June 09, 2022

RESULTS INCLUDE 11m @ 1.42 LI2O, 9m @ 1.09 LI2O AND 7m @ 1.82% LI2O

Growing multi-asset West Australian lithium company, Global Lithium Resources Limited (ASX: GL1, Global Lithium or the Company) is pleased to report continued encouraging lithium assay results from its Q1/Q2 CY2022 Exploration Program at the Company’s wholly owned MBLP, located 150km southeast of Port Hedland in the Pilbara region of Western Australia.

Key Highlights:

- Significant intervals of lithium mineralisation continue to be intersected from the ongoing drilling at the Marble Bar Lithium Project (MBLP) in the Pilbara Region of Western Australia.

- Results include:

- 11m @ 1.42% Li2O and 62ppm Ta2O5 from 25m in MBRC0258

- 12m @ 0.88% Li2O and 44ppm Ta2O5 from 82m in MBRC0269

- 9m @ 1.09% Li2O and 61ppm Ta2O5 from 44m in MBRC0270

- 10m @ 0.81% Li2O and 80ppm Ta2O5 from 40m in MBRC0271

- 7m @ 1.00% Li2O and 71ppm Ta2O5 from 24m in MBRC0300

- 7m @ 1.82% Li2O and 66ppm Ta2O5 from 20m in MBRC0310

- Wide intervals from the drilling continue to demonstrate the robustness of the MBLP and enhance the opportunities for increasing the resource base in proximity to the current Archer deposit and along strike further to the south and east • Ongoing drilling will target these lithium mineralised pegmatites to establish their prospectivity both along strike and down dip.

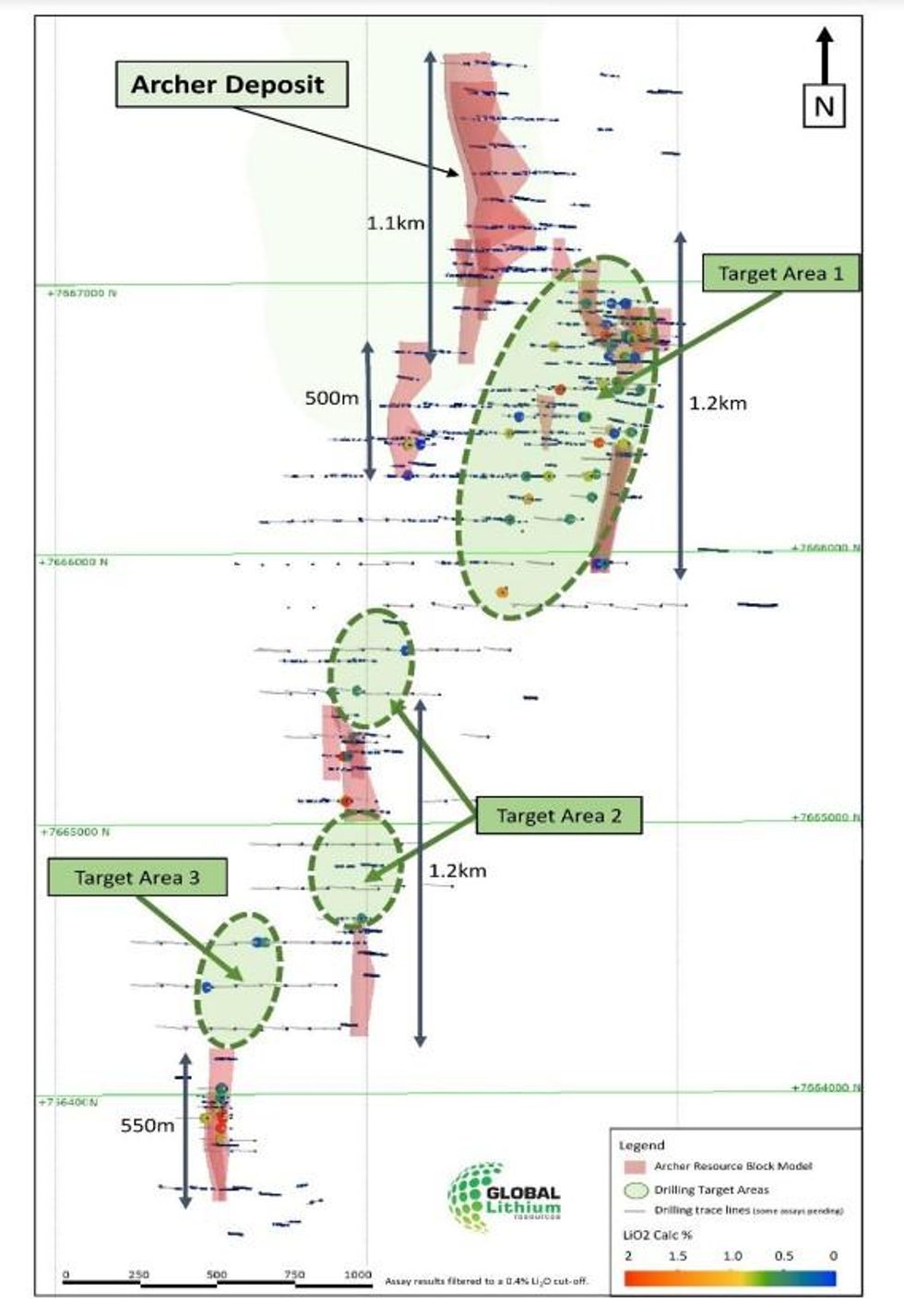

- Mapping and soils work has delineated three distinct target areas for further exploration (refer to Figure 1).

- Additional outcropping lithium targets remain untested by drilling and these areas will form part of the ongoing focus for the CY2022 drilling program.

Global Lithium Head of Geology, Stuart Peterson commented,

“Commencing in February 2022, our 60,000m exploration drilling program has continued to build momentum at the MBLP, with lithium intercepts continuing along the >6km strike of the mineralisation already identified within the project area. The results highlight the prospectivity of the area, particularly as the drilling moves to the southern and eastern areas of GL1’s tenement package.”

“The drilling program supports the targeting effort by the Global Lithium and CSA Global geology teams and provides a strong platform for future growth.”

“Our immediate exploration focus, to add shareholder value across our two assets, remains clearly defined. Firstly, deliver the ongoing CY2022 program at MBLP, including the highly prospective targets that remain untested and secondly, safely execute a 20,000m drilling and exploration campaign at the Manna Lithium Project in the Goldfields region. To our knowledge, we are the only lithium company to be drilling at two independent lithium project sites in the globally recognised, tier 1 lithium mining jurisdiction of Western Australia.”

The majority of MBLP drilling has been designed and targeted to test geochemical trends and mapped pegmatite targets, particularly along the greenstone belt and also several granite hosted pegmatite targets that are located between the Archer deposit and the area to the east near the major regional structural feature of the Brockman Zone.

The drilling intersection highlights reported above have been recorded from drilling to the south and to the east of the Archer pegmatite resource. The drill target locations with prospective mineralised zones are detailed in Figure 1. The target zones extend over distances from 500m to 1.2km with a majority of the drilling being undertaken on a nominal grid pattern with a line spacing of 160m and a hole spacing of 80m.

Click here for the full ASX Release

This article includes content from Global Lithium Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GL1:AU

The Conversation (0)

04 December 2024

Strategic Acquisition Consolidates Large Scale Gold and Base Metal Target Area

Acquisition of Octava Minerals’ Talga Project and Exploration Update

Established multi-asset Western Australian lithium company, Global Lithium Resources Limited (ASX: GL1, Global Lithium or the Company) is pleased to announce the acquisition of seven strategic tenements adjacent to the Company’s Marble Bar Gold Project to complete coverage of a large gold in... Keep Reading...

24 October 2022

Quarterly Report: Ending 30 September 2022

Breaker Resources (ASX: BRB) is pleased to present its Quarterly Report. Key Highlights Lake Roe Gold Project (100%) The underground development strategy advances with completion of the Tura underground scoping study as one of several underground prospects – stage 1 could produce 88,000oz at... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00