July 07, 2022

Alvo Minerals Limited (ASX: ALV) (Alvo or the Company), high-grade copper-zinc explorer, is pleased to announce the results of several FLEM surveys that have highlighted multiple discovery and extensional targets at the Palma VMS Project in Brazil.

HIGHLIGHTS

- Fixed Loop Electromagnetic (FLEM) surveys across the Palma Project at C3, Macaw and Mafico are now complete and have resulted in multiple new potentially mineralised VMS conductors being identified

- C3 Extensions – Large, highly conductive plate, closely matching with known VMS mineralisation

- EM plates highlighted significant potential extensions at depth and along strike

- Highlighted possible extensions to northernmost hole PD3-018 that reported 15.0m @ 2.89% Cu, 4.41% Zn, 0.33% Pb, 29.8g/t Ag & 0.09g/t Au from 71m

- Offers further scale potential to C3 JORC Resource of 2.8Mt @ 1.1% Cu, 4.3% Zn, 0.2% Pb & 23g/t Ag

- Mafico Prospect – Newly identified conductive target, initial interpretations show a large EM plate, dipping ~60 degrees to the west and splits into two high conductance targets at the northern end

- Macaw Prospect – low tenure anomaly associated with VTEM and Induced Polarisation (IP) surveys

- The interpreted plate is similar in orientation and intensity to the known C1 VMS mineralisation

- C3 West – extensive anomaly revealed, the target of FLEM survey currently underway

- Next steps – Newly identified targets will be drill tested as part of the ongoing phase 1 and phase 2 diamond drill campaigns at Palma; while FLEM surveys at untested areas will continue- aiming to determine the true scale of the Palma Project

The FLEM surveys covered the C3 advanced prospect and nearby VTEM conductors now named Mafico and C3 West. A FLEM survey was also completed at the northern extension of the C1 deposit, now named Macaw. Importantly, high and lower tenor conductors have been highlighted, associated with known high-grade VMS mineralisation. In addition, multiple new conductors, which could be significant vectors toward new discoveries, have been revealed.

Alvo will systematically test both the discovery and extensional targets highlighted by the recent surveys as part of its ongoing phase 1 and phase 2 diamond drill program at the C1 and C3 prospects.

Alvo Minerals’ Managing Director, Rob Smakman, commented:

“We are incredibly pleased with the efficiency and quality of data delivered by the recent FLEM survey results that have been collected and processed by our team daily.

“The EM plates at the C3 deposit in particular, represent exciting possible extensions to the high-grade VMS mineralisation – both along strike and down-dip. We intend to aggressively test these extensional targets following the interpretation of downhole EM at C3, anticipated to commence shortly.

“Of course, the key to our exploration model is to make discoveries and we are excited to be refining multiple new targets at Macaw, Mafico, and C3 West; all of which show strong potential to be new discoveries to be tested in the coming drill campaign.

“Since listing in October last year, Alvo has been aggressively carrying out its stated three-prong exploration strategy – upgrade, expand, discover. With the consistency of existing mineralisation confirmed through phase 1 drilling at C3 and C1, we are eagerly anticipating the next phase of exploration aimed at significantly expanding existing high-grade mineralisation and making new discoveries. This is undoubtedly the most exciting part of the exploration campaign!”

C3, Mafico and C3 West

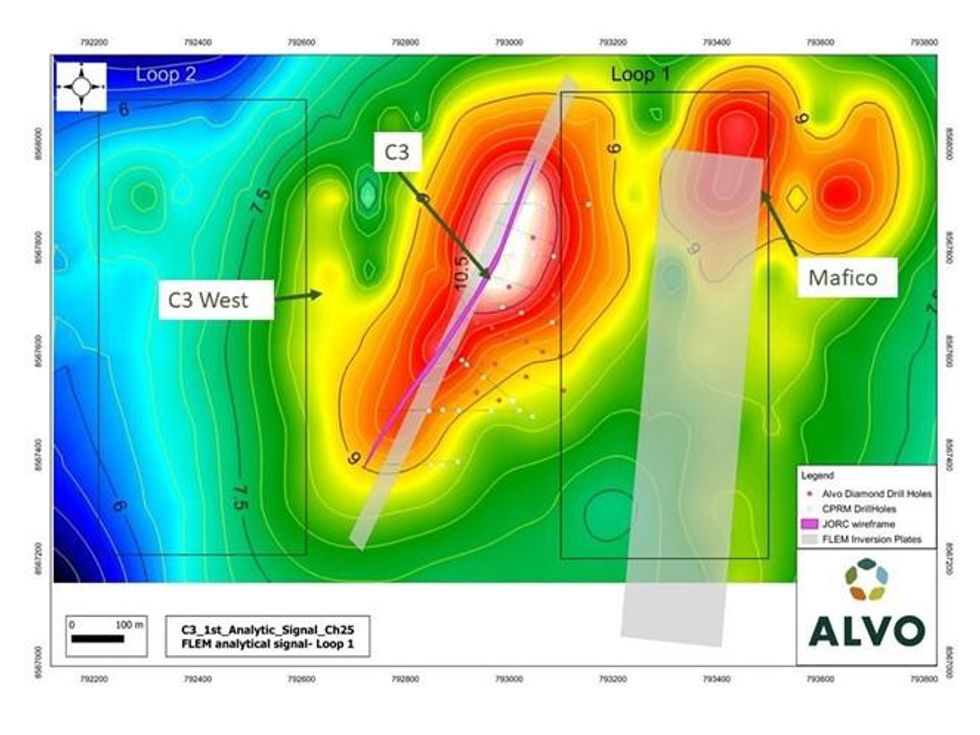

Alvo’s in-house survey team commenced at C3 to look for extensions of the known high-grade VMS mineralisation. The FLEM survey quickly revealed a strong signature associated with the mineralisation at C3, as well as a strong and extensive conductor at Mafico (to the east of C3) and a subtle signature at C3 West (see Figure 1).

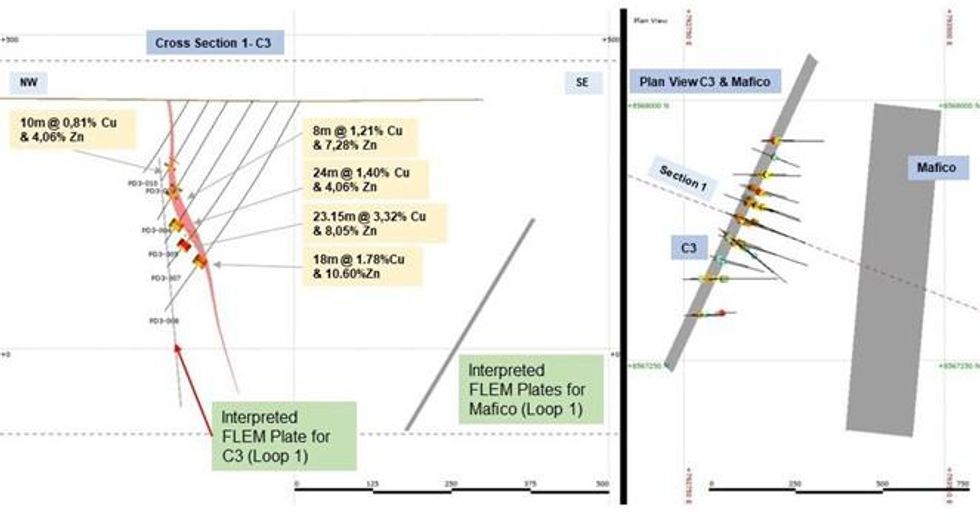

The interpreted plate location at C3 closely matches the known mineralisation (see Figures 1 & 2), with the plate extending significantly at depth (depth extent of ~ 400m- from the top of the plate at ~ 60m below surface) and extends ~ 1km NE-SW. This plate will be tested in phase 2 drilling, set to begin once the additional information from loop 2 FLEM and downhole electromagnetic (DHEM) is complete. As such, the current interpretation and inversion of the data (at C3 and Mafico) is preliminary only and will be improved prior to drilling.

The interpreted plate at C3 extends for at least 200m to the NE and SW beyond known mineralisation and up to 200m below the known mineralisation. The apparent thickness/conductance is very high at ~ 1,000 siemens1.

Preliminary interpretation of the plate at Mafico is of a large plate, striking north-south and dipping at about 60 degrees to the west- different to the orientation to C3. The thickness/conductance is high at ~ 300 siemens and appears to converge with C3 towards the north where it splits into two shallower high conductance targets. Inversion and interpretation on the northern plates at Mafico is ongoing.

The subtle anomaly at C3 West is being tested by a second, more westerly loop (loop 2), which will test the theory that the distance to the C3 West anomaly is affected by the long distance from loop 1.

The loop 2 FLEM survey is ongoing at C3 West and early indications suggest C3 West as a major conductor of similar tenor to the main C3 Conductor.

Figure 1. FLEM plan at C3 with interpreted conductive plates and drill traces. Base image is the Channel 25 analytical signal from Loop 1 only. C3 West loop (loop 2) is currently underway to better define the anomaly at C3 West (and further refine C3).

Figure 2. Cross-section and drill plan at C3 and Mafico, showing the interpreted EM plate locations and Alvo drilling.

Macaw Prospect

The FLEM survey at Macaw (formally C1 North) has shown a lower conductance anomaly closely associated with the historic VTEM survey and the more recent IP survey completed in conjunction with the University of Brasilia (see Figure 3).

Inversion of this survey suggests a plate with a conductance of 30-50 siemens with an easterly dip, similar to the conductance and dip orientation at C1. The plate has an apparent extension of ~ 500m (north-south) and is open to the south (although reducing in intensity). The top of the plate is expected at ~ 95m below the surface.

Alvo plans to test the Macaw Prospect as part of the phase 1 diamond drill program at the C1 deposit.

Click here for the full ASX Release

This article includes content from Alvo Minerals Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ALV:AU

The Conversation (0)

08 August 2022

Alvo Minerals

District-Scale Copper-Zinc VMS Project in Brazil

District-Scale Copper-Zinc VMS Project in Brazil Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data showed that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00