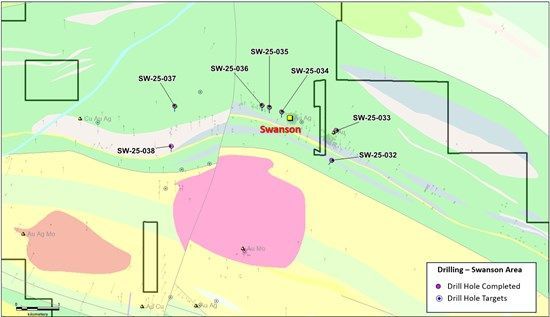

LaFleur Minerals Inc. (CSE: LFLR,OTC:LFLRF) (OTCQB: LFLRF) (FSE: 3WK0) ("LaFleur Minerals" or the "Company") is pleased to announce that to date, seven (7) diamond drill holes totaling 1,764 metres have been completed at its Swanson Gold Project ("Swanson") since drilling commenced in early July (Figure 1). Three (3) of these holes have been sampled, sawn, and sent to the assay laboratory for analysis, with final results expected in the coming weeks. The Swanson Gold Project is particularly well positioned as it lies in the heart of the Abitibi Greenstone Belt near Val-d'Or, Québec, a globally renowned gold district.

Drilling is currently focused on the northern part of the Swanson Gold Project near the Swanson Gold Deposit, which hosts an Indicated and Inferred Mineral Resource Estimate. These regional exploration holes are testing geological, geophysical, and geochemical targets up to 3 km from the Swanson Gold Deposit and along strike of a major structural break. Visual core logging suggests that several of the completed holes intersected geological features similar to those hosting known mineralization at the Swanson Gold Deposit.

Key observations from core logging of the recent drill holes are summarized below:

Pyrite and other sulphides are consistently observed in the drill holes, classic pathfinder minerals for gold.

A 17.9-metre-wide sulphide-rich zone (true width currently unknown) in drill hole SW-025-038 is a standout intersection that may indicate the potential for gold mineralization; however, assay results are still pending.

The presence of silicification, carbonate alteration, sericite, chlorite, fuchsite, and quartz veining are classic indicators of hydrothermal fluid movement, which often carries gold. The consistent appearance of shearing, stockwork veining, and brecciation also suggests structural controls that may localize gold mineralization. The presence of alteration and sulphides over multiple holes and rock types also increases the likelihood of defining a larger mineralized system.

Fuchsite alteration in drill hole SW-025-036 is particularly notable as it is also an important pathfinder and frequently associated with gold mineralization in the Abitibi Greenstone Belt.

PRELIMINARY SWANSON DRILLING HIGHLIGHTS

Below is a brief summary of preliminary geological and mineralization observations from core logging of the recent diamond drill holes completed by the Company. Half-core samples have been securely sent to AGAT Labs ("AGAT") in Val-d'Or, Québec for sample preparation, fire assay, and four-acid ICP geochemical testing, with final analytical results still pending. AGAT is independent of LaFleur Minerals and fully certified and accredited to ISO/IEC 17025:2017 and ISO 9001:2015 standards.

Drill hole SW-025-032: Strongly bleached basalts with silicification and carbonate alteration. Pyrite mineralization observed. Occasional quartz-carbonate-tourmaline veins with trace chalcopyrite.

Drill hole SW-025-033: Altered, carbonate-rich basalts with well-developed shear zones and sericite. Disseminated and stringer pyrite observed. Contact with ultramafic rocks featuring chlorite-talc-carbonate stockworks.

Drill hole SW-025-034: Alternating altered basalts and ultramafics, sheared with quartz veining. Disseminated and stringer style pyrite observed.

Drill hole SW-025-035: Sequence includes altered basalts, ultramafics, and possible syenites with shearing and sericite alteration. Pyrite mineralization observed.

Drill hole SW-025-036: Basalts, ultramafics, and intermediate porphyritic intrusives with significant quartz veining and pervasive fuchsite alteration. Pyrite mineralization observed.

Drill hole SW-025-037: Pink syenite with sulphides, transitioning to a non-magnetic basalt with sulphides observed such as semi-massive pyrite and magnetite-rich intervals.

Drill hole SW-025-038: Intersected altered tuffs, breccias, mafic/ultramafic flows, and felsic intrusives. A 17.9 m wide sulphide-rich zone was identified (true width currently unknown), composed of semi-massive to massive pyrite-pyrrhotite stockwork within a brecciated tuff, with strong sericite, chlorite, and silica alteration.

"We are very encouraged by the early progress of the Swanson drilling program and the geological and mineralization similarities seen in the recent drill core to the known Swanson Gold Deposit," said Paul Ténière, CEO of LaFleur Minerals. "We're particularly optimistic about the mineralized zone encountered in hole SW-025-038 and we look forward to releasing assay results in the near future."

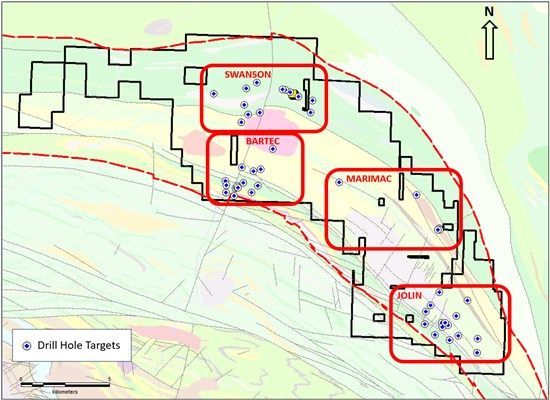

Further drilling is ongoing, and additional updates will be provided by the Company as results become available. The fully funded and permitted drill program includes a minimum of 5,000 metres of drilling targeting priority areas identified through extensive historical data compilation and recent fieldwork, including the Swanson Gold Deposit, as well as the Bartec, Jolin, and Marimac target zones (Figure 2). This will include priority targets from over 50 promising targets identified to date.

ACQUISITION OF KEY MINERAL CLAIM FROM GLOBEX MINING ENTERPRISES

The Company also announces that it will acquire a key mineral claim from Globex Mining Enterprises Inc. ("Globex") located immediately adjacent to and east of the Swanson mining lease, which hosts the Swanson Gold Deposit. The mineral claim will be acquired through an arm's length asset purchase agreement dated August 14, 2025, between the Company and Globex (the "Purchase Agreement"). The consideration payable by the Company to Globex for 100% ownership of the mineral claim is a cash payment of C$2,500 due upon execution of the Purchase Agreement. Globex will retain a 2% Gross Metal Royalty (GMR) upon commencement of commercial production from the mineral claim.

NI 43-101 TECHNICAL REPORT UPDATE

LaFleur Minerals is also pleased to announce that it has filed an updated NI 43-101 Technical Report ("Technical Report") for the Swanson Gold Project that discloses the results of recent exploration programs by LaFleur Minerals and the 2024 Mineral Resource Estimate for the Swanson Gold Deposit, which remains unchanged. The Technical Report has an effective date of July 29, 2025 and has been filed on the Company's SEDAR+ profile at www.sedarplus.ca and is available on the Company's website at www.lafleurminerals.com.

SITE VISIT DETAILS - BEACON GOLD MILL AND SWANSON GOLD PROJECT

LaFleur Minerals confirms a site visit and tour of its Beacon Gold Mill and Swanson Gold Project in the Val-d'Or region will occur on August 11-13, 2025. Interested parties are encouraged to contact the Company as soon as possible at info@lafleurminerals.com for further details and to confirm their attendance.

Figure 1: Drill Holes recently completed near the Swanson Gold Deposit

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6526/261546_345e3eead4f5ea37_001full.jpg

Figure 2: Swanson drilling target regions and proposed 2025 drill holes (in blue)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6526/261546_345e3eead4f5ea37_002full.jpg

CAUTIONARY STATEMENT

Visual estimates of mineral abundance or apparent mineralization observed in drill core are preliminary in nature and readers are cautioned they should not be relied upon as a substitute for analytical results. While the core appears to contain sulphides such as pyrite, chalcopyrite, and pyrrhotite, and quartz veining, laboratory assays are required to determine the actual grades and composition. There is no guarantee that the visual observations will correlate with assay results.

QUALIFIED PERSON STATEMENT

All scientific and technical information in this news release has been prepared and approved by Louis Martin, P.Geo. (OGQ), Exploration Manager and Technical Advisor of the Company and considered a Qualified Person for the purposes of NI 43-101.

About LaFleur Minerals Inc.

LaFleur Minerals Inc. (CSE: LFLR,OTC:LFLRF) (OTCQB: LFLRF) (FSE: 3WK0) is focused on the development of district-scale gold projects in the Abitibi Gold Belt near Val-d'Or, Québec. The Company's mission is to advance mining projects with a laser focus on our resource-stage Swanson Gold Project and the Beacon Gold Mill, which have significant potential to deliver long-term value. The Swanson Gold Project is approximately 18,304 hectares (183 km2) in size and includes several prospects rich in gold and critical metals previously held by Monarch Mining, Abcourt Mines, and Globex Mining. LaFleur has recently consolidated a large land package along a major structural break that hosts the Swanson, Bartec, and Jolin gold deposits and several other showings which make up the Swanson Gold Project. The Swanson Gold Project is easily accessible by road allowing direct access to several nearby gold mills, further enhancing its development potential. LaFleur Minerals' fully-permitted and refurbished Beacon Gold Mill is capable of processing over 750 tonnes per day and is being considered for processing mineralized material from Swanson and for custom milling operations for other nearby gold projects.

ON BEHALF OF LaFleur Minerals INC.

Paul Ténière, M.Sc., P.Geo.

Chief Executive Officer

E: info@lafleurminerals.com

LaFleur Minerals Inc.

1500-1055 West Georgia Street

Vancouver, BC V6E 4N7

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Statement Regarding "Forward-Looking" Information

This news release includes certain statements that may be deemed "forward-looking statements." All statements in this new release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Forward-looking statements in this news release include, without limitation, statements related to the use of proceeds from the Offering. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/261546