- WORLD EDITIONAustraliaNorth AmericaWorld

August 26, 2024

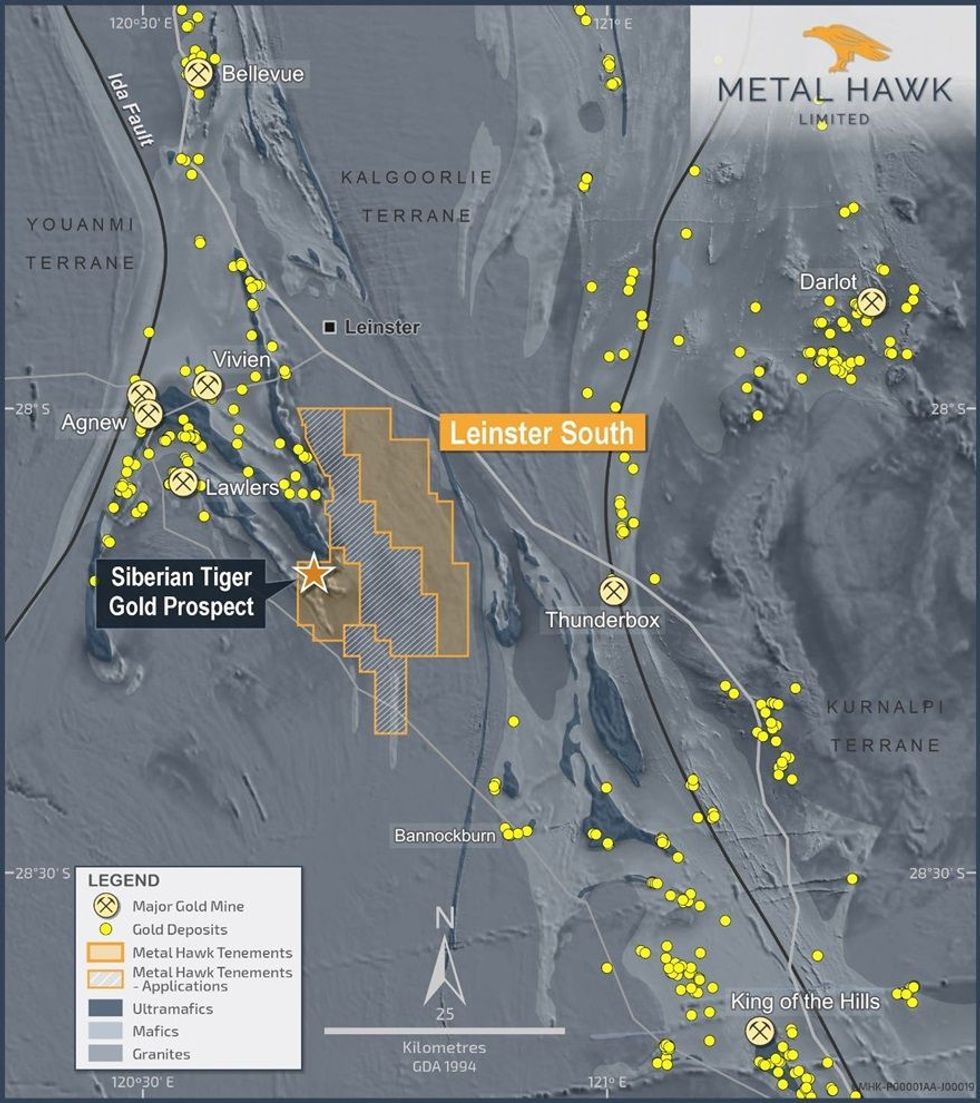

Metal Hawk Limited (ASX: MHK, “Metal Hawk” or the “Company”) is pleased to provide an exploration update for its 100% owned Leinster South project, located 30km south of Leinster in the Western Australian goldfields. Since the Company returned high-grade gold results from rockchip sampling at the Siberian Tiger prospect (see ASX announcement 5 August 2024), further exploration activities have commenced and Metal Hawk is progressing towards a maiden drilling program at the prospect as soon as possible.

- High resolution UAV (drone) magnetic survey underway at Leinster South, covering the majority of western tenement E 36/1068 which includes the Siberian Tiger gold prospect.

- New detailed geophysical data will significantly enhance the geological and structural understanding of the project area and will further assist Metal Hawk with identifying targets for drilling.

- Reconnaissance rockchip samples at Siberian Tiger returned high grade gold up to 20.2g/t from outcropping quartz veining. Additional samples of outcropping quartz veins along strike from Siberian Tiger have been delivered to the laboratory for gold and multi-element analysis.

- New tenement applications expand the Leinster South project area to over 430km2.

- Heritage negotiations and drilling approvals are underway.

The Company recently applied for two new exploration licenses to the east of Siberian Tiger, increasing the Leinster South project area to more than 430km2. This is a significant landholding in one of the most well-endowed gold regions of WA. The Siberian Tiger gold discovery is located along the southern limb of the Lawlers anticline and only 15km from the Lawlers mining centre (Figure 1). Past production from the Agnew - Lawlers deposits is > 5 million oz @ 5gt Au1.

A high-resolution UAV (drone) magnetic survey has commenced, with 50m spaced east-west lines at a flying height of 25m conducted over the majority of Leinster South tenement E36/1068, which includes the Siberian Tiger gold prospect. The Pegasus Airborne UAV system is able to quickly and efficiently provide high quality, detailed magnetic data which can be used to identify important structures and geological features of gold deposits. The magnetic survey will assist Metal Hawk geologists with targeting at Siberian Tiger and other regional prospect areas. Processing and interpretation of geophysical data will be carried out immediately following completion of the survey, which is expected to take 3-4 days.

Metal Hawk’s Managing Director Will Belbin commented: “We are collecting important geochemical, structural and geophysical data to better understand the controls and potential characteristics of gold mineralisation in the area. The drone magnetic survey will enable better interpretation of the subsurface geology and ultimately help us to determine the best possible target locations for the maiden drilling program at Siberian Tiger.”

“Whilst the historical geophysical dataset over the Leinster South tenure is poor, we expect that the new magnetic survey will show excellent detail and key structural features of the pronounced southeast trending greenstone belt.”

Click here for the full ASX Release

This article includes content from Metal Hawk Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

02 October 2024

Metal Hawk Limited

Gold-focused exploration in Western Australia’s prolific Eastern Goldfields region

Gold-focused exploration in Western Australia’s prolific Eastern Goldfields region Keep Reading...

11h

High-Grade Near-Surface Graphite Intersected at Millennium

Metal Bank (MBK:AU) has announced High-Grade Near-Surface Graphite Intersected at MillenniumDownload the PDF here. Keep Reading...

12h

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

13h

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

13h

High-Grade Gold in Initial White Dam Drilling Results

Pacgold (PGO:AU) has announced High-Grade Gold in Initial White Dam Drilling ResultsDownload the PDF here. Keep Reading...

20 February

Top 5 Canadian Mining Stocks This Week: Belo Sun is Radiant with 109 Percent Gain

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.On Tuesday (February 17) Canadian Prime Minister Mark Carney announced the creation of... Keep Reading...

20 February

Editor's Picks: Gold, Silver End Week Higher, Experts Share Next Price Targets

Gold and silver prices experienced declines early in the week, but ended higher. The yellow metal closed the week at US$5,111.88 per ounce, while silver finished at US$84.65 per ounce, buoyed by reignited tariff uncertainty out of the US. On Friday (February 20), the US Supreme Court stuck down... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00