September 17, 2023

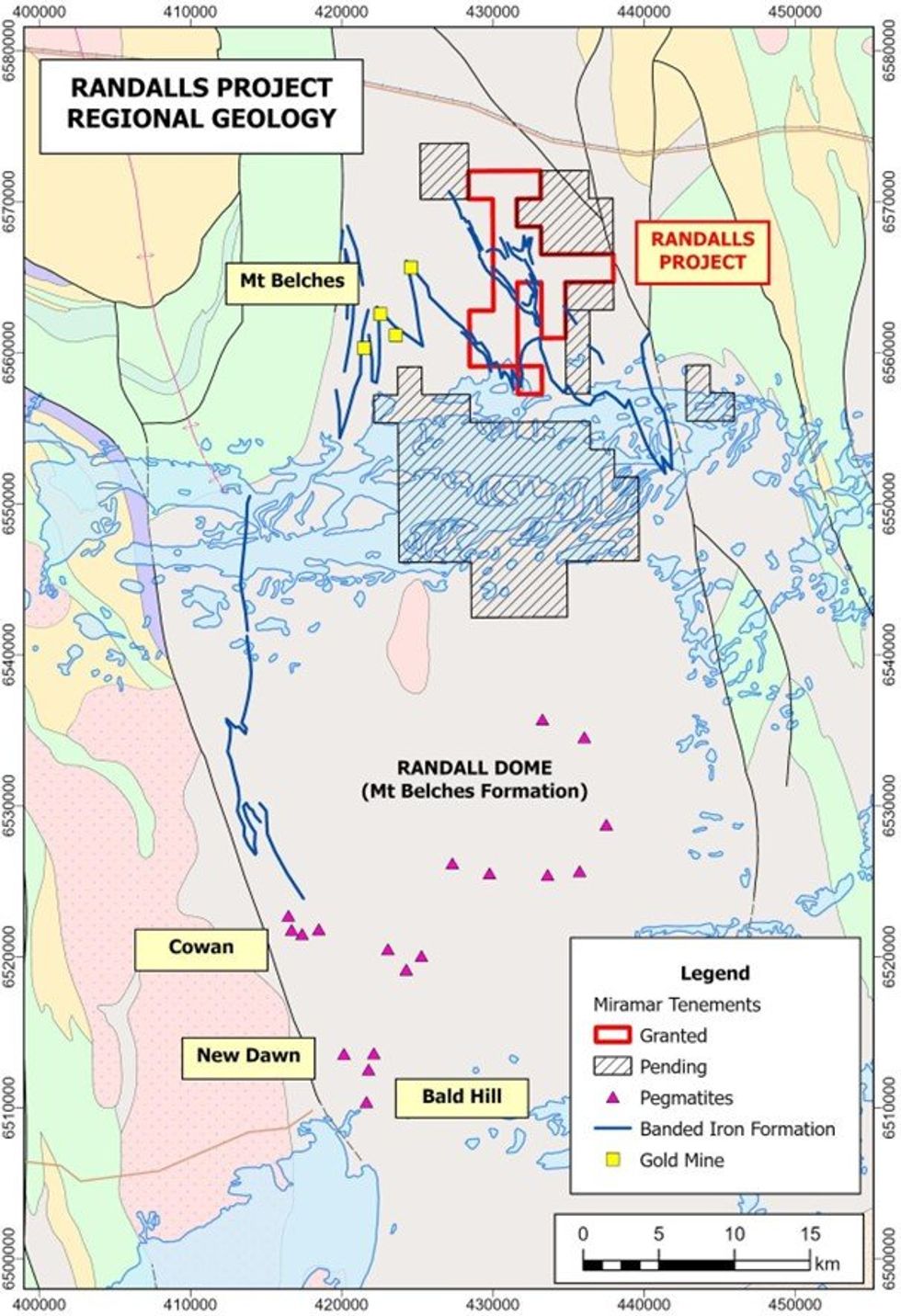

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) advises it has identified potential for lithium-bearing pegmatites at the Company’s 100%-owned Randalls Project (“Randalls” or “the Project”), located approximately 70km east of Kalgoorlie in the Eastern Goldfields of WA.

- Comparable geological setting to the Bald Hill and New Dawn Lithium Projects

- No previous exploration for lithium within Randall Project tenements

- New applications consolidate land position over prospective geology

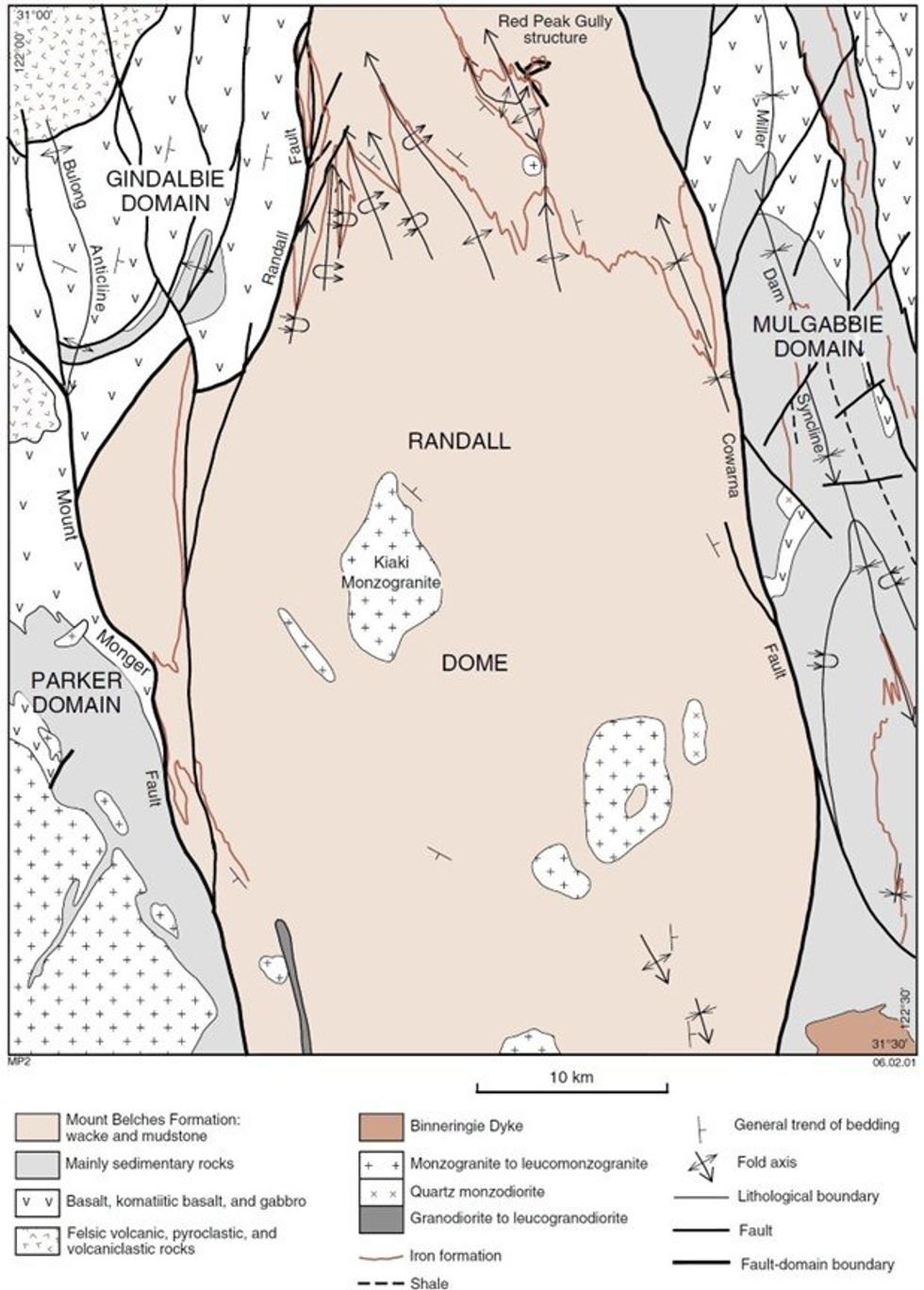

The Randalls Project is located on the northeastern margin of the “Randall Dome”, a folded sequence of black shales, banded iron formation (BIF) and other sediments of the Mt Belches Formation, underlain by a central granitoid core (Figure 1).

According to the Geological Survey of WA, the Randall Dome was formed by the combination of granite emplacement and east-west compression resulting in a doubly-plunging anticline with a NNW-SSE- trending central axis (Figure 2).

As such, Miramar’s tenements are diagonally opposite and in a similar stratigraphic position to several significant lithium-bearing pegmatites on the southwestern margin of the Randall Dome including:

- Bald Hill – the subject of a takeover by Mineral Resources Ltd (ASX Release 4 Sept 2023)

- New Dawn – recently purchased by Torque Metals Ltd (ASX Release, 5 Sept 2023)

- Cowan - multiple lithium-bearing pegmatite occurrences

Regional radiometric data shows significant potassium anomalism associated with these known lithium pegmatites. Similar potassium anomalism is seen within the Randalls Project tenements north of Lake Randall (Figure 3).

Pegmatites are common south of Lake Randall however a review of historical open file data reveals no evidence of exploration for lithium over the Randalls Project tenements, with previous work mostly limited to gold exploration within the folded BIF which hosts the Mt Belches gold deposits operated by Silver Lake Resources Limited.

Miramar’s Executive Chairman, Mr Allan Kelly, said that, given the strong similarities between Randalls and the Bald Hill area and the lack of previous exploration, there was significant potential for the discovery of lithium bearing pegmatites within the Company’s tenements.

“Our Randalls Project is basically a mirror image of the Bald Hill and New Dawn areas, on the other side of the Randall Dome,” Mr Kelly said.

“The regional radiometric data strongly suggests that there could be lithium bearing pegmatites hidden under thin surficial cover within our tenements but they could be easily missed even when specifically targeted,” he added.

“We are excited about the opportunity to discover lithium bearing pegmatites on our ground,” he added.

The Company will complete a soil geochemical survey over the granted tenement, E25/596, and undertake reconnaissance sampling over its existing tenement applications.

Miramar has also increased its land position over the most prospective geology by submitting applications for four new Exploration Licences.

For more information on Miramar Resources Limited, visit the Company’s website at www.miramarresources.com.au, follow the Company on social media (Twitter @MiramarRes and LinkedIn @Miramar Resources Ltd) or contact:

| Allan Kelly | Margie Livingston |

| Executive Chairman | Ignite Communications |

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00