July 10, 2024

Deposit starts from surface with significant scope for further growth

DevEx Resources (ASX: DEV; DevEx or the Company) is pleased to announce a maiden Inferred Mineral Resource Estimate (MRE) for its 100%-owned Kennedy Rare Earths Project (Kennedy Project) in North Queensland (Figure 1).

Highlights

- Inferred Mineral Resource Estimate (MRE) completed for the Kennedy Ionic Adsorption Clay-Hosted REE Project in North Queensland, reported in accordance with JORC 2012 guidelines:

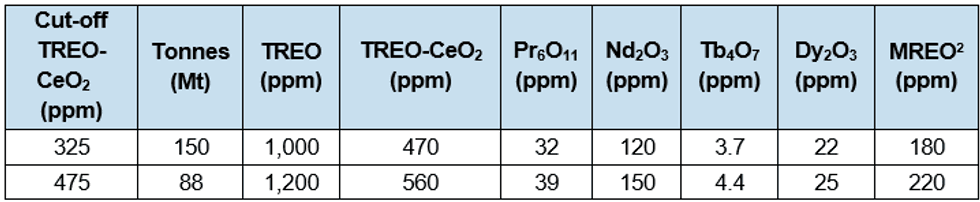

- 150Mt @ 1,000ppm TREO1 (470ppm TREO-CeO2) at a 325ppm TREO-CeO2 cut-off

- The entire Inferred MRE sits in unconsolidated clay-rich gravels commencing from surface with no overburden.

- At a 475ppm TREO-CeO2 cut off, the Inferred MRE is 88Mt @ 1,200ppm TREO (560ppm TREO-CeO2).

- Further potential to expand the Inferred MRE with in-fill and extensional drilling to target several priority areas outside the Inferred MRE to the west.

- Previously reported preliminary metallurgical test work demonstrates rapid recoveries can be achieved by desorption of REE in the first 30 minutes using ammonium sulfate solution ((NH4)2SO4) in weak acidic conditions (pH4) with very low acid consumption.

- Being adjacent to the Kennedy Highway, the Project stands to further benefit from the Queensland Government’s significant investment into infrastructure upgrades and support for critical minerals development.

The Inferred MRE for the Kennedy Project, which occurs in surface unconsolidated gravelly clays, totals 150 million tonnes at 1,000ppm TREO (470ppm TREO-CeO2) using a cut-off grade of 325ppm TREO-CeO2 (Tables 1 and 2 and Figures 2 and 4) or 88Mt @ 1,200ppm TREO (470ppm TREO-CeO2) using a 475ppm cut-off grade (Tables 1 and 2 and Figures 3 and 5).

DevEx’s Managing Director, Brendan Bradley, said:

“Delivering a maiden Inferred Mineral Resource within a year from the discovery of this deposit is a significant achievement by our team and sets a strong foundation for the Kennedy Project.

“The key attributes of the Resource are that it commences at surface with no overburden, extends over a considerable area with further scope for growth, and is one of the few ionic adsorption clay- hosted REE deposits in Australia.

“The favourable results from initial metallurgical test work – combined with the deposit’s scale and established road and port infrastructure in the region – highlight its potential as a future source of highly valuable magnet rare earths.

“Rare earths are considered a critical input for renewable energy applications such as electric vehicles and wind turbines, and aligns with DevEx’s broader strategy to discover minerals which contribute to the clean energy transition.”

The Inferred MRE for the Kennedy Project, contains the important and high-value Magnetic Rare Earth Oxides (MREO’s) – Praseodymium (Pr6O11), Neodymium (Nd2O3), Dysprosium (Dy2O3) and Terbium (Tb4O7), which are essential in the manufacture of permanent rare earth magnets used in electric vehicles, wind turbines and numerous other renewable energy applications. The Company has strategically targeted these MREO’s and mineralised zones where they concentrate, in both grade and thickness.

The Kennedy Project remains one of only a select few ionic clay projects that have been defined in Australia and is considered to be similar to the Makuutu Heavy Rare Earths Project in the Republic of Uganda owned by Ionic Rare Earths Limited (ASX: IXR).3

Drilling and preliminary metallurgical test work completed to date at the Kennedy Project has identified the potential for favourable mining and processing attributes including:

- Shallow: The mineralisation occurs from surface with minimal to no overlying overburden.

- Soft: The rare earths lie in unconsolidated clays with irregular pisolite, and nodules (gravels) dispersed amongst the clays.

- Favourable metallurgy: Preliminary leach test work demonstrates rapid recoveries by desorption of REE in the first 30 minutes using ammonium sulfate solution ((NH4)2SO4) in weak acidic conditions (pH4) with very low acid consumption and very low dissolution of gangue elements including calcium (see Company Announcements 16 May 2023 and 10 July 2023).

- Significant scale: Broad-spaced drilling to the south-west of the Inferred MRE area highlights several exploration areas for follow up and in-fill drilling.

The majority of the Kennedy Inferred MRE sits across two pastoral properties, allowing for efficient engagement with landholders. DevEx has successfully negotiated access agreements to conduct its exploration activities across both properties and continues to engage with these key landholders and the broader community for the project's progression.

The Kennedy Project is well-located nearby to existing infrastructure networks, including transportation, power supply and bulk port facilities. Queensland has a well-established mining sector supported by a skilled workforce and government support.

The Project stands to benefit from the Queensland Government’s Critical Minerals Strategy which outlines four key objectives to achieve Queensland’s ambitions for a prosperous critical minerals sector - move faster and smarter, maximise investment, build value chains and foster research and ESG excellence. Current commitments by the Government include: i) $245 million investment into growing the critical minerals sector and establishing critical mineral zones; and ii) the $5 billion being invested into Copper String 2032 which is essential to the new Queensland Super Grid backbone under the Queensland Energy and Jobs Plan.

The Company has been awarded $175,000 under this Initiative to assist with undertaking further metallurgical testwork at the Project.

Click here for the full ASX Release

This article includes content from DevEx Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

9h

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00