- Results from hole LADD031 reported 12.72 metres grading 8.56 g/t gold, 12.10 metres grading 1.67 g/t gold, 15.00 metres grading 1.88 g/t gold and 3.23 metres grading 5.98 g/t gold

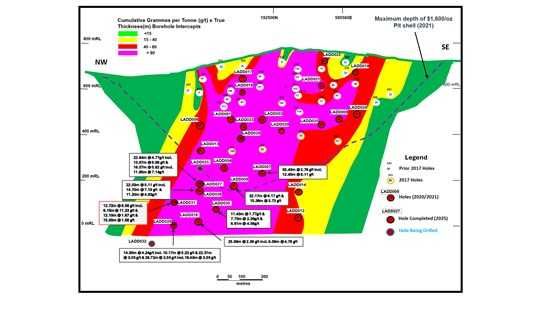

Loncor Gold Inc. (TSX: LN,OTC:LONCF) (OTCQX: LONCF) (FSE: LO5) ("Loncor" or the "Company") is pleased to announce further multiple, mineralised intersections from its deep drilling program at the Company's 3.66 million ounce Adumbi deposit where an indicated mineral resource of 1.88 million ounces of gold (28.185 million tonnes grading 2.08 gt Au), and an inferred mineral resource of 1.78 million ounces of gold (20.83 million tonnes grading 2.65 gt Au) have already been delineated within a USD1,600oz open pit shell. Borehole LADD031 intersected 12.72 metres grading 8.56 grammes per tonne (gt) gold (including 6.15 metres grading 11.23 grammes per tonne), 12.10 metres grading 1.67 gt gold, 15.00 metres grading 1.88 grammes per tonne and 3.23 metres grading 5.98 gt gold (see Table and Figure 1 below).

Significant mineralized sections for borehole LADD031 are summarised in the table below:

| Borehole Number | From (m) | To (m) | Intersected Width (m) | Grade (g/t) Au |

| LADD031 | 541.20 | 545.55 | 4.35 | 1.95 |

| LADD031 | 559.00 | 571.72 | 12.72 | 8.56 |

| LADD031 including | 560.20 | 566.35 | 6.15 | 11.23 |

| LADD031 including | 568.30 | 571.05 | 2.75 | 12.99 |

| LADD031 | 614.55 | 626.65 | 12.10 | 1.67 |

| LADD031 | 666.00 | 681.00 | 15.00 | 1.88 |

| LADD031 | 697.42 | 700.65 | 3.23 | 5.98 |

| LADD031 including | 699.20 | 700.00 | 0.80 | 21.63 |

Note: It is estimated that the true width of the mineralised sections for core hole LADD031 is approximately 70% of the intersected widths in the above table. Regular measurements of inclination and azimuth were taken at 30 metre intervals downhole and all the core was orientated. All intercepted grades are uncut with maximum internal dilution equal to or less than 4 metres of intersected width.

Commenting on these latest drilling results, Loncor CEO John Barker said: "Core hole LADD031 was situated below the open pit shell in the northwest of the Adumbi deposit and intersected several mineralized zones at a vertical depth of 570 metres below surface and approximately 265 metres below the USD1,600 pit shell outline on section. The total true thickness of the banded ironstone formation (BIF) package which hosts the gold mineralization was 132 metres which demonstrates that the BIF is still thick and well mineralized at this depth, towards the projected northwest edge of the Adumbi deposit."

Quality Control and Quality Assurance

Drill cores for assaying were taken at a maximum of one-metre intervals and were cut with a diamond saw, with one-half of the core placed in sealed bags by Company geologists and sent to the Company's on-site sample preparation facility. The core samples were then crushed down to 80% passing minus 2 mm and split with one half of the sample up to 1.5 kg pulverized down to 90% passing 75 microns. Approximately 150 grams of the pulverized sample was then sent to the SGS Laboratory in Mwanza, Tanzania (independent of the Company). Gold analyses were carried out on 50g aliquots by fire assay. In addition, check assays were also carried out by the screen fire assay method to verify high-grade sample assays obtained initially by fire assay. As part of the Company's QA/QC procedures, internationally recognized standards, blanks and duplicates were inserted into the sample batches prior to submitting to SGS Laboratory.

Qualified Person

Peter N. Cowley, who is President of Loncor and a "qualified person" as such term is defined in National Instrument 43-101, has reviewed and approved the technical information in this press release.

Figure 1: Adumbi Deposit Longitudinal Section Looking Northeast with Drill Hole Grade (g/t) x True Thickness (Metre) Product Contours

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1824/271606_3257a1ed04ab4b74_001full.jpg

Technical Report

Additional information with respect to the Company's Adumbi deposit (and other properties of the Company within its Imbo Project) is contained in the technical report of New SENET (Pty) Ltd and Minecon Resources and Services Limited dated December 15, 2021 and entitled "NI 43-101 Preliminary Economic Assessment of the Adumbi Deposit in the Democratic Republic of the Congo". A copy of the said report can be obtained from SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov.

About Loncor Gold Inc.

Loncor is a Canadian gold exploration company focussed on the Ngayu Greenstone Gold Belt in the northeast of the Democratic Republic of the Congo (the "DRC"). The Loncor team has over two decades of experience of operating in the DRC. Loncor's growing resource base in the Ngayu Belt is focused on the Imbo Project where the Adumbi deposit holds an indicated mineral resource of 1.88 million ounces of gold (28.185 million tonnes grading 2.08 g/t gold), and the Adumbi deposit and two neighbouring deposits hold an inferred mineral resource of 2.090 million ounces of gold (22.508 million tonnes grading 2.89 g/t Au), with 84.68% of these resources being attributable to Loncor. Following a drilling program carried out by the Company at the Adumbi deposit in 2020 and 2021, the Company completed a Preliminary Economic Assessment ("PEA") of the Adumbi deposit and announced the results of the PEA in December 2021.

Additional information with respect to Loncor and its projects can be found on Loncor's website at www.loncor.com.

Cautionary Note Concerning Forward-Looking Information

This press release contains forward-looking information. All statements, other than statements of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding drilling results at Adumbi, underground mineral resource potential below the Adumbi pit shell, mineral resource estimates, potential mineralization, future exploration and development) are forward-looking information. This forward-looking information reflects the current expectations or beliefs of the Company based on information currently available to the Company. Forward-looking information is subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking information, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things, the possibility that future exploration (including drilling) or development results will not be consistent with the Company's expectations, risks related to the exploration stage of the Company's properties, uncertainties relating to the availability and costs of financing needed in the future, the possibility that drilling programs will be delayed, failure to establish estimated mineral resources (the Company's mineral resource figures are estimates and no assurances can be given that the indicated levels of gold will be produced), changes in world gold markets or equity markets, political developments in the DRC, gold recoveries being less than those indicated by the metallurgical testwork carried out to date (there can be no assurance that gold recoveries in small scale laboratory tests will be duplicated in large tests under on-site conditions or during production), fluctuations in currency exchange rates, inflation, changes to regulations affecting the Company's activities, delays in obtaining or failure to obtain required project approvals, the uncertainties involved in interpreting drilling results and other geological data and the other risks disclosed under the heading "Risk Factors" and elsewhere in the Company's annual information form dated March 31, 2025 filed on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov. Forward-looking information speaks only as of the date on which it is provided and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.

For further information, please visit our website at www.loncor.com or contact:

John Barker, CEO, +44 7547 159 521

Arnold Kondrat, Executive Chairman, +1 416 366 7300

Peter Cowley, President, +44 790454 0856

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/271606