July 05, 2023

Titan Minerals Limited (Titan or the Company) (ASX:TTM) is pleased to announce a first Mineral Resource Estimate (MRE), which is reported in accordance with JORC (2012) on the Company’s 100% owned Dynasty Gold Project (Dynasty), in the Loja Province, southern Ecuador.

Key Highlights

- Indicated and Inferred Mineral Resource Estimate of 43.54 Mt at 2.23 g/t Au & 15.7 g/t Ag for a contained 3.12 million ounces of gold and 21.98 million ounces of silver1

- Mineral Resources reported by area:

- Cerro Verde: 28.8Mt @ 2.08 g/t Au, 13.00 g/t Ag for 1.92 Moz Au, 12.04 Moz Ag

- Iguana: 10.9Mt @ 2.02 g/t Au, 13.68 g/t Ag for 0.71 Moz Au, 4.81 Moz Ag

- Papayal: 2.9Mt @ 3.80 g/t Au, 39.31 g/t Ag for 0.36 Moz Au, 3.71 Moz Ag

- Trapichillo: 0.9Mt @ 4.54 g/t Au, 50.85 g/t Ag for 0.13 Moz Au, 1.43 Moz Ag

- Significant high-grade component of 17.3Mt @ 3.77 g/t Au, 24.0g/t Ag for a contained 2.09 million ounces of gold and 13.33 million ounces of silver2

- Over half of Mineral Resources contained within 100 metres from surface

- 39% Indicated and 61% Inferred Resources, with majority of Indicated resources at Cerro Verde, which is largely credited to the additional drilling and QAQC work completed by Titan over this area and gives confidence that the same classification can be achieved through moderate drilling and geological workstreams at other resource areas.

- Papayal and Trapichillo vein systems exhibit extremely high gold and silver grades, albeit relatively low tonnes, which is largely a function of sparse drilling. These areas will be a focus for resource growth, with drilling set to commence in the coming months.

- Dynasty Gold Project significantly derisked with completion of JORC compliant Mineral Resource, providing a robust 3D model for targeting resource growth and initiating future mine development studies.

- Substantial depth extensions to the epithermal Au-Ag vein system confirmed to 350m in latest drill results at Brecha-Comanche (Cerro Verde), providing the confidence to test, and potentially add substantial resources through delineating depth extensions across the project.

- Several high conviction

areas for resource additions identified with minimal drilling required. Several significant drill intercepts were excluded from the resource

due to uncertainty in geological interpretation in some areas. Minimal drilling required to improve geological understanding in these areas,

representing potential near-term future resource additions.

- Ongoing discussions with strategic investors for Dynasty and other projects progressing

Titan’s CEO Melanie Leighton commented:

“The completion of a JORC 2012 compliant Mineral Resource for Dynasty is a fantastic achievement, which represents a significant milestone. It is the culmination of a massive body of work, including validation of historical data, considerable QAQC, and 3D geological modelling. The integration of extensive qualitative and quantitative datasets has been instrumental in generating a robust mineral resource.

“The maiden JORC compliant MRE has not only verified, but substantially grown the previous NI43-101 resource, with 3.12M ounces of gold and 21.98M ounces of silver now contained in JORC resource estimates within the epithermal vein system, and even more impressive is that more than half of the resource sits within 100 metres from surface, with preliminary optimisation studies indicating robust economics for open pit and underground mining.

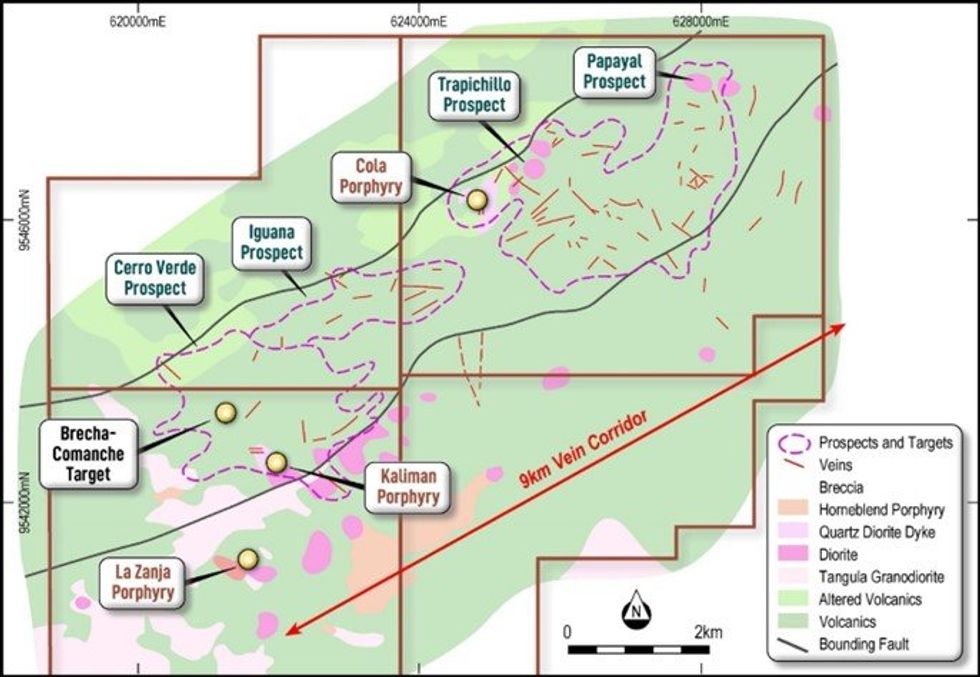

“Dynasty boasts a 9km epithermal corridor, seeded with porphyry targets, and drilling to date has only tested a portion- less than half- of the system. Titan is in a prime position to rapidly grow the resource, with resource extension drill testing set to commence in the coming month, along with the continuation of exploration work programs across priority targets identified in exploration work currently underway at the Papayal and Trapichillo prospects.

“Titan aspires to emulate the success of Lundin Gold Inc. (TSX:LUG) and their world-class Fruta del Norte Gold Project in southeast Ecuador, an epithermal gold-silver intermediate sulphidation system with many similarities to Dynasty and containing Mineral Resources of 9.81 Moz gold and 15.0 Moz silver. Touted as one of the highest grade, lowest cost mines in the world, Fruta del Norte commenced operation in 2019, and in 2022 total revenue was $841 million.”

Click here for the full ASX Release

This article includes content from Titan Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TTM:AU

The Conversation (0)

31 March 2022

Titan Minerals

Developing Ecuador’s Underexplored High-Grade Mineral Deposits

Developing Ecuador’s Underexplored High-Grade Mineral Deposits Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00