Lomiko Metals Inc. (TSX.V: LMR) ("Lomiko Metals" or the "Company") is pleased to announce the third round of analytical results from the infill and extension exploration drill program at its wholly-owned La Loutre Graphite property, located approximately 180 kilometres northwest of Montréal in the Laurentian region of Québec. The La Loutre graphite project site is located within the Kitigan Zibi Anishinabeg (KZA) First Nations territory. The drilling was supervised by Québec-based, independent geological consultant Breakaway Exploration Management Inc. and was operated under ECOLOGO requirements and compliance protocols, as Lomiko is ECOLOGO certified. Please see the press release issued on March 23, 2022 for more details about Lomiko's ECOLOGO certification.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220928005630/en/

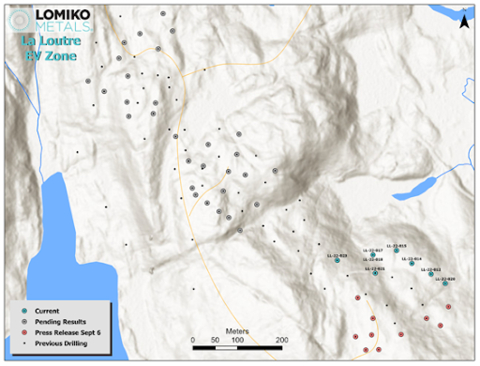

Figure 1: EV Zone Drill Hole Locations

Belinda Labatte, CEO and Director stated: "Our team is very excited to see that the results from the 14 holes drilled at the northern end of the EV Zone in 2022 demonstrate strong graphite mineralization over significant widths. Many holes intersected high grades over 110-to-120-metre intervals. The number of holes confirms the potential of this area for additional graphite resources. We look forward to more results in the next 21 holes in the EV zone which will be released as more assays are received. Our vision is to become a responsible operator and part of a climate success story in Southern Quebec."

Highlights

- First initial drill results from the northern part of EV Zone show very thick mineralization zones with high grades in 8 out of 10 mineralized holes (please see table below).

- Several wide intervals of near-surface, high-grade flake graphite mineralization including 11.02% Cg over 120.00m from 32.0 to 152.0m in hole LL-22-032 including 48.0m at 15.58% Cg from 50.0 to 98.0m.

- Second best result of 8.73% Cg over 110.5m from 81.5 to 192.0m in hole LL-22-019 Including 69.0m at 12.09% Cg from 102.5 to 171.5m

- Numerous intersections remain open; additional assay results pending including holes LL-22-022, -024, 025, -026, -029, -030, -032 and -033

- Northeastern limit of graphite mineralization defined with holes LL-22-27& LL-22-028

- EV Zone shows a robust trend and remains open to the northwest in holes LL-22-019 & LL-22-022

The drill program at La Loutre was initiated on May 15, 2022, with the goal to further define the deposit, provide the data needed to increase confidence in the mineral resource and build on the results of the positive Preliminary Economic Assessment for the La Loutre project as announced in the Company's July 29, 2021, press release (see link). Lomiko has retained InnovExplo Inc, a Quebec-based independent consulting firm specializing in geology, resource estimation, mining engineering and sustainable development, to prepare an updated NI 43-101 compliant resource estimate for the La Loutre project following the completion of the 2022 drill program.

The assay results reported in this press release are for the 14 holes drilled at the north end of the EV Zone. These holes were drilled to determine the northern extent of the graphite mineralization, confirm the results of the previous drilling, and provide better detail of the EV Zone in this part of the deposit. Please refer to Table 1 for the weighted average graphitic carbon-bearing drill intersections (not true thickness) and Table 2 and Figure 1 for the collar locations referred to in this press release. These results are in addition to the assay results for eighteen holes announced in Lomiko's press releases dated September 6 and 20 , 2022.

| Table 1: Weight averaged graphitic carbon-bearing drill intersections (not true thickness) | |||||

| Hole | From m | To m | Int. m | % Cg | Notes |

| LL-22-011 |

|

|

|

| Not Sampled, abandoned hole, redrilled as LL-22-013 |

| LL-22-013 | 3.0 | 6.0 | 3.0 | 1.23 |

|

| LL-22-016 | 73.0 | 85.0 | 12.0 | 3.76 |

|

| 139.0 | 164.5 | 25.5 | 4.80 |

| |

| Including | 154.0 | 163.0 | 9.0 | 8.16 |

|

| LL-22-019 | 81.5 | 192.0 | 110.5 | 8.73 |

|

| Including | 102.5 | 171.5 | 69.0 | 12.09 |

|

| LL-22-022 | 4.0 | 20.5 | 16.5 | 4.09 | Open down-hole from 20.5m |

| Including | 5.5 | 16.0 | 10.5 | 5.68 |

|

| 38.5 | 70.0 | 31.5 | 4.09 |

| |

| Including | 43.0 | 47.5 | 4.5 | 16.07 |

|

| 93.0 | 132.0 | 39.0 | 4.39 |

| |

| Including | 120.0 | 127.5 | 7.5 | 13.19 |

|

| LL-22-024 | 42.0 | 67.5 | 25.5 | 2.31 | Open up-hole from 42.0m & down-hole from 67.5m |

| 90.0 | 109.5 | 19.5 | 2.99 | Open up hole from 90.0m | |

| LL-22-025 | 80.0 | 101.0 | 21.0 | 6.17 |

|

| Including | 87.5 | 95.0 | 7.5 | 13.50 | Open up-hole from 87.5m & down-hole from 95.0m |

| 140.0 | 185.0 | 45.0 | 15.07 | Open down-hole from 185.0m | |

| LL-22-026 | 121.0 | 125.5 | 4.5 | 3.59 | Open up-hole from 121.0m |

| LL-22-027 |

|

|

|

| No sampling, entirely quartzite |

| LL-22-028 |

|

|

|

| No sampling, entirely quartzite |

| LL-22-029 | 83.7 | 89.7 | 6.0 | 5.74 | Open up-hole from 83.7m & down-hole from 89.7m |

| LL-22-030 | 47.5 | 56.5 | 9.0 | 4.05 | Open up-hole from 47.5m |

| LL-22-032 | 32.0 | 152.0 | 120.0 | 11.02 | Open down-hole from 152.0m |

| Including | 50.0 | 98.0 | 48.0 | 15.58 |

|

| 176.0 | 186.5 | 10.5 | 5.59 | Open-up hole from 176.0m | |

| LL-22-033 | 33.4 | 45.4 | 12.0 | 4.83 | Open up-hole from 33.4m, |

|

| 168.5 | 191 | 22.5 | 8.69 | Stopped in graphite mineralization |

| Including | 170.0 | 180.5 | 10.5 | 15.20 |

|

On the northeast side of the EV Zone, holes LL-22-011, -013, -026, -027 and -28 were drilled entirely or mostly in quartzite and encountered no or very narrow graphite mineralization within narrow paragneiss bands within the quartzite. The lack of significant graphite in these holes effectively defines the northeastern limit of the EV Zone.

Wide intervals of high- to moderate-grade graphite were encountered in holes LL-22-016, -019, -022, -024, -025, -030, -032 and -033 and narrow, moderate-grade intervals in LL-22-029 and -30 within paragneiss. Exceptional intervals of near-surface, high-grade flake graphite mineralization include 11.02% graphitic carbon ("% Cg") over 120.0 metres ("m) from 32.0 to 152.0m in hole LL-22-032 and 8.73% Cg over 110.5m from 81.5 to 192.0m in hole LL-22-019. These impressive intersections define a strong graphite trend and indicate that the EV Zone has excellent potential to continue to the northwest. Additional sampling has been done and assays are pending to fully close these intervals.

| Table 2: Drill Hole Collar Locations (UTM NAD 83, Zone 18) | ||||||

| Hole | UTM_mE | UTM_mE | Elev._m | Azimuth_° | Dip_° | Length_m |

| LL-22-011 | 499286 | 5098374 | 337 | 60 | -50 | 24.2 |

| LL-22-013 | 499286 | 5098374 | 337 | 60 | -50 | 150.0 |

| LL-22-016 | 499251 | 5098354 | 337 | 60 | -49 | 174.0 |

| LL-22-019 | 499239 | 5098319 | 340 | 60 | -51 | 192.0 |

| LL-22-022 | 499170 | 5098268 | 340 | 60 | -55 | 141.5 |

| LL-22-024 | 499206 | 5098245 | 334 | 65 | -50 | 199.0 |

| LL-22-025 | 499259 | 5098279 | 347 | 60 | -51 | 200.0 |

| LL-22-026 | 499338 | 5098419 | 344 | 60 | -56 | 153.0 |

| LL-22-027 | 499359 | 5098380 | 338 | 60 | -55 | 96.0 |

| LL-22-028 | 499327 | 5098340 | 339 | 60 | -52 | 151.7 |

| LL-22-029 | 499257 | 5098221 | 352 | 60 | -53 | 174.0 |

| LL-22-030 | 499261 | 5098189 | 351 | 60 | -57 | 174.3 |

| LL-22-032 | 499321 | 5098219 | 352 | 60 | -52 | 189.3 |

| LL-22-033 | 499316 | 5098195 | 353 | 60 | -52 | 195.0 |

Qualified Person

The technical content presented in this press release was reviewed by Mark Fekete, P.Geo. who actively participated in the La Loutre drill program as an independent consultant to the Company as the "Qualified Person" as that term is defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

QAQC and Analytical Procedures

The drill core was logged and marked for sampling by a professional geologist. All the core was photographed as part of the logging procedure. Core samples were collected by splitting each sample interval in half lengthwise with a hydraulic core splitter. One half of the interval was returned to the core box, and the other half was placed in a plastic bag with a tag. The tag number was marked in indelible ink on the outside of the bag, and the bag was sealed with a plastic tie-wrap. One certified reference material standard and one blank were included in each batch of 21 samples. For shipping, samples were placed in rice bags that were individually sealed with numbered, tamper-proof security tags. The rice bags were then placed on wooden pallets, secured with plastic wrapping, and delivered by truck to Manitoulin Transport Inc. for shipping to Activation Laboratories Ltd. ("Actlabs") in Ancaster, Ontario.

At Actlabs the samples were crushed to 80% passing 2mm and then riffle split to a 250g sub-sample that was pulverized to pulp 95% passing 105μm (Actlabs Code RX1). The sample pulps were then analyzed for graphitic carbon "Cg") by mild hydrochloric acid digestion followed by combustion in an infrared induction furnace (Actlabs Code 8Cg). Actlabs is accredited under ISO 9001:2015 registration and is independent of the Company.

About Lomiko Metals Inc.

Lomiko Metals has a new vision and a new strategy in new energy. Lomiko represents a company with purpose: a people-first company where we can manifest a world of abundant renewable energy with Canadian and Quebec critical minerals for a solution in North America. Our goal is to create a new energy future in Canada where we will grow the critical minerals workforce, become a valued partner and neighbour with the communities in which we operate, and provide a secure and responsibly sourced supply of critical minerals.

In addition to La Loutre, Lomiko is working with Critical Elements Lithium Corporation towards earning its 70% stake in the Bourier Project as per the option agreement announced on April 27 th , 2021 . The Bourier project site is located near Nemaska Lithium and Critical Elements south-east of the Eeyou Istchee James Bay territory in Quebec which consists of 203 claims, for a total ground position of 10,252.20 hectares (102.52 km2), in Canada's lithium triangle near the James Bay region of Quebec that has historically housed lithium deposits and mineralization trends.

About the La Loutre Graphite Project

The Company holds a 100% interest in its La Loutre graphite development project in southern Quebec. The La Loutre project site is located within the Kitigan Zibi Anishinabeg (KZA) First Nations territory. The KZA First Nations are part of the Algonquin Nation and the KZA territory is situated within the Outaouais and Laurentides regions. Located 180 kilometres northwest of Montreal, the property consists of one large, continuous block with 76 mineral claims totalling 4,528 hectares (45.3 km2).

The Property is underlain by rocks belonging to the Grenville Province of the Precambrian Canadian Shield. The Grenville was formed under conditions that were very favourable for the development of coarse-grained, flake-type graphite mineralization from organic-rich material during high-temperature metamorphism.

Lomiko Metals published a July 29, 2021 Preliminary Economic Estimate (PEA) which indicated the project had a 15-year mine life producing per year 100,000 tonnes of graphite concentrate at 95% Cg or a total of 1.5Mt of graphite concentrate. This report was prepared as National Instrument 43-101 Technical Report for Lomiko Metals Inc. by Ausenco Engineering Canada Inc., Hemmera Envirochem Inc., Moose Mountain Technical Services, and Metpro Management Inc., collectively the Report Authors.

On behalf of the Board,

Belinda Labatte

CEO and Director, Lomiko Metals Inc.

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. The information in this news release about the Company; and any other information herein that is not a historical fact may be "forward-looking information" ("FLI"). All statements, other than statements of historical fact, are FLI and can be identified by the use of statements that include words such as "anticipates", "plans", "continues", "estimates", "expects", "may", "will", "projects", "predicts", "proposes", "potential", "target", "implement", "scheduled", "intends", "could", "might", "should", "believe" and similar words or expressions. FLI in this new release includes, but is not limited to: the Company's objective to become a responsible supplier of critical minerals, exploration of the Company's projects, including expected costs of exploration and timing to achieve certain milestones, including timing for completion of exploration programs; the Company's ability to successfully fund, or remain fully funded for the implementation of its business strategy and for exploration of any of its projects (including from the capital markets); any anticipated impacts of COVID-19 on the Company's business objectives or projects, the Company's financial position or operations, and the expected timing of announcements in this regard. FLI involves known and unknown risks, assumptions and other factors that may cause actual results or performance to differ materially. This FLI reflects the Company's current views about future events, and while considered reasonable by the Company at this time, are inherently subject to significant uncertainties and contingencies. Accordingly, there can be no certainty that they will accurately reflect actual results. Assumptions upon which such FLI is based include, without limitation: current market for critical minerals; current technological trends; the business relationship between the Company and its business partners; ability to implement its business strategy and to fund, explore, advance and develop each of its projects, including results therefrom and timing thereof; the ability to operate in a safe and effective manner; uncertainties related to receiving and maintaining exploration, environmental and other permits or approvals in Quebec; any unforeseen impacts of COVID-19; impact of increasing competition in the mineral exploration business, including the Company's competitive position in the industry; general economic conditions, including in relation to currency controls and interest rate fluctuations.

The FLI contained in this news release are expressly qualified in their entirety by this cautionary statement, the "Forward-Looking Statements" section contained in the Company's most recent management's discussion and analysis (MD&A), which is available on SEDAR at www.sedar.com , and on the investor presentation on its website. All FLI in this news release are made as of the date of this news release. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220928005630/en/

For more information on Lomiko Metals, review the website at www.lomiko.com or please contact :

Kimberly Darlington

k.darlington@lomiko.com

514-771-3398