August 23, 2022

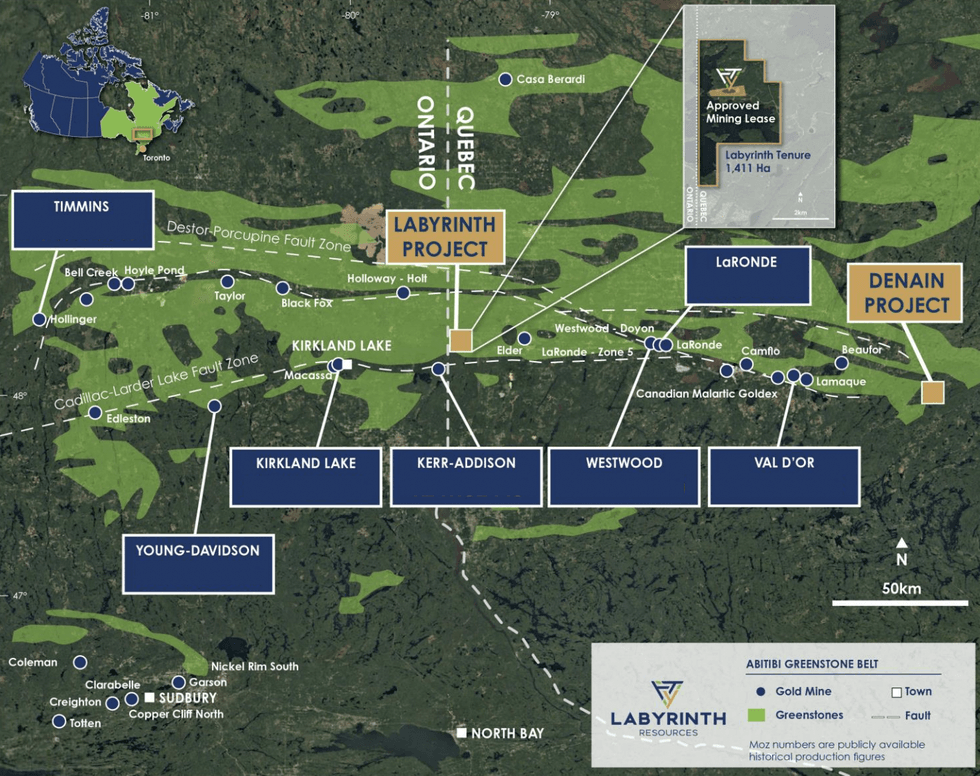

Labyrinth Resources Limited (ASX: LRL) advances an underexplored gold asset located in the heart of the Abitibi Gold Belt. The Labyrinth Gold Project is located on the Abitibi Gold Belt in Quebec, a recognised tier-1 jurisdiction. However, the asset has not received significant exploration attention for over 15 years, creating tremendous blue sky potential. Labyrinth Resources has a solid management team with a record of consistent delivery of operational success throughout world-class mining assets.

The Labyrinth Gold Project has a 2010 foreign resource estimate of 479,000 ounces of gold at 7.1 g/t, which is only modelled to 250-400 meters in depth. Yet, the project has neighbours with deposits reaching over 2 kilometres in depth. Many of those neighbours are also sitting on multi-million-ounce deposits. Despite the proven presence of high-grade gold, only one single 400-meter hole has been drilled within the past 15 years by the asset’s previous owner. The project has a multi-million-ounce potential for Labyrinth Resources to fully realise. In 2022, Labyrinth received assays for the first three holes of the maiden surface exploration program at its flagship Labyrinth Gold Project. Assays revealed high-grade results which include 44g/t in LABS-22-01A and 20.53g/t in LABS-22-02 extending the Boucher lode by a significant 375m downdip. The company is working towards a new JORC-compliant resource estimate.

Company Highlights

- Labyrinth Resources is a junior minor exploration and development mining company with an underexplored gold asset on the Abitibi Gold Belt in Quebec.

- Quebec is a globally-recognized tier-1 mining jurisdiction with strong government and community support.

- The Labyrinth Gold Project has significant blue sky potential as it has not received meaningful exploration attention over the past 15 years.

- The project has a 2010 foreign resource estimate of 479,000 ounces of gold at 7.1 g/t, and the company is working towards a current JORC-compliant estimate.

- The company’s project is surrounded by prolific mining companies with multi-million-ounce gold deposits, with testing of the Labyrinth deposit barely scratching the surface in comparison to the deep nature of many Abitibi gold operations.

- A management team with a proven track record of success in the natural resources industry adds value to the company. It creates confidence in its ability to capitalise on its project fully.

This Labyrinth Resources profile is part of a paid investor education campaign.*

LRL:AU

The Conversation (0)

31 August 2023

Labyrinth Resources

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia.

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia. Keep Reading...

6h

Blackrock Silver Named to 2026 TSX Venture 50 List of Top Performing Companies

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce it has been named to the 2026 TSX Venture 50™ list of top performing companies.2026 TSX Venture 50™To view an enhanced version of this graphic, please... Keep Reading...

19h

Top 10 Central Bank Gold Reserves

Global central banks own about 17 percent of all the gold ever mined, with reserves topping 36,520.7 metric tons (MT) at the end of November 2025. They acquired the vast majority after becoming net buyers of the metal in 2010.Central banks purchase gold for a number of reasons: to mitigate risk,... Keep Reading...

20h

Why Québec’s La Grande and Opinaca Subprovinces are Gaining Attention from Gold Explorers

The James Bay region of Northern Québec sits within the Superior Province, one of the world’s oldest and most metal-endowed Archean crustal blocks. While iconic gold districts like the Abitibi have seen generations of exploration and mine development, other Archean terrains in Québec — notably... Keep Reading...

16 February

Metallurgical Testwork Commences at Oaky Creek High Grade Antimony Prospect

Red Mountain Mining Limited (ASX: RMX, US CODE: RMXFF, or “Company”), a Critical Minerals exploration and development company with an established portfolio in Tier-1 Mining Districts in the United States and Australia, is pleased to announce the commencement of metallurgical testing work for the... Keep Reading...

15 February

Boundiali extends strike and depth at BDT3 and BST1

Aurum Resources (AUE:AU) has announced Boundiali extends strike and depth at BDT3 and BST1Download the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00