April 03, 2023

Hot Chili Limited (ASX: HCH) (TSXV:HCH) (OTCQX: HHLKF) ("Hot Chili" or the "Company") is pleased to announce encouraging drill results that confirm the potential for further resource growth at the Cortadera copper-gold resource, the centrepiece of the Company’s low-altitude, Costa Fuego copper- gold project in Chile.

Highlights

- New drill assay results from the Cortadera copper-gold resource in Chile confirm significant mineralisation outside of the current Cuerpo 1 mineralised envelope – increasing the potential for future Mineral Resource expansion

- Standout results include:

- 270m grading 0.5% CuEq* (0.4% Copper (Cu), 0.1g/t Gold (Au)) from surface (CRP0202D)

including 114m grading 0.7% CuEq (0.6% Cu, 0.1g/t Au) from 70m depth, - 84m grading 0.4% CuEq (0.4% Cu) from 336m depth downhole (CORMET001)

including 26m grading 0.6% CuEq (0.6% Cu, 0.1g/t Au) from 374m depth.

- 270m grading 0.5% CuEq* (0.4% Copper (Cu), 0.1g/t Gold (Au)) from surface (CRP0202D)

- Results pending for three additional drill holes (including CRP0201D) that are testing the depth potential of copper-gold mineralization below Cuerpo 1

- Completion of first-pass drill programme across new AMSA landholding, results pending for fifteen reverse circulation drill holes

- Compilation of results and planning underway for second-pass drill programme on new AMSA landholding expected to commence in the coming weeks

Cortadera’s Mineral Resource comprises three porphyry centres, which extend from surface over a strike extent of 2.3km. Cortadera’s two eastern porphyries have been defined to vertical depths up to 1.3km, however, drilling across the western-most porphyry (Cuerpo 1) had previously not intersected higher grade mineralisation (+0.3% CuEq) below 220m depth prior to 2023’s drill programme.

New drill results now confirm that higher grade mineralisation (+0.3% CuEq) extends and remains open at depth below Cuerpo 1 ahead of a planned Mineral Resource update for the second half of 2023.

New Results Confirm Extension to Mineralisation at Cuerpo 1

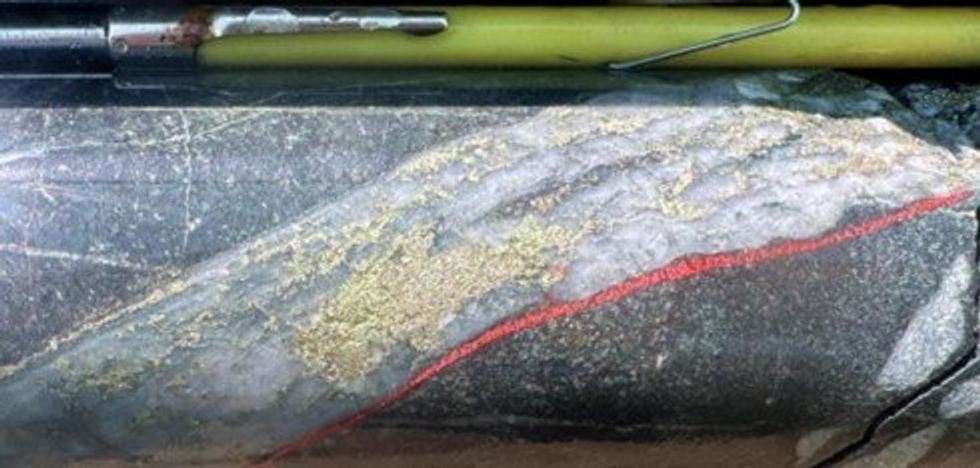

In 2022, the Company recorded an end-of-hole drill result (CORMET001, 6m grading 0.6% Cu from 354m depth) from a development study geotechnical drill hole (see Announcement released 29th April 2022) located below the Mineral Resource envelope for Cuerpo 1.

Over the past two months, the Company has extended diamond drill hole CORMET001, and completed a further five drill holes below Cuerpo 1. Initial assay results confirm a significant extension to mineralisation below the current Mineral Resource, intersecting mineralised porphyry (early- and intra-mineral) up to 300m below the Indicated Mineral Resource for Cuerpo 1.

Complete results have been received for three of six holes completed, and only partial results for two diamond holes (CRP0201D and CRP0202D) and one reverse circulation RC hole (CRP0203). Significant intersections recorded to date include:

- 270m grading 0.5% CuEq (0.4% Cu, 0.1g/t Au) from surface (CRP0202D1)

including 114m grading 0.7% CuEq (0.6% Cu, 0.1g/t Au) from 70m depth, or including 60m grading 0.9% CuEq (0.8% Cu, 0.1g/t Au) from 110m depth - 54m grading 0.5% CuEq (0.4% Cu, 0.1g/t Au, 55ppm Mo) from surface (CRP0201D1)

- 84m grading 0.4% CuEq (0.4% Cu) from 336m (CORMET0012)

including 26m grading 0.6% CuEq (0.6% Cu, 0.1g/t Au) from 374m depth. - 256m grading 0.3% CuEq (0.3% Cu) from 192m depth (CRP0200D)

including 36m grading 0.5% CuEq (0.5% Cu, 0.1g/t Au) from 210m depth,

and including 74m grading 0.4% CuEq (0.4% Cu) from 374m depth

1Partial result reported, currently awaiting assays for remaining intervals.

2Note that this intersection includes an interval from 336m to 350m previously reported in April 2022.

The Company looks forward to the return of the remaining drillholes from this program in the coming weeks.

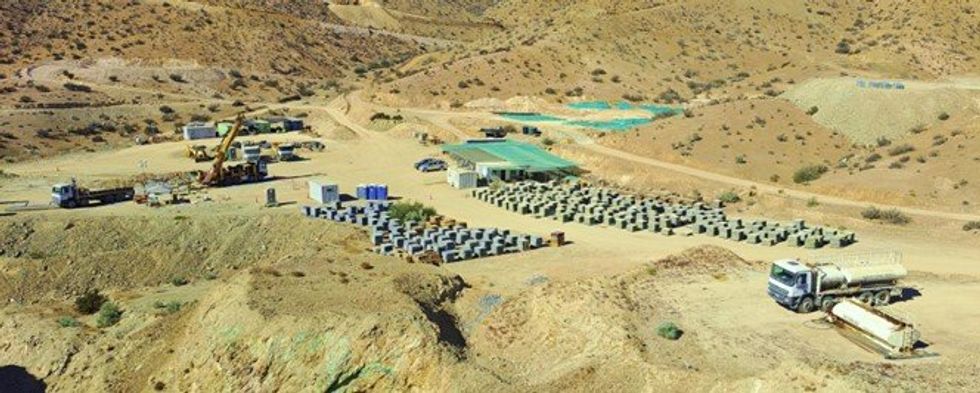

First-Pass Drilling Completed Across Western Cortadera (AMSA Landholding)

A first-pass drill programme, comprising sixteen RC drill holes for 4,116m, is complete across three porphyry targets within the recently secured AMSA landholding (see announcement dated 13th January 2023). These holes are located along the western extent of the Cortadera copper-gold Mineral Resource and results for fifteen of the sixteen holes are pending.

Drilling was primarily shallow (less than 300m depth) and focussed on defining the extent of Cortadera’s fourth porphyry (Cuerpo 4).

The Company confirmed significant copper mineralization associated with Cuerpo 4 in February with first results from diamond hole LCD001 (see announcement dated 23rd February 2023), which recorded 120m grading 0.5% CuEq* (0.4% Cu, 0.2g/t Au from 22m depth down-hole to end of hole. Importantly, this wide intersection also included 38m grading 1.0% CuEq* (0.8% Cu, 0.4g/t Au) from 22m depth, or 18m grading 1.3% CuEq* (1.0% Cu, 0.5g/t Au) from 32m depth.

Once all assay results have been received and reviewed, the Company and Antofagasta Minerals (AMSA) will plan a second-pass drill programme to follow-up the initial results of this programme as part of the 6,000m drill commitment to the option agreement (see announcement dated 28th November 2022).

The Company looks forward to receiving further results in the coming weeks.

Click here for the full ASX Release

This article includes content from Hot Chili Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

HCH:AU

The Conversation (0)

13 June 2022

Hot Chili Limited

Low-Altitude Sizeable Copper Development in South America

Low-Altitude Sizeable Copper Development in South America Keep Reading...

8h

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00