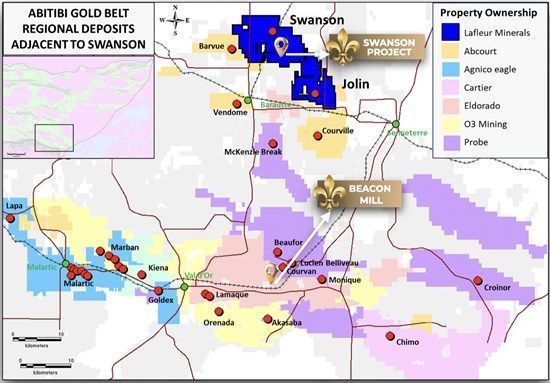

LaFleur Minerals Inc. (CSE: LFLR) (OTCQB: LFLRF) (FSE: 3WK0) ("LaFleur Minerals" or the "Company") is advancing towards a restart of the Company's 100%-owned Beacon Gold Mill in Val-d'Or, Québec and a Preliminary Economic Assessment (PEA) as it aims to restart production at the mill by early 2026. LaFleur Minerals plans to immediately launch a minimum 5,000-metre diamond drilling program at its highly prospective, district-scale Swanson Gold Project ("Swanson"). LaFleur Minerals also reiterates key results of its recent exploration programs, including an update on its diamond drilling and bulk sampling plans at Swanson, refer to LaFleur Minerals News Release dated June 4, 2025 and the LaFleur Minerals Webinar Replay dated June 5, 2025.

RESTART PLAN FOR BEACON GOLD MILL

LaFleur Minerals is methodical and laser-focused on completing the necessary activities required to restart production at its fully permitted Beacon Gold Mill, a 750 tonne per day facility that underwent over C$20 million in repairs and refurbishments just prior to acquiring the asset in Fall 2024. The Company is also finalizing a PEA to evaluate the economics of an open-pit mining scenario at Swanson and the processing of the mineralized material at its Beacon Gold Mill, capitalizing on the current gold market rally with prices hovering above USD$3,300 per ounce.

The Beacon Gold Mill greatly benefits from numerous gold deposits in its vicinity for bulk sampling and custom milling opportunities, existing infrastructure, and direct access to roads, power, and skilled labor, which further enhances the overall value proposition of LaFleur Minerals by providing an anticipated path to production and revenue-generation. As part of its ongoing mill assessment, the Company has developed a comprehensive mill restart plan which includes improvements of ~C$3.8 million for mill equipment and maintenance, and tailings storage facility repairs of ~C$1.8 million. The Company is evaluating the processing of a large bulk sample from the Swanson gold deposit at the Beacon Mill to test its metallurgical and processing characteristics. The Beacon Mill's viability is further supported by the fact that it has no outstanding royalties or encumbrances given that previously issued royalties were eliminated during the Monarch Mining Companies' Creditors Arrangement Act (CCAA) process, and the Company also holds a $2.4 million bond on the mill as a backstop.

SWANSON GOLD DEPOSIT

- The Swanson Gold Project is a district scale 166 km2 project that includes numerous prospects rich in gold and critical metals previously held by Monarch Mining, Abcourt Mines, and Globex Mining. The Swanson Gold Project hosts an Indicated Mineral Resource of 2,113,000 t with an average grade of 1.8 g/t gold for 123,400 oz of contained gold and Inferred Mineral Resource Estimate of 872,000 t with an average grade of 2.3 g/t gold for 64,500 oz of contained gold, and LaFleur Minerals has targeted aggressive exploration and drilling this season to increase the gold resource at the Swanson Gold Project based on 4 primary target areas with new and historical gold occurrences (Swanson, Bartec, Marimac, and Jolin targets).

(MRE source: NI 43-101 technical report, effective September 17, 2024, filed on the Company's SEDAR+ profile and website).

Bulk Sample Planning in Progress:

Planning and permitting is currently underway for an up to 100,000-tonne bulk sample from the existing mining lease hosting the Swanson Gold Deposit, which would be tested for its metallurgical and processing characteristics at the Beacon Mill once it becomes fully operational. A bulk sample mining and environmental closure and remediation plan is currently being finalized for regulatory approval with the Québec government.

Over 50 drill hole targets have been identified at Swanson and nearby Bartec, Jolin, and Marimac. Recent high-grade results-including 11.7 g/t Au in a grab sample at Jolin-point to significant upside as the Company prepares to test multiple new zones. The Company's immediate plans are to complete at least 5,000 metres of diamond drilling at Swanson starting in June using existing flow-through (FT) funds. Refer to the Company's news release dated June 4, 2025 for further details on recent exploration work by LaFleur Minerals at Swanson which included geological mapping and prospecting, soil sampling surveys, and Induced Polarization (IP) geophysics surveys.

Paul Ténière, CEO of LaFleur Minerals stated:

"We are grateful to have acquired the fully permitted and refurbished Beacon Gold Mill, which received over C$20 million in upgrades by its previous operator and is located in the midst of numerous gold deposits in the historic Val-d'Or and Rouyn-Noranda mining districts, including our own Swanson Gold Deposit. Based on our recent detailed assessments, the Beacon Gold Mill requires minimal repairs and improvements, and we are methodically executing a strategy to eventually restart production at the mill. We are also excited to commence planning for a large bulk sample at Swanson and a PEA to evaluate a mining and processing scenario at current record gold prices. With gold prices at record highs this is a pivotal year for LaFleur Minerals as we focus on restarting gold production at the Beacon Gold Mill and diamond drilling at the Swanson Gold Project to increase mineral resources."

SITE VISIT

The Company plans to coordinate a site visit of its Beacon Gold Mill and Swanson Gold Project in July 2025 for prospective investors, shareholders, and analysts. Those interested are asked to contact the Company directly to coordinate. Interested parties are invited to contact LaFleur Minerals at info@lafleurminerals.com to coordinate air travel, hotel lodging, and transportation to and from the Beacon Gold Mill. The Company is currently in discussions with several groups to finance the restart of the Beacon Gold Mill with mineralized material from the Swanson Gold Deposit.

Figure 1: Swanson Gold Project located 50 km from the Beacon Gold Mill, and surrounding deposits

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6526/256400_42a8ad0c8458cb47_001full.jpg

GRANT OF STOCK OPTIONS

The Company also announces that it has granted incentive stock options ("Options") to Directors of the Company to acquire an aggregate of 1,000,000 common shares at $0.35 per share, for a period of three years. These Options have been granted in accordance with the Company's stock option plan, and any common shares issued upon the exercise of, are subject to a four month hold period from the date of grant in accordance with the policies of the Canadian Securities Exchange.

QUALIFIED PERSON STATEMENT AND DATA VERIFICATION

All scientific and technical information in this news release has been prepared and approved by Louis Martin, P.Geo. (OGQ), Exploration Manager and Technical Advisor of the Company and considered a Qualified Person for the purposes of NI 43-101. Mr. Martin has reviewed and verified the rock sampling results and certified analytical data underlying the technical information disclosed. Mr. Martin noted no errors or omissions during the data verification process and the Company's management have also verified the technical information disclosed. The Company and Mr. Martin do not recognize any factors of sampling or recovery that could materially affect the accuracy or reliability of the assay data and exploration results disclosed in this news release.

About LaFleur Minerals Inc.

LaFleur Minerals Inc. (CSE: LFLR) (OTCQB: LFLRF) (FSE: 3WK0) is focused on the development of district-scale gold projects in the Abitibi Gold Belt near Val-d'Or, Québec. Our mission is to advance mining projects with a laser focus on our resource-stage Swanson Gold Project and the Beacon Gold Mill, which have significant potential to deliver long-term value. The Swanson Gold Project is over 16,600 hectares (166 km2) in size and includes several prospects rich in gold and critical metals previously held by Monarch Mining, Abcourt Mines, and Globex Mining. LaFleur has recently consolidated a large land package along a major structural break that hosts the Swanson, Bartec, and Jolin gold deposits and several other showings which make up the Swanson Gold Project. The Swanson Gold Project is easily accessible by road allowing direct access to several nearby gold mills, further enhancing its development potential. LaFleur Minerals' fully-refurbished and permitted Beacon Gold Mill is capable of processing over 750 tonnes per day and is being considered for processing mineralized material at Swanson and for custom milling operations for other nearby gold projects.

ON BEHALF OF LaFleur Minerals INC.

Paul Ténière, M.Sc., P.Geo.

Chief Executive Officer

E: info@lafleurminerals.com

LaFleur Minerals Inc.

1500-1055 West Georgia Street

Vancouver, BC V6E 4N7

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Statement Regarding "Forward-Looking" Information

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this new release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Forward-looking statements in this news release include, without limitation, statements related to the use of proceeds from the Offering. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/256400