June 25, 2025

NevGold (TSXV:NAU,OTCQX:NAUFF,FSE:5E50) is advancing a portfolio of high-quality oxide and porphyry gold projects in Nevada and Idaho, targeting the discovery and growth of a multi-million-ounce gold-equivalent resource. With a market capitalization of under C$50 million, the company offers substantial upside potential. As NevGold continues to expand resources and de-risk its assets, it is well-positioned for a meaningful valuation re-rating over the next 12 to 18 months.

NevGold is actively advancing three projects with fully funded drill programs, metallurgical studies, and resource updates following its recent capital raise. The company is well-positioned to capitalize on rising gold and copper prices, surging strategic demand for antimony, and heightened interest from major mining companies seeking high-quality, undervalued juniors. Backed by a proven team with deep expertise in mine development and M&A, NevGold offers a compelling growth opportunity in the current commodity cycle.

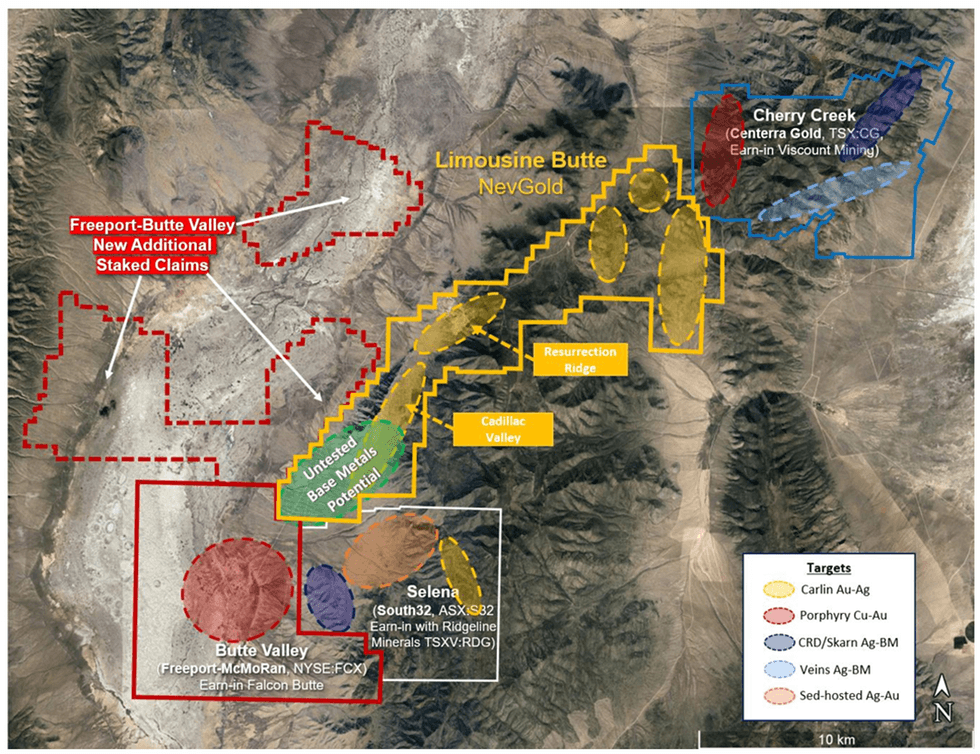

The Limo Butte Project is NevGold’s cornerstone development asset, located in eastern Nevada within a highly prospective Carlin-style gold district.

Company Highlights

- Multi-million-ounce Target: NevGold is on track to define 5+ Moz gold equivalent in combined resources at Limo Butte and Nutmeg Mountain by Q4 2025.

- Gold+Antimony Critical Metals Advantage: Limo Butte is emerging as a significant near-surface oxide gold-antimony system – one of only two of its kind in the United States.

- Substantial Resource Base: Nutmeg Mountain contains a 2023 NI 43-101 compliant oxide gold resource of 1.28 Moz (indicated + inferred), with strong exploration upside and favorable heap-leach characteristics.

- District-scale Copper Exposure: Zeus offers early-stage copper-gold-molybdenum potential in a highly active porphyry belt, adjacent to a Barrick-backed discovery.

- Strategic Location, Strategic Commodities: All projects are located in mining-friendly jurisdictions with excellent infrastructure, low geopolitical risk, and growing US demand for domestic gold and critical mineral supply.

- Fully Funded Growth: Recent C$6 million financing supports 2025 drill campaigns, metallurgical testwork, and updated NI 43-101 estimates across the portfolio.

- Tight Capital Structure & Strong Support: Backed by strategic shareholders including GoldMining and McEwen Mining.

- Significant Valuation Gap: Trading at a fraction of peers such as Perpetua Resources (~C$1.7 billion), despite similar resource and jurisdictional advantages.

This NevGold profile is part of a paid investor education campaign.*

Click here to connect with NevGold (TSXV:NAU) to receive an Investor Presentation

NAU:CA

Sign up to get your FREE

NevGold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 December 2025

NevGold

Strategic portfolio of gold, antimony and copper projects in tier 1 jurisdictions in the United States

Strategic portfolio of gold, antimony and copper projects in tier 1 jurisdictions in the United States Keep Reading...

18h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

18h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

19h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

19h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

NevGold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00