May 31, 2022

Comet Resources Ltd (Comet or the Company) (ASX:CRL) is pleased to provide an update on the proposed acquisition of the Mount Margaret Copper Mine from Glencore Plc which was previously announced on 4 April 2022.

Highlights:

- Notice of Meeting to approve Mount Margaret acquisition now issued. Meeting to be held on 27 June 2022 – 10am (WST).

- Joint Lead Managers to the Company’s capital raising appointed - Jett Capital Advisors LLC and Petra Capital Pty Ltd

- Comet Managing Director, Matthew O’Kane, to conduct video interview on the transaction and plans post completion. This will be distributed on the ASX platform via press release and also on the Company website approximately mid-June.

- Estimated timing for completion of the transaction and re-quotation of shares is currently 15 July 2022

Since the 4 April 2022 announcement, the Company has been working with the vendor of Mount Margaret, Glencore Plc, legal counsel and advisors on the preparation of the documentation required to complete the acquisition and preparing for the capital raising required as a part of the transaction.

During this period, the Company has appointed Jett Capital Advisors LLC (Jett Capital) and Petra Capital Pty Ltd (Petra Capital) in addition to the previously announced participation of Euroz Hartleys. Jett Capital and Petra Capital will act as Joint Lead Managers to the Company’s $50 million capital raising (Public Offer). Euroz Hartleys will remain involved in the Public Offer in the role of Co-Manager to the Public Offer. The Company is pleased to have the support of this team of advisors to assist us in closing the transaction.

As disclosed in the Notice of Meeting (NOM) released on 27 May 2022, the estimated timing to close the transaction has been extended, with a current estimate being completion of all requirements and re-quotation of the Company’s shares on the ASX of 15 July 2022. The Company notes that this timeline is an estimate only and is subject to variation based on a range of factors, many of which the Company is not able to directly control. It is the Company’s intention to close the transaction as soon as it can.

The Company has been receiving some queries from shareholders regarding the timing of the transaction and also on certain aspects of the transaction. It is unfortunately not possible to address each shareholders queries directly via phone or email, and therefore we have planned an interview with Matthew O’Kane, Managing Director of Comet, to summarise the transaction highlights, explain the plans for the future post completion of the transaction, and to also respond to some of the common queries the Company has been receiving. The Company invites shareholders to send questions they would like Mr O’Kane to address in this interview to comet@cometres.com.au.

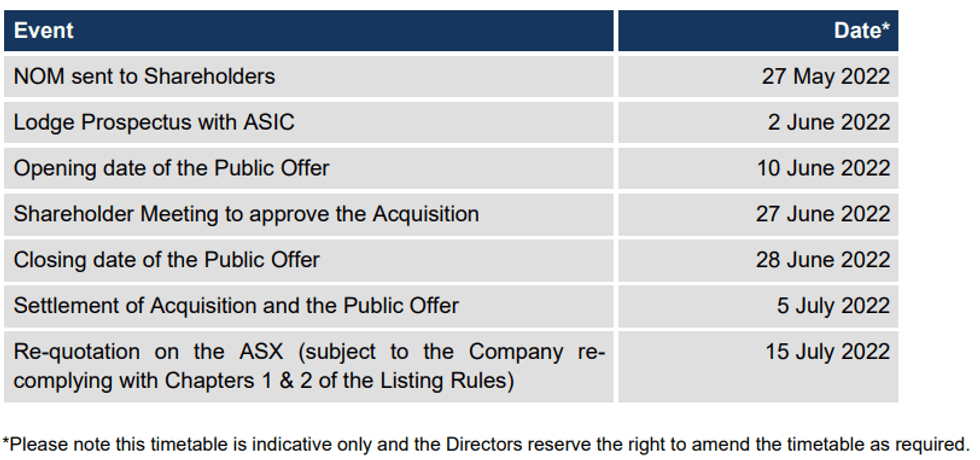

For a current summary of the expected timeline of milestones to the completion of the transaction, please refer to the indicative timetable below, which was also published in the NOM released on 27 May 2022 (refer to section 1.10 on page 31). The Company encourages shareholders to read the NOM fully as it also contains significant information of the transaction that will assist shareholders with voting on the resolutions the subject of the NOM. Further information will be available in the prospectus once that is published.

The indicative timetable for completion of the Mount Margaret acquisition is as follows:

This announcement has been authorised by the Board of Comet Resources Limited

Click here for the full article.

This article includes content from Comet Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CRL:AU

The Conversation (0)

25 February 2021

Comet Resources

Battery Commodities for the Low-Carbon Revolution

Working to develop resource projects including gold, copper and graphite.

Working to develop resource projects including gold, copper and graphite. Keep Reading...

5h

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drilling Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia is taking part in a ministerial meeting hosted by the US aimed at exploring a strategic critical minerals... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00