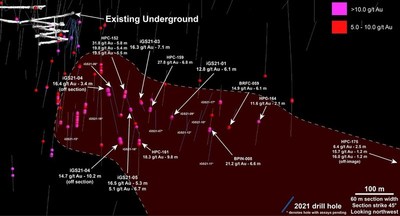

First four holes return 14.7 g/t Au over 10.2 m , 16.3 g/t Au over 7.1 m , 12.8 g/t Au over 6.1 m , & 16.5 g/t Au over 5.3m

i-80 Gold Corp. (TSX: IAU) (OTCQX: IAUCF) ("i-80", or the "Company") is pleased to announce positive results from the ongoing surface drill program, that includes step-out drilling at depth, at the Company's Granite Creek Property ("Granite Creek" or "the Property") located in Humboldt County, Nevada .

High-grade results from drilling from the surface drill program is targeting the expansion of mineralization at depth below the mine workings at Granite Creek suggest significant expansion potential. To-date, fourteen holes have been completed, testing at depth. Assays have been received for the first four holes and all having returned impressive gold grades and widths of mineralization.

Highlight results from initial deep drilling:

- 12.8 g/t Au over 6.1 m in hole iGS21-01

- 16.3 g/t Au over 7.1 m in hole iGS21-03

- 14.7 g/t Au over 10.2 m and 16.4 g/t Au over 3.4 m in hole iGS21-04

- 16.5 g/t Au over 5.3 m and 5.1 g/t Au over 6.7 m in hole iGS21-05

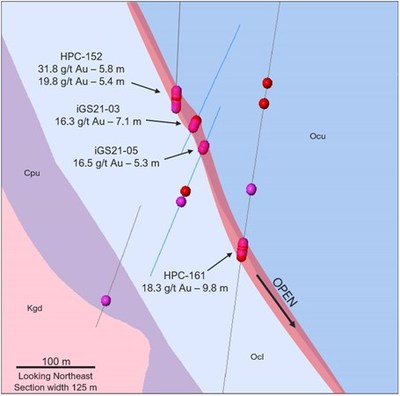

The step-out program is one of multiple target areas being drilled in the current program that will comprise more than 20,000 metres from surface and underground and continue well into the new year. While the primary goal of the 2021 drill program is to advance underground and open pit opportunities to production, an important part of the program is to expand resources at depth and along strike where the deposit remains open. When combined with wide-spaced historic drilling in the down-dip expansion area, drilling has defined high-grade mineralization over a strike length of at least 600 metres and 250 metres of dip length and remains wide open at depth and along strike to the north (see Figures 1 and 2).

"The expansion program at Granite Creek is demonstrating the significant upside opportunity and confirm the potential to materially increase high-grade resources", stated Tyler Hill , Senior Geologist of i-80. "The fault structures are becoming more competent at depth suggesting the potential for increased widths, improved ground conditions and mineability, and enhanced continuity within the gold-bearing structures. Visually, every hole of the step-out program has intersected strong alteration and faulting".

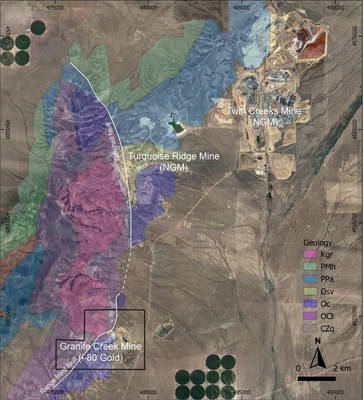

High-grade mineralization at Granite Creek occurs in a near-identical geological setting as that at the multi–million ounce Turquoise Ridge Mine located immediately to the north (see figure 3); proximal to a major regional fault (the Getchell or Range Front fault) on the eastern edge of the large Osgood Mountains intrusive complex. The Granite Creek deposit remains open at depth and along strike from the existing underground workings.

It is expected that refractory mineralization from the underground operation at Granite Creek will initially be trucked to Twin Creeks for processing, pursuant to the agreement recently entered into with Nevada Gold Mines , until such time that the Company's Lone Tree facility is operational. A Preliminary Economic Assessment for Granite Creek was released last week based on the current resource and demonstrated the economic opportunity that is being advanced with an NPV@5% of US$244.9 M and an After-Tax IRR of 34.2% prior to considering the potential benefits that could be realized by utilizing the existing processing facilities at Lone Tree or incorporating any of the drilling performed by the Company in 2021.

Table 1 – Summary Assay Results from Initial Surface Drilling

| New 2021 Drill Results from Granite Creek Estimated true widths 70-80% of Drill Intercept | |||||

| Drillhole ID | Type | From | To | Length | Au |

| iGS21-01 | Core | 386.6 | 392.7 | 6.1 | 12.8 |

| iGS21-03 | Core | 391.4 | 398.5 | 7.1 | 16.3 |

| iGS21-04 | Core | 288.0 | 289.6 | 1.5 | 37.4 |

| iGS21-04 | Core | 326.3 | 329.8 | 3.4 | 16.4 |

| iGS21-04 | Core | 336.7 | 337.9 | 1.2 | 44.1 |

| iGS21-04 | Core | 468.3 | 478.5 | 10.2 | 14.7 |

| iGS21-05 | Core | 398.4 | 403.7 | 5.3 | 16.5 |

| iGS21-05 | Core | 444.7 | 451.4 | 6.7 | 5.1 |

| *Hole iGS21-02 was drilled into the near-surface Mag Pit target and is not included in this release. | |||||

| Table 1a Collar Coordinates | ||||||

| UTM | Drillhole ID | East m | North m | Elevation m | Azimuth | Dip |

| NAD83 Zone 11 | iGS21-01 | 478579 | 4554235 | 1468 | 308 | -46 |

| iGS21-03 | 478323 | 4554116 | 1554 | 352 | -55 | |

| iGS21-04 | 478323 | 4554116 | 1554 | 340 | -64 | |

| iGS21-05 | 478323 | 4554116 | 1554 | 351 | -59 | |

Of the more than 20,000 metres of drilling planned in the ongoing drill program, approximately 12,500 metres have been completed. Initial underground rehabilitation to facilitate definition drilling has been completed as part of an aggressive plan to re-commence mining from the existing mine workings and several areas are being prepared for test mining in advance of production ramp-up targeted for H1-2022.

QAQC Procedures

All samples were submitted to Paragon Geochemical Assay Laboratories (PAL) of Sparks, NV , which is an ISO 9001 and 17025 certified and accredited laboratory, independent of the Company. Samples submitted through PAL are run through standard prep methods and analysed using FA-Pb30-ICP (Au; 30g fire assay) and 48MA-MS (48 element Suite; 0.5g 4-acid digestion/ICP-MS) methods. PAL also undertake their own internal coarse and pulp duplicate analysis to ensure proper sample preparation and equipment calibration. i-80 Gold Corp's QA/QC program includes regular insertion of CRM standards, duplicates, and blanks into the sample stream with a stringent review of all results. Historic holes were assayed by various accredited laboratories. Refer to the November 9 th , 2021 Granite Creek Mine Project Preliminary Economic Assessment NI 43-101 Technical Report for information on historic assays.

Qualified Person

Tim George, PE, is the Qualified Person for the information contained in this press release and is a Qualified Person within the meaning of National Instrument 43-101.

About i-80 Gold Corp.

i-80 Gold Corp. is a well-financed, Nevada-focused, mining company with a goal of achieving mid-tier gold producer status through the development of multiple deposits within the Company's advanced-stage property portfolio to complement existing gold production from the Ruby Hill open pit.

______________________________

| Certain statements in this release constitute "forward-looking statements" or "forward-looking information" within the meaning of applicable securities laws, including but not limited to, commencement of trading of i-80 Gold on the Toronto Stock Exchange and completion of the acquisition of the Getchell Project. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as "may", "would", "could", "will", "intend", "expect", "believe", "plan", "anticipate", "estimate", "scheduled", "forecast", "predict" and other similar terminology, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. These statements reflect the Company's current expectations regarding future events, performance and results and speak only as of the date of this release. |

| Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to: material adverse changes, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations. |

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/i-80-gold-intersects-high-grade-gold-in-expansion-drilling-at-granite-creek-301424977.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/i-80-gold-intersects-high-grade-gold-in-expansion-drilling-at-granite-creek-301424977.html

SOURCE i-80 Gold Corp

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/November2021/16/c1467.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/November2021/16/c1467.html