August 23, 2022

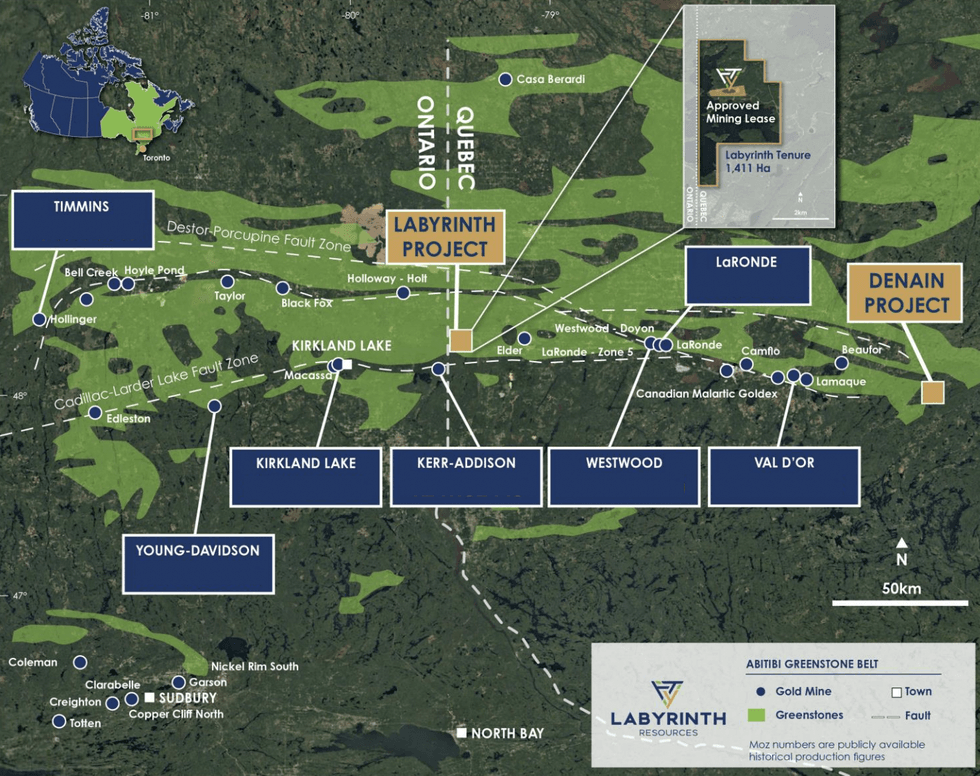

Labyrinth Resources Limited (ASX: LRL) advances an underexplored gold asset located in the heart of the Abitibi Gold Belt. The Labyrinth Gold Project is located on the Abitibi Gold Belt in Quebec, a recognised tier-1 jurisdiction. However, the asset has not received significant exploration attention for over 15 years, creating tremendous blue sky potential. Labyrinth Resources has a solid management team with a record of consistent delivery of operational success throughout world-class mining assets.

The Labyrinth Gold Project has a 2010 foreign resource estimate of 479,000 ounces of gold at 7.1 g/t, which is only modelled to 250-400 meters in depth. Yet, the project has neighbours with deposits reaching over 2 kilometres in depth. Many of those neighbours are also sitting on multi-million-ounce deposits. Despite the proven presence of high-grade gold, only one single 400-meter hole has been drilled within the past 15 years by the asset’s previous owner. The project has a multi-million-ounce potential for Labyrinth Resources to fully realise. In 2022, Labyrinth received assays for the first three holes of the maiden surface exploration program at its flagship Labyrinth Gold Project. Assays revealed high-grade results which include 44g/t in LABS-22-01A and 20.53g/t in LABS-22-02 extending the Boucher lode by a significant 375m downdip. The company is working towards a new JORC-compliant resource estimate.

Company Highlights

- Labyrinth Resources is a junior minor exploration and development mining company with an underexplored gold asset on the Abitibi Gold Belt in Quebec.

- Quebec is a globally-recognized tier-1 mining jurisdiction with strong government and community support.

- The Labyrinth Gold Project has significant blue sky potential as it has not received meaningful exploration attention over the past 15 years.

- The project has a 2010 foreign resource estimate of 479,000 ounces of gold at 7.1 g/t, and the company is working towards a current JORC-compliant estimate.

- The company’s project is surrounded by prolific mining companies with multi-million-ounce gold deposits, with testing of the Labyrinth deposit barely scratching the surface in comparison to the deep nature of many Abitibi gold operations.

- A management team with a proven track record of success in the natural resources industry adds value to the company. It creates confidence in its ability to capitalise on its project fully.

This Labyrinth Resources profile is part of a paid investor education campaign.*

LRL:AU

The Conversation (0)

31 August 2023

Labyrinth Resources

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia.

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia. Keep Reading...

1h

Pan African To Acquire Emmerson Resources in US$218 Million Gold Deal

South African gold producer Pan African Resources (LSE:PAF) has agreed to acquire Australian explorer Emmerson (LSE:EML) in an all-share transaction valued at approximately US$218 million.The acquisition will be carried out through a scheme of arrangement under which Pan African will acquire 100... Keep Reading...

17h

David Erfle: Gold, Silver Under Pressure, Key Price Levels to Watch

David Erfle, editor and founder of Junior Miner Junky, explains why gold and silver prices took a hit not long after war in the Middle East was announced. While the near term could be volatile, he said the long-term outlook for precious metals is strong. Don't forget to follow us @INN_Resource... Keep Reading...

17h

Tavi Costa: Gold, Silver Stocks to Rerate, "Explosive" Energy, Copper Opportunities

Tavi Costa, CEO of Azuria Capital, explains where he's looking to deploy capital right now, mentioning mining, energy and emerging markets. "When I apply macro analysis into markets, there's a few things that look exceptionally cheap today that could be extremely asymmetric," he commented.... Keep Reading...

18h

One Bullion Advances Toward Drill-Ready Targets at Botswana Gold Assets

One Bullion (TSXV:OBUL,OTCPL:OBULF) CEO and President Adam Berk shared the advantages of working in the mining-friendly jurisdiction of Botswana and big milestones ahead in 2026.Surveys are expected to commence within the next few weeks at the company's Maitengwe and Vumba projects, which will... Keep Reading...

09 March

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00