August 09, 2022

Maiden JORC Resource set for release next month; Latest results, which significantly extend known lodes and reveal gold in previously unmodelled zones, will form part of subsequent Resource update

Labyrinth Resources Limited (ASX: LRL) (‘Labyrinth’ or ‘the Company’) is pleased to announce that assays received for the first three holes of the maiden surface exploration program at its flagship Labyrinth Gold Project in Quebec, Canada contain high-grade results which extend the mineralisation significantly.

Key Points

- Assays received for first three holes of the maiden surface program at Labyrinth significantly extend the many currently defined lodes at depth and along strike

- Drilling also intersected mineralisation in previously unmodelled zones, indicating potential for substantial increases in scale of the deposit

- The initial outstanding result (reported previously – refer ASX Announcement 25 July 2022) in hole LABS-22-01A, located 125m down-dip of the defined Front-West lode, was:

- 2.2m @ 10.67g/t from 143.5m including 0.5m @ 44.12g/t, part of a broader mineralised interval of 8.1m @ 4.05g/t from 143.5m

- This result is strongly supported by the latest assays, with hole LABS-22-02 delivering an excellent result 375m down-dip of the defined Boucher lode of:

- 1.4m @ 13.32g/t from 652.3m including 0.9m @ 20.53g/t

- Visual quart and pyritic mineralisation observed in LABS-22-04 and LABS-22-05 indicate further down-dip and along strike extensions to existing modelled lodes, with assays pending

- Drilling at Labyrinth remains only shallow compared to other significant projects in the region, which are host to multi-million ounce deposits (refer figure 2)

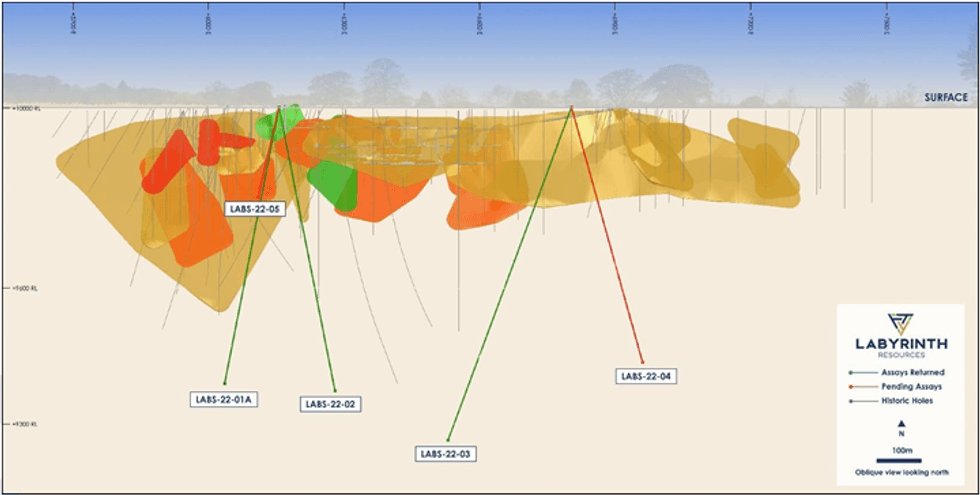

Figure 1 – Maiden surface exploration targeting mineralisation extensions to depth of up to ~700m below surface

Highlights include 20.53g/t in LABS-22-02, which extends the Boucher lode by a significant 375m down- dip.

This follows the previously reported result of 44.12g/t in LABS-22-01, which was 125m down dip of the currently defined Front-West lode (Refer ASX Announcement 25 July 2022).

Drilling of phase one is now successfully complete, with 3,135m drilled across 5 holes in just 44 days, under budget and with no safety incidents.

Assays are pending for LABS-22-04 and LABS-22-05.

Quartz and pyritic mineralisation characteristic to Labyrinth has been observed across multiple lodes, with results confirming the mineralisation extends up to 375m down dip and to a depth of ~550m below surface, remaining open at depth and along strike.

Labyrinth is on track to publish its maiden JORC Resource next month. These latest assays and those pending will form part of a subsequent Resource update.

Labyrinth Chief Executive Matt Nixon said: “These are outstanding results which highlight the scope for substantial growth in the deposit, both along strike and at depth.

“We are in the throes of finalising our maiden JORC Resource and already we have established substantial mineralisation which sits outside these parameters, paving the way for a subsequent Resource update.

“We have barely scratched the surface at Labyrinth compared with the drilling completed at other major deposits in the Abitibi region. The scale of these endowments shows the upside we have at Labyrinth”.

Click here for the full ASX Release

This article includes content from Labyrinth Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRL:AU

The Conversation (0)

31 August 2023

Labyrinth Resources

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia.

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia. Keep Reading...

15h

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

15h

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

18h

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00