June 04, 2024

Field work programs identify new strongly anomalous base metal zones to the north and south of the high-grade Evergreen zone

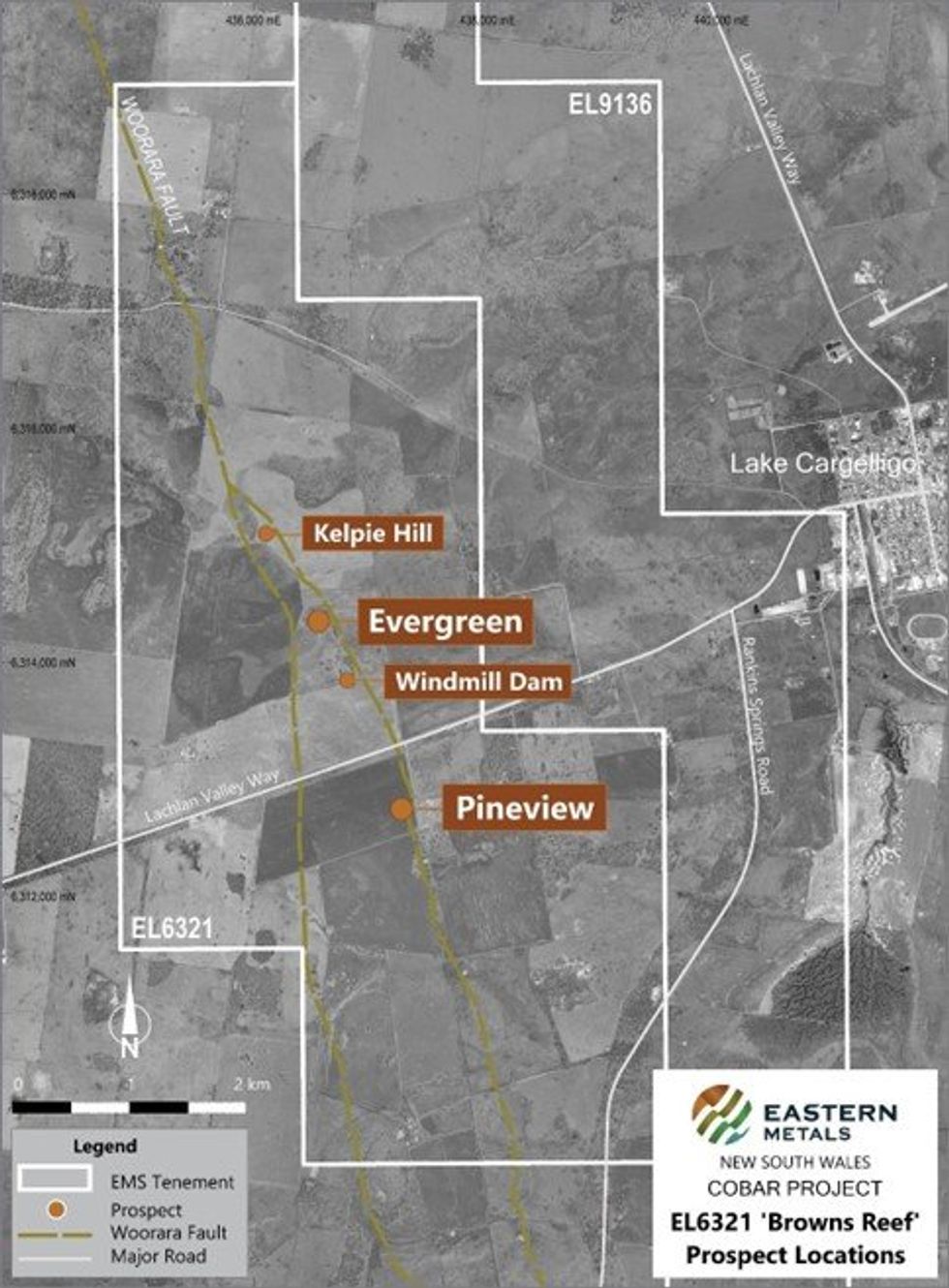

Eastern Metals Ltd (ASX:EMS) (“Eastern Metals” or “the Company”) is pleased to announce that recent fieldwork programs across the 100%-owned EL6321, part of its Browns Reef Project (Figure 1), located in the southern Cobar Basin of NSW, have identified new zones of anomalous base metal mineralisation in the northern portion of the project area.

KEY HIGHLIGHTS

- Assay results from recent fieldwork programs to the north of known high-grade mineralisation at the Browns Reef Project in NSW’s southern Cobar Basin have returned highly anomalous grades from surface rock chip samples.

- Mapping and pXRF traverses along the Woorara Fault, a regional-scale structure related to known mineralisation at the high-grade Pineview and Evergreen zones, have identified new anomalous zones north and south of Evergreen, which have been named ‘Kelpie Hill’ and ‘Windmill Dam’ respectively.

- Planning is underway to update and extend the existing drilling approvals for Evergreen to include these prospects, along with an Induced Polarisation (IP) survey.

- Three land access agreements have now been secured for EL9136 (Bothrooney), with reconnaissance fieldwork on this tenement scheduled for mid-June 2024.

The fieldwork programs were completed in April 2024 and May 2024 and focused on the Woorara Fault, to the north of the known high-grade Pineview and Evergreen zones at Browns Reef1. A JORC Table 1 is provided at Appendix A.

Commenting on the results, Eastern Metals’ Chief Executive Officer Ley Kingdom said: “These are highly encouraging initial results from our fieldwork programs, which have confirmed the ability of mapping and soil pXRF analysis to identify geochemical trends within EL6321.

“What’s even more encouraging is that these programs have highlighted new anomalous areas along the prospective Woorara Fault. These new areas include Kelpie Hill and Windmill Dam, located to the north and south of the known high-grade mineralisation zone at Evergreen.

“Kelpie Hill and Windmill Dam will be high-priority target areas for upcoming exploration programs, with IP surveys and drilling planned to test whether these represent a continuous zone of mineralisation between Pineview and Evergreen, and potentially, a northern extension of Evergreen.”

EL6321 Browns Reef Overview

Browns Reef (EL6321) is an ‘advanced exploration project’ located 5km west of Lake Cargelligo in the southern Cobar Basin, NSW. It is a structurally controlled, polymetallic system extending along the inferred Woorara Fault and the Preston Formation and Clements Formation contact.

Fieldwork within EL6321 was undertaken in April 2024 and focused on the area between the Lachlan Valley Way Road and the North Uabba Road. The program was aimed at ground truthing and, where possible, adding to the auger and rotary air blast (RAB) hole data and geological mapping originally acquired by the Electrolytic Zinc Company of Australasia Ltd (EZ) in the 1970s.

Most paddocks in the area have been cropped or cultivated at some stage and outcrop is rare; however, gossanous material is commonly evident in stone raked piles throughout the entire strike length of the inferred Woorara Fault and Preston-Clements contact, defining a north-northwest trending zone.

In addition, ground reconnaissance revealed that gossanous float material was often present scattered along the approximate trend of the inferred mineralised zone; it is believed that significant displacement of this float due to farm activities has not taken place. In total, 28 samples of gossanous rock material were collected for assaying, comprising an average of 1-2kg per sample from multiple pieces of surface float.

A second field trip was conducted in mid-May 2024 utilising a SciAps X555 portable X-ray fluorescence analyser (pXRF) to conduct soil readings every 10 metres along east-west traverses. Line spacing was informed based on real-time results and the previous day’s visual assessment of geochemical dispersion of lead. The program was used to test the pXRF capabilities for detecting lead in soils and identifying geochemical trends across the different lithologies at Browns Reef.

The Tertiary basalt coverage within EL6321 is a considerable masking lithology that potentially covers portions of the northern extension of the Browns Reef mineralisation. The pXRF demonstrated that soil anomalism of lead (Pb) and arsenic (As) were readily traceable within the soil profiles and decreasing Pb results could effectively map out the basalt and Clements Formation contact zones. Rock chip samples paired with the pXRF readings were able to distinguish further prospective zones to the south and north of the Evergreen deposit.

Of particular note are two new prospective areas now designated “Kelpie Hill” and “Windmill Dam”. Kelpie Hill is located approximately 700 metres to the northwest of Evergreen, and Windmill Dam is 500 metres to the southeast.

Click here for the full ASX Release

This article includes content from Eastern Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EMS:AU

The Conversation (0)

07 October 2024

Eastern Metals

Exploring for strategic metals vital to energy security in Australian, resource-rich provinces

Exploring for strategic metals vital to energy security in Australian, resource-rich provinces Keep Reading...

31 January 2025

Quarterly Activities and Cash Flow Reports 31 December 2024

Eastern Metals (EMS:AU) has announced Quarterly Activities and Cash Flow Reports 31 December 2024Download the PDF here. Keep Reading...

2m

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

26 February

EIA Approval for Agdz Cu-Ag Project and Funding

Aterian plc (AIM: ATN), the Africa-focused critical metals exploration company, is pleased to announce the approval of it's recently commissioned Environmental Impact Assessment (''EIA'') for the 100%-owned Agdz Mining Licence, part of the Agdz ("Cu-Ag") Project ("Agdz" or the "Project") in the... Keep Reading...

25 February

Clem Chambers: I Sold My Gold and Silver, What I'm Buying Next

Clem Chambers, CEO of aNewFN.com, explains why he sold his gold and silver, and where he's looking next, mentioning the copper and oil sectors. He also speaks about the importance of staying positive as an investor: "The media negativity is the most wealth-crushing thing you can fall for. So be... Keep Reading...

25 February

What Was the Highest Price for Silver?

Like its sister metal gold, silver has been attracting renewed attention as a safe-haven asset. Although silver continues to exhibit its hallmark volatility, a silver bull market is well underway. Experts are optimistic about the future, and as the silver price's momentum continues in 2026,... Keep Reading...

23 February

Stefan Gleason: Silver Wakeup in the West — What's Happening, What's Next

Stefan Gleason, CEO of Money Metals, breaks down recent silver and gold dynamics, discussing trends in the US retail market, as well as backups at refineries. While the situation has begun to normalize, he sees potential for further disruptions in the future. Don't forget to follow us... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00