July 02, 2023

Firm commitments for $1m placement plus $1.7m rights issue; Experienced executive and geologist Jennifer Neild to lead exploration drive at Labyrinth and Comet Vale projects

Labyrinth Resources Limited (ASX: LRL) (‘Labyrinth’ or ‘the Company’) is pleased to announce the appointment of Ms. Jennifer Neild as Chief Executive Officer.

Ms. Neild is a resources executive with more than 18 years’ experience in exploration across a broad range of commodities in various jurisdictions. She was most recently Chief Executive Officer of Peak Minerals Limited (ASX: PUA).

Ms. Neild holds a Bachelors Degree in Geology (Hons) from Laurentian University in Sudbury, Ontario and a Masters Degree in Geophysics from Curtin University in Perth, Western Australia. She has previously held senior positions in exploration, resource geology and production geology in both Australia and Canada with Newmont Australia and Falconbridge Ltd, as well as General Manager - Interpretation for expert geophysics group HiSeis Pty Ltd.

Ms. Neild’s geological and geophysics expertise in both Western Australia and Canada, combined with her corporate and executive experience in the resources industry, means she is ideally placed to drive the next round of exploration at the Company’s Labyrinth and Comet Vale projects.

Current Chief Mr. Executive Matt Nixon will transition to the Board in a Non-Executive Director role, effective 1 July 2023. This follows a tenure of over two years initially as Chief Operating Officer from February 2021 and then Chief Executive Officer since November 2021. In this role, he led Labyrinth through a transformational period of portfolio evaluation, administrative rectification, project acquisition, Company rebranding and strategic reset.

The retention of Mr. Nixon’s expertise in the resources industry and knowledge of the Labyrinth business in a Director capacity ensures the Company remains well placed to deliver it’s strategic objectives and generate shareholder value.

Mr. Nixon will provide Chief Executive services on a consultancy basis to ensure a smooth transition to the commencement of Ms. Neild.

Capital RaisingLabyrinth has received firm commitments for A$1,015,500 in a private share placement to new strategic sophisticated investors and existing major shareholders at a price of 0.7c per share (‘Placement’). Proceeds will support the growth and exploration of the Company’s high-grade gold projects.The Placement price represents a 25% discount to the 5-day volume weighted average price(VWAP) of the Company’s shares.

The Placement will result in the issuing of 145,071,429 new shares with settlement anticipated on 17 July 2023. The new shares will rank equally with existing shares on issue and will be issued using the Company’s existing placement capacity under ASX Listing Rule 7.1 (57,131,295 shares) and 7,1A (88,401,676 shares), accordingly shareholder approval is not required.

Entitlement Offer

In conjunction with the Placement, Labyrinth will undertake a pro-rata non-renounceable entitlement issue (‘Rights Issue’) of one (1) new share for every four (4) existing shares held by eligible shareholders at an issue price of 0.7c each, representing an identical discount to the 5-day VWAP which is being applied for the calculation of the Placement price, to raise up to $1,679,103.

The Rights Issue will be made to all shareholders of Labyrinth Resources named on the Company’s share register at 5:00pm WST on 13 July 2023. A maximum total of 239,871,836 shares will be issued pursuant to the Rights Issue. The Company will retain the right, at the discretion of the Board of Directors, to place any shortfall on identical terms following completion of the Entitlement Offer. The Board presently intends to allocate shortfall shares as follows:

a) to Eligible Shareholders who apply for an excess of their full entitlement, provided that the issue of the shortfall shares would not take their voting power in excess of 19.99%; and then

b) to other parties identified by the Directors, which may include parties who are not currently shareholders

Use Of Funds

Proceeds of the Placement and Rights Issue will be used towards:

- Exploration work at the Company’s high-grade gold projects Labyrinth and Comet Vale

- Generating strategic growth and strengthening of the Company’s asset portfolio

- Completing the final CAD$500,000 payment (plus interest) to G.E.T.T Gold Inc related to the acquisition of the Company’s Quebec projects (refer ASX Announcement 1 May 2023); and

- General working capital

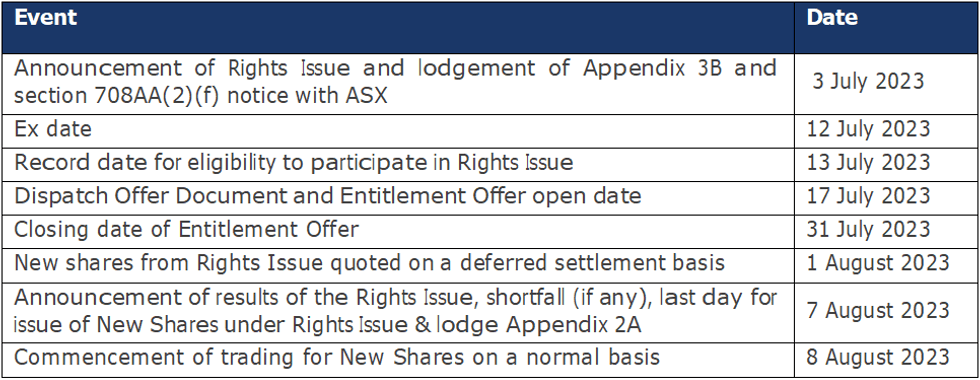

Timetable

Resignation of Mel Ashton as Non-Executive Director

Labyrinth advises that as part of the strategic Board and key management changes, Mel Ashton will resign from his role of Non-Executive Director, effective 30 June 2023. Mr. Ashton provided his expertise to the Company throughout the transformational acquistion and establishment of operations in Canada over the past two years.

The Company thanks him for his strong contribution and guidance and wishes him all the best in his future endeavours.

Labyrinth Non-Executive Chairman Dean Hely said: “The appointment of Jennifer as chief executive, Matt’s appointment to the Board and the capital raising mean the Company is very well positioned to take full advantage of the opportunities at it’s two projects.

“We believe these assets have outstanding potential to create shareholder value through exploration, we have the team to unlock this value and the funds for them to pursue the next leg of this strategy.

“On behalf of the Board, I welcome Jennifer to the Company and Matt to the Board. I would also like to thank Mel for the valuable contribution he has made to Labyrinth and wish him all the best for the future”.

Click here for the full ASX Release

This article includes content from Labyrinth Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRL:AU

The Conversation (0)

31 August 2023

Labyrinth Resources

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia.

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia. Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00