Morgan Stanley Wealth Management today announced the results of its quarterly retail investor pulse survey:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20251021762345/en/

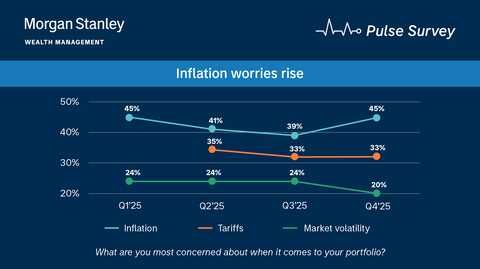

- Inflation concerns persist. While nearly half of investors expect inflation to moderate this quarter (47%), it continues to be their top concern (45%), rising six percentage points from last quarter and the top concern for every quarter in 2025. Tariffs (33%) and market volatility (21%) remain the top two and three concerns, respectively.

- Bullishness dipped. Bullishness was down five percentage points from last quarter to 56%.

- More investors believe rate cuts are on the horizon. Over two in five investors (41%) think the Fed will cut rates by 0–0.25% at the next meeting—up 12 percentage points from last quarter. Roughly one in five (19%) believe they will stand pat—down eight percentage points from Q3.

- Yet investors plan to stay the course. 41% of investors do not plan to make changes to their portfolios over the next six months and less than one in five (14%) will move to the sidelines in cash.

"Investors undoubtedly have some whiplash amid a government shutdown, uncertain monetary policy, and some cracks in the labor market," said Chris Larkin, Managing Director, Head of Trading and Investing, E*TRADE from Morgan Stanley. "That said, the market is still humming along, and investors seem to see the bigger picture, sticking to their investment strategies as they navigate potential headwinds."

The survey explored investor views on sector opportunities for the fourth quarter of 2025:

- IT– Interest remained strong in tech (56%)—a perennial favorite—amid continued solid performance.

- Energy– Investor interest in energy remained steady (42%) even as the sector lagged, with supply and demand pressures weighing on oil prices, and opportunities for AI to shape the sector creating potential tailwinds.

- Health care– Amid some signs of cautious optimism, health care, a historically defensive area of the market, reclaimed its spot in the top three this quarter (34%).

About the Survey

This wave of the survey was conducted from October 3 to October 20 of 2025 among an online US sample of 961 self-directed investors, investors who fully delegate investment account management to financial professionals, and investors who utilize both. The survey has a margin of error of ±3.20 percent at the 95 percent confidence level. It was fielded and administered by Dynata. The panel is broken into three investable assets: less than $500k, between $500k to $1 million, and over $1 million. The panel is 60% male and 40% female and self-select as having moderate+ investing experience, with an even distribution across geographic regions, and age bands.

About Morgan Stanley Wealth Management

Morgan Stanley Wealth Management, a global leader, provides access to a wide range of products and services to individuals, businesses and institutions, including brokerage and investment advisory services, financial and wealth planning, cash management and lending products and services, annuities and insurance, retirement and trust services.

About Morgan Stanley

Morgan Stanley (NYSE: MS) is a leading global financial services firm providing a wide range of investment banking, securities, wealth management and investment management services. With offices in 42 countries, the Firm's employees serve clients worldwide including corporations, governments, institutions and individuals. For further information about Morgan Stanley, please visit www.morganstanley.com .

This has been prepared for informational purposes only and is not a solicitation of any offer to buy or sell any security or other financial instrument, or to participate in any trading strategy. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Morgan Stanley recommends that investors independently evaluate particular investments and strategies and encourages investors to seek the advice of a Financial Advisor.

Morgan Stanley Portfolio Solutions are portfolios available in our Select UMA platform under either Firm Discretionary UMA or Managed Advisory Portfolio Solutions. Please see the Select UMA ADV at www.morganstanley.com/ADV

Past performance is not a guarantee or indicative of future performance. Historical data shown represents past performance and does not guarantee comparable future results.

This material contains forward-looking statements and there can be no guarantee that they will come to pass.

Diversification and asset allocation do not guarantee a profit or protect against loss in a declining financial market.

This material should not be viewed as investment advice or recommendations with respect to asset allocation or any particular investment.

Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States.

Morgan Stanley Smith Barney LLC and Dynata are not affiliates.

© 2025 Morgan Stanley Smith Barney LLC. Member SIPC.

Referenced Data

| Please rate how much you agree or disagree with the following statement. We will reach normal levels of inflation by the end of the quarter. | |

|

| Q4' 25 |

| Agree (Top 2) | 47% |

| Strongly agree | 18% |

| Somewhat agree | 29% |

| Neither agree nor disagree | 19% |

| Somewhat disagree | 19% |

| Strongly disagree | 15% |

| Which of the following are you most concerned about when it comes to your portfolio? (Top 2) | ||||

|

| Q1'25 | Q2'25 | Q3'25 | Q4'25 |

| Inflation | 45% | 41% | 39% | 45% |

| Tariffs | n/a | 35% | 33% | 33% |

| Market volatility | 24% | 24% | 24% | 21% |

| Current administration | 21% | 19% | 17% | 18% |

| A recession | 17% | 16% | 15% | 13% |

| Earnings | 19% | 13% | 15% | 11% |

| Fed monetary policy | 12% | 9% | 12% | 11% |

| Geopolitical conflict | 17% | 10% | 13% | 10% |

| Energy costs | 15% | 11% | 11% | 10% |

| Jobs market | 6% | 4% | 4% | 8% |

| None | 3% | 2% | 3% | 3% |

| When it comes to the current market are you ? | ||

|

| Q3' 25 | Q4' 25 |

| Bullish | 61% | 56% |

| Bearish | 39% | 44% |

| What changes do you think the Fed will make to its rate policy at the next meeting? | ||

|

| Q3' 25 | Q4' 25 |

| Cut rates by 0 –. 25% | 29% | 41% |

| Cut rates by .25% – .50% | 20% | 19% |

| Raise rates by 0 –. 25% | 18% | 17% |

| Raise rates by . 25% .50% | 5% | 3% |

| Make no change | 28% | 20% |

| When it comes to your portfolio for the next six months are you considering any of the following strategies? | |

|

| Q4'25 |

| Make no changes to my portfolio | 41% |

| Change the allocations in my portfolio | 26% |

| Move out of cash and in to new positions | 18% |

| Move out of current positions and in to cash | 14% |

| Other | 1% |

| What industries do you think offer the most potential this quarter ? (Top three) | ||

| Q3'25 | Q4'25 | |

| Information technology | 57% | 56% |

| Energy | 43% | 42% |

| Health care | 31% | 34% |

| Real estate | 28% | 31% |

| Financials | 35% | 28% |

| Utilities | 21% | 26% |

| Industrials | 24% | 20% |

| Communication services | 20% | 20% |

| Materials | 16% | 17% |

| Consumer staples | 15% | 17% |

| Consumer discretionary | 10% | 10% |

View source version on businesswire.com: https://www.businesswire.com/news/home/20251021762345/en/

Media Relations: Lynn Cocchiola lynn.cocchiola@morganstanley.com