Lion One Metals Limited (TSXV: LIO,OTC:LOMLF) (OTCQX: LOMLF) ("Lion One" or the "Company") is pleased to provide an update on mining operations at the Company's 100% owned Tuvatu Alkaline Gold Project in Fiji.

The Company's first shrinkage stope has been a success. A total of 5,704 tonnes of material has been mined from the shrinkage stope, at an average grade of 10.60 g/t gold. Most of the shrinkage stope production occurred from July to September and was blended with material from other parts of the mine. The Company's second shrinkage stope is now in development with production anticipated to begin in November. The second shrinkage stope is expected to be twice as large as the first.

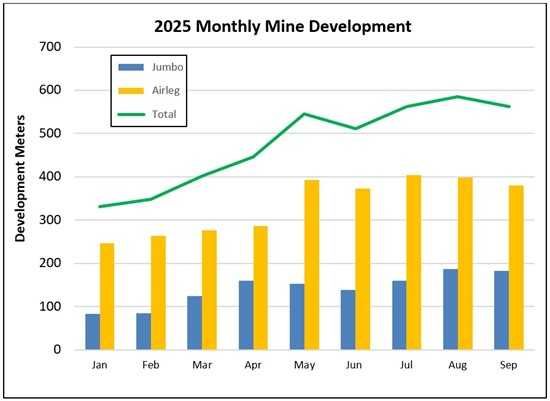

The Company has also increased overall development at Tuvatu by approximately 70% from January to September 2025. Overall development meters per month increased from 330.8 meters in January to 563.9 meters in September (Figure 1). This is a significant improvement as it enables the Company to accelerate the development of production stopes and workplaces underground. The Company expects that the increased development rates are sustainable and may be further improved upon with the arrival of additional mining equipment.

Lion One Metals' CEO Ian Berzins stated: "We're very pleased both with the success of the shrinkage stope and with the increased development rates at Tuvatu. These achievements have been made possible because of the new mining equipment and operational improvements initiated on site over the past several months. We're excited for the next shrinkage stope to come online and for the arrival of still more new mining equipment as we continue to advance operations at Tuvatu."

Shrinkage Stope

The Company's first shrinkage stope is located near surface in Zone 2 in the northwest part of Tuvatu. It targeted a section of the Ura1 lode that is approximately 62 m long, 24 m tall and 1.5 m wide. Development of the shrinkage stope was completed in June, and production started in July. Production from the shrinkage stope has been a major success with a total of 5,704 tonnes of material mined at an average grade of 10.60 g/t gold. Production from this shrinkage stope is now complete.

The Company's second shrinkage stope is in development and is anticipated to be twice as large as the first. The second shrinkage stope is located in Zone 5 on the east side of Tuvatu. It is focused on the UR2 lode and will be approximately 60 m long, 50 m tall, and 1.5 m wide, with expected tonnes of 11,520. Development of the second shrinkage stope is anticipated to be complete in October, with production scheduled to start in November and the final draw down to be complete in mid-January.

The success of the Company's first shrinkage stope is a major achievement and milestone for the Company and confirms shrinkage mining as an optimal mining method for Tuvatu. The Tuvatu deposit is a high-grade narrow-vein gold deposit, and the shrinkage mining method is designed to maximize gold production while minimizing dilution in a narrow-vein setting. Compared to traditional long hole mining methods, shrinkage stope mining offers the benefits of taller stopes and narrower widths - ideal for narrow-vein deposits such as Tuvatu.

Mine Development

To increase mine development and production rates, Lion One Metals initiated a series of productivity improvements and purchased new mining equipment to support these improvements. As a result, from January to September 2025 the Company increased the rate of large capital development by 126% and the rate of small development by 59%. Large capital development increased from 0.77 rounds per day to 1.74 rounds per day based on a 3.5-meter development round while small development in ore zones and accesses increased from 4.43 rounds per day to 7.03 rounds per day based on a 1.8-meter development round. Overall development rates at Tuvatu have increased by approximately 70% from January to September 2025 (Figure 1). This is a significant achievement and positions the company well to open new production stopes and workplaces underground, and to accelerate the capital development schedule including access to the Zone 500.

Figure 1. Tuvatu Monthly Development, 2025. Monthly development rates at Tuvatu have steadily increased throughout 2025 as a result of operational improvements and the addition of new equipment.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/268860_liononemetalsfig1.jpg

The productivity improvements at Tuvatu include changing the methodology on how the Company sequences the drilling, blasting, mucking and bolting functions in a development heading. Traditionally the Company has used two-boom jumbos in the inclines and declines to drill, scale and insert ground support to advance the capital development workings. Under the change in methodology, the Company is now using jumbos simply to drill blastholes on new headings. Following drilling, blasting and mucking of the heading, a bolting crew is inserted into the cycle to scale, screen and bolt the heading from a scissor lift and bolting platform. The jumbo is thus freed up to move to the next heading. This is a much more efficient method of operation as it increases the utilization of the jumbos and leverages the Fijian expertise in handheld mining.

To support this change in methodology, the Company has modified a Caterpillar IT28 utility vehicle with a bolting platform to support the bolting crew. In parallel, the Company has procured an RES scissor lift to provide a dedicated bolting machine in support of the operation. Additionally, the Company has recently procured a third two-boom jumbo to further support the underground fleet. With a third two-boom jumbo and dedicated scissor lift, the Company anticipates capital development rates to further improve, which will provide a significant benefit to the mine operations at Tuvatu.

COO Announcement

The Company would also like to announce the retirement of Patrick Hickey as COO of Lion One Metals. Mr Hickey joined Lion One Metals in the summer of 2021 and was instrumental in the construction and development of the Tuvatu Gold Mine. Through his 40-plus years of experience in the mining industry, Mr Hickey has become an expert in the design and construction of mines throughout the world. Mr Hickey has made immeasurable contributions to the success of Lion One Metals, bringing the Company from development through to production.

Walter Berukoff, Chairman and President of Lion One Metals stated: "On behalf of the Board and the entire Lion One team, I want to thank Patrick for his leadership and dedication during this critical period in the Company's growth. Patrick's contributions have laid the foundation for Tuvatu's continued success, and we wish him all the best in his retirement."

Following Mr Hickey's retirement, the duties of the COO will be assumed by Lion One Metals' CEO Ian Berzins.

Qualified Persons Statement

In accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43- 101"), Mark Horan, P.Eng., Chief Mining Engineer for the Company, is the Qualified Person for the Company and has reviewed and approved the technical and scientific content of this news release.

About Lion One Metals Limited

Lion One Metals is an emerging Canadian gold producer headquartered in North Vancouver BC, with new operations established in late 2023 at its 100% owned Tuvatu Alkaline Gold Project in Fiji. The Tuvatu project comprises the high-grade Tuvatu Alkaline Gold Deposit, the Underground Gold Mine, the Pilot Plant, and the Assay Lab. The Company also has an extensive exploration license covering the entire Navilawa Caldera, which is host to multiple mineralized zones and highly prospective exploration targets.

On behalf of the Board of Directors,

Walter Berukoff, President, Chairman of the Board

Contact Information

Email: info@liononemetals.com

Phone: 1-855-805-1250 (toll free North America)

Website: www.liononemetals.com

Neither the TSX-V nor its Regulation Service Provider accepts responsibility or the adequacy or accuracy of this release

This press release may contain statements that may be deemed to be "forward-looking statements" within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information. Generally, forward-looking information may be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "proposed", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. This forward-looking information reflects Lion One Metals Limited's current beliefs and is based on information currently available to Lion One Metals Limited and on assumptions Lion One Metals Limited believes are reasonable. These assumptions include, but are not limited to, the actual results of exploration projects being equivalent to or better than estimated results in technical reports, assessment reports, and other geological reports or prior exploration results. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance, or achievements of Lion One Metals Limited or its subsidiaries to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the stage development of Lion One Metals Limited, general business, economic, competitive, political and social uncertainties; the actual results of current research and development or operational activities; competition; uncertainty as to patent applications and intellectual property rights; product liability and lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation, affecting mining, timing and availability of external financing on acceptable terms; not realizing on the potential benefits of technology; conclusions of economic evaluations; and lack of qualified, skilled labor or loss of key individuals. Although Lion One Metals Limited has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Accordingly, readers should not place undue reliance on forward-looking information. Lion One Metals Limited does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/268860