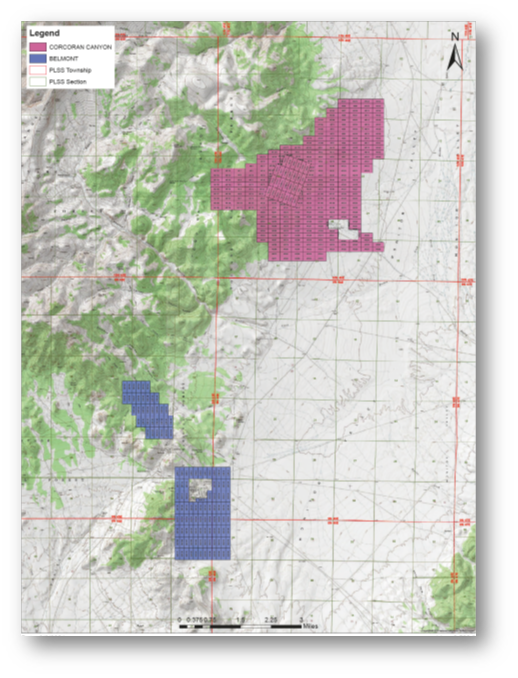

Nevada Silver Corporation ("NSC" or the "Company") (TSXV:NSC)(OTCQB:NVDSF) is pleased to advise that it has filed 124 new claims and reached agreement to acquire a number of patented claims, to cover two areas of extensive historic silver mines 15 kilometers southwest of the Company's 100% owned Corcoran Silver-Gold Project and 80 kilometers north-east of Tonopah in central Nevada (Figure 1). A total of 2,800 acres of unpatented and patented claims have been secured

The new NSC claim areas (Belmont Silver Project and the North Belmont Silver Project) surround or cover the majority of old silver workings of the Belmont silver mining camp near the historic Belmont town.

Belmont was among the earliest and richest silver mining camps in the Tonapah district with an estimated ore head-grade averaging 25 ounces per ton of silver. Historical accounts describe numerous prospect pits and mine openings of shallow underground workings with richest ore above the water table where silver occurred mostly as silver chloride (cerargyrite). Silver-bearing sulfides together with copper, molybdenum, lead, zinc and antimony minerals were reported at depth.

During the camp's silver mining heyday between 1865 and 1889 Belmont's population was about 10,000 and the town was the seat of Nye County Government. 1887 silver production from the district was estimated as $3,793,103 (1887 value) from 58,906 tons, more than $110,000,000 in today's dollars1. Most mining activities are thought to have been suspended when mine dewatering reduced the Belmont township water supply.

Belmont Silver Project

Accounts of mining activities in the main Belmont mines suggest the two principal shafts (Highbridge (110 meters) and Belmont (180 meters)) were connected on the 300-foot level and that the 500-foot level contained a ‘large tonnage of ore'. Two main vein systems were mined. The eastern veins (Highbridge and Transylvania ledges) were hosted in slate and limestone and dip easterly at 40-50 degrees. High-grade mineralization was reported adjacent to hanging walls of massive quartz veins and generally conformable with strata of Ordovician shale, quartzite and limestone.

Between 1915-17 the Monitor-Belmont Company treated some remaining mine dumps and in 1918 dewatering of old workings was undertaken by the Nevada Wonder Mining Company although no underground production was reported. There has been negligible exploration during recent decades despite high-grade silver samples (up to 5,000g/t silver) collected from remnant dumps during a surface geochemical study of the Belmont silver district by the US Geological Survey in 1985.

North Belmont Silver Project

At the North Belmont Silver Project two separate clusters of historic silver workings are located in quartz vein systems hosted by Ordovician rocks. The northernmost mined area has five old shafts on a near vertical quartz-vein zone trending 030o within thin-bedded silicified limestone. Mine dumps include pyrite, galena, stibnite and tetrahedrite ore minerals.

Seven shallow inclines and numerous prospecting cuts occur in the southern workings north of Belmont town. These workings expose a NW trending quartz vein breccia zone formed along bedding planes in limestone.

Figure 1. Claim location map of Nevada Silver Corporation's Belmont Silver, North Belmont Silver and Corcoran Canyon Silver-Gold Projects.

Exploration Targets

At the Belmont Silver Project silver-base metal deposits could extend along trend from the old workings and at depth beneath the mined lodes and other near-surface, silver-quartz veins may not have been identified by early miners because of poor outcrop and widespread talus.

The depth and lateral extent of mineralization in both projects has not been determined and the Company intends to undertake mapping, geochemical assessment and surface geophysical surveys in early 2022 followed by drill testing of priority targets.

Comments

NSC's CEO Gary Lewis commented, "The addition of these projects cements NSC's footprint in an historic silver mining camp which has been overlooked for more than 100 years. Considering the very high reported silver ore grades in relatively shallow mine workings we are surprised that exploration drilling for remnant silver has not been undertaken."

"Located close to Corcoran, Belmont offers the company considerable logistic synergies for exploration and importantly, successful discovery would influence future development options."

"We believe that low-cost geophysical surveys in coming weeks will identify drill targets both beneath and along trend from the old workings and our technical team have commenced exploration planning and permitting."

Qualified Person

The scientific and technical data contained in this news release was reviewed and approved by Ian James Pringle PhD, who is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

For further Information please contact:

Gary Lewis

Group CEO & Director, Nevada Silver Corporation

T: +1 (416) 941 8900

E: gl@nevadasilvercorp.com

About Nevada Silver Corporation

Nevada Silver Corporation (TSXV: NSC) (OTCQB: NVDSF) is a multi-commodity resource company with two exploration projects in the USA. NSC's principal asset is the Corcoran Silver-Gold Project in Nevada. In addition, NSC has management and ownership rights over the Emily Manganese Project in Minnesota, which has been the subject of considerable technical studies, with US$24 million invested to date. Both Corcoran and Emily have been the subject of National Instrument 43-101 compliant mineral resource estimates.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words "believes," "may," "plans," "will," "anticipates," "intends," "could", "estimates", "expects", "forecasts", "projects" and similar expressions, and the negative of such expressions. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the Company's actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information, including, without limitation, risks as a result of the Company having a limited operating history and may have a wide variance from actual results, risks concerning the ability to raise additional equity or debt capital to continue its business, uncertainty regarding the inclusion of inferred mineral resources in the mineral resource estimate which are too speculative geologically to be classified as mineral reserves, uncertainty regarding the ability to convert any part of the mineral resource into mineral reserves, uncertainty involving resource estimates and the ability to extract those resources economically, or at all, uncertainty involving exploration (including drilling) programs and the Company's ability to expand and upgrade existing resource estimates, risks involved in any future regulatory processes and actions, risks from making a production decision (if any) without any feasibility study completed on the Company's properties, risks applicable to mining exploration, development and/or operations generally, and risk as a result of the Company being subject to certain covenants with respect to its activities by creditors, as well as other risks.

Forward-looking information is based on the reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances at the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information.

All forward-looking information herein is qualified in its entirety by this cautionary statement, and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law.

1 Part of the total production may not have been recorded with the State as often happened in the early days of Statehood; Lincoln reports a much higher figure. University of Nevada Bulletin Vol. XLV, January 1951 No. 3.

SOURCE: Nevada Silver Corporation

View source version on accesswire.com:

https://www.accesswire.com/686860/Nevada-Silver-Corporation-Acquires-Historic-High-Grade-Silver-Mines-South-of-the-Corcoran-Silver-Gold-Project-Nevada-USA