Marvel Discovery Corp. (TSX-V:MARV)(Frankfurt:O4T)(MARVF:OTCQB); ("Marvel" or the "Company") is pleased to announce that an application has been made to the Provincial and Municipal governments for a Drill Program on the Duhamel Nickel-Copper-Cobalt-Platinum Group Property. In addition, notice has been sent to the Nitassinan de Mashteuiatsh First Nation for their review

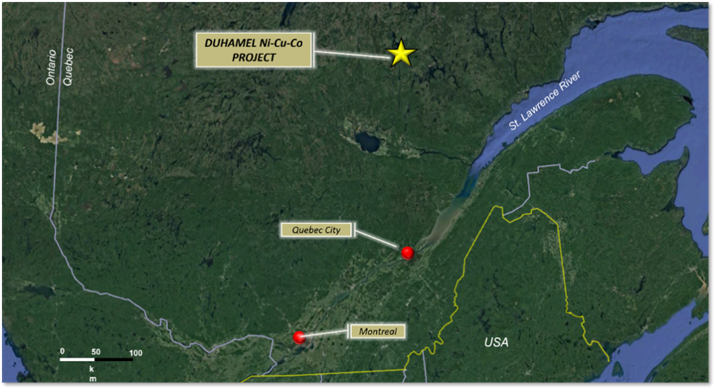

Figure 1. Regional location of the Duhamel Property

The company plans for an inaugural drill campaign of 2000m with plans to test up to 10-20 target areas with hole depths ranging from 100-200m. Airborne magnetic and TDEM surveys identified several high priority target areas which will be the focus and tested by diamond drilling.

Mr. Karim Rayani, Chief Executive Officer commented, "We are extremely satisfied with our compilation data at Duhamel and are excited to begin drilling on what we consider a very intriguing Nickel Target. Of considerable interest is that we know there is Nickel mineralization in this system, as drilling by Virginia Gold Mines in 2000 intersected over 3m of mineralization with assays of 1.27% Nickel, 0.33% Copper and 0.12% Cobalt. This historical drilling appears to be proximal to the higher conductance TDEM targets. In other words, we don't think the best conductors have ever been drill tested, and while it is unknown if there is a direct correlation between high conductivity and increase nickel content in this location, it certainly does hold true for most magmatic nickel-copper sulphide deposits."

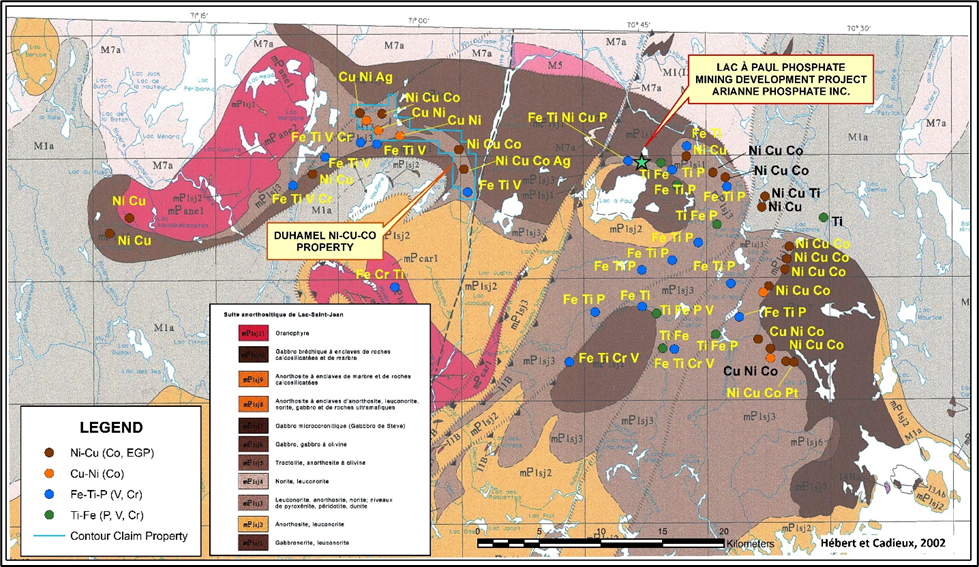

The Duhamel project is located between Chutes-des-Passes and Pipmuacan Reservoir deformation zones (or areas) included in central part of Proterozoic Grenville Geological Province (Figure 2). The Duhamel Property is characterized by the presence of large mafic to ultramafic intrusive rock bodies located in northern margin of the Saguenay‐Lac‐Saint‐Jean (SAGLSJ) Anorthosite Suite, one of the largestanorthosite intrusive bodies in the world. The Chute-des-Passes-Pipmuacan reservoir areas contains numerous massive sulfide and iron oxide mineralization occurrences recognized and documented by the Quebec government (Sigeom, Figure 2).

Figure 2. Ni‐Cu‐Co-PGE and Fe‐Ti‐P‐V mineral occurrences on the Chute-des-Passes and Pipmuacan Areas (modified from Hébert et Cadieux, 2002)

Qualified Person

Wayne Holmstead, P. Geo, an independent qualified person as defined in National Instrument 43-101, has reviewed, and approved the technical contents of this news release on behalf of the Company.

About Marvel Discovery Corp.

Marvel, listed on the TSX Venture Exchange for over 25 years, is a Canadian based emerging resource company. The Company is systematically exploring its extensive property positions in:

- Newfoundland (Slip, Gander North, Gander South, Victoria Lake, Baie Verte, and Hope Brook - Au Prospects)

- Atikokan, Ontario (BlackFly - Au Prospect)

- Elliot Lake, Ontario (East Bull - Ni-Cu-PGE Prospect)

- Quebec (Duhamel - Ni-Cu-Co prospect & Titanium, Vanadium, and Chromium Prospect)

- Prince George, British Columbia (Wicheeda North - Rare Earth Elements Prospect)

The Company's website is: https://marveldiscovery.ca/

ON BEHALF OF THE BOARD

Marvel Discovery Corp.

"Karim Rayani"

Karim Rayani

President/Chief Executive Officer, Director

Tel: 604 716 0551 email: k@r7.capital

Disclaimer for Forward-Looking Information:

Certain statements in this release are forward-looking statements which reflect the expectations of management. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Forward-looking statements in this press release relate to, among other things: completion of the proposed Arrangement. Actual future results may differ materially. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. There is no assurance any of the conditions for closing will be met. Forward-looking statements reflect the beliefs, opinions, and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the respective parties, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these times. Except as required by law, the Company does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Marvel Discovery Corp.

View source version on accesswire.com:

https://www.accesswire.com/729714/Marvel-Makes-Application-in-Preparation-for-Drilling-on-the-Duhamel-Ni-Cu-Co-pge-Property-Lac-St-Jean-Quebec