Nevada Sunrise Metals Corporation (TSXV: NEV) (OTCBB: NVSGF) ("Nevada Sunrise" or the "Company") is pleased to announce that the Company has initiated a geological and geophysical data review on its Coronado Copper Project (" Coronado ", or the " Project ") located in Pershing County, Nevada approximately 48 kilometers (30 miles) southeast of Winnemucca . The purpose of the Coronado data review is to identify new, shallow drill targets in an area of the Project where historical drilling in 1976 identified high-grade copper mineralization.

Highlights of the Coronado Copper Project

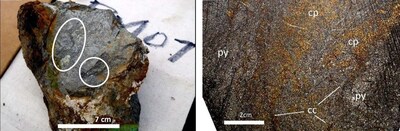

- Coronado is located in an underexplored region that hosts a past-producing volcanogenic massive sulphide ("VMS") deposit known as Big Mike, where high-grade copper was mined in the early 1970s (see Figure 1 below: photo of Big Mike mineralization in a grab sample collected by the Company in 2018);

- VMS deposits such as Big Mike are often found in "chains" or "clusters" along zones of structural weakness, where such deposits may be buried under overburden and exhibit no surface exposure – only one VMS deposit has been discovered to date in the Project area;

- Nevada Sunrise plans to explore a new target area in the northern part of Coronado known as the Red Metal prospect, where Utah International intersected shallow, high-grade copper mineralization in 1976 drill hole C-1, which reportedly returned 1.84% copper over 10.98 metres (36 feet) from 39.9 metres (131 feet) to 50.9 metres (167 feet) 1 ;

- The Company is commissioning a new desktop study of its Coronado 2018 Versatile Time Domain Electromagnetic ("VTEM TM ") data using a computer modeling process to determine the Airborne Inductive Induced Polarization ("AIIP") effect, which can measure chargeability of potential sulphide minerals and add to the interpretation of conventional airborne electromagnetic ("EM") data. Other geophysical anomalies were observed in the 2018 airborne survey data, which Nevada Sunrise plans to investigate on the ground.

| 1. Source: DeMatties, Theodore A. (2024) Reassessment of the Big Mike Copper-Cobalt Volcanogenic Massive Sulfide Deposit (VMS): Implications for Further Exploration in the Late Paleozoic Havallah Ophiolite Sequence, North-Central Nevada, USA. Int. J. Earth Sci and Geophys, 10:074 |

2024 Coronado Exploration Plans

Nevada Sunrise plans to carry out an AIIP effect study by Geotech Ltd. ("Geotech") on the 2018 Coronado VTEM TM airborne survey data. AIIP chargeability mapping opens new avenues in mineral exploration for airborne time domain electromagnetic systems in the search for sulphides, especially in terrain with substantial overburden that can mask conventional electromagnetic responses. Other geophysical anomalies observed in the Company's 2018 airborne data are being reviewed, including the "Mikey" target, located approximately 600 metres (2,000 feet) southeast of the historic Big Mike open pit mine.

Geotech also offers Structural Complexity ("SC") analysis of historical VTEM TM data using a method introduced by Kovesi (1997). SC is an important exploration parameter for structurally-controlled mineral deposits (Groves et al., 2018). Linear structures such as magnetic ridges from positive magnetic linear anomalies can be mapped and interpreted using the Centre for Exploration Targeting (University of Western Australia grid analysis module), a process which could provide valuable insight in the structural complexity at Coronado .

Nevada Sunrise plans to carry out a prospecting and geological mapping and sampling survey over significant geophysical anomalies identified from the AIIP modelling program. Any identified geophysical anomalies will be gridded and sampled with a soil gas hydrocarbon ("SGH") survey, an economical soil sampling method developed by Activation Laboratories of Ancaster, ON , Canada , which is known to detect subtle geochemical anomalies over buried mineral deposits. In conjunction with newly-acquired geophysical data, SGH could assist in the development of new drill targets in Coronado's underexplored terrain.

The Company holds an active drill permit for Coronado , which is good until October 2024 .

About Coronado

Coronado currently consists of 152 unpatented claims totaling approximately 3,040 acres (1,230 hectares) located over an interpreted trend adjacent to the historic Big Mike copper mine that lies within the Middle Pennsylvanian to Late Permian-age Havallah volcanic-sedimentary sequence. The Company's land position controls an important seven mile-long (11.3 kilometres) regional trend along which high-priority airborne VTEM TM anomalies have been identified within the Early Pennsylvanian–early Late Permian Pumpernickel Formation of the Havallah sequence.

In 1970, Ranchers Exploration and Development Company ("Ranchers") developed the high-grade portion of Big Mike and produced approximately 25 million pounds of copper in 100,000 tons of ore grading 10.5% copper, which was shipped directly to smelters in West Germany and Japan . Heap leaching of lower-grade disseminated copper ore was also carried out by Ranchers; approximately 300,000 tons of mineralized rock was treated. Historical sampling also shows the presence of cobalt at Big Mike, with values in the deposit ranging up to 2,500 parts per million (0.25%) cobalt ( Source: Rye et al, Economic Geology, Vol. 79, 1984 ).

Nevada Sunrise optioned the Project from local vendors in 2018 and has carried out exploration in several campaigns including a high-resolution airborne VTEM TM survey, a follow-up ground gravity survey, an SGH geochemical survey, and a total of three diamond drill holes in 2018 and 2020.

The Company's 2018 airborne EM survey outlined a strong conductive system located within favourable geology in conjunction with an SGH anomaly, supporting the Company's belief that VMS deposits could be present at the Project (see Nevada Sunrise news release dated October 8, 2020 ). The U.S. Bureau of Land Management has approved nine drill hole locations throughout the Project, where each location can host multiple holes. In the drill testing performed by the Company to date, difficult ground conditions hampered the effectiveness of the three drill holes, none of which provided a definitive test of the targeted geophysical anomaly at Coronado South.

To view maps and photos depicting the Company's exploration activities at Coronado , click here

National Instrument 43-101 Disclosure

Theodore A. DeMatties , CPG, PG, a geological consultant to Nevada Sunrise, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 and has reviewed and approved the technical information contained herein. Geochemical results for the Big Mike grab sample were produced by Bureau Veritas Mineral Laboratories in Vancouver, BC , Canada , by Aqua Regia digestion and Ultratrace ICP-MS analysis, and gold results by fire assay with AAS finish. Readers are cautioned that some of the technical information described in this news release is historical in nature; however, the information is deemed credible and was produced by professional geologists of the eras discussed. Mineralization located on adjacent properties by historical exploration and mining operations may not be present on Coronado .

About Nevada Sunrise

Nevada Sunrise is a junior mineral exploration company with a strong technical team based in Vancouver, BC , Canada , that holds interests in copper, lithium and gold exploration projects located in the State of Nevada, USA , one of the best mining jurisdictions in the world ( Fraser Institute, 2023 ).

The Company's key gold asset is a 18.74% interest in a joint venture with CopAur Minerals Inc. at the Kinsley Mountain Gold Project near Wendover, NV , where a N.I. 43-101-compliant resource has been outlined by historical drilling carried out by Liberty Gold Corp. and New Placer Dome Gold Corp. from 2011 to 2020.

Nevada Sunrise has right to earn a 100% interest in the Coronado VMS Project, located approximately 48 kilometers (30 miles) southeast of Winnemucca .

Nevada Sunrise owns 100% interests in the Gemini, Jackson Wash and Badlands lithium projects, all of which are located in the Lida Valley of Esmeralda County . The Company owns Nevada water right Permit 86863, located within the Lida Valley basin near Gold Point, Nevada .

Website: www.nevadasunrise.ca

Forward Looking Statements:

All statements in this release, other than statements of historical fact, are "forward-looking information" with respect to Nevada Sunrise Metals Corporation ("Nevada Sunrise") within the meaning of applicable Canadian securities laws, including statements that address future mineral production, reserve potential, exploration drilling, the future price of copper, gold and other metals, potential quantity and/or grade of minerals, potential size of a mineralized zone, potential expansion of mineralization, the timing and results of current or future mineral resource estimates or other studies, proposed exploration and development of our exploration properties and the estimation of historical mineral resources on properties adjacent to the Company's mineral properties, including the Coronado property. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievement of Nevada Sunrise to differ materially from those anticipated in such forward-looking information.

Such factors include, among others, risks related to the actual results of drilling and other exploration at the Coronado property, reliance on technical information provided by third parties on any of our exploration properties, including access to and interpretation of historical information on the Coronado property as well as specific historical data associated with drill results and sampling from adjacent areas to the Coronado property; information from the public domain, current exploration and development activities; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; labor disputes and other risks of the mining industry; delays due to pandemic; delays in obtaining governmental approvals, financing or in the completion of exploration, as well as those factors discussed in the section entitled "Risk Factors" in the Company's Management Discussion and Analysis for the Six Months ended March 31, 2024 , which is available under Company's SEDAR profile at www.sedarplus.ca

Although Nevada Sunrise has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Nevada Sunrise disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise. Accordingly, readers should not place undue reliance on forward-looking information.

Forward-looking statements are made as of the date hereof and accordingly are subject to change after such date. Except as otherwise indicated by Nevada Sunrise, these statements do not reflect the potential impact of any non-recurring or other special items or of any dispositions, monetizations, mergers, acquisitions, other business combinations or other transactions that may be announced or that may occur after the date hereof. Forward-looking statements are provided for the purpose of providing information about management's current expectations and plans and allowing investors and others to get a better understanding of our operating environment. Nevada Sunrise does not undertake to update any forward-looking statements that are included in this document, except in accordance with applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of TSX Venture Exchange) accepts responsibility for the adequacy of accuracy of this release.

SOURCE Nevada Sunrise Metals Corporation

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/July2024/11/c5052.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/July2024/11/c5052.html