(TheNewswire)

TheNewswire - November 9th, 2021 - Green Battery Minerals Inc. ("Green Battery" or the "Company") (TSXV:GEM ) ( FSE:BK2P ) ( WKN:A2QENP ) ( OTC:GBMIF) is pleased to announce that it has mobilized a Québec based drill contractor to commence additional drilling at Zone 1 and Zone 6 of it's 100% owned Berkwood Graphite Project. The program is intended to further define the extent and grade of the Zone 1 graphite discovery and to carry out an initial drilling of the Zone 6 EM anomaly which has previously been confirmed with grab and channel samples on surface.

The Company has previously completed four drill programs that have been completed on Zone 1 for a total of 6,085 meters in 44 drillholes. All 44 holes contained graphite mineralization with 43 of the holes intersecting significant zones of graphite enrichment. These intersections support an evolving structural model of multiple recumbently folded graphitic horizons hosting thick and apparently continuous graphitic intervals of compelling grade and true thickness.

Goldminds Geo-Services Inc., who carried out the previous resource estimate at the Zone 1 deposit, has been retained to provide an updated resource estimate across shallower (80-100m) parts of the zone 1 deposit. The Company focus is on defining open-pit mineable, low strip ratio and high value graphite (coarser flake size and more readily recoverable). The targeted depth is similar to that undertaken by Mason Graphite for its planned open-pit development.

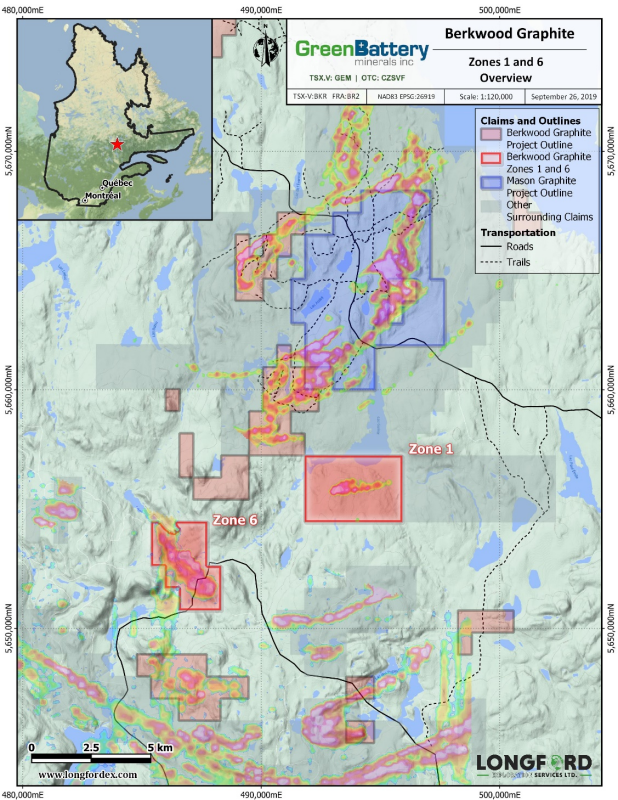

The Zone 1 discovery lies 8 km southwest of Mason Graphite's deposit which is the subject of a current feasibility study. The Company believes its Zone 1 deposit and that of Mason share many similar geological characteristics with the Zone 1 deposit being one of the highest-grade graphite deposits in the world. Mason is concluding its permitting process to start development following a successful feasibility study completed in 2018 . This may likely further benefit Green Battery Mineral's project development as commissioning of an adjacent mine will likely provide development of district area infrastructure.

Figure 1: Overview of the Zone 1 and Zone 6 Deposits and proximity to the adjacent development and infrastructure.

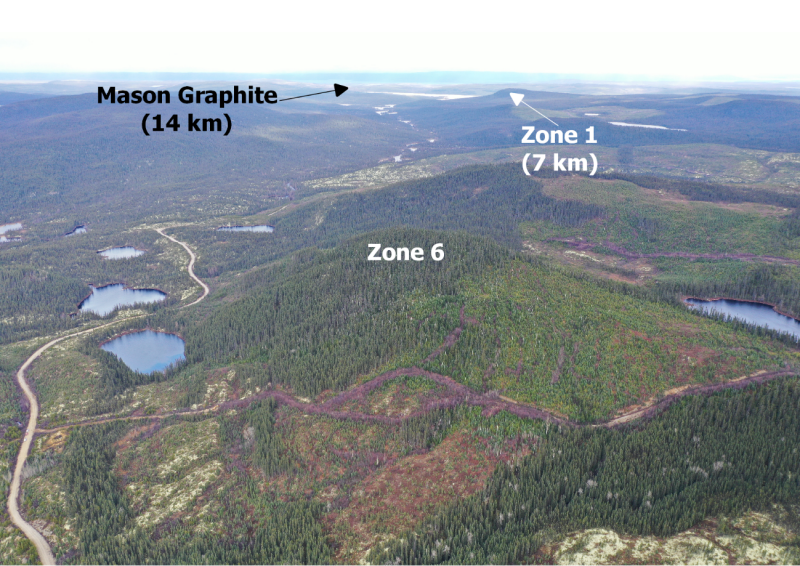

Figure 2: Perspective view facing north of the Zone 6 exploration target, Zone 6 Resource, and Mason Graphite Project.

Tom Yingling, President and CEO of Green Battery states "After years of study at the Zone 1 deposit and fieldwork across our other targets, we are extremely excited to get another drill turning again to expand on what we've learned so far and continue to explore and develop these graphite discoveries. Drilling at Zone 6 is particularly exciting as the shape and intensity of the EM anomaly is similar in nature to that of Zone 1 and has already been proven to contain high grade graphite which has been sampled on surface. We look forward to releasing complete results from this campaign early in the new year and updating our investors as this exciting new phase of exploration develops."

Fall 2021 Work Program

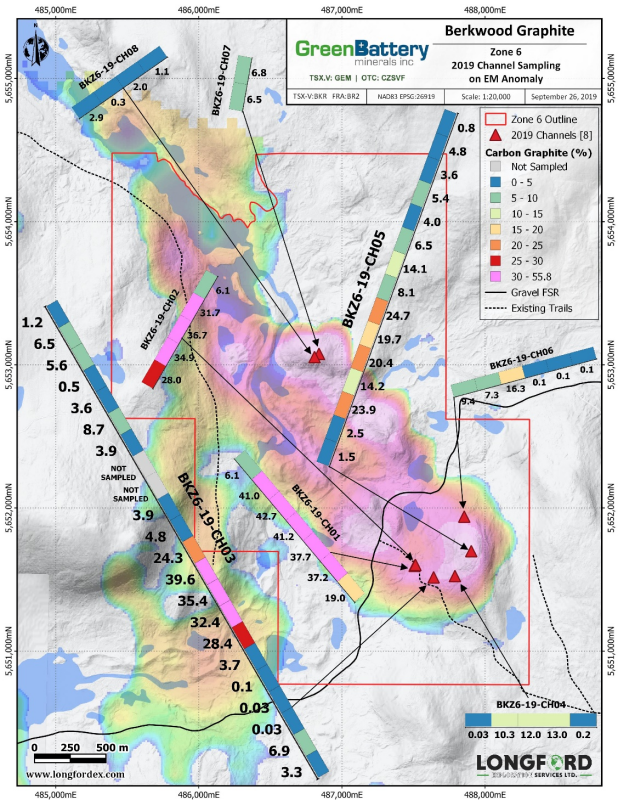

The proposed drill program is expected to include approximately 2500-3000m of HQ drilling in approximately 25 holes targeting surface potential resources within 100m of the surface. Drilling will commence in Zone 6 where the vertical continuity and orientation of previously sampled graphite outcrops will be tested at depth. The extent of the drilling program at Zone 6 will be determined based on the success of the initial exploration campaign before switching the drilling focus to Zone 1.

Figure 3: Zone 6 Drilling areas with trench/channel sample results from high-grade outcrop locations.

At Zone 1 additional step-out expansion drilling will focus on expanding potential resources within the 100m of surface to optimize a favourable near surface/low strip ratio mining scenario, some existing resource areas will also be infilled to improve resource confidence. Particular attention is to be focused on existing known resource areas of high value and near surface graphite enrichment. Further technical analysis is currently underway by our excellent technical team at Longford Exploration Services, under the guidance of Green Battery's technical advisors on how to best allocate the budgeted metres within the Zone 1 resource area.

Both at Zone 1 and Zone 6 graphite outcrops at the surface, meaning there is likely a future mining scenario where waste rock removal and less environmental disruption is conceivable. This would furthermore facilitate rapid reclamation and remediation during mine closure. These qualities may also favourably improve the economics of the project significantly and allow us to maintain our environmentally friendly business model. Green Battery also remains delighted at how it will benefit from extensive existing infrastructure, including hydroelectric power, year-round maintained highways, and a local skilled workforce. All our properties are road accessible and there are existing accommodation facilities nearby. All these factors help make our program greener, cleaner and maintains the Companies strong ESG mandate.

Qualified Person: Alexander Beloborodov (P.Geo) is a Qualified Person ( "QP" ) as defined by National Instrument 43-101 guidelines, and he has reviewed and approved the technical content of this news release.

The Company is pleased to announce that it is conducting a non-brokered private placement consisting of the issuance of up to 3,500,000 flow-through units (each, a " Flow-Through-Unit ") at a price of $0.15 per Flow-Through-Unit for gross aggregate proceeds of up to $525,000 (the " Offering "). Each Flow-Through-Unit will consist of one common share in the capital of the Company that is issued on a flow-through basis in accordance with the Income Tax Act (Canada) (each, a " Flow-Through-Share ") and one half of one share purchase warrant (each whole warrant, a " Warrant "), with each Warrant entitling the holder thereof to purchase one (non-flow-through) common share in the capital of the Company (each, a " Warrant Share ") at a price of $0.20 per Warrant Share for a period of twenty four months following issuance.

The proceeds from the Offering are expected to be used for Canadian exploration expenses and will qualify as flow-through mining expenditures, as defined in Subsection 127(9) of the Income Tax Act (Canada), which will be renounced to the subscribers with an effective date no later than December 31, 2021, to the initial purchasers of the Flow-Through Units in an aggregate amount not less than the gross proceeds raised from the issue of the flow-through shares, as applicable, and, if the qualifying expenditures are reduced by the Canada Revenue Agency, the Company will indemnify each subscriber for any additional taxes payable by such subscriber as a result of the Company's failure to renounce the qualifying expenditures as agreed. Net proceeds will be used for costs associated with the continued exploration/drill program and reports for a planned PEA for the Berkwood Graphite project.

Finder's fees and commissions may be payable in connection with the Offering in accordance with the policies of the TSX Venture Exchange (the " Exchange ") . All securities issued in connection with the Offering will be subject to a statutory hold period expiring four months and one day after closing of the Offering. Completion of the Offering is subject to a number of conditions, including, without limitation, receipt of all regulatory approvals, including approval of the Exchange.

None of the securities to be issued in connection with the Offering will be or have been registered under the United States Securities Act of 1933 , as amended (the " 1933 Act "), and none may be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the 1933 Act. This press release is being issued pursuant to Rule 135c of the 1933 Act and shall not constitute an offer to sell or a solicitation of an offer to buy, nor shall there be any sale of the securities, in any state where such offer, solicitation or sale would be unlawful.

About the Company: Green Battery Minerals is managed by a team with over 150 years of collective experience with a proven track record of not just finding numerous mines but building and operating them as well. The Green Battery Minerals management team's most recent success is discovering the Berkwood graphite deposit in Northern Québec. Green Battery Minerals owns 100% of this asset and the Company's shareholders will benefit from this asset as the demand for graphite for electric vehicles increases significantly.

On Behalf of the Board of Directors

‘Thomas Yingling'

President, CEO & Director

FOR MORE INFORMATION, PLEASE CONTACT:

Investor Relations:

or 1-604-343-7740

info@greenbatteryminerals.com www.greenbatteryminerals.com

Disclaimer for Forward-Looking Information:

Certain statements in this document which are not purely historical are forward-looking statements, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Forward looking statements in this news release include that the Company will carry out the drill program described in this news release, conduct the Offering and expend funds on Berkwood Graphite Project exploration . It is important to note that the Company's actual business outcomes and exploration results could differ materially from those in such forward-looking statements. Risks and uncertainties include that further permits may not be granted timely or at all; the mineral claims may prove to be unworthy of further expenditure; there may not be an economic mineral resource; methods we thought would be effective may not prove to be in practice or on our claims; economic, competitive, governmental, environmental and technological factors may affect the Company's operations, markets, products and prices; our specific plans and timing drilling, field work and other plans may change; we may not have access to or be able to develop any minerals because of cost factors, type of terrain, or availability of equipment and technology; and we may also not raise sufficient funds to carry out our plans. Additional risk factors are discussed in the section entitled "Risk Factors" in the Company's Management Discussion and Analysis for its recently completed fiscal period, which is available under Company's SEDAR profile at www.sedar.com . No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits the Company will obtain from them. These forward-looking statements reflect management's current views and are based on certain expectations, estimates and assumptions, which may prove to be incorrect. Except as required by law, we will not update these forward-looking statement risk factors.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release .

Copyright (c) 2021 TheNewswire - All rights reserved.