- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

January 04, 2024

Oceana Lithium Limited (ASX: OCN, “Oceana” or “the Company”) is pleased to report the final results from the phase one scout RC drilling campaign at its Solonópole Lithium Project in Ceará State, Brazil, which was successful in intercepting multiple thick pegmatites containing some anomalous Lithium and Tantalum grades at shallow depth.

Solonópole Lithium Project, Ceará, Brazil

- Last nine RC drill hole assay results from shallow scout drilling campaign confirm new Lithium-Caesium-Tantalum (LCT) pegmatite targets for deeper drilling in un-weathered zones at Tin Mine, Zilcar II and Rolados.

- All assay results received from 30 shallow scout RC drill holes (~2,000m) and validated by internal QAQC.

- Anomalous Lithium grades (up to 0.95% Li2O) and Tantalum grades (up to 380ppm) returned from seven drill holes (NGR-RC-002, NGR-RC-009, NGR-RC-014, SOL-RC-001, SOL-RC-002, SOL-RC-005 and SOL-RC-008), confirming their LCT nature.

- Best intercepts were from SOL-RC-008 at Zilcar II, with maximum value over 1m of 0.95% Li2O and Lithium mineralised zone from 46m to 53m (7m not true width) averaging 0.49% Li2O, including 3m at 0.69% Li2O.

- Over 8,300 soil samples collected from Solonópole and analysed by XRF for LCT pathfinders, of which 1,908 soil samples have also been analysed by SGS laboratory for Lithium.

- New data from geophysics and soil geochemistry anomalies indicates several swarms of pegmatite bodies striking in a NE-SW direction, showing more than one Lithium bearing pegmatite at the BJdB Pit; BJdB Central; Tin Mine; Zilcar II; and Rolados targets.

- RC results and other field data are being interpreted to support the next follow-up diamond drilling campaign.

Napperby Lithium Project, Northern Territory, Australia

- Completion of field work for soil geochemistry infill program with 107 sample points along ~30km of sample lines to better define and understand the anomalies highlighted by 2022 soil sampling program.

Oceana’s Senior Geologist and Competent Person James Abson said: “The scout drilling program has returned anomalous Lithium and Tantalum grades on five (BJdB Pit, BJdB Central, Tin Mine, Zilcar II and Rolados) of the seven targets tested so far. Oceana is now planning additional exploration activities including a Diamond Drilling campaign at Solonópole, which is now supported by more robust geological, geochemical and geophysical datasets.”

Solonópole Lithium Project, Brazil

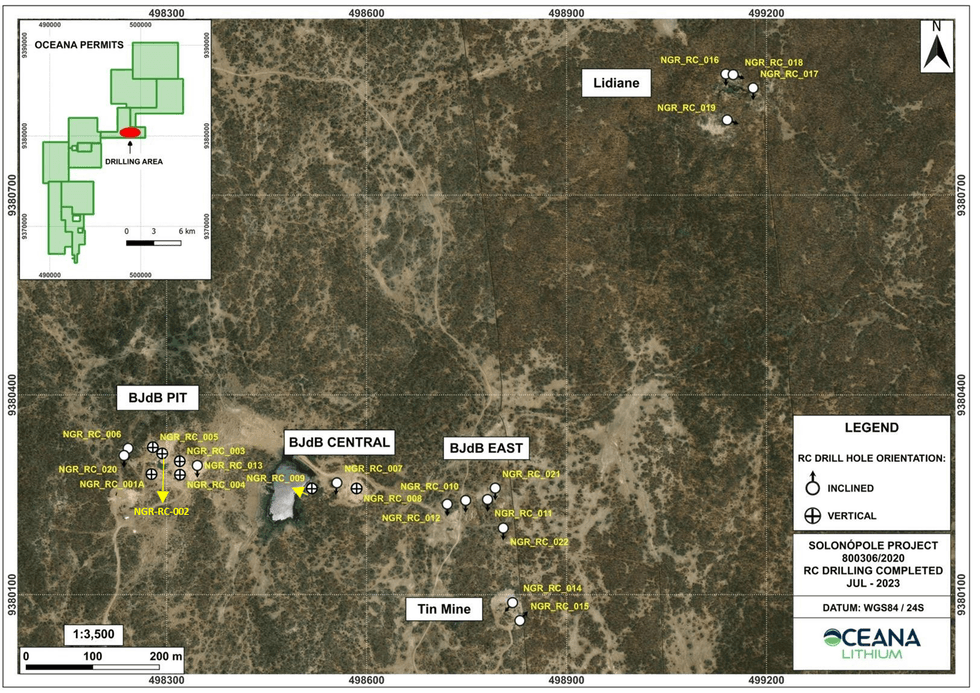

As announced by Oceana on 7 August 2023 and 3 November 2023, the shallow scout RC holes (NGR-RC-001 to NGR-RC-022) completed at Bom Jesus de Baixo (“BJdB”) Prospect confirmed the presence of thick pegmatites in five different outcropping areas (BJdB Pit, BJdB Central, BJdB East, “Tin Mine” and “Lidiane”) on Permit 800306 (Figure 1).

Best scout drilling final results from the prospect include anomalous Lithium grades in three drill holes (NGR- RC-002, NGR-RC-009 and NGR-RC-014):

- BJdB Pit Area: NGR-RC-002, with maximum value over 1m of 0.83% Li2O. A Lithium mineralised zone exists from 23m to 38m (15m not true width) averaging 0.34% Li2O, including 6m at 0.50% Li2O. This hole is proximal to where spodumene was previously identified in the BJdB pit.

- BJdB Central Area: NGR-RC-009, with maximum value over 1m of 0.42% Li2O. A Lithium mineralised zone exists from 7m to 17m (10m not true width) averaging 0.20% Li2O, including 3m at 0.31% Li2O.

- Tin Mine Area: NGR-RC-014, with maximum value over 1m of 0.45% Li2O. A Lithium mineralised zone exists from 4m to 7m (3m not true width) averaging 0.32% Li2O.

Although neither spodumene nor lepidolite was visually identified in the very fine RC chips, the geochemical assay signatures (low P, and low Rb and Cs) indicate that the Lithium bearing mineral is spodumene, which is known to be present at surface in a weathered state. XRD analysis will be undertaken to confirm this observation.

Click here for the full ASX Release

This article includes content from Oceana Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

OCN:AU

The Conversation (0)

12 March 2024

Oceana Lithium

Large-scale, highly prospective, pre-discovery projects in Brazil and Australia

Large-scale, highly prospective, pre-discovery projects in Brazil and Australia Keep Reading...

22h

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00