Black Mass Tests Achieve 99% Leach Extraction Efficiency for Lithium, Nickel, Cobalt, and Manganese

American Manganese Inc. (TSXV:AMY)(OTCQB:AMYZF)(FSE:2AM) ("AMY" or the "Company") is pleased to report the successful upcycling of lithium-ion battery black mass into NMC-622 (nickel-manganese-cobalt oxide) cathode precursor, using AMY's RecycLiCo™ closed-loop process. The black mass feedstock was produced by mechanical size reduction of end-of-life lithium-ion batteries, resulting in a powder substance that contains critical battery materials, including lithium, cobalt, nickel, and manganese, as well as copper, aluminum, and graphite. American Manganese sourced and tested the samples of black mass from an electric vehicle manufacturer for demonstration of the RecycLiCo™ process and validation of its products

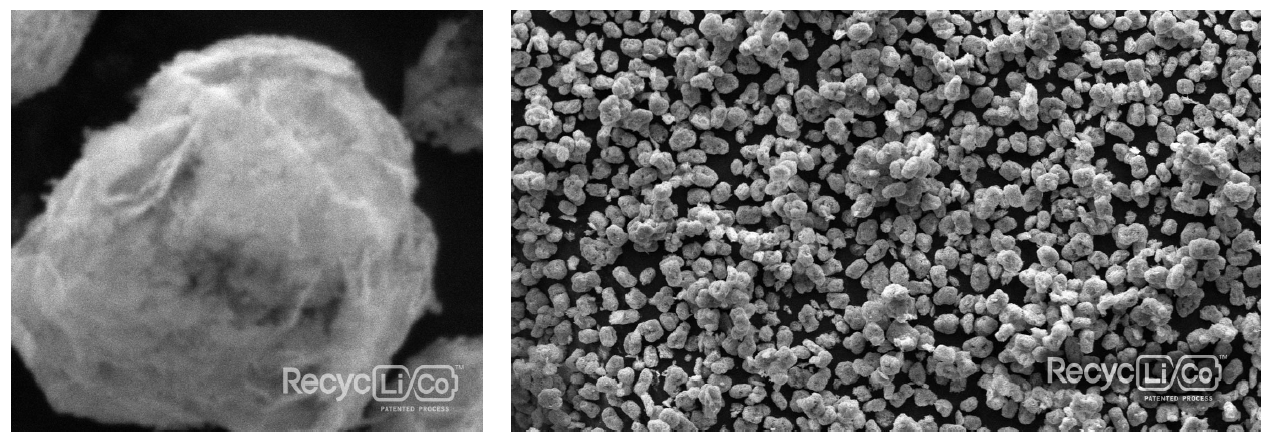

Lab-scale testing of the black mass samples demonstrated a 99% leach extraction efficiency of lithium, nickel, manganese, and cobalt. The resulting pregnant leach solution (PLS) was then adjusted to the desired ratio of nickel, manganese, and cobalt before the direct co-precipitation of the NMC-622 cathode precursor. As seen in the Scanning Electron Microscopy (SEM) scans, the RecycLiCo™ NMC-622 product shares the same high-quality technical specifications - such as particle morphology, size, and distribution - found in conventional lithium-ion battery cathode precursor materials produced from mined raw materials.

Black Mass from Mechanically Treated Electric Vehicle Batteries (Left); Upcycled NMC622 Cathode Precursor from Black Mass (Right)

Figure 2 -Scanning Electron Microscopy Scan of Cathode Precursor from Upcycled Lithium-ion Battery Black Mass

"RecycLiCo™ is a critical resource solution, not waste disposal. Our focus is more than just breaking down waste material. We have been focused on the upcycling of waste lithium-ion battery cathode materials to create useful, high-value products and I'm proud to demonstrate our processing efficiency to industry leaders that recognize the potential benefits of integrating RecycLiCo™ alongside their facilities," said Larry Reaugh, President and CEO of American Manganese. "Our continued success in upcycling EV battery production scrap and black mass broadens our business strategy and potential for strategic partners."

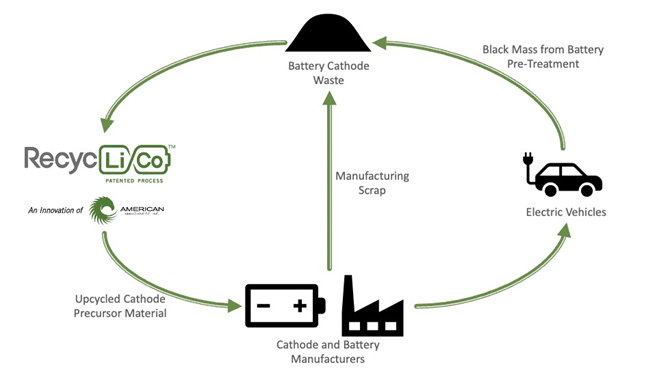

American Manganese offers an advanced upcycling solution of cathode waste - from battery manufacturing scrap and end-of-life lithium-ion batteries - into cathode precursors with one closed-loop process, as seen in the figure below. Therefore, reducing traditional battery supply chain complexity, cost, and pollution. Compared to competing recycling technologies that create lower-value products, the RecycLiCo™ closed-loop and integrated processing strategy offers a more practical, cost-effective, and efficient solution for achieving a circular economy.

Figure 3 - Integration of the RecycLiCo™ with Feedstock from Battery Manufacturing Scrap and End-of-Life EV Batteries

American Manganese Inc. is a critical minerals company focused on the upcycling of lithium-ion battery waste into high-value battery cathode materials, using its closed-loop RecycLiCo™ process. With minimal processing steps and up to 99% extraction of lithium, cobalt, nickel, and manganese, the upcycling process creates valuable lithium-ion battery materials for direct integration into the re-manufacturing of new lithium-ion batteries.

On behalf of Management

American Manganese Inc.

Larry W. Reaugh, President and Chief Executive Officer

Telephone: 778 574 4444 Email: lreaugh@amymn.com

www.americanmanganeseinc.com

www.recyclico.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain "forward-looking statements", which are statements about the future based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements by their nature involve risks and uncertainties, and there can be no assurance that such statements will prove to be accurate or true. Investors should not place undue reliance on forward-looking statements. The Company does not undertake any obligation to update forward-looking statements except as required by law.

SOURCE: American Manganese Inc.

View source version on accesswire.com:

https://www.accesswire.com/661035/American-Manganese-Successfully-Upcycles-EV-Battery-Black-Mass-into-NMC-622-Cathode-Precursor