Tempus Resources Ltd (" Tempus " or the " Company ") (ASX:TMR)(TSXV:TMRR)(OTCQB:TMRFF) is pleased to announce further assay results from drill-holes from its Elizabeth Gold Project in British Columbia, Canada. Drill holes being reported in this release are EZ-21-15, EZ-21-16, EZ-21-17, EZ-21-18, and EZ-21-19. The drill holes targeted the SW Vein at a vertical depth below 200 metres and the Blue Vein (EZ-21-19

HIGHLIGHTS

- Assays received for the first follow-up drill-hole on the Blue Vein (drill-hole EZ-21-19) in the vicinity of the ‘bonanza' grade discovery hole (drill-hole EZ-21-12, announced on 21 October) demonstrate high grade mineralisation continues down dip.

- Multiple high grade intersections were encountered in drill-hole EZ-21-19:

- 0.50m at 4.52g/t Au from 127.50m;

- 1.50m at 4.25g/t Au from 129.00m; and

- 0.90m at 6.14g/t Au from 167.80m

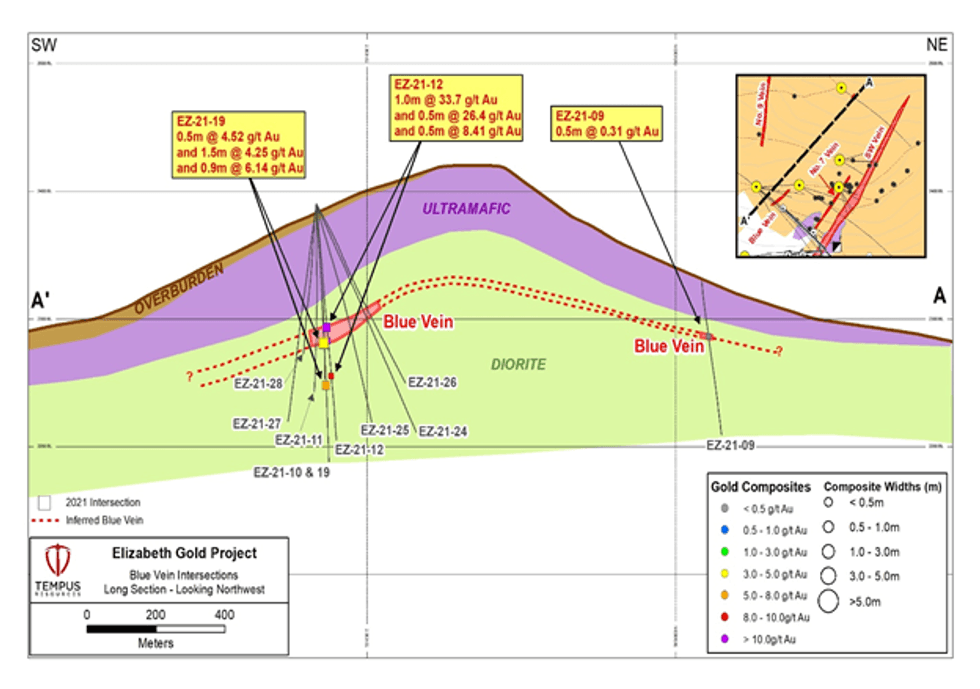

- Assay results have now been received for three drill holes that intersected the Blue Vein located approximately 150 metres NW of the SW Vein (EZ-21-09, EZ-21-12, EZ-21-19). The results to date show continuity of the Blue Vein over a strike length of at least 380 metres and demonstrates continuity down dip.

- The results from EZ-21-19 indicate the potential for the Blue Vein to be a source of new Mineral Resources at Elizabeth Gold Project.

- More broadly, the discovery of the Blue Vein and continued success in demonstrating its mineralised content, highlight the potential for multiple vein sets at the Elizabeth Project. Multiple identified veins are yet to be drilled (No 9 Vein, Main Vein and West Vein) and there's great potential for additional new vein discoveries.

- Tempus has suspended drilling at Elizabeth for the season, pending the approval of the Notice of Work amendment for extension of the Lower Portal adit access for underground drilling - A total of 28 drill-holes over approximately 7,740 metres were completed during 2021. Assays are pending for nine drill holes from the 2021 drill program, including four drill holes that intersected the Blue Vein (EZ-21-24, EZ-21-25, EZ-21-26, EZ-21-27), which are expected to be received in tranches over the next 12 weeks

Tempus President and CEO, Jason Bahnsen commented "The assay results for drill hole EZ-21-19 show continued high-grade gold mineralisation down dip of the previously reported ‘bonanza' grade intersection at the newly discovered Blue Vein. Assays have now been received for three out of the seven drill holes that have intersected the Blue Vein. With the historic resource at Elizabeth largely centred on the SW Vein, the Blue Vein holds significant potential for expanding the current resource base for the project."

Blue Vein Results

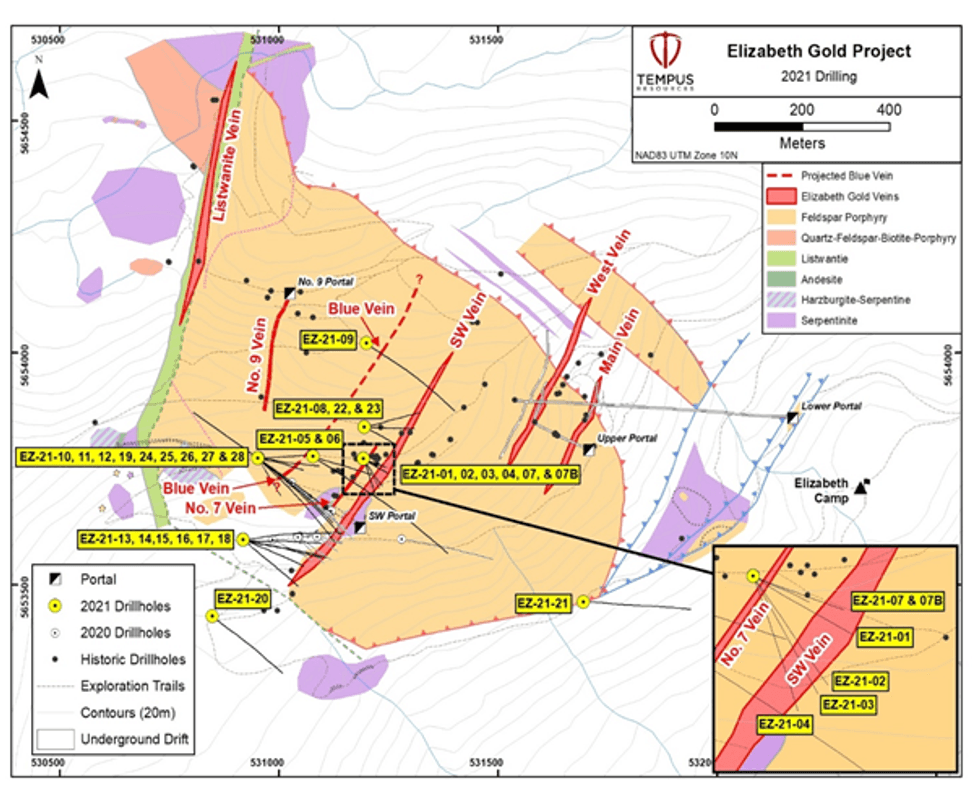

Tempus discovered the new Blue Vein with drill hole EZ-21-12 with an intersection of visible gold in the drill core, as announced on 27 September 2021. The Blue Vein is located approximately 150 metres to the northwest, and parallel, to the SW Vein (See Figure 1). This previously unknown vein has now been intersected by 7 drill-holes (EZ-21-09, EZ-21-12, EZ-21-19, EZ-21-24, EZ-21-25, EZ-21-26, EZ-21-27) demonstrating an initial strike length of 380 metres (see Figure 2), with four of those drill-holes pending assay results.

Drill hole EZ-21-12 (see announcement 26 October 2021) included high-grade gold intersections with assays of including 33.7g/t gold over 1.0 metre from 117.8 metres, 26.4g/t gold over 0.5m from 130.7 metres, and 8.4g/t gold over 0.5m from 163.9 metres. EZ-21-19 was drilled at a steeper angle than EZ-21-12 and demonstrates continuity of the Blue Vein down dip .

Results from EZ-21-24 to EZ-21-27, which specifically target the Blue Vein, were all successful in intersecting the quartz vein and are currently in the lab with assays pending. See Table 1 below for Blue Vein drill results received to date.

Table 1 - Elizabeth Gold Project Blue Vein Drill Intersections

Hole ID | From (m) | To (m) | Interval (m) | True Thickness (m) | Gold Grade (g/t Au) | MET Screen Grade (g/t Au) |

EZ-21-09 | 58.60 | 59.10 | 0.50 | 0.43 | 0.31 | Not Performed |

EZ-21-12 | 117.80 | 118.80 | 1.00 | 0.85 | 47.6 | 33.7 |

and | 130.70 | 131.20 | 0.50 | 0.43 | 26.4 | Not Performed |

and | 163.90 | 164.40 | 0.50 | 0.43 | 5.50 | 8.41 |

EZ-21-19 | 127.50 | 128.00 | 0.50 | 0.43 | 4.52 | Not Performed |

and | 129.00 | 130.50 | 1.50 | 1.28 | 4.25 | Not Performed |

and | 167.80 | 168.70 | 0.90 | 0.76 | 4.50 | 6.14 |

EZ-21-24 | pending | |||||

EZ-21-25 | pending | |||||

EZ-21-26 | pending | |||||

EZ-21-27 | pending | |||||

*true thickness is estimated using a multiplier of 0.85.

SW Vein Results

Each of drill holes being reported today have successfully intersected the SW Vein and continue to indicate significant mineralisation and anomalous gold values. Mineralised intervals are consistent with mesothermal/orogenic gold veins and contain highly elevated values in arsenic, antimony, silver, and mercury. Drill holes EZ-21-15, EZ-21-16, EZ-21-17, EZ-21-18, and EZ-21-19 targeted the southern portion of the SW Vein at depths below 200m vertical. See Appendix 1 Table 1 for detailed results.

Tempus has now completed exploration drilling at Elizabeth for 2021. A total of 28 drill holes have been completed at Elizabeth for approximately 7,740 metres. Combined with the 11 drill holes completed in 2020, Tempus has now completed 39 drillholes for a total of approximately 9,750 metres at Elizabeth since Tempus began drilling in November 2020. Drill collar information can be seen in Appendix 1, Table 1. There are currently 9 drill holes pending assay results.

The underground development permit for the Elizabeth Lower Portal exploration drift is still pending (see announcement 13 September 2021).

Figure 1 - The Elizabeth Project - Plan map of drilling

Figure 2 - Elizabeth Project - Long-section of the Blue Vein

Competent Persons Statement

Information in this report relating to Exploration Results is based on information reviewed by Mr. Kevin Piepgrass, who is a Member of the Association of Professional Engineers and Geoscientists of the province of BC (APEGBC), which is a recognised Professional Organisation (RPO), and an employee of Tempus Resources. Mr. Piepgrass has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined by the 2012 Edition of the Australasian Code for reporting of Exploration Results, Mineral Resources and Ore Reserves, and as a Qualified Person for the purposes of NI43-101. Mr. Piepgrass consents to the inclusion of the data in the form and context in which it appears.

For further information:

Tempus Resources LTD

Melanie Ross - Director/Company Secretary Phone: +61 8 6188 8181

About Tempus Resources Ltd

Tempus Resources Ltd ("Tempus") is a growth orientated gold exploration company listed on ASX ("TMR") and TSX.V ("TMRR") and OTCQB ("TMRFF") stock exchanges. Tempus is actively exploring projects located in Canada and Ecuador. The flagship project for Tempus is the Elizabeth-Blackdome Project, a high-grade gold past producing project located in Southern British Columbia. Tempus is currently midway through a drill program at Elizabeth-Blackdome that will form the basis of an updated NI43-101/JORC resource estimate. The second key group of projects for Tempus are the Rio Zarza and Valle del Tigre projects located in south east Ecuador. The Rio Zarza project is located adjacent to Lundin Gold's Fruta del Norte project. The Valle del Tigre project is currently subject to a sampling program to develop anomalies identified through geophysical work.

Forward-Looking Information and Statements

This press release contains certain "forward-looking information" within the meaning of applicable Canadian securities legislation. Such forward-looking information and forward-looking statements are not representative of historical facts or information or current condition, but instead represent only the Company's beliefs regarding future events, plans or objectives, many of which, by their nature, are inherently uncertain and outside of Tempus's control. Generally, such forward-looking information or forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or may contain statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "will continue", "will occur" or "will be achieved". The forward-looking information and forward-looking statements contained herein may include, but are not limited to, the ability of Tempus to successfully achieve business objectives, and expectations for other economic, business, and/or competitive factors. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Tempus to control or predict, that may cause Tempus' actual results, performance or achievements to be materially different from those expressed or implied thereby, and and are developed based on assumptions about such risks, uncertainties and other factors set out herein and the other risks and uncertainties disclosed on Page 27 under the heading "Risk and Uncertainties" in the Company's Management's Discussion & Analysis for the quarter ended September 30, 2021 dated November 15, 2021 filed on SEDAR. Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although Tempus believes that the assumptions and factors used in preparing, and the expectations contained in, the forward-looking information and statements are reasonable, undue reliance should not be placed on such information and statements, and no assurance or guarantee can be given that such forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information and statements. The forward-looking information and forward-looking statements contained in this press release are made as of the date of this press release, and Tempus does not undertake to update any forward-looking information and/or forward-looking statements that are contained or referenced herein, except in accordance with applicable securities laws. All subsequent written and oral forward-looking information and statements attributable to Tempus or persons acting on its behalf are expressly qualified in its entirety by this notice. Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release .

Appendix 1

Table 1:Drill Hole Collar Table

UTM | UTM | ||||||

| Hole ID | Target | Easting (NAD83 | Northing (NAD83 | Elevation (m) | Length (m) | Azimuth | Dip |

Z10) | Z10) | ||||||

| EZ-21-01 | SW Vein | 531203 | 5653771 | 2400 | 105 | 121 | -52 |

| EZ-21-02 | SW Vein | 531203 | 5653771 | 2400 | 132 | 146 | -55 |

| EZ-21-03 | SW Vein | 531203 | 5653771 | 2400 | 111 | 158 | -47 |

| EZ-21-04 | SW Vein | 531203 | 5653771 | 2400 | 135 | 168 | -58 |

| EZ-21-05 | SW Vein | 531078 | 5653776 | 2400 | 561 | 123 | -48 |

| EZ-21-06 | SW Vein | 531078 | 5653776 | 2400 | 255 | 110 | -55 |

| EZ-21-07 | SW Vein | 531203 | 5653771 | 2400 | 126 | 115 | -75 |

| EZ-21-07b | SW Vein | 531203 | 5653771 | 2400 | 186 | 115 | -75 |

| EZ-21-08 | SW Vein | 531195 | 5653839 | 2427 | 231 | 115 | -68 |

| EZ-21-09 | SW Vein | 531200 | 5654020 | 2330 | 360 | 120 | -48 |

| EZ-21-10 | SW Vein | 530953 | 5653772 | 2390 | 354 | 127 | -50 |

| EZ-21-11 | SW Vein | 530953 | 5653772 | 2390 | 381 | 136 | -50 |

| EZ-21-12 | SW Vein | 530953 | 5653772 | 2390 | 375 | 125 | -45 |

| EZ-21-13 | SW Vein | 530919 | 5653596 | 2300 | 261 | 94 | -45 |

| EZ-21-14 | SW Vein | 530919 | 5653596 | 2300 | 261 | 108 | -55 |

| EZ-21-15 | SW Vein | 530919 | 5653596 | 2300 | 330 | 100 | -55 |

| EZ-21-16 | SW Vein | 530919 | 5653596 | 2300 | 330 | 83 | -48.5 |

| EZ-21-17 | SW Vein | 530919 | 5653596 | 2300 | 414 | 98 | -63 |

| EZ-21-18 | SW Vein | 530919 | 5653596 | 2300 | 351 | 128.5 | -63 |

| EZ-21-19 | SW Vein | 530953 | 5653772 | 2390 | 417 | 129 | -58 |

| EZ-21-20 | SW Vein | 530849 | 5653432 | 2260 | 300 | 129 | -45 |

| EZ-21-21 | East Veins | 531695 | 5653463 | 2120 | 357 | 90 | -45 |

| EZ-21-22 | SW Vein | 531195 | 5653839 | 2427 | 188 | 75 | -45 |

| EZ-21-23 | SW Vein | 531695 | 5653463 | 2120 | 165 | 91 | -45 |

| EZ-21-24 | Blue Vein | 530953 | 5653772 | 2390 | 219 | 84 | -54 |

| EZ-21-25 | Blue Vein | 530953 | 5653772 | 2390 | 201 | 105 | -58 |

| EZ-21-26 | Blue Vein | 530953 | 5653772 | 2390 | 198 | 95 | -45 |

| EZ-21-27 | Blue Vein | 530953 | 5653772 | 2390 | 195 | 150 | -60 |

| EZ-21-28 | No.9 Vein | 530953 | 5653772 | 2390 | 321 | 300 | -55 |

Table 2: Significant Interval Table

Hole ID | From (m) | To (m) | Interval (m) | True Thickness (m) | Gold Grade | MET Screen Grade | Vein |

EZ-21-01 | 94.00 | 96.60 | 2.60 | 2.21 | 4.60 | 5.12 | SW Vein |

and | 83.50 | 84.00 | 0.50 | 0.43 | 20.50 | pending | SW Vein |

EZ-21-02 | 102.40 | 109.00 | 6.60 | 5.61 | 8.40 | pending | SW Vein |

including | 105.40 | 106.50 | 1.10 | 0.93 | 46.30 | pending | SW Vein |

EZ-21-03 | 88.60 | 95.00 | 6.40 | 5.44 | 7.22 | pending | SW Vein |

including | 89.30 | 91.90 | 2.60 | 2.21 | 11.80 | pending | SW Vein |

and | 90.00 | 91.30 | 1.30 | 1.11 | 19.80 | pending | SW Vein |

and | 34.70 | 35.20 | 0.50 | 0.43 | 3.15 | pending | SW Vein |

EZ-21-04 | 122.00 | 126.00 | 4.00 | 3.40 | 31.20 | 34.40 | SW Vein |

including | 123.00 | 124.50 | 1.50 | 1.28 | 52.10 | 68.30 | SW Vein |

including | 124.00 | 124.50 | 0.50 | 0.43 | 72.00 | 87.30 | SW Vein |

EZ-21-05 | 134.00 | 135.00 | 1.00 | 0.85 | 1.38 | not performed | 7 Vein |

217.55 | 218.25 | 0.70 | 0.59 | 1.74 | 1.67 | SW Vein | |

and | 256.00 | 256.50 | 0.50 | 0.43 | 1.03 | 0.89 | SW Vein |

and | 554.85 | 555.35 | 0.50 | 0.43 | 0.24 | not performed | West Vein |

EZ-21-06 | 134.50 | 136.00 | 1.50 | 1.28 | 1.10 | 1.71 | 7 Vein |

and | 245.00 | 246.00 | 1.00 | 0.85 | 2.05 | 2.45 | SW Vein |

EZ-21-07 | Hole lost | ||||||

EZ-21-07B | 40.10 | 41.10 | 1.00 | 0.85 | 4.88 | not performed | 7 Vein |

and | 51.50 | 52.20 | 0.70 | 0.60 | 9.06 | not performed | 7 Vein |

and | 160.00 | 165.75 | 5.75 | 4.89 | 0.53 | 0.70 | SW Vein |

EZ-21-08 | 196.25 | 202.40 | 6.15 | 5.23 | 0.65 | 0.66 | SW Vein |

and | 226.60 | 227.10 | 0.50 | 0.43 | 1.54 | 1.85 | SW Vein |

EZ-21-09 | 58.60 | 59.10 | 0.50 | 0.43 | 0.31 | not performed | Blue Vein |

and | 270.90 | 272.90 | 2.00 | 1.70 | 2.56 | not performed | SW Vein |

and | 355.88 | 357.00 | 1.12 | 0.95 | 0.85 | not performed | SW Vein |

EZ-21-10 | 223.00 | 223.50 | 0.50 | 0.43 | 4.04 | not performed | 7 Vein |

and | 347.70 | 349.20 | 1.50 | 1.28 | 0.22 | 0.21 | SW Vein |

EZ-21-11 | 326.90 | 327.40 | 0.50 | 0.43 | 0.55 | 0.44 | SW Vein |

Hole ID | From (m) | To (m) | Interval (m) | True Thickness (m) | Gold Grade | MET Screen Grade | Vein |

EZ-21-12 | 117.80 | 118.80 | 1.00 | 0.85 | 47.6 | 33.7 | Blue Vein |

and | 130.70 | 131.20 | 0.50 | 0.43 | 26.4 | not performed | Blue Vein |

and | 163.90 | 164.40 | 0.50 | 0.43 | 5.50 | 8.41 | Blue Vein |

and | 344.90 | 347.00 | 2.10 | 1.79 | 0.78 | 1.22 | SW Vein |

EZ-21-13 | 230.70 | 232.60 | 1.90 | 1.62 | 0.76 | 0.71 | SW Vein |

EZ-21-14 | 224.00 | 224.90 | 0.90 | 0.77 | 1.63 | 1.15 | SW Vein |

EZ-21-15 | 318.40 | 320.80 | 2.40 | 2.04 | 0.31 | not performed | SW Vein |

including | 320.30 | 320.80 | 0.50 | 0.43 | 1.14 | not performed | SW Vein |

EZ-21-16 | 305.00 | 306.90 | 1.90 | 1.61 | 0.55 | not performed | SW Vein |

EZ-21-17 | 171.00 | 171.50 | 0.50 | 0.43 | 0.14 | 0.57 | Vein |

and | 204.00 | 204.60 | 0.60 | 0.51 | 0.53 | not performed | vein |

and | 254.60 | 256.85 | 2.25 | 1.91 | 1.40 | 1.58 | 7 Vein |

and | 350.13 | 350.75 | 0.62 | 0.53 | 1.01 | not performed | SW Vein |

and | 379.47 | 382.00 | 2.53 | 2.15 | 0.63 | 0.64 | SW Vein |

EZ-21-18 | 299.50 | 299.90 | 0.40 | 0.34 | 1.53 | not performed | SW Vein |

EZ-21-19 | 127.50 | 128.00 | 0.50 | 0.43 | 4.52 | not performed | Blue Vein |

and | 129.00 | 130.50 | 1.50 | 1.28 | 4.25 | not performed | Blue Vein |

and | 167.80 | 168.70 | 0.90 | 0.76 | 4.50 | 6.14 | Blue Vein |

and | 351.80 | 354.90 | 3.10 | 2.63 | 0.34 | not performed | SW Vein |

*true thickness is estimated using a multiplier of 0.85.

Appendix 2: The following tables are providedto ensure compliance with the JORC Code (2012) requirements for the reporting of Exploration Results for the Elizabeth - Blackdome Gold Project

Section 1: SamplingTechniques and Data

(Criteria in this sectionapply to all succeeding sections.)

Criteria | JORC Code explanation | Commentary |

Sampling techniques |

information. |

|

Drilling techniques |

what method, etc). |

|

Drill sample recovery |

have occurred due to preferential loss/gain of fine/coarse material. |

|

Criteria | JORC Code explanation | Commentary | |

Logging |

|

| |

Sub- sampling techniques andsample preparation |

|

| |

Quality of assay data and laboratory tests |

|

| |

Verification ofsampling and assaying |

|

| |

Criteria | JORC Code explanation | Commentary | |

Location of datapoints |

|

| |

Data spacing anddistribution |

|

| |

Orientation of data in relation to geological structure |

|

| |

Sample s Security |

|

| |

Audits or Reviews |

|

| |

Section 2: Reportingof Exploration Results

(Criteria listed in the preceding section also apply to this section.)

Criteria | JORC Code explanation | Commentary | |

Mineral tenement and land tenurestatus |

|

(refer to ASX announcement 15 December 2020)

| |

Exploration done by other parties |

|

| |

Criteria | JORC Code explanation | Commentary |

| Mining operations lasted six months and ended in May of 1999. During this period, 6,547 oz of Au and 17,300 oz of Ag were producedfrom 21,268 tons of ore. Further exploration programs were continued by Claimstaker over the following years and a Japanese joint venture partnerwas brought onboardthat prompted a name changeto J-Pacific Gold Inc. This partnership was terminated by 2010, resulting in another name change to Sona Resources Corp.

| ||

Geology |

|

Blackdome and are correlated with the KamloopsGroup seen in the Ashcroft and Nicola regions. |

Criteria | JORC Code explanation | Commentary |

| Geochemical studies (Vivian, 1988)have shown these rocks to be derivedfrom a "calc-alkaline" magma in a volcanicarc type tectonicsetting. Eocene age granitic intrusions at Poison Mountain some 22 kilometres southwest of Blackdome are host to a gold bearing porphyry copper/molybdenum deposit. It is speculated that this or related intrusions could reflect the source magmas of the volcanic rocks seen at Blackdome. There is some documented evidenceof young graniticrocks several kilometres south of the mine near Lone Cabin Creek. The youngest rocks present are Oligocene to Miocene basalts of the Chilcotin Group. These are exposed on the uppermost slopes of Blackdome Mountain and Red Mountain to the south.

brittle faulting believed to be contemporaneous with mid- Eocene extensional faulting along the Marshall Creek,Mission Ridge and Quartz Mountain faults. |

Criteria | JORC Code explanation | Commentary |

Drill hole Information |

of the report, the Competent Person should clearlyexplain why this isthe case. |

|

Data aggregation methods |

|

|

Relationship between mineralisation widths andintercept lengths |

known'). |

|

Diagrams |

hole collar locations and appropriate sectional views. |

|

Criteria | JORC Code explanation | Commentary |

| Balanced reporting |

Results. |

|

Other substantive exploration data |

substances. |

|

Further work |

information is not commercially sensitive. |

|

SOURCE: Tempus Resources Ltd

View source version on accesswire.com:

https://www.accesswire.com/674512/Further-Drill-Results-Highlight-Blue-Vein-Potential