: TDG Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/670917/TDG-Gold-Corp-Continues-to-Intersect-Significant-Thicknesses-of-Mineralization-at-Its-Shasta-Gold-Silver-Project-Toodoggone-District-BC