- WORLD EDITIONAustraliaNorth AmericaWorld

February 09, 2023

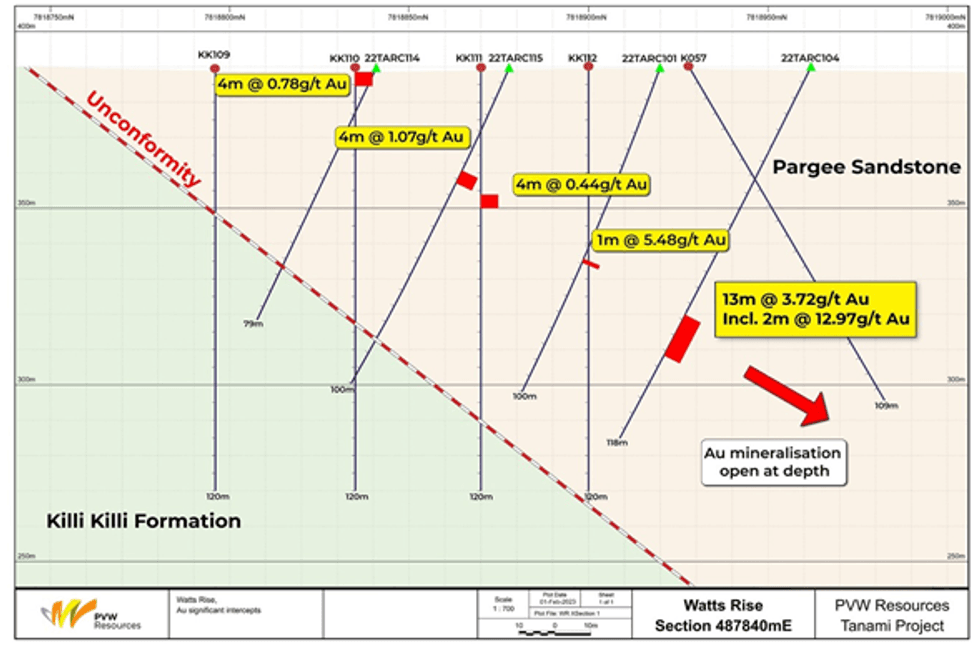

1m resamples upgrade gold potential at Watts Rise; Air-core results identify a regional gold trend over 4km at Monte Cristo

PVW Resources (‘PVW’, “the Company”) is pleased to advise that final assay results from the 2022 drilling program at the 100%-owned Tanami Heavy Rare Earth and Gold Project in Western Australia have further upgraded the project’s gold potential, with one-metre resampling of 4m composite assays from the Watts Rise prospect returning high-grade results, and air-core drilling defining an extensive gold anomalous zone at Monte Cristo.

Highlights

- 1m resampling of previously reported significant 4m composite gold intercepts from Reverse Circulation drilling at the Watts Rise Prospect returns high grades, including:

- 22TARC104 – 13m @ 3.72 g/t Au from 79m

- including 2m @ 12.97 g/t Au from 79m

- and including 1m @ 11.55 g/t Au from 83m

- 22TARC102 – 14m @ 1.08 g/t Au from 64m

- including 1m @ 6.81 g/t Au from 76m

- 22TARC101 – 1m @ 5.48 g/t Au from 59m

- 22TARC104 – 13m @ 3.72 g/t Au from 79m

- Air-core drilling at the Monte Cristo prospect highlights 4km of gold anomalous Killi Killi Formation on wide spaced drilling, including an end-of-hole assay result from the centre of the anomaly of:

- 22TAAC0279 – 2m @ 0.31g/t Au (308ppb Au), from 68m.

The one-metre resampling was undertaken on significant 4m composite results from Reverse Circulation (RC) drilling initially announced in October 2022 (ASX:PVW 24 October 2022 – Latest assays confirm rare earths and gold potential at Tanami REE Project, WA).

The gold results reported in this announcement add to the exciting Rare Earth Element (REE) results reported from air-core drilling (ASX:PVW 09 February 2023, Multiple new Heavy Rare Earth targets identified following exciting air-core results), reinforcing the Tanami Project’s exceptional discovery potential.

Executive Director Mr George Bauk said: “These results illustrate the outstanding gold potential in the Tanami region, with one-metre resamples of the 4m composites reported from our 2022 RC drilling campaign delivering a number of plus 10 gram-per-tonne gold results.

“These results are located less than 20km from Black Cat Syndicate’s Coyote Gold Deposit, which represents one of the highest-grade gold deposits in Australia with a recently updated underground Resource of 365,000 ounces grading an exceptional 14.6g/t Au1.

“PVW’s exploration programs at the Tanami Project have now delivered exciting results in both Rare Earths and gold, which represent a match made in heaven as a combination of minerals in one deposit.

“The PVW team is now finalising an interpretation of both the gold and REE results, with this analysis to underpin our 2023 exploration programs for both REE and gold.”

Click here for the full ASX Release

This article includes content from PVW Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PVW:AU

The Conversation (0)

24 March 2022

PVW Resources

Exploring Western Australia for REE and HREE

Exploring Western Australia for REE and HREE Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00