- WORLD EDITIONAustraliaNorth AmericaWorld

December 06, 2023

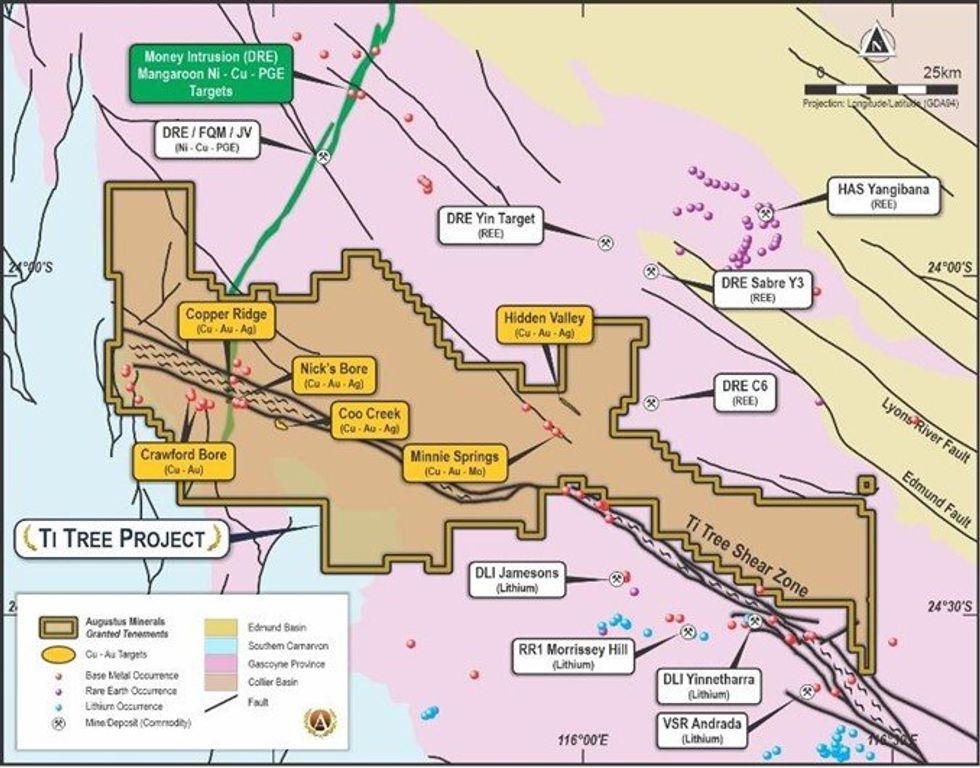

Augustus Minerals (ASX: AUG; “Augustus” or the “Company”) is pleased to advise of the completion of its maiden drilling campaign at its 100% owned Ti-Tree project in the Gascoyne region of Western Australia.

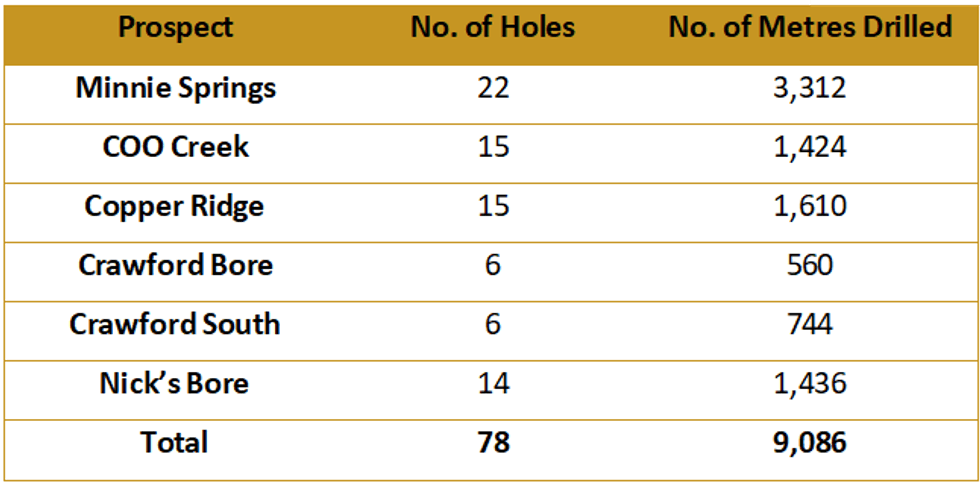

- 9,086m drilled in 78 holes across six project areas

- Campaign designed to test extensive surface mineralisation identified through soil sampling and rock chip analysis

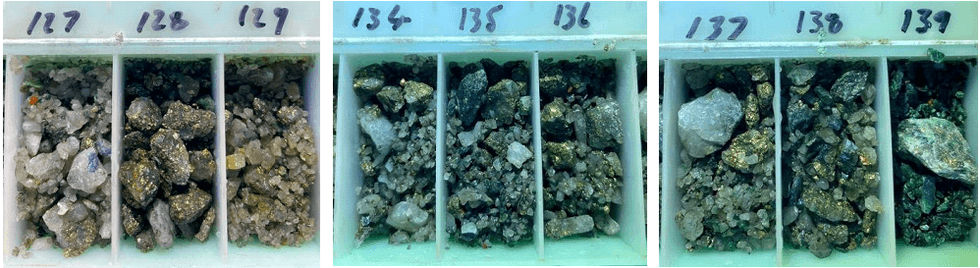

- Visual observations of copper sulphide mineralisation in quartz veining in multiple holes at depth

- Assays are due back progressively over the coming weeks.

- Exploration and drilling activities to re-commence in Q1 2024

The drilling campaign included 78 holes totalling 9,086m of Reverse Circulation (RC) drilling. The program consisted of discovery drilling only and was designed to confirm historical results and to test near surface mineralisation at depth and along strike, with drilling having been limited to approximately 70m vertical depth.

Holes in the Crawfords, Nic’s Bore and Copper Ridge areas also intersected some visible disseminated mineralisation within quartz veins in the form of pyrite, malachite and chalcopyrite and assay are awaited.

Andrew Reid, Managing Director

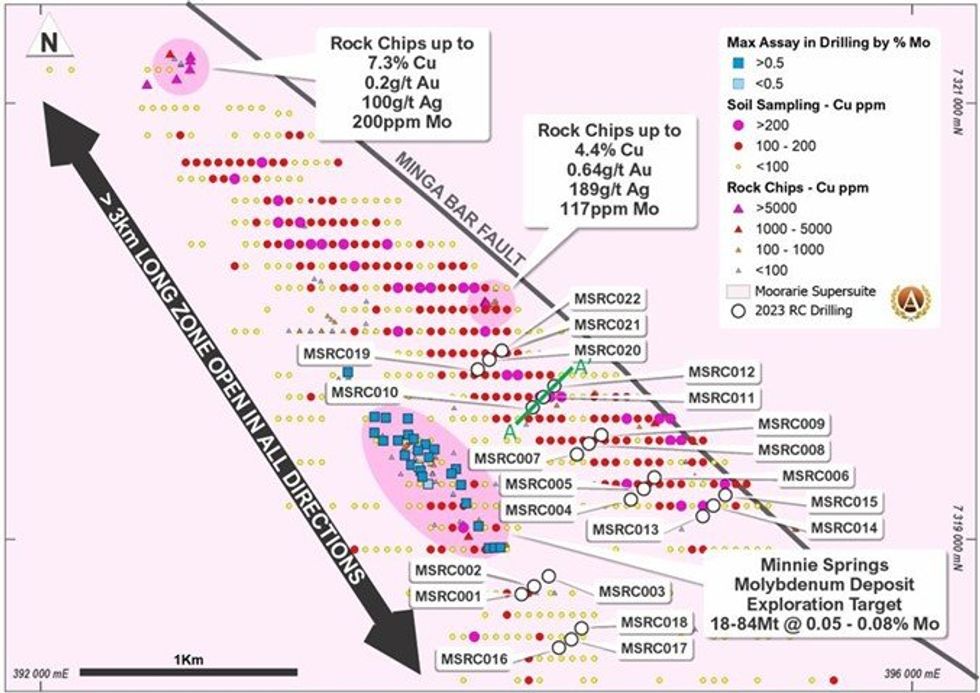

“Our maiden drilling campaign following the IPO in May 2023 is now completed and has been a great success. The campaign was designed to test for mineralisation both at near surface and at depth and resulted in visually identifying mineralisation/veining in the majority of drill holes at our Minnie Springs copper-molybdenum-gold project.

Minnie Springs could represent a sizeable porphyry hosted copper deposit with the next step to be the completion of drilling in the remaining 50% of the copper-in-soil anomaly yet to be tested during the next drilling campaign in Q1 2024.”

The second northern-most line at Minnie Springs (Figure 2. MSRC 010 – 012) intersected multiple zones of copper sulphide mineralisation1 co-incident with chlorite-epidote alteration in hole MSRC012, which is characteristic of propylitic alteration commonly seen in in porphyry copper-molybdenum-gold deposits.

Click here for the full ASX Release

This article includes content from Augustus Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AUG:AU

Sign up to get your FREE

Augustus Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 July 2023

Augustus Minerals

Vast Land Package for Critical and Precious Metals Exploration in Australia

Vast Land Package for Critical and Precious Metals Exploration in Australia Keep Reading...

28 January

Quarterly Activities/Appendix 5B Cash Flow Report

Augustus Minerals (AUG:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

11 January

Heritage Approval for Drilling at Music Well

Augustus Minerals (AUG:AU) has announced Heritage Approval for Drilling at Music WellDownload the PDF here. Keep Reading...

15 December 2025

CEO Resignation

Augustus Minerals (AUG:AU) has announced CEO ResignationDownload the PDF here. Keep Reading...

18 November 2025

Exploration Update - Soil Sampling Results

Augustus Minerals (AUG:AU) has announced Exploration Update - Soil Sampling ResultsDownload the PDF here. Keep Reading...

16 November 2025

Augustus Secures Vanapa River Tenement Application in PNG

Augustus Minerals (AUG:AU) has announced Augustus Secures Vanapa River Tenement Application in PNGDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Augustus Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00