December 01, 2023

Many Peaks (ASX:MPK) capitalizes on Australia’s and Canada’s ongoing push to strengthen domestic critical mineral production by advancing its gold-copper assets in Queensland, Australia, and other key energy transition projects in Newfoundland and Labrador, Canada.

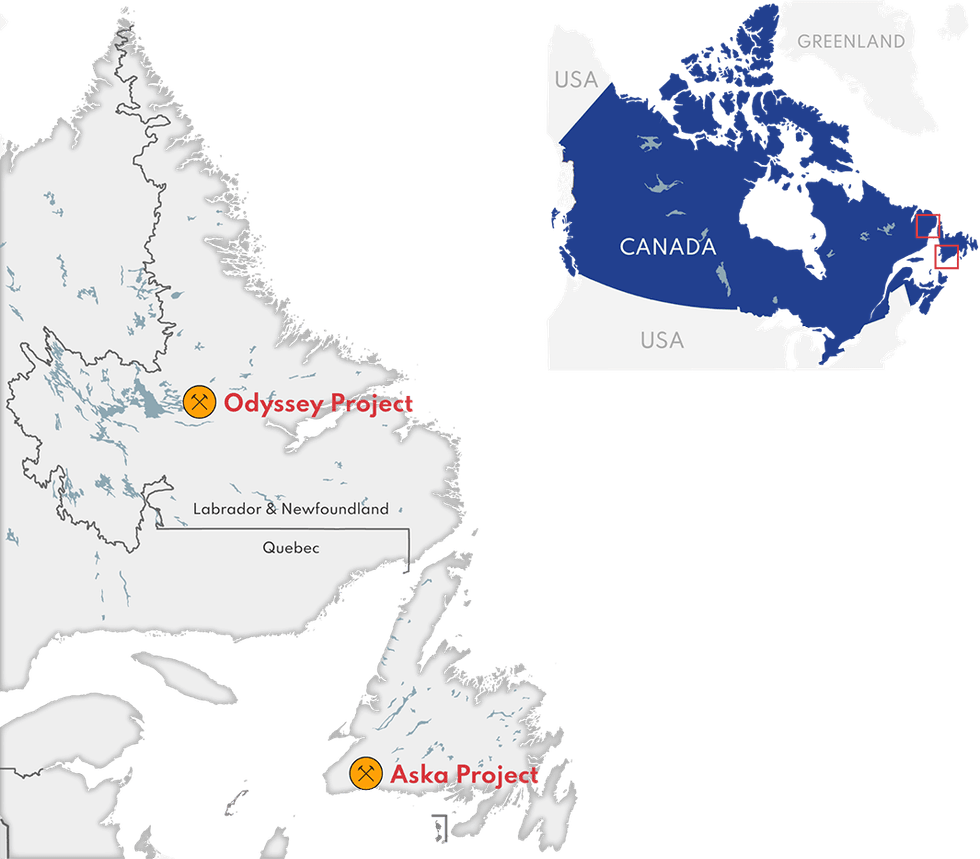

Many Peaks’ Canadian assets target REE and lithium deposits where Newfoundland represents an emerging district of lithium strategically positioned with access to both European and North American markets. The company’s REE project has not been previously drilled but has a defined, drill-ready target with the potential for a significant REE deposit.

The company’s assets in Queensland, meanwhile, cover a combined 464 square kilometers, with an 80 percent interest and an option over the remaining 20 percent. The company’s Australian portfolio has an excellent existing infrastructure and is host to intrusion-related gold systems and copper-gold porphyry style mineralization. The presence of copper allows these assets to meet the growing demand for the critical mineral, while gold creates additional value.

A management team with a range of experience throughout the natural resources industry leads the company toward achieving its goals of strengthening shareholder value through exploration.

Company Highlights

- Many Peaks is a mineral exploration company with assets in Australia and Canada.

- The company’s assets include several drill-ready targets focusing on minerals necessary for the transition to clean energy.

- Many Peaks aims to capitalize on both countries' push to strengthen domestic sources of critical minerals, while gold further improves the value of its assets.

- Both countries have mining-friendly regulations and the potential for future incentives to help bolster the domestic supply of lithium, copper and REEs.

- Many Peaks owns two critical minerals assets in Newfoundland and Labrador, Canada, and an extensive portfolio of copper-gold assets in Australia.

- The company’s Queensland assets cover a combined 464 square kilometers with several drill-ready copper-gold targets.

- An expert management team with extensive experience throughout the natural resources industry leads the team toward fully exploring its assets.

This Many Peaks profile is part of a paid investor education campaign.*

Click here to connect with Many Peaks (ASX:MPG) to receive an Investor Presentation

MPK:AU

The Conversation (0)

10 September 2024

Many Peaks Minerals

Advancing gold discoveries in Côte d’Ivoire, West Africa

Advancing gold discoveries in Côte d’Ivoire, West Africa Keep Reading...

14 April 2025

Diamond Drilling Commences at Ferke Gold Project

Many Peaks Minerals (MPK:AU) has announced Diamond Drilling Commences at Ferke Gold ProjectDownload the PDF here. Keep Reading...

19 March 2025

Raises A$6.22m to Intensify Drilling at Ferke

Many Peaks Minerals (MPK:AU) has announced Raises A$6.22m to Intensify Drilling at FerkeDownload the PDF here. Keep Reading...

16 March 2025

New High Grade Gold Shoot at Ferke Project

Many Peaks Minerals (MPK:AU) has announced New High Grade Gold Shoot at Ferke ProjectDownload the PDF here. Keep Reading...

11 March 2025

AC Drilling Commences on Priority Targets at Ferke Project

Many Peaks Minerals (MPK:AU) has announced AC Drilling Commences on Priority Targets at Ferke ProjectDownload the PDF here. Keep Reading...

23 February 2025

Reconnaissance AC Drilling Yield Structural Targets

Many Peaks Minerals (MPK:AU) has announced Reconnaissance AC Drilling Yield Structural TargetsDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00