Tempus Resources Ltd. (“Tempus Resources” or the “Company”) (ASX:TMR)(TSXV:TMRR)(OTCQB:TMRFF) is pleased to announce that mobilisation is underway for the 2021 Exploration Program at the Elizabeth Gold Project in southern BC, Canada

The Company has executed a contract with Full Force Diamond Drilling Ltd. for the provision of diamond-core drilling services at Elizabeth. The flexible contract provides for drilling of up to 12,000 cumulative linear metres. In support of the Program, road clearing and preparation of drilling pads has commenced, and a base line environmental sampling and cultural survey is being coordinated. The drill rigs and operators are expected to complete mobilisation to Elizabeth by late-May. Further information regarding the drilling for the Elizabeth Project 2021 Exploration Program is set out later in this announcement.

Tempus has also retained Precision GeoSurveys Inc. to conduct a helicopter-borne high resolution aeromagnetic and radiometric survey over the entire 115km2 Elizabeth claim block area. The data collection survey flights are planned for early June and will be flown on a 200m line spacing with 100m spacing for infill areas for a total estimated 735 line kilometres. The geophysical surveys will assist in the generation of additional greenfields gold targets and identification of structures in the Elizabeth Project area.

Tempus continues to build positive relationships with First Nations Committees associated with the Elizabeth Project. Tempus has an Exploration Agreement for the Elizabeth Project with the Xwisten (Bridge River Indian Band). Approximately 50% of the planned workforce for the 2021 Elizabeth Project exploration program comprise of members of the Xwisten community, this includes key members of the Environmental and Cultural Heritage monitoring teams for the project.

Elizabeth Gold Project – 2021 Exploration Program (drilling component)

Drilling for the 2021 Exploration Program at Elizabeth will continue and extend the exploration drilling that began in November 2020 (total 2,006 metres over 11 holes already completed) that intercepted several high-grade zones with assays of up to 186 grams per tonne gold (see announcement “Tempus Resources – Announces High-Grade Assay Results at Elizabeth Project, 8 Feb 2021″ for details).

The high-grade quartz veins encountered in the 2020 drilling at Elizabeth show close geological similarities to the Bralorne mesothermal vein system which has been mined to a depth of approximately 2,000 metres and suggests there is strong potential to extend the mineralisation down plunge from the current deepest intersections that are approximately only 200 metres below surface. Tempus is planning on drilling a minimum of 7,500 metres at Elizabeth during the 2021 Exploration Program, with the potential to increase to 12,000 metres.

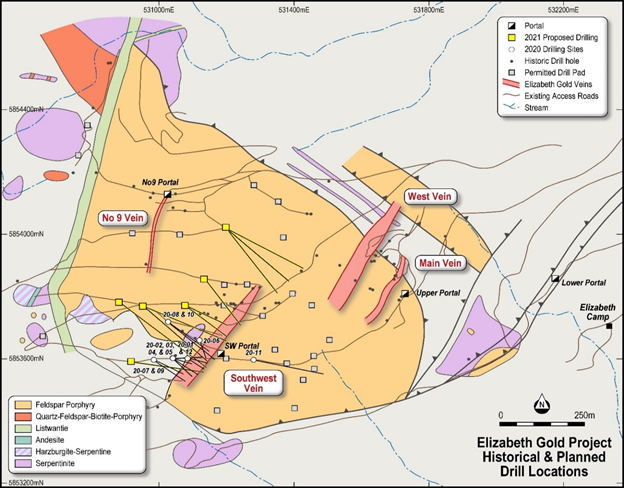

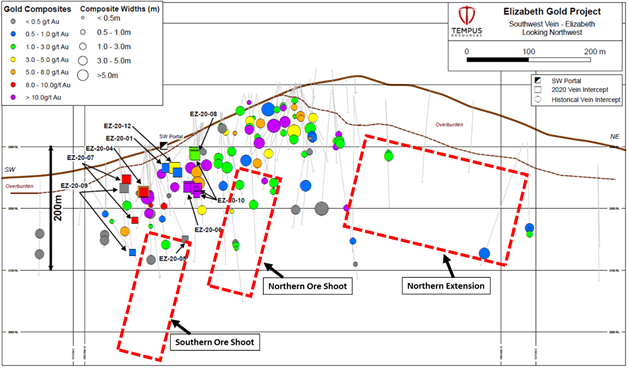

The 2021 drilling will focus on three key zones: (Figure 1 and Figure 2)

- Down plunge step-outs below the high-grade intercepts from drill-holes EZ-20-06 and EZ-20-10

- Infill and down plunge extension of the Northern ore shoot on the SW Vein

- Exploration of the SW Vein structure along strike to the North

Figure 1 – Elizabeth Plan View Showing 2020 and Planned 2021 Drill Locations

Figure 2 – Elizabeth SW Vein Long Section (looking Northwest)

This announcement has been authorised by the Board of Directors of Tempus Resources Limited.

Competent Persons Statement

Information in this report relating to Exploration Results is based on information reviewed by Mr. Kevin Piepgrass, who is a Member of the Association of Professional Engineers and Geoscientists of the province of BC (APEGBC), which is a recognised Professional Organisation (RPO), and an employee of Tempus Resources. Mr. Piepgrass has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined by the 2012 Edition of the Australasian Code for reporting of Exploration Results, Mineral Resources and Ore Reserves, and as a Qualified Person for the purposes of NI43-101. Mr. Piepgrass consents to the inclusion of the data in the form and context in which it appears.

For further information:

Tempus Resources LTD

Melanie Ross – Director/Company Secretary

Phone: +61 8 6188 8181

About Tempus Resources Ltd

Tempus Resources Ltd (“Tempus”) is a growth orientated gold exploration company listed on ASX (“TMR”) and TSX.V (“TMRR”) and OTCQB (“TMRFF”) stock exchanges. Tempus is actively exploring projects located in Canada and Ecuador. The flagship project for Tempus is the Blackdome-Elizabeth Project, a high grade gold past producing project located in Southern British Columbia. Tempus is currently midway through a drill program at Blackdome-Elizabeth that will form the basis of an updated NI43-101/JORC resource estimate. The second key group of projects for Tempus are the Rio Zarza and Valle del Tigre projects located in south east Ecuador. The Rio Zarza project is located adjacent to Lundin Gold’s Fruta del Norte project. The Valle del Tigre project is currently subject to a sampling program to develop anomalies identified through geophysical work.

Forward-Looking Information and Statements

This press release contains certain “forward-looking information” within the meaning of applicable Canadian securities legislation. Such forward-looking information and forward-looking statements are not representative of historical facts or information or current condition, but instead represent only the Company’s beliefs regarding future events, plans or objectives, many of which, by their nature, are inherently uncertain and outside of Tempus’s control. Generally, such forward-looking information or forward-looking statements can be identified by the use of forward-looking terminology such as ”plans”, ”expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, ”anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or may contain statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “will continue”, ”will occur” or “will be achieved”. The forward-looking information and forward-looking statements contained herein may include, but are not limited to, the ability of Tempus to successfully achieve business objectives, and expectations for other economic, business, and/or competitive factors. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Tempus to control or predict, that may cause Tempus’ actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein and the other risks and uncertainties disclosed under the heading “Risk and Uncertainties” in the Company’s Management’s Discussion & Analysis for the quarter and six months ended December 31, 2020 dated February 16, 2021 filed on SEDAR. Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although Tempus believes that the assumptions and factors used in preparing, and the expectations contained in, the forward-looking information and statements are reasonable, undue reliance should not be placed on such information and statements, and no assurance or guarantee can be given that such forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information and statements. The forward-looking information and forward-looking statements contained in this press release are made as of the date of this press release, and Tempus does not undertake to update any forward-looking information and/or forward-looking statements that are contained or referenced herein, except in accordance with applicable securities laws. All subsequent written and oral forward-looking information and statements attributable to Tempus or persons acting on its behalf are expressly qualified in its entirety by this notice.

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Tempus Resources Ltd

View source version on accesswire.com:

https://www.accesswire.com/645960/Mobilisation-for-Tempus-2021-Gold-Exploration-Drilling